Updated on June 23rd, 2020 by Josh Arnold

As an oil and gas producer, Enerplus Corporation (ERF) has suffered from the downturn in commodity prices over the past several years.

Indeed, after peaking at $24 per share in 2014, Enerplus fell to below $3 in early 2016. In the interim, Enerplus has seen a strong rebound to nearly $14 per share, but a new oil price crash in early 2020 has the stock trading under $3 once more.

One advantage for Enerplus is that it pays its dividend each month, rather than on a quarterly or semi-annual basis. Monthly dividends give investors the ability to compound dividends even faster, and provide more timely income for those relying upon it for living expenses.

Enerplus is one of just 56 stocks that pay monthly dividends. You can access the complete database of monthly dividend stocks (along with price-to-earnings ratios, dividend yields, and payout ratios) by clicking on the link below:

This article will discuss Enerplus’ business model, and whether it is an attractive option for income investors.

Business Overview

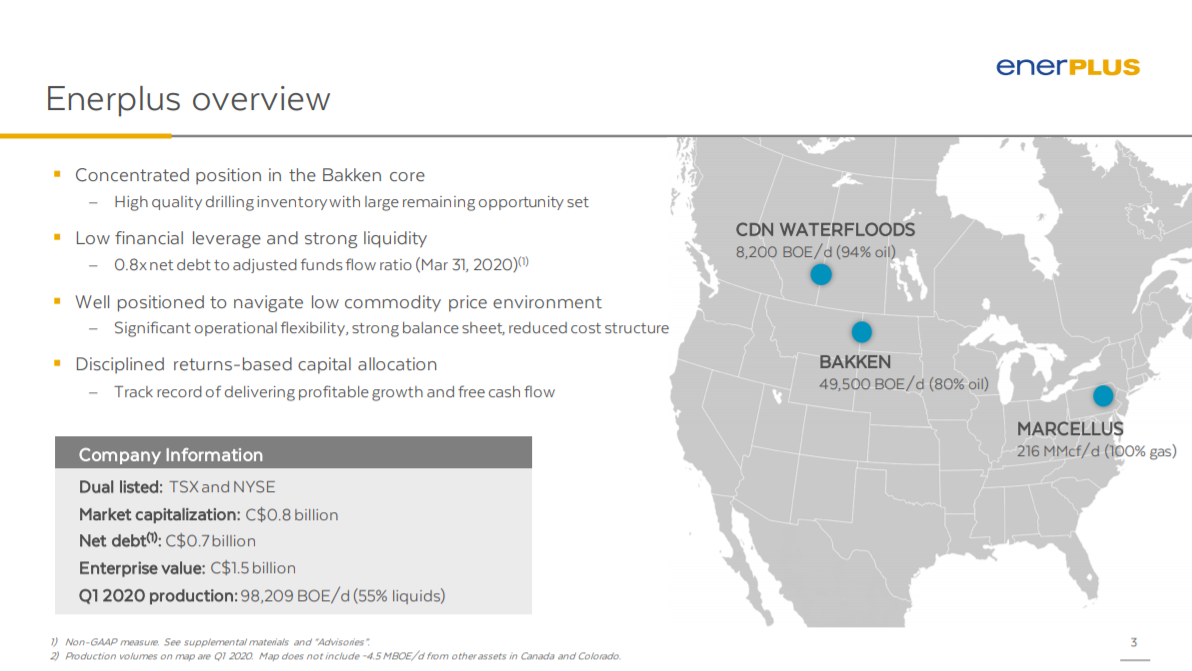

Enerplus was established in 1986. Today, it is a producer of crude oil and natural gas assets in Canada and the U.S. It is a small-cap stock, with a market capitalization of just ~$645 million after the massive selloff so far in 2020.

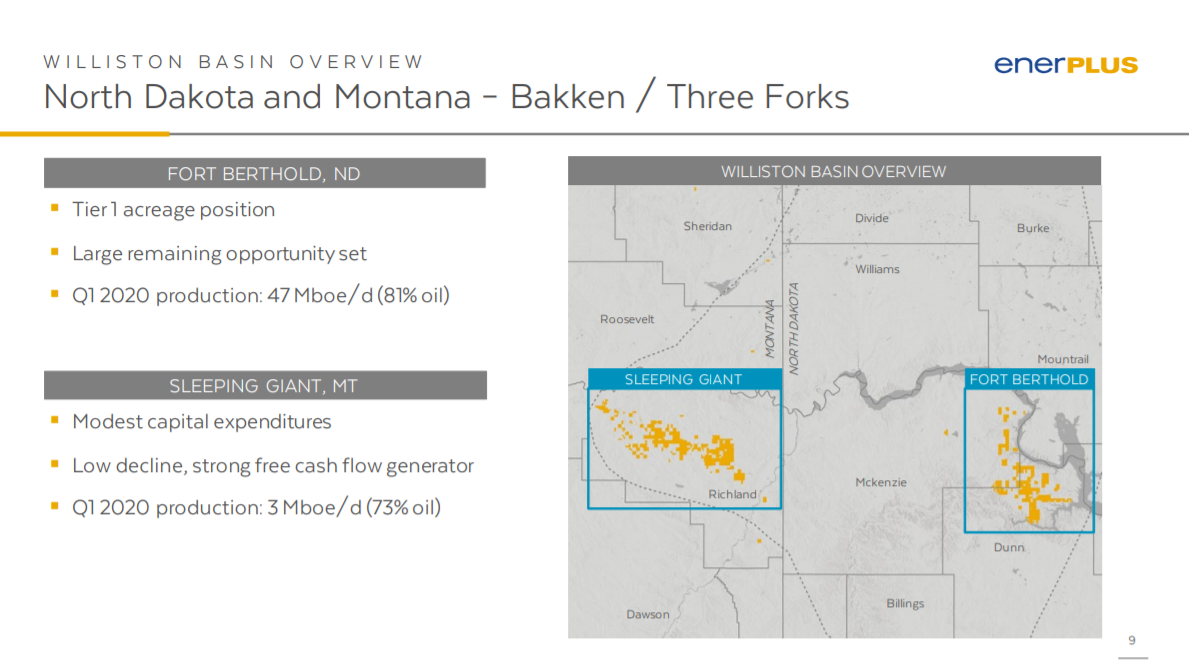

Enerplus has high-quality assets, with operations in some of the premier oil and gas fields in North America, such as the Bakken/Three Forks field in North Dakota.

The Williston Basin has significant production totals and future growth potential.

Source: Investor presentation, page 9

Production in the first quarter of this year was ~50,000 barrels of oil equivalent, or boe, about 80% of which was oil.

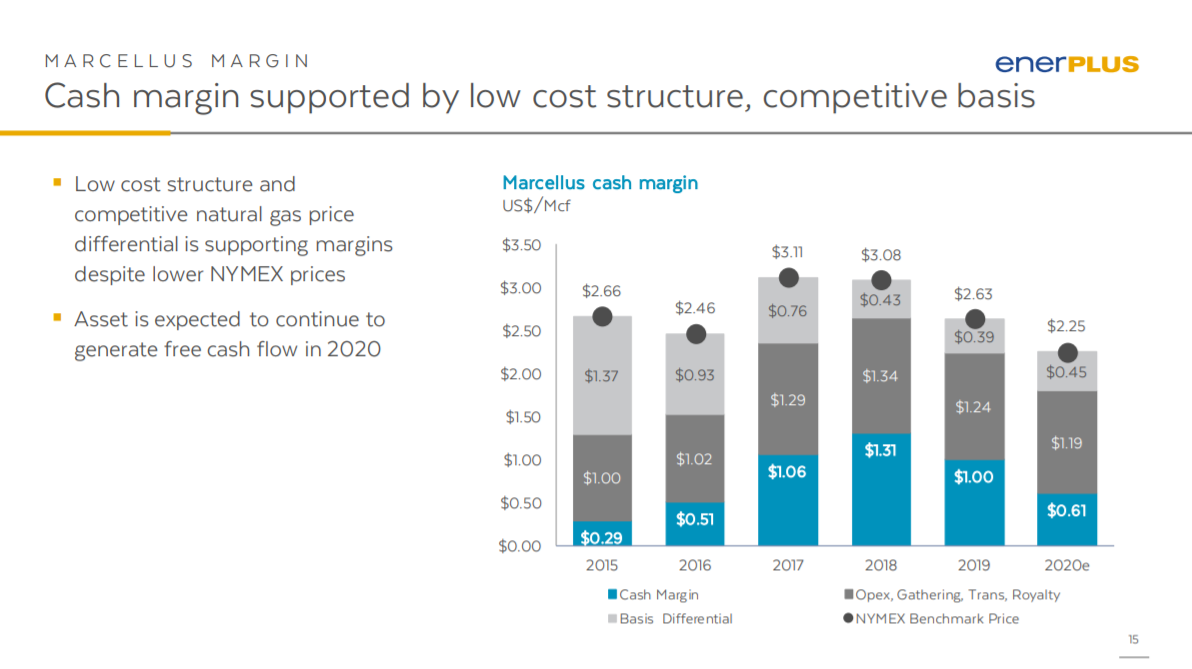

Its natural gas assets are primarily located in the high-quality Marcellus shale, one of the most economically-sound natural gas fields in North America.

Source: Investor presentation, page 14

Marcellus produced slightly lower totals in Q1 of this year than last year, but production was still in excess of 2018 levels. Enerplus also notes that Marcellus provides low-cost, high-quality gas reserves with consistent free cash flow. Production will decline this year due to reduced capex and lower pricing, both of which are products of COVID-19.

The vast majority of Enerplus’ production comes from the U.S, but it does have some international properties as well. The Canadian Oil Waterfloods area brings 8,200 barrel equivalent production per day, which is down from just over 9,000 boe last year.

Source: Investor presentation, page 3

However, even with this diversification, Enerplus is primarily focused on oil production in Williston and gas production from Marcellus.

Enerplus had a productive year in 2019. The company managed to boost liquids production by 15% year-over-year, building upon a 22% increase in 2018. It also generated $90 million in free cash flow, good for a free cash flow yield on the current market capitalization of about 14%.

Enerplus returned a staggering $206 million of cash to shareholders via dividends and buybacks during the year. And finally, it increased its proved-plus-probable reserves by a 3%, and achieved 139% reserve replacement on production.

Moving forward, the company hopes a combination of higher commodity prices, cost reductions, and production growth will help sustain the positive momentum.

Growth Prospects

Enerplus’ first growth catalyst is higher commodity prices. While oil and gas prices are up significantly from their 2020 lows, they are still a long way from their 2014 peak levels.

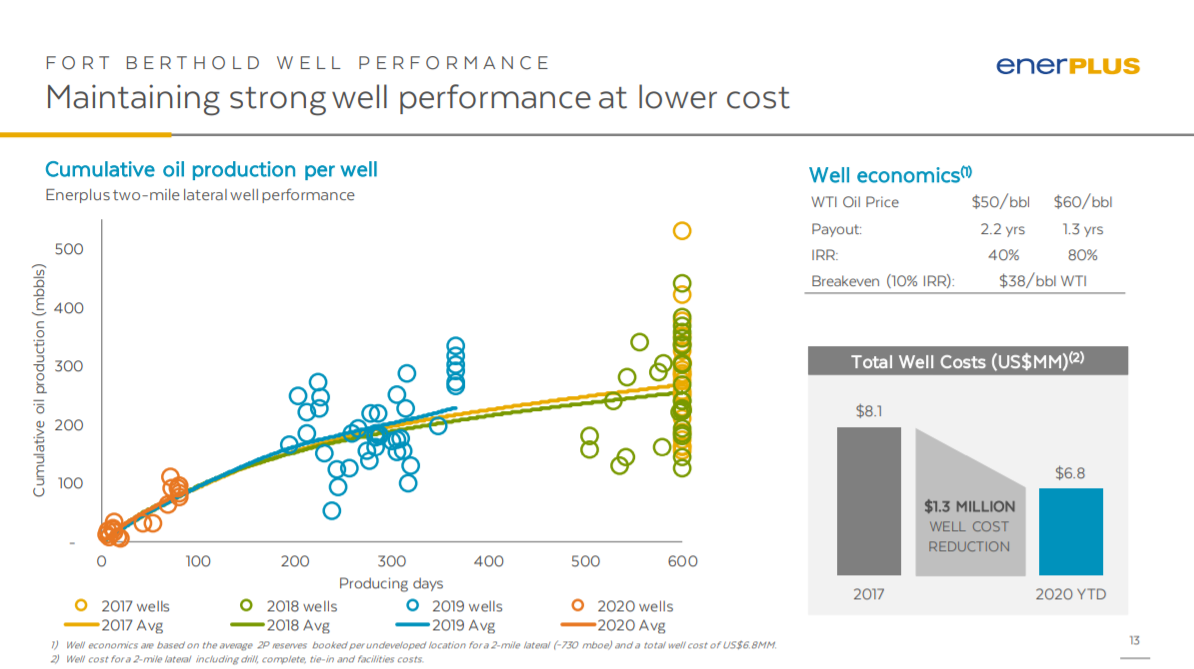

Today, WTI crude trades for about $40 per barrel. Enerplus has very strong economics at the well level at $50+ per barrel. While $40 is a sustainable price for Enerplus, it is far from ideal.

Source: Investor presentation, page 13

The company obviously cannot control oil prices. Instead, Enerplus is focusing on managing what it can control, which is well costs. As you can see above, Enerplus has managed to reduce total well costs significantly in recent years, which helps lower its breakeven point.

To that end, one initiative the company has undertaken is reducing its costs per barrel. Enerplus’ margins have expanded at times as a result.

Source: Investor presentation, page 15

However, much lower commodity pricing thus far in 2020 has crimped margins considerably. Cash margin in Marcellus, for example, was $1.31 per thousand cubic feet of gas in 2018, but is expected to be less than half that amount this year.

Like other oil and gas producers, Enerplus has significant operating leverage, which works in both directions to move margins. Importantly, operating costs are falling, which is what Enerplus can control.

Lastly, Enerplus is investing to ramp up production.

Source: Investor presentation, page 7

Enerplus sees continued production growth in the coming years, after conditions normalize. Production has been scaled back this year somewhat due to lower commodity pricing, but Enerplus is committed to growing over the long-term, and at significant rates.

In addition, operating leverage above the funded level of $50 per barrel for WTI crude is significant. Should oil prices return to $60 per barrel or move higher, Enerplus stands to gain enormously.

Of course, this leverage works both ways. If prices moderate, earnings will suffer, as they did in Q1 and almost certainly in Q2 of 2020. The majority of future capital spending will be allocated to the Williston Basin. This is consistent with prior years as Enerplus continues to bet big on its major production area.

Dividend Analysis

Enerplus recently declared its June dividend and it came in at approximately $0.0077 in US dollars. That works out to a current yield of 3.1%, which is above the S&P 500 average, meaning Enerplus is a decent income stock.

Note: As a Canadian stock, a 15% dividend tax will be imposed on US investors investing in the company outside of a retirement account. See our guide on Canadian taxes for US investors here.

An important consideration for investors is dividend sustainability. One of the benefits of a low dividend yield is that it is easier to sustain the dividend payout when business conditions deteriorate. For example, Enerplus earned $90 million in free cash flow in 2019, while spending just $28 million on dividend payments.

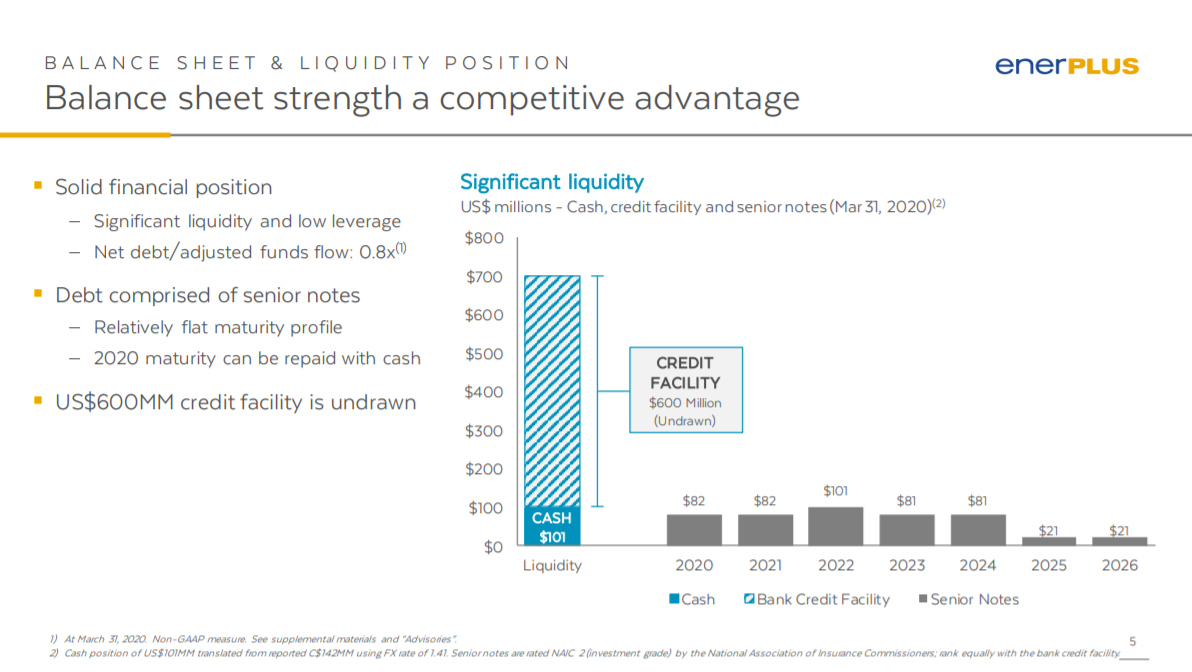

That means the dividend is well-covered and shouldn’t be at risk of a cut, even if commodity prices remain weak for some time. Plus, the company has a solid balance sheet and significant untapped liquidity.

Further, what debt the company does have matures on a steady basis, so it is well equipped to handle its debt in the coming years.

Source: Investor presentation, page 5

With a low dividend payout, combined with cost cuts, Enerplus has used excess capital to pay off debt over the past five years. Net debt to trailing-twelve month adjusted funds flow was 2.5x in 2015, but is just 0.8x today. Enerplus is based in Canada, which means there are also unique tax considerations for U.S. investors.

The first is that the company’s dividends will be issued in Canadian dollars, which exposes U.S. investors to currency risk. This means that even if the dividend declared is the same month after month, the amount U.S. investors receive will fluctuate.

The good news is that the withholding tax is waived for U.S. investors who hold the stock in a qualified retirement account, such as a 401(k) or IRA. And, the stock offers an above-average yield. That said, a return to dividend growth is unlikely, unless commodity prices rise significantly from present levels.

Final Thoughts

Enerplus has a low dividend yield, and the company has made no indication it plans any significant dividend expansion at this stage. Management appears more interested in deleveraging the balance sheet and investing for future production growth.

The company stands to benefit from rising commodity prices and its cost-cutting program. In addition, it has drastically improved its balance sheet over the past few years.

Enerplus may not be attractive for investors looking solely for high dividend yields, but it could be viewed more attractively as a growth stock if oil and gas prices rise. However, risk-averse investors looking for stability should avoid Enerplus stock.