Updated on July 22nd, 2021 by Bob Ciura

Real estate and dividend stocks are two of the most popular vehicles for creating passive retirement income.

The downside to owning rental properties is that it is not really passive. Any landlord who has had to call a plumber or an electrician during the middle of the night can attest to this.

For investors looking to capture the returns of the real estate sector while benefiting from the hands-off approach of dividend stocks, real estate investment trusts – or REITs – are a very attractive investment vehicle.

EPR Properties (EPR) is one of the most well-known REITs. EPR recently reinstated its monthly dividend, after suspending it for over a year due to the coronavirus pandemic.

That means EPR rejoins the list of monthly dividend stocks. We’ve compiled a list of 51 monthly dividend stocks, along with important financial metrics like dividend yields and payout ratios, which you can view by clicking on the link below:

This article will analyze the investment prospects of EPR Properties in detail.

Business Overview

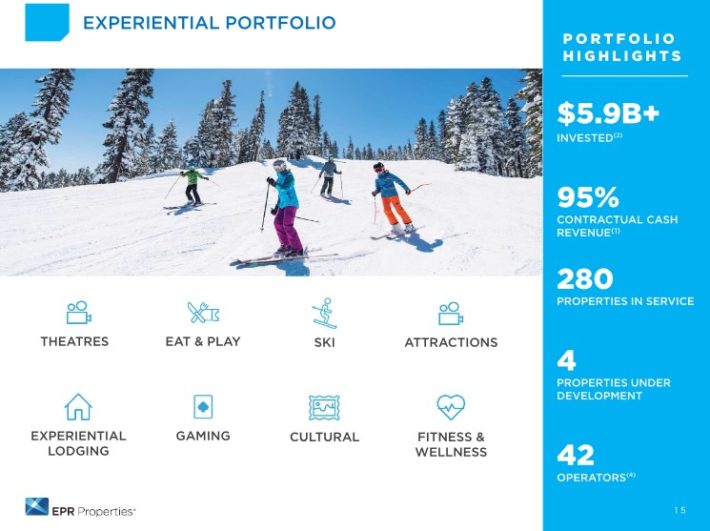

EPR Properties is a triple net lease real estate investment trust that focuses on entertainment, recreation, and education properties.

Triple net lease means that the tenant is responsible for paying the three main costs associated with real estate: taxes, insurance, and maintenance. Operating as a triple net lease REIT reduces the operating expenses of EPR Properties.

EPR has identified entertainment, recreation, and education, respectively, as its three large buckets in which it invests. It has then identified attractive sub-segments of those larger segments including movie theaters, ski resorts, and charter schools, as examples.

The portfolio includes more than $5.9 billion in investments across 300+locations in 44 states, including over 250 tenants.

Source: Investor Presentation

EPR is focused in a variety of different metropolitan areas throughout the US and parts of Canada, so it is highly diversified with not only its tenants, but geographically as well.

2020 was a difficult year for REITs, as the coronavirus pandemic resulted in prolonged closures over the course of the year. EPR’s portfolio metrics deteriorated as a result. Fortunately, the company has made a notable comeback in 2021, as properties reopen.

As of June 30th, approximately 99% of the its theater locations and 98% of of non-theater locations were open, with certain assets remaining closed in Canada. This should fuel a recovery for EPR going forward.

Growth Prospects

Prior to 2020, EPR had maintained a track record of steady growth. From 2010 to 2019, EPR compounded its adjusted FFO-per-share by almost 8% per year. The coronavirus pandemic upended virtually all REITs, and caused EPR’s FFO-per-share to decline from $5.44 in 2019 to $1.43 in 2020.

EPR is still dealing with the pandemic’s impact on its financial results, which were evident in the most recent quarter. EPR reported first-quarter earnings on May 5th, 2021, and results were still fairly ugly. Total revenue declined 26% year-over-year. Cash collections were still just 72% of pre-COVID contractual cash revenue. Adjusted funds-from-operation, or FFO, were $0.52 per share, down from $1.14 in the same quarter last year.

Still, EPR’s results beat expectations for revenue and FFO, and the results were a notable improvement on a quarter-over-quarter basis.

Although the past year has been extremely challenging for EPR, it still has many opportunities to drive its growth. The company’s focus on experiential properties gives it a competitive advantage by protecting it against e-commerce threats. EPR believes that its properties will still generate strong traffic, as consumers will still want those experiences.

Overall, we expect 5% annual FFO-per-share growth over the next five years. EPR’s growth will be fueled by its competitive advantages. EPR’s competitive advantage is its portfolio of specialized properties. EPR has methodically identified the most profitable properties through years of experience and focuses its investments in these areas.

It certainly isn’t immune to recessions, but we see EPR as one of the better–run REITs in our coverage universe for these reasons. A return to growth should allow the company to slowly raise the dividend over time.

Dividend History

EPR’s dividend history was impressive heading into 2020. The company had increased its annual per-share dividend by roughly 6% per year from 2010-2019. Of course, the pandemic forced the company to suspend its dividend for most of 2020.

Fortunately, EPR management expects the recent recovery to continue. This expectation gave management the confidence to reinstate the monthly dividend at a rate of $0.25 per share.

On an annualized basis, the $3 per share dividend is still below the pre-COVID payout of $4.59 per share. Still, at a level of $3 per share, EPR stock yields 5.7%. Therefore, EPR stock is still attractive for income investors as a high dividend stock.

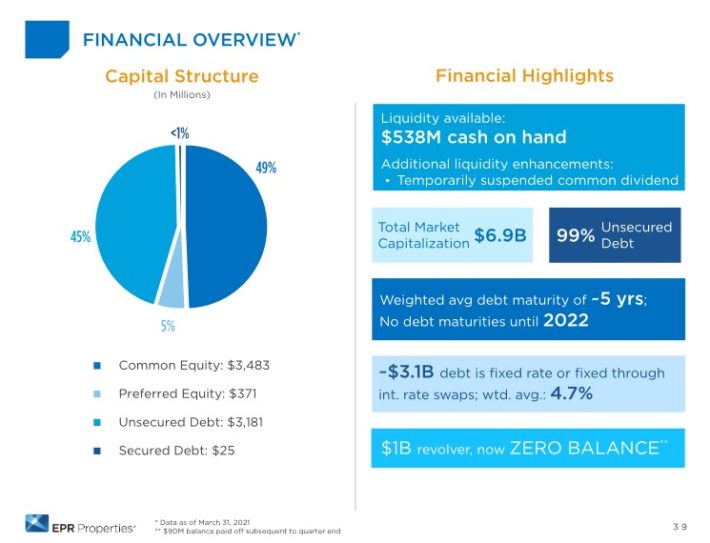

EPR has a reasonably leveraged capital structure that affords it significant flexibility. It has worked to repair its balance sheet in the wake of the pandemic, to further improve its dividend safety and growth potential.

Source: Investor Presentation

EPR’s debt totals about $3.2 billion, with a weighted average debt maturity of 5 years and a weighted average interest rate of 4.7%. It has a $1 billion credit revolver that now has a zero balance, giving EPR plenty of liquidity.

All of this supports EPR’s growth plans and by extension, its ability to not only pay its dividend, and hopefully raise it over time.

EPR’s dividend appears to be secure, and it is likely the trust will continue to raise it at meaningful rates over time if its FFO continues to recover back to pre-COVID levels. This makes the stock attractive for those seeking current income and dividend growth.

Final Thoughts

EPR Properties looks to be improving from the major downturn of 2020 marked by the coronavirus pandemic.

The REIT has a dominant position in the ownership of movie theaters, recreational facilities, and educational properties.

These are relatively small sub-segments of the real estate industry, and give EPR the benefit of being ‘a big fish in a small pond.’

EPR Properties stock has a 5.6% dividend yield and has resumed its monthly dividend payments. As a result, it is once again an appealing stock for income investors looking for high yields and monthly payouts.

Of course, this is dependent on the continued recovery in EPR’s portfolio metrics and financial results. Based on all these factors, EPR Properties appears to be a good choice for income investors, or investors that are looking for some exposure to high-yield REITs.