Updated on March 4th, 2020 by Josh Arnold

Real Estate Investment Trusts are popular investments among income investors, and for obvious reasons.

They are required to pass along the vast majority of their earnings in order to retain a favorable tax structure, which often results in very high dividend yields across the asset class. You can see our full list of all 166 publicly-traded REITs here.

One such REIT is Chatham Lodging Trust (CLDT). After a massive selloff in recent weeks due to coronavirus concerns, shares yield a staggering 9.6%, putting it in exclusive company in the U.S. stock market in terms of absolute yield. Indeed, it is a high-yield stock with well above a 5%+ dividend yield.

Not only does it have a very high dividend yield, but it also makes its payments each month. This helps differentiate Chatham, as there are currently just 58 monthly dividend stocks.

We have compiled a full list of monthly dividend stocks. You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Stocks with high yields can also carry significant risk. As a result, it is critical for investors to make sure the high dividend payouts are sustainable over the long-term.

In the case of Chatham, we see the dividend as sustainable based upon the trust’s earnings capacity. Combined with the nearly-10% yield, Chatham looks attractive for investors focused on income generation.

Business Overview

Chatham Lodging Trust is a self-advised REIT that invests in upscale extended-stay hotels, as well as premium-branded select service hotels. Select service hotels tend to be somewhat cheaper for guests, as they don’t offer a full suite of benefits that a premium, full-service hotel would, with concierge service being one such example.

That means select service hotels appeal to a wider audience, but also tend to generate lower revenue-per-available-room, or RevPAR. Chatham’s hotels are located in major markets that have high barriers to entry, and it acquires properties near primary demand generators for both business and consumer guests. These areas include cities with large corporate headquarters, convention centers, or tourist attractions.

The trust is relatively small at less than $700 million in market capitalization, and its initial public offering was completed in 2010.

Source: March 2020 investor presentation, page 3

Chatham currently has a total portfolio of 40 wholly-owned hotels in the premium-branded extended stay and select service categories. In addition, it has nearly 100 other properties where it owns an interest through joint ventures.

Its properties are scattered throughout the country, with its highest concentration in the Northeast. The trust’s properties are in major metropolitan areas that have consistent demand for rooms.

Chatham’s geographic focus not only helps drive occupancy, but average rate as well. Indeed, Chatham’s average RevPAR in 2019 was $133, which is outstanding for a select service portfolio, and rivals that of some of the full-service brands.

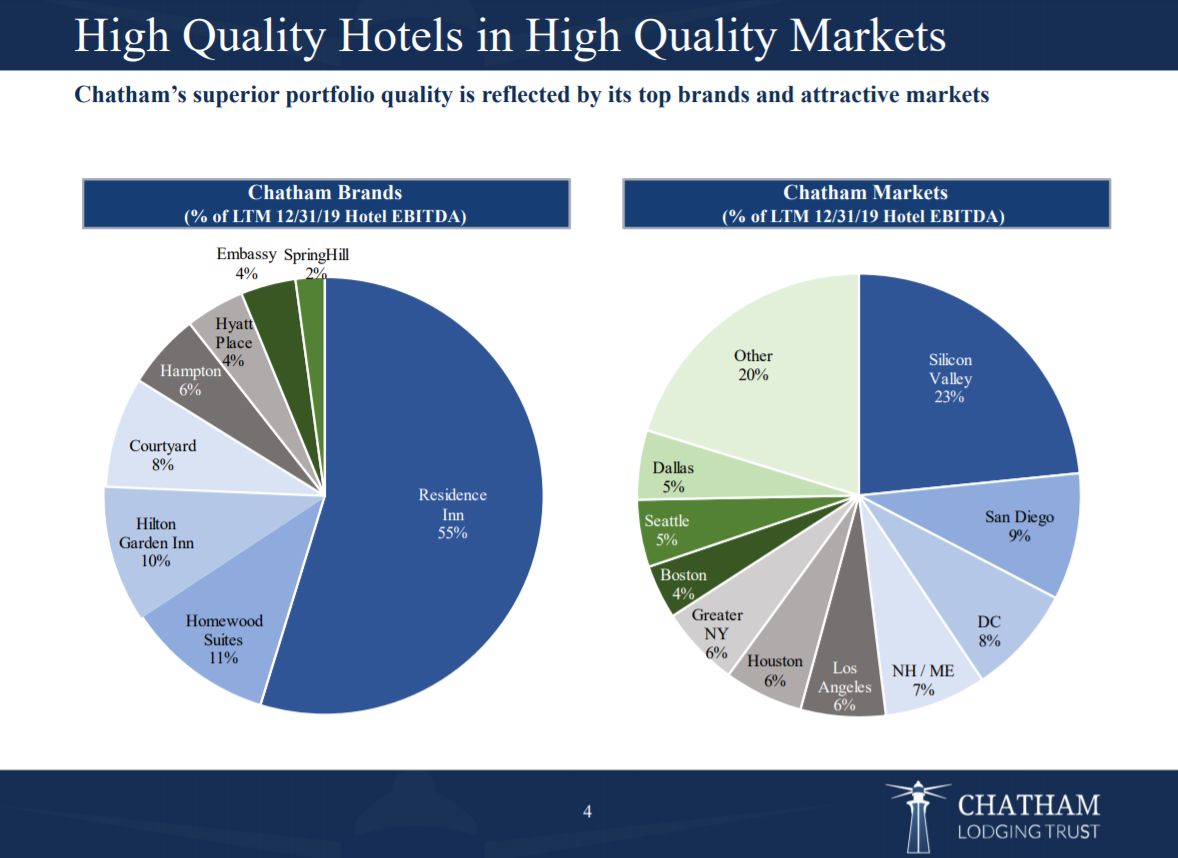

Source: March 2020 investor presentation, page 4

Chatham’s mix of brand and geographical exposure is quite attractive as well, as it is in many different markets. Importantly, none of these markets make up even one-quarter of revenue on its own. And while Chatham is highly concentrated with the Residence Inn brand making up just over half of revenue, it also owns several other brands that provide diversification.

The trust has made a point of investing in markets and brands that are diversified in order to help facilitate long-term growth, and to protect itself from weakness in any particular brand or market performance. The strategy has worked quite well over the years, and we believe it will continue to do so.

Growth Prospects

Chatham reported Q4 earnings on 2/26/20 and results were very strong, as the trust beat expectations for the quarter. RevPAR declined 4.9% year-over-year, which beat expectations for a decline of 5% to 6.5%. The fourth quarter of 2018 had unusually high demand in Boston and San Diego, which Chatham was clear about being unsustainable.

This made the comparable base very high, and resulted in the year-over-year decline in RevPAR. We don’t see this as a long-term issue, but one that is transitory. Average daily rate was down 4.1% to $157 and occupancy was down 0.8% to 76%.

Adjusted funds-from-operations, or FFO, declined $3.1 million to $15.3 million, but exceeded the upper end of the trust’s guidance range of $14.6 million. Adjusted FFO-per-diluted-share also exceeded guidance of $0.28 to $0.31, coming in at $0.32.

Operating margins declined due to lower pricing, falling 150bps to 42.6% of revenue. Comparable hotel EBITDA margins were down 200bps to 34.4%, which was also higher than the guidance range Chatham provided.

Source: March 2020 investor presentation, page 9

Chatham is at the top of the pile among its competitors in terms of profitability, which is one reason we like its fundamentals. Chatham’s EBITDA margin is in excess of 38%, and while that is down from 2018, and closer to the rest of the pack, Chatham continues to lead the way.

Select-service lodging provides higher margins than full-service, and Chatham focuses on the former in part for that very reason.

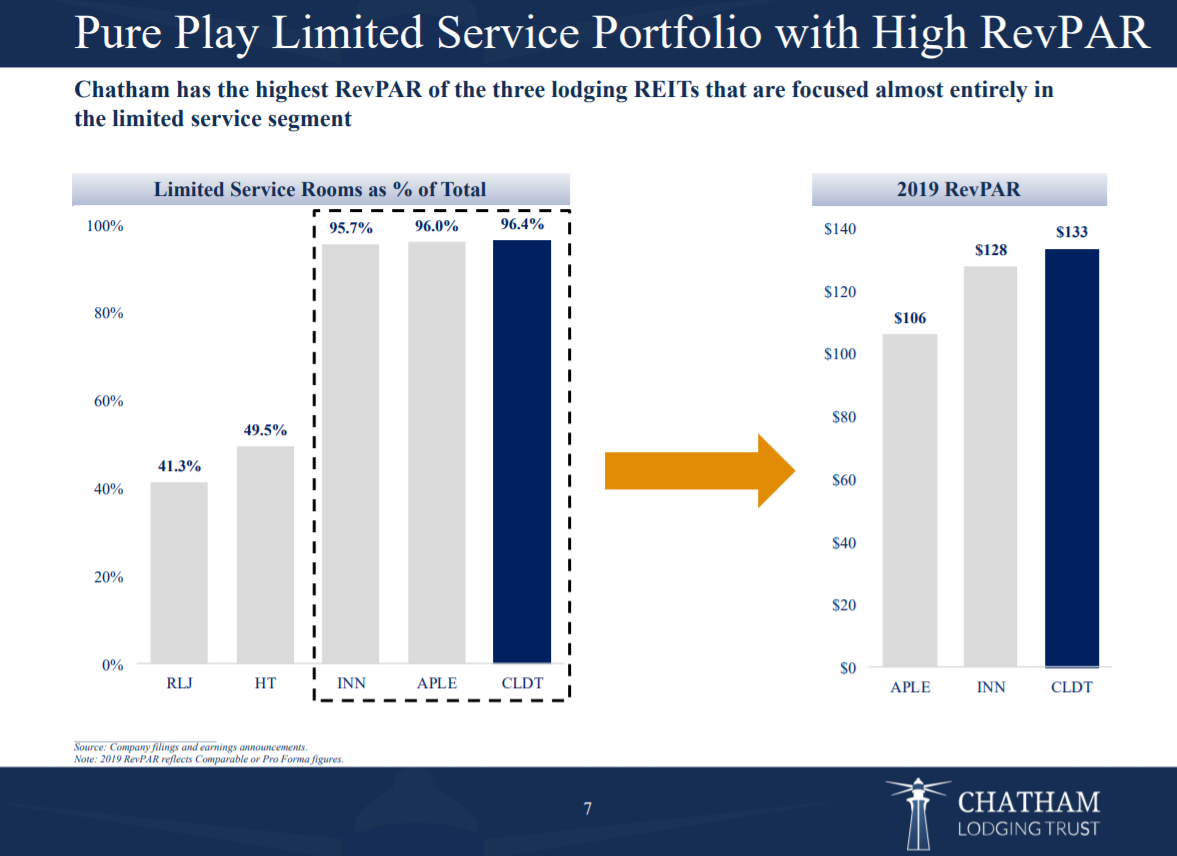

Source: March 2020 investor presentation, page 7

Chatham’s focus on the best markets and brands in the select-service sector has boosted its RevPAR above the other REITs that focus on select-service properties.

This helps drive not only higher revenue, but better margins as well as fixed costs are leveraged down. Indeed, we can see that Chatham drives better RevPAR than all of its competitors by using this strategy.

Chatham’s focus on the select-service model and its execution has been outstanding thus far. This should serve it well in the years to come in terms of growth, meaning Chatham’s future is bright. We note that Q4 results were somewhat weaker than the long-term trend, but believe this is a temporary issue, not a sign of permanent or even semi-permanent impairment.

Dividend Analysis

Chatham’s yield is obviously a major draw for shareholders, as it is at 9.6% today. Many REITs have yields near this level, but we believe Chatham’s yield has an important distinction, which is sustainability of the dividend.

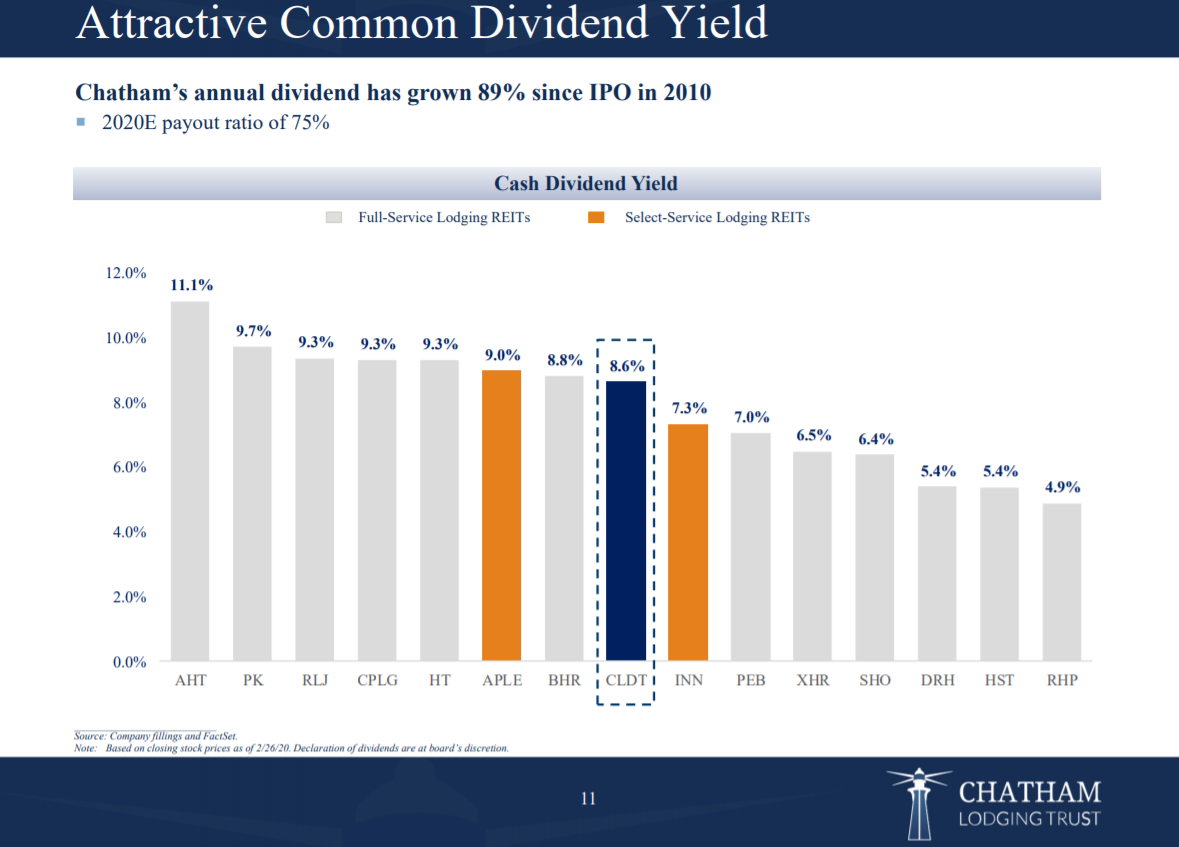

Source: March 2020 investor presentation, page 11

Chatham’s payout ratio against its adjusted FFO-per-share guidance for 2020 is just 75%. The monthly dividend is still 11 cents, or $1.32 per share annually, and it has been that way for four years.

Chatham’s dividend has grown by 89% since the IPO, but growth hasn’t occurred since March of 2016. Given Chatham’s reticence in raising the payout, we don’t see dividend growth as imminent.

Thus, if investors are looking for dividend growth, Chatham may not be an appealing stock. However, if investors are focused more on current income, it appears to offer a level of dividend safety not often found with such a high yield. Of course, investors should always monitor the quarterly results of high-yield stocks like Chatham, to ensure the dividend remains covered.

Final Thoughts

While many REITs offer high yields, we believe Chatham offers an intriguing blend of high yield and safety that differentiates it from the rest of the high-yield pack.

The stock offers a very strong yield and robust growth prospects that we believe protects the payout over time. While the lack of dividend growth has been an issue, for those seeking a high yield and the a monthly payout instead of quarterly, we see Chatham as attractive at current prices.

Chatham also offers a strong value proposition after the recent selloff, trading for just 7.8 times this year’s guidance of $1.76 in FFO-per-share. With fair value between 9 and 10 times FFO, we see Chatham as offering investors a very high yield with a favorable valuation, and reasonable dividend safety for a REIT. Given these factors, we think investors that want to own Chatham have an opportunity to do so at favorable prices today.