Updated on March 19th, 2020 by Samuel Smith

REITs are a phenomenal asset class for investors to generate passive income from property ownership without any of the headaches of being a conventional landlord.

However, there are so many REITs out there that it can be difficult to find the best for investment. What makes a good REIT? The best REITs tend to have built competitive advantages by operating with expertise in a subsector of the real estate industry.

Apple Hospitality REIT (APLE) is a prime example of this – it is a hotel REIT that specializes in leasing to the upscale Marriott and Hilton hotel brands. The company currently has an extremely high dividend yield of 18.9%, qualifying it for inclusion among the group of elite dividend stocks with 5%+ yields.

You can see the full list of stocks with 5%+ dividend yields here.

Better yet, Apple Hospitality pays its dividends monthly. For investors that rely on their portfolio for current income, this monthly payout is far superior to the traditional quarterly distribution policy. Unfortunately, there are very few monthly dividend stocks.

We’ve compiled a list of monthly dividend stocks, along with important metrics like dividend yields and payout ratios, which you can access below:

Apple Hospitality’s high yield and monthly payout create an intriguing value proposition for income investors. But as always, investors need to make sure the dividend payout is sustainable.

This article will analyze the investment prospects of Apple Hospitality REIT in detail.

Business Overview

Apple Hospitality REIT is a Real Estate Investment Trust that focuses on owning hotels and other tourism properties. Apple Hospitality is externally-managed, which means it hires a third-party property management company to identify new tenants and secure leases.

The company is relatively young as a publicly-traded security. It first began trading on the New York Stock Exchange on May 18, 2015 – nearly five years ago. However, do not be fooled by Apple Hospitality’s short history in the public markets. The company was a private hotel owner prior to its IPO, and has a very impressive real estate portfolio.

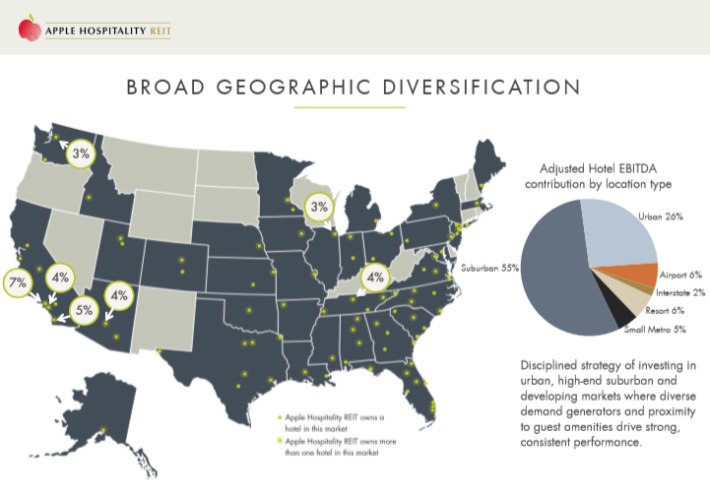

Apple Hospitality owns 231 hotels in 87 markets across 34 states. All said, the company controls 29,535 guestrooms. Apple Hospitality has a high degree of geographic diversification in its property portfolio.

This is especially important given that the REIT operates in the hotel industry. By having a presence in a wide range of tourist markets, Apple Hospitality isolates itself from the risk that any particular geography becomes less attractive for tourists.

More details about Apple Hospitality’s geographic diversification can be seen below.

Source: Investor Presentation

Apple’s diversified portfolio has served the company well, with consistent cash flow. On February 25th, the company reported fourth-quarter and full-year financial results. Fourth quarter modified FFO-per-share of $0.32 declined from $0.36 in the year-ago quarter. Total quarterly revenue of $290.0M also fell from $295.3M a year earlier.

These declines were due to a combination of dispositions as well as a 0.9% decline in comparable hotels RevPAR. That being said, comparable hotels occupancy increased by 20 basis points year-over-year to 72.9%.

Looking forward to fiscal 2020, management has withdrawn guidance as the evolving impacts of the coronavirus pandemic continue to reduce its outlook for the year.

Growth Prospects

Apple Hospitality’s future growth will be driven by its proven investment strategy. The REIT trend to focus on upscale hotels, and partners with the three best hotel brands in this category: Marriott, Hilton, and Hyatt.

After acquiring properties suitable for these hotel chains, Apple Hospitality hires best-in-class property operators to minimize vacancies and enhance the financial performance of its properties.

More details about Apple Hospitality’s investment strategy can be seen below.

Source: Investor Presentation

As a REIT, Apple Hospitality is required by law to pay out 90% of its ordinary income as distributions to its shareholders. This limits the amount of capital that is available for internal reinvestment.

Thus, to acquire new properties, REITs generally do one of two things:

- Issue new units on the open market (through an ‘at-the-market’, or ATM, equity issuance program)

- Leverage their balance sheet by issuing new debt to raise capital

Each option has its pros and cons. The first option does not pose any additional financial risk to Apple Hospitality, but it dilutes existing shareholders and worsens the company’s per-share financial performance.

Thus, the second option may appear more attractive for driving financial performance. However, some REITs are already highly leveraged and cannot reasonably increase their leverage to acquire new properties.

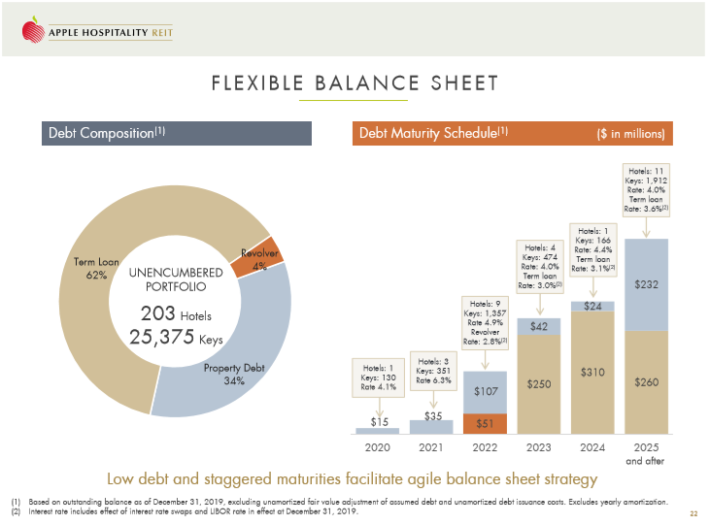

Fortunately, Apple Hospitality has a very conservatively-financed balance sheet. The company has plenty of room to increase their leverage if they find compelling opportunities to acquire new hotel properties.

Apple Hospitality’s conservative financing structure means the company has plenty of financial flexibility to drive growth moving forward.

Competitive Advantages & Recession Performance

Apple Hospitality has a significant scale-based competitive advantage that comes from being one of the largest upscale hotel owners in the United States. In fact, there are only three upscale hotel operators with a larger market capitalization than Apple Hospitality:

- Host Hotels & Resorts (HST)

- Park Hotels & Resorts (PK)

- Pebblebrook Hotel Trust (PEB)

Apple Hospitality also benefits from many other competitive advantages. Aside from the obvious economies of scale that come from operating most large businesses, Apple Hospitality has a substantial data-based competitive advantage.

The company owns more than 200 hotels, so it has a high level of operational expertise. This gives Apple Hospitality a unique ability to identify areas of opportunity and spread best practices across its business.

Another advantage held by Apple Hospitality is its influence with its two major tenants, Marriott and Hilton. Because of the ongoing partnership between these companies, Apple Hospitality has representation on 10 Marriott and Hilton brand advisory boards.

This helps to align the interests of the landlord (Apple Hospitality) and the tenant (Marriott & Hilton), which benefits each party involved.

Despite these competitive advantages, I would not expect Apple Hospitality to be a strong performer during a recession. The REIT’s tenants (hotels) are prone to serious downturns. Consumers typically avoid spending at hotels when disposable income becomes tight. This squeezes hotel revenues and increases default risk for tourism REITs like Apple Hospitality.

With that said, Apple Hospitality is well-positioned to manage a recession because of its conservatively structured balance sheet.

Source: Investor Presentation

The company has a low level of absolute debt, and a high proportion of its properties (203 hotels) are unencumbered, meaning that they are not currently being used for any real estate secured lending.

Apple Hospitality also has a favorable debt maturity schedule. The company has little debt maturing until 2022, and the majority of its outstanding debt matures in 2024 and beyond. With this in mind, I would not view Apple Hospitality as a defensive position for an investment portfolio.

Valuation & Expected Total Returns

Apple Hospitality’s future returns will be driven by dividend payments, valuation changes, and growth in the company’s earnings power (as measured by funds from operations).

Related: How To Calculate The Expected Total Returns of Any Stock

Of those three, the most tangible driver of Apple Hospitality’s future returns will be the company’s dividend payment. The REIT currently pays a monthly dividend of $0.10 per share, which yields 18.9% on the company’s current stock price of ~$6.34.

Unfortunately for analysts, REITs cannot be accurately analyzed using the conventional price-to-earnings ratio because of the substantial depreciation and amortization charges associated with owning long-lived assets like real estate.

Instead, one straightforward method to assess a REIT’s valuation is by comparing its current dividend yield to its historic dividend yield. If a REIT’s current dividend yield is higher than normal, it could be undervalued. If a REIT’s current dividend yield is lower than average, then the REIT is likely overvalued.

Apple Hospitality’s current dividend yield is noticeably elevated from its historical level. Thus, the REIT appears undervalued and right now looks to be a solid opportunity to initiate a position in this hospitality REIT.

The dividend appears to be secure based on 2019 numbers and initial 2020 guidance. However, it recently withdrew guidance due to the coronavirus outbreak and the resulting sharp decline in travel and hotel bookings. As a result, we are very uncertain about the near-term security of the dividend.

But over the long term, we expect the company to be able to sustain its current dividend payout if it so chooses once normal travel patterns normalize. When that happens is a different question, and remains unanswered at the present time.

Aside from dividend payments and valuation changes, the remainder of Apple Hospitality’s shareholder returns will be composed of growth in the company’s per-share funds from operations. Typically, investors can get a sense of a company’s future growth rate by extrapolating its historical growth rate forward into future years (assuming the business outlook is relatively constant).

This is not possible to the same extent with Apple Hospitality because of the REIT’s short history as a publicly-traded security. Thus, investors are best served to conservatively estimate Apple’s future growth.

Apple Hospitality saw its funds from operations remain pretty flat over the past three fiscal years and they were expected to remain flattish this year as well, although the coronavirus pandemic will likely result in a significant decline in performance.

Given the hospitality sector’s poor track record in recessions and the late stage of the economic cycle, combined with the sluggish growth at the present time, it is prudent to assume a low growth rate for the foreseeable future. As a result, we forecast 1% annual FFO per share growth over the next five years.

To sum up, Apple Hospitality’s future returns will be composed of:

- 18.9% dividend yield

- 1% growth in funds from operations

For total shareholders returns of 19.9%, before any impact of valuation changes.

Tax Implications

REITs avoid double taxation by paying no tax at the organizational level. For obvious reasons, this is a large benefit over operating as a corporation.

One of the trade-offs to this favorable organizational tax treatment is the complicated tax nature of REIT distributions for its investors.

REIT distributions are generally composed of three types of income:

- Ordinary income

- Capital gains

- Returns of capital

The first two types (ordinary income and capital gains) are exactly what you would expect, and are taxed at your marginal tax rate and the short- or long-term capital gains tax rate, respectively.

The third type (return of capital) reduces the cost basis of your holdings in exchange for cash payments now. Thus, the tax paid on return of capital distributions is not paid until you eventually sell the REIT shares.

The overall tax paid on REIT distributions depends heavily on the income breakdown within those distributions.

A reasonable expectation for the tax breakdown of general REIT distributions is 70% ordinary income, 15% capital gains, and 15% return of capital. With that said, this holds for REITs in general, and will vary based on which REIT you own.

Fortunately, REITs have to publish their dividend breakdown in Form 1099s, sent to their investors on an annual basis. The income breakdown of REIT distributions is usually quite constant over time – meaning that if Apple Hospitality REIT paid 20% returns of capital over the past few years, it is likely to continue doing so moving forward.

With that in mind, let’s take a look at the historic characterization of Apple Hospitality’s distributions:

“The percentage of nontaxable cash distributions (Return of Capital) is 22%. The tax basis of each shareholder of common stock held throughout 2019 should be reduced by $0.26.” – Apple Hospitality REIT 2019 Form 8937, page 1

Since Apple Hospitality’s distributions are typically composed mostly of ordinary income, this REIT is best held in a tax-advantaged account such as an IRA. However, that does not mean this REIT should never be held in a taxable account.

Final Thoughts

Apple Hospitality is a leader in the hotel real estate industry. Its market leadership and strong relationship with the Marriott, Hilton, and Hyatt hotel brands give it a competitive advantage over many of its smaller peers.

The company is also very shareholder-friendly. Its 18.9% dividend yield and monthly dividend payments are appealing for investors looking to generate current income from their investment portfolios.

Apple is priced very attractively right now, at least relative to its short history as a publicly-traded REIT. The company merits further research for income-oriented investors and should be viewed as a speculative buy until the uncertainty stemming from the coronavirus pandemic is cleared up.