MicroVision Announces First Quarter 2023 Results

REDMOND, WA / ACCESSWIRE / May 9, 2023 / MicroVision, Inc. (NASDAQ:MVIS), a leader in MEMS-based solid-state automotive lidar and ADAS solutions, today announced its first quarter 2023 results.

“Following the closing in January of our acquisition of assets from Ibeo Automotive Systems GmbH, we are energized by the strength of our combined team, accelerated engagement with multiple OEMs, and positive financial performance in Q1 2023. Revenue of $0.8 million was ahead of our expectations, primarily driven by the acquisition.” said Sumit Sharma, MicroVision's Chief Executive Officer. “I am pleased with our significant achievements in the first quarter, with the momentum in our top line driven by our expanded product offerings and the efficient integration of our U.S. and Germany teams.

“With the dynamic-view MAVIN™, our MEMS-based scanning lidar for long-range highway pilot; MOVIA™, our flash-based short-range lidar for automotive and non-automotive applications; and MOSAIK™, our validation software suite for OEMs and Tier 1s, MicroVision is uniquely positioned to capture meaningful market share in both automotive and non-automotive verticals,” continued Sharma. “Our product offerings and unmatched technical capabilities are proving to be compelling in key RFIs and RFQs from several OEMs around the globe. We maintain our 2023 revenue guidance of $10-15 million from our expanded product suite.”

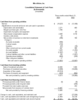

Key Financial Highlights for Q1 2023

- Revenue for the first quarter of 2023 was $0.8 million, compared to $0.4 million for the first quarter of 2022. The revenue growth in the first quarter was primarily due to the IBEO acquisition and includes the sale of lidar hardware and related software to various customers.

- Net loss for the first quarter of 2023 was $19.0 million, or $0.11 per share, which includes $2.9 million of non-cash, share-based compensation expense, $1.7 million bargain purchase price gain, compared to a net loss for the first quarter of 2022 of $13.2 million, or $0.08 per share, which includes $3.7 million of non-cash, share-based compensation expense.

- Adjusted Gross Profit for the first quarter of 2023 was a $0.5 million, compared to a $0.3 million for the first quarter of 2022.

- Adjusted EBITDA for the first quarter of 2023 was a $15.8 million loss, compared to a $9.0 million loss for the first quarter of 2022.

- Cash used in operations in the first quarter of 2023 was $13.8 million, compared to cash used in operations in the first quarter of 2022 of $10.9 million.

- The Company ended the first quarter of 2023 with $67.7 million in cash and cash equivalents including investment securities, compared to $82.7 million at December 31, 2022.

Conference Call and Webcast: Q1 2023 Results

MicroVision will host a conference call and webcast, consisting of prepared remarks by management, a slide presentation, and a question-and-answer session at 2:00 PM PT/5:00 PM ET on Tuesday, May 9, 2023 to discuss the financial results and provide a business update. Analysts and investors may pose questions to management during the live webcast on May 9, 2023.

The live webcast and slide presentation can be accessed on the Company's Investor Relations website under the Events tab at https://ir.microvision.com/events. The webcast will be archived on the website for future viewing.

About MicroVision

With over 350 employees and global presence in Redmond, Detroit, Hamburg, and Nuremberg, MicroVision is a pioneering company in MEMS-based laser beam scanning technology that integrates MEMS, lasers, optics, hardware, algorithms and machine learning software into its proprietary technology to address existing and emerging markets. The Company's integrated approach uses its proprietary technology to provide automotive lidar sensors and solutions for advanced driver-assistance systems (ADAS) and for non-automotive applications including industrial, smart infrastructure and robotics. The Company has been leveraging its experience building augmented reality micro-display engines, interactive display modules, and consumer lidar modules.

For more information, visit the Company's website at www.microvision.com, on Facebook at www.facebook.com/microvisioninc, and LinkedIn at https://www.linkedin.com/company/microvision/.

MicroVision, MAVIN, MOSAIK, and MOVIA are trademarks of MicroVision, Inc. in the United States and other countries. All other trademarks are the properties of their respective owners.

Non-GAAP information

To supplement MicroVision's condensed financial statements presented in accordance with GAAP, the Company presents investors with the non-GAAP financial measure "adjusted EBITDA" and “adjusted Gross Profit.” Adjusted EBITDA consists of GAAP net income (loss) excluding the impact of the following: interest income and interest expense; income tax expense; depreciation and amortization; and share-based compensation. Adjusted Gross Profit is calculated as GAAP gross Profit before stock-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

MicroVision believes that the presentation of adjusted EBITDA and adjusted Gross Profit provides important supplemental information to management and investors regarding financial and business trends, provides consistency and comparability with MicroVision's past financial reports, and facilitates comparisons with other companies in the Company's industry, many of which use similar non-GAAP financial measures to supplement their GAAP results. Internally, management uses this non-GAAP measure when evaluating operating performance because the exclusion of the items described above provides an additional useful measure of the Company's operating results and facilitates comparisons of the Company's core operating performance against prior periods and its business objectives. Externally, the Company believes that adjusted EBITDA and adjusted Gross Profit is useful to investors in their assessment of MicroVision's operating performance and the valuation of the Company.

Adjusted EBITDA and adjusted Gross Profit is not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures have limitations in that they do not reflect all of the costs associated with the operations of MicroVision's business as determined in accordance with GAAP. The Company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from its non-GAAP financial measure should not be construed as an inference that these costs are unusual or infrequent. The Company compensates for limitations of the measure by prominently disclosing GAAP net income (loss), which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation from GAAP net income (loss) to adjusted EBITDA.

Similarly for Adjusted Gross Profit, the Company compensates for limitations of the measure by prominently disclosing GAAP gross profits which is the difference between Revenue and Cost of revenue, which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation by backing out stock-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

Forward-Looking Statements

Certain statements contained in this release, including the Company's plans regarding benefits of the acquisition, market position, product portfolio, product capabilities, and expected revenue, expenses and cash usage are forward-looking statements that involve a number of risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include the risk its ability to operate with limited cash or to raise additional capital when needed; market acceptance of its technologies and products or for products incorporating its technologies; the failure of its commercial partners to perform as expected under its agreements, including from the impact of COVID-19 (coronavirus); its financial and technical resources relative to those of its competitors; its ability to keep up with rapid technological change; government regulation of its technologies; its ability to enforce its intellectual property rights and protect its proprietary technologies; the ability to obtain customers and develop partnership opportunities; the timing of commercial product launches and delays in product development; the ability to achieve key technical milestones in key products; dependence on third parties to develop, manufacture, sell and market its products; potential product liability claims; its ability to maintain its listing on The Nasdaq Stock Market, and other risk factors identified from time to time in the Company's SEC reports, including the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC. These factors are not intended to represent a complete list of the general or specific factors that may affect the Company. It should be recognized that other factors, including general economic factors and business strategies, may be significant, now or in the future, and the factors set forth in this release may affect the Company to a greater extent than indicated. Except as expressly required by federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changes in circumstances or any other reason.

Investor Relations Contact

Jeff Christensen

Darrow Associates Investor Relations

Media Contact

Robyn Komachi

Source: MicroVision, Inc.

MicroVision Inc Stock

With 0 Sell predictions and 2 Buy predictions the community sentiment towards the MicroVision Inc stock is not clear.

Based on the current price of 1.07 € the target price of 4 € shows a potential of 275.02% for MicroVision Inc which would more than double the current price.