Published March 7th, 2020

This is a guest contribution by Ryan Krueger of investment advisory firm Krueger & Catalano. You can follow Ryan on Twitter @RyanKruegerROI.

Growth or Income? There are more than enough Tortoise and Hare investment products to choose from, and even more investment analogies drawn from this great race.

A more un-crowded question is what animal do you think runs the fastest for the longest?

It’s YOU and ME!

“All animals are equal, but some animals are more equal than others.”

– George Orwell

Humans’ secret weapon is sweat. We have a couple million more sweat glands than other animals. Not having much fur helps also. Plus, our IT bands hold elastic energy unlike any other animal. Those bouncy tendons in our legs propel us, reducing the amount of energy to take the next big step forward.

“Hairless, clawless and largely weaponless, ancient humans used the unlikely combination of sweatiness and relentlessness to gain the upper hand over faster, stronger, more dangerous animals.”

– Harvard Anthropology Professor Daniel Leiberman

Consider a third competitor, overlooked in the investment races between Tortoises and Hares. Rather than choosing between fast Growth or slow Income, the most relentless step forward that will last the longest is Growth OF Income.

Hiding in Plain Sight

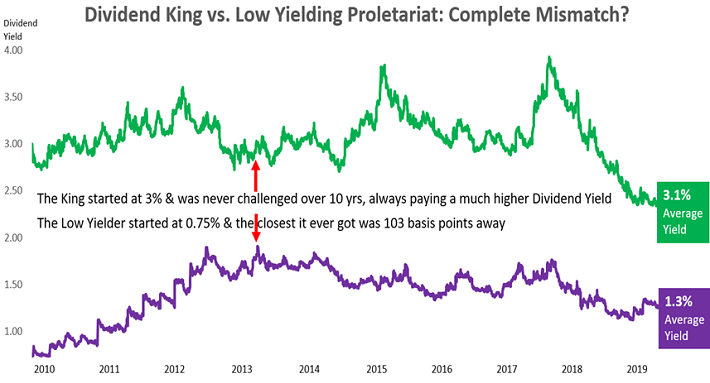

It is extremely hard to see this third sweaty choice, capable of outrunning the Tortoises and Hares. Look at this example of two household products companies over the past decade, paying dividends to shareholders. The first is one of the Dividend Kings, the name given to stocks which have increased dividends for more than 50 years in a row. Its rich history and high yield attract a convinced crowd.

The King’s shareholders were rewarded with a consistent dividend yield that was never challenged by this Dividend Proletariat – which is our own very non-branded, un-indexed name for the sweaty working class of dividend payers.

Look at the big difference in dividend yields between these two stocks over the past ten years:

At no time during the past decade did the lower yield ever come close to catching or passing the understandably more beloved higher yield of the Dividend King. At last count this King is owned inside investment products at 3,696 institutions. Our Dividend Proletariat is owned at 1,494, by comparison.

Agreement is expensive. Despite the company’s much slower operating growth, the Dividend King is priced currently at an Enterprise Value / EBITDA that is 50% more expensive than the Dividend Proletariat.

“What everybody else knows, is not worth knowing.”

-Gerald Loeb

Follow the Money to YOUR Mailbox

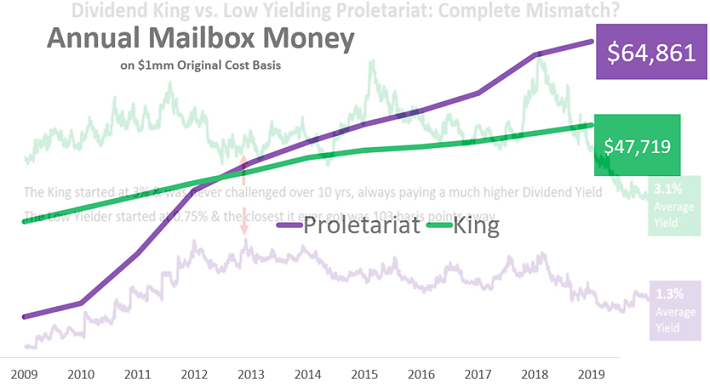

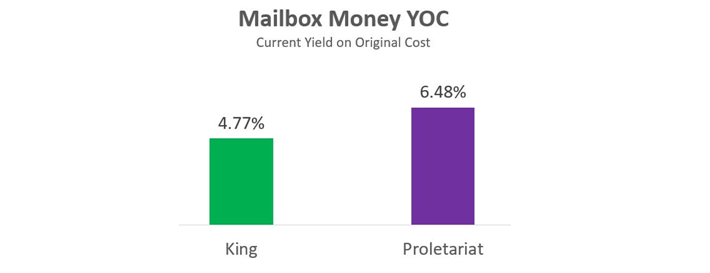

Investors looking at the racetrack of current dividend yields to compare stocks every day, are missing a better competition – the growth of dividend payments. In this case, the Dividend King is paying out the majority of its Free Cash Flow that is barely growing. The Dividend Proletariat paid out less than one-third of its Free Cash Flow, which more than tripled. As a result, the Dividend Proletariat was able to comfortably sweat out dividend increases more than 10 times greater than the Dividend King.

Lower current dividend yields can be misleading, which is why we stick with mailbox math shown above, on top of the original chart of the same two stocks. The size of the dividend payments being delivered to your mailbox is how investing can become most real, to hold in your hands. Look what happened to annual dividend payments if the same $1 million was invested in shares of each company. The always lower yielder caught the high yielder and passed it in mailbox money delivered.

The relentless patience for, and the rewards from the best dividend growers remind me of the story of a Zen student asking how long it would take to gain enlightenment if he joined the temple.

“Ten years,” – Zen master.

“Well, how about if I work really hard and double my effort?”- the student

“Twenty years.” – Zen master

When you look out at the next ten years, we always think it is a good idea to stress test your Investment Plan with this question – what if the Stock Market provided you zero price growth? That stress test is why no total return is shown in our simple mailbox money math of Dividend Yield on Cost.

Rather than counting on more growth to later invest in more income, we prefer to find Growth OF Income.

YOUR Tremendous Advantage as an Individual Investor

Your advantage over big institutional investors is bigger during a crisis and crowded confusion. They must sell panic, you do not. Big investment firms are trading the entire market as a basket of S&P 500 stocks. A recent Vanguard study revealed individual investors are less likely to act on changes in optimism or pessimism than institutional investors. Another huge difference is individual investors’ expectations are statistically much more realistic than institutional rates of return projections. Individuals do not have to answer to committees or crowds – so, we are not forced to react.

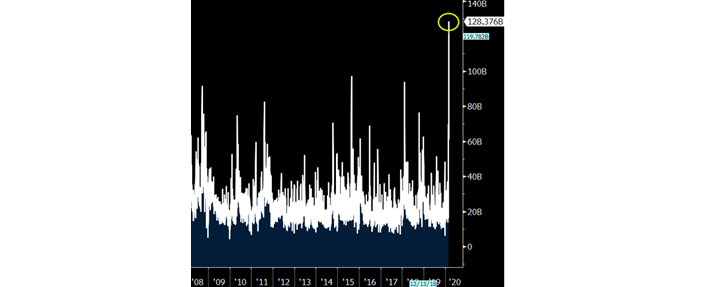

The all-time record for trading of a single security in one day was shattered with $128 billion in volume (previously none even crossed $100b). Any guesses on the most volatile name you can think of?

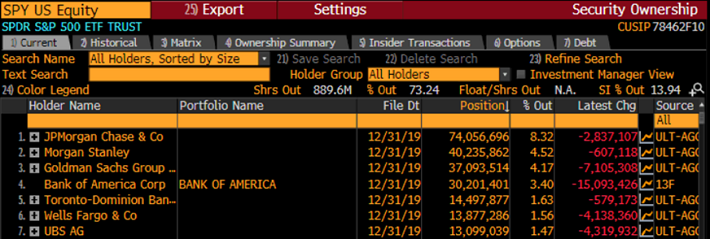

This is SPY, the exchange traded fund (ETF) for the entire S&P 500 Index of stocks. Notice who panics the most now. Below are the largest holders of SPY. No moms or pops are on this list. The big investment firms are the ones over-reacting, and more indiscriminately than ever before.

After 131 straight months without a traditional 20% market correction, the longest running bull market on record, the crowd of large investors were ready to use any scary excuse to sell stocks. When all stocks get sold together in a basket, thrown away with no regard to prices received for very, very different underlying businesses, THAT is when an individual has their biggest advantage of all.

“Bad companies are destroyed by crisis, good companies survive them, great companies are improved by them.”

-Andy Grove.

For our family and friends of Sure Dividend we are happy to personally answer any questions you may have at [email protected]. We look forward to sharing more posts in this Financial Freedom Day series for you.

We can be followed on Twitter @RyanKruegerROI.