Magnificent 7 Earnings Loom: What to Expect?

The Q4 earnings reporting cycle ramps up this week, with more than 300 companies on deck to report results, including four of the ‘Magnificent 7’ members and 102 S&P 500 members. We have Microsoft MSFT, Meta Platforms META, and Tesla TSLA reporting results the same day after the market’s close on Wednesday, January 28th, and Apple AAPL on Thursday, January 29th, after the market’s close.

The Mag 7 stocks have struggled lately, with the group lagging the broader market over the trailing twelve-month period, as can be seen by the blue line (+8.9%) in the chart below. While all four Mag 7 stocks reporting this week have underperformed, Meta and Microsoft have been particularly weak, while Apple and Tesla have done marginally better.

Image Source: Zacks Investment Research

The key issues with Microsoft, Meta, and even Apple are all tied to what these companies are doing in the AI space. While Microsoft and Meta are among the big spenders on AI, Apple has been missing in action, making Apple investors nervous about the company’s long-term competitive positioning.

Microsoft was initially seen as a leader in the space, with its relationship with OpenAI adding to its credentials. But that leadership status has now gone to Alphabet, particularly since regulatory headwinds eased for the search giant last year.

In terms of specific expectations, Apple is expected $2.65 per share in earnings on $137.5 billion in revenues, representing year-over-year gains of +10.4% and +10.6%, respectively. The revisions trend has been positive, with estimates steadily moving up.

For Microsoft, the expectation is of $3.88 per share in earnings on $80.2 billion in revenues, representing year-over-year growth rates of +20.1% and +15.2%, respectively. The revisions trend has been positive for Microsoft as well, with estimates for both the December quarter and fiscal year 2026 (FY ends in June) going up.

For Meta, the expectation is of $8.15 per share in earnings on $58.4 billion in revenues, representing year-over-year growth rates of +1.6% and +20.7%, respectively. The stock was down big following the last quarterly release on October 29th.

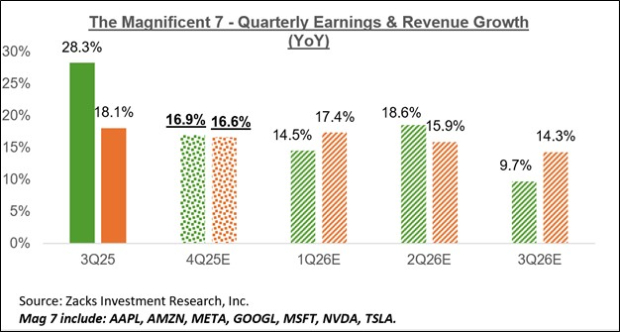

Looking at the Mag 7 group as a whole, Q4 earnings are expected to increase by +16.9% from the same period last year on +16.6% higher revenues. The chart below shows the group’s 2025 Q4 earnings and revenue growth expectations in the context of what was achieved in the preceding period and what is expected in the coming three quarters.

Image Source: Zacks Investment Research

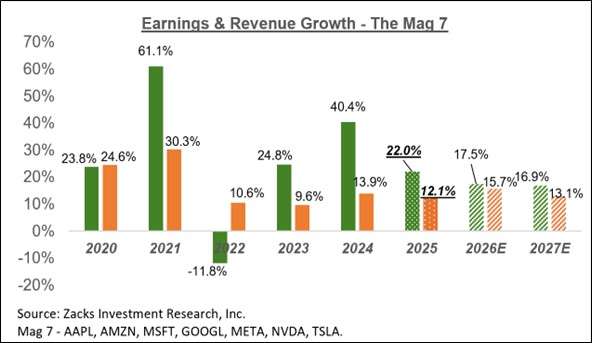

The chart below shows the Mag 7 group’s earnings and revenue growth picture on an annual basis.

Image Source: Zacks Investment Research

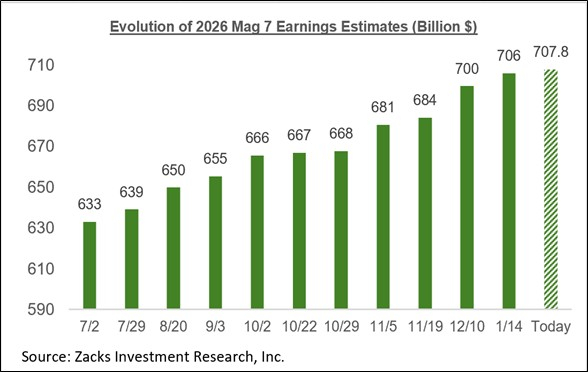

The group has been enjoying a steadily improving earnings outlook, with analysts raising their estimates. We saw that trend in play ahead of the start of the Q3 earnings season, and something similar is in place for 2025 Q4 as well.

The chart below shows how aggregate earnings estimates for the Mag 7 group have evolved since July 2025.

Image Source: Zacks Investment Research

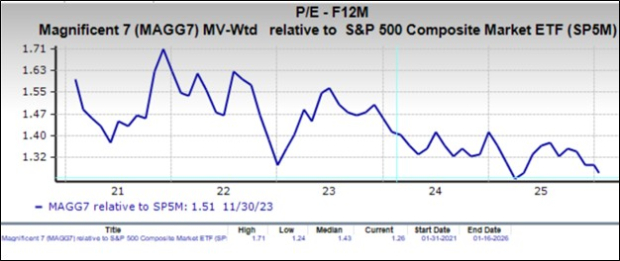

The chart below shows the Mag 7 group’s valuation on a forward 12-month P/E basis over the last five years relative to the S&P 500 index.

Image Source: Zacks Investment Research

The chart below shows the Mag 7 forward valuation multiple relative to the market multiple.

Image Source: Zacks Investment Research

The way to interpret the above chart is that the Mag 7 group is currently trading at 126% of the S&P 500 multiple, or at a 26% premium to the market multiple. Over the last five years, the Mag 7 group has traded as high as a 71% premium, as low as a 24% premium, with a median premium of 43%.

Q4 Earnings Season Scorecard

Through Friday, January 23rd, we have seen Q4 results from 64 S&P 500 members. Total earnings for these companies are up +17.5% from the same period last year on +7.8% higher revenues, with 82.8% beating EPS estimates and 68.8% beating revenue estimates.

As noted earlier, we have 102 index members reporting results this week. The week’s line-up includes, besides the aforementioned Mag 7 members, a representative cross-section of bellwether operators, including UPS, Boeing, GM, Starbucks, AT&T, IBM, Visa and Mastercard, Caterpillar, Comcast, American Express, Exxon, Chevron, and others.

The comparison charts below compare the growth rates for these 64 index members with those we saw from this same group of companies in other recent periods.

Image Source: Zacks Investment Research

The comparison charts below put the Q4 EPS and revenue beats percentages for this group companies relative to what we had seen from them in other recent periods.

Image Source: Zacks Investment Research

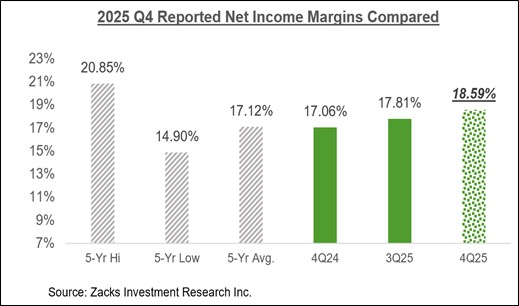

The comparison chart below puts the Q4 net margins for the 64 companies that have reported in a historical context.

Image Source: Zacks Investment Research

As you can see above, earnings and revenue growth remain strong, and EPS beats are tracking above the average for this group of companies in the preceding 20-quarter period, though revenue beats are a tad on the weaker side.

Plenty of results are still to come. But at this early stage, the revenue beats percentage is tracking below the historical average, with all the other metrics in the historical range.

The Earnings Big Picture

The chart below shows the Q4 earnings and revenue growth expectations in the context of where growth has been in the preceding four quarters and what is expected in the coming three quarters.

Image Source: Zacks Investment Research

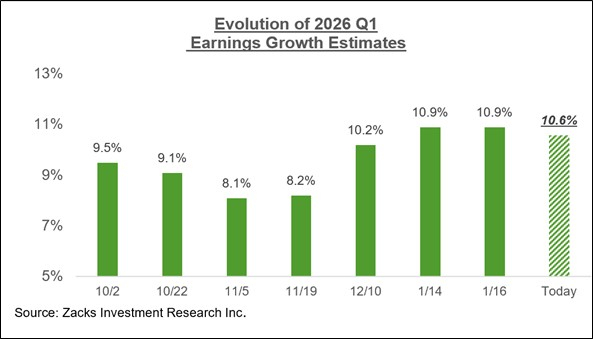

Estimates for the current period (2026 Q1) have come under some pressure in recent days, as the chart below shows.

Image Source: Zacks Investment Research

The above downtrend notwithstanding, estimates have actually increased modestly for 10 of the 16 Zacks sectors since the start of January, including Tech, Basic Materials, Autos, Industrials, Transportation, and others. On the negative side, estimates have come down for 6 of the 16 Zacks sectors, including Energy, Medical, Consumer Discretionary, and others.

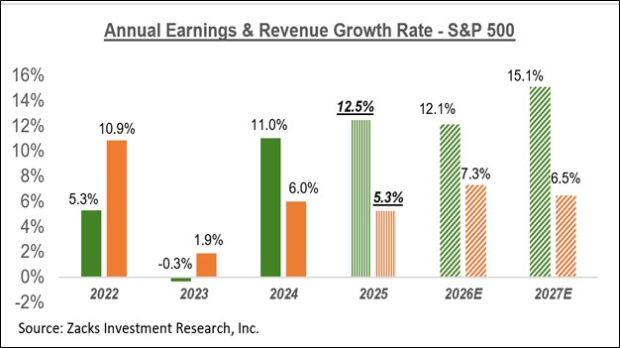

The chart below shows the overall earnings picture on a calendar-year basis, with double-digit earnings growth expected in 2025 and 2026.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>> Earnings Estimates Keep Rising: A Closer Look

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com