Updated on February 21st, 2020 by Nate Parsh

Kevin O’Leary is Chairman of O’Shares Investments, but you probably know him as “Mr. Wonderful”.

He can be seen on CNBC as well as ABC’s Shark Tank. Investors who have seen him on TV have likely heard him discuss his investment philosophy.

Mr. Wonderful looks for stocks that exhibit three main characteristics. First, they must be quality companies with strong financial performance and solid balance sheets. Second, he believes a portfolio should be diversified across different market sectors. Third, and perhaps most important, he demands income—he insists the stocks he invests in pay dividends to shareholders.

In fact, of the top 10 holdings in the O’Shares FTSE U.S. Quality Dividend ETF (OUSA), 8 are on our list of Blue Chip stocks.

Blue chip stocks are established, safe, dividend payers. We define Blue Chip stocks as companies that are members of 1 or more of the following 3 lists:

- Dividend Achievers (10+ years of rising dividends)

- Dividend Aristocrats (25+ years of rising dividends)

- Dividend Kings (50+ years of rising dividends)

You can download the complete list of all 260+ blue chip stocks (plus important financial metrics such as dividend yield, P/E ratios, and payout ratios) by clicking below:

Click here to download your Excel spreadsheet of all 265 blue chip stocks, including metrics that matter like dividend yield and the price-to-earnings ratio.

OUSA owns stocks that display a mix of all three qualities. They are market leaders with strong profits, diversified business models, and they pay dividends to shareholders. The list of OUSA portfolio holdings is an interesting source of quality dividend growth stocks.

This article analyzes the fund’s top largest holdings in detail.

Table of Contents

The top 10 holdings from the O’Shares FTSE U.S. Quality Dividend ETF are listed in order of their weighting in the fund, from lowest to highest.

- Cisco Systems (CSCO)

- PepsiCo (PEP)

- Pfizer (PFE)

- Intel Corporation (INTC)

- Chevron Corporation (CVX)

- Home Depot (HD)

- Procter & Gamble (PG)

- Exxon Mobil Corporation (XOM)

- Johnson & Johnson (JNJ)

- Apple Inc (AAPL)

No. 10: Cisco Systems (CSCO)

Dividend Yield: 3.1%

Market Capitalization: $197 billion

Forward Price-to-Earnings Ratio: 14.5

Cisco is a global technology leader. The company’s routers and switches allow networks around the world to connect to each other through the internet.

Cisco is one of the younger dividend paying stocks in O’Leary’s top 10 list as the company has only paid a dividend since 2011. Since then, its dividend is 12x what it was nine years ago. After increasing its dividend by 2.9% for the upcoming 4/22/2020 payment, Cisco is now a Dividend Achiever.

With an expected payout ratio of 44%, Cisco will likely continue growing its dividend closer to its earnings growth rate going forward.

Cisco brings in annual revenues of nearly $52 billion and is a high margin business. Cisco has positioned itself into more of a reoccurring revenue business over the past few years by focusing on subscriptions. This is reflected in the company’s latest quarter.

Source: Investor Presentation

Subscriptions represented just under three-quarters of all software revenue in the second quarter of fiscal 2020, which was a 7% increase from the previous year. We expect the company to grow earnings a rate of 6% through 2025.

Shares of Cisco have a forward price-to-earnings ratio of 14.5, which is above our target multiple of 15x earnings. The company has experienced multiples expansions due to having an increasing subscription-based revenue that leads to higher predictability.

Therefore, the expansion of the valuation multiple appears to be warranted in this case. Returning to our target price-to-earnings ratio would add annual returns by 0.7% over the next five years. Adding in a current dividend yield of 3.1%, Cisco is expected to offer a total annual return of 9.8% through 2025.

No. 9: PepsiCo, Inc (PEP)

Dividend Yield: 2.6%

Market Capitalization: $202 billion

Forward Price-to-Earnings Ratio: 24.7

Pepsi is a global food and beverages company whose products are available in more than 200 countries and territories. Headquartered in Purchase, New York, Pepsi is one of the largest publicly-traded food and beverage companies. The revenue mix is about 54% food to 46% beverage.

Pepsi’s top brands include Pepsi, Frito-Lay chips, Mountain Dew, Tropicana orange juice, Gatorade, Doritos, and Quaker foods.

Source: Investor Presentation

The consumer defensive sector has been one of the stock market’s most stable performers throughout history. The sector is also extraordinarily recession-resistant. With this in mind, it’s unsurprising that Mr. Wonderful has Pepsi as a top 10 holding.

PepsiCo is trading at 24.7x expected 2020 earnings, meaning that the company appears to be expensive relative to its historical average valuation level. The stock has traded with a price-to-earnings ratio of 18.9 over the last 10 years. Reverting to this average valuation would reduce annual returns by 5.2% through 2025.

Earnings-per-share are projected to improve 5.5% annually through 2025. Shares of PepsiCo yield 2.6% today, which compares favorably to the overall market’s yield of 1.7%.

PepsiCo has increased its dividend for 48 consecutive years. As such, the company is a member of the Dividend Aristocrats, an exclusive group of S&P 500 Index companies with 25+ consecutive years of dividend increases.

Factoring in earnings growth, multiple reversion and dividend yield, PepsiCo is expected to return 2.9% annually over the next five years.

No. 8: Pfizer Inc. (PFE)

Dividend Yield: 4.2%

Market Capitalization: $189 billion

Forward Price-to-Earnings Ratio: 12.3

Pharmaceutical companies benefit from the fact that many people cannot go without their medications. This heavily insulates Big Pharma’s bottom line. Further, pharmaceutical companies have the ability to raise prices on key drugs. Because of this, healthcare stocks like Pfizer have proven to be a stable dividend payer.

In 2019, revenue decreased 1%. Consumer Healthcare revenue decreased 100%, but this is due to the segment now being reported as part of a joint venture with GlaxoSmithKline (GSK). Excluding Consumer Healthcare, revenue was up 2% for the year. Adjusted earnings-per-share decreased 1.7% to $2.95.

Pfizer has a strong oncology portfolio and has been spending a large portion of its investments in this area. Currently, it has 18 approved cancer medicines and biosimilars and up to 20 potential approvals expected by 2025. Down the road, new drugs should help boost Pfizer’s revenue.

Source: Investor Presentation

The drug manufacturer has historically generated pretty stable earnings through economic cycles. Coupled with a very sustainable payout ratio of about 50% this year, investors can continue to expect steady dividend growth that more or less matches with its earnings growth. With this in mind, it’s unsurprising that Pfizer remains a top 10 holding for Mr. Wonderful.

Pfizer trades at 12.3x expected 2020 earnings. The company appears to be fairly valued. The stock offers a dividend yield of 4.2%, which is more favorable than the overall market’s yield Earnings-per-share growth is estimated to be about 5% per year over the next few years. Overall, an investment today can deliver total returns of 9.2% per year over the next five years.

No. 7: Intel Corporation (INTC)

Dividend Yield: 2.0%

Market Capitalization: $275 billion

Forward Price-to-Earnings Ratio: 13

Intel is the largest manufacturer of microprocessors for personal computers. The company ships about 85% of the world’s microprocessors. Intel also manufactures products like servers and storage devices that are used in cloud computing.

More broadly, Intel’s products (microchips and semiconductors) will experience increasingly strong demand as the demand for data undoubtedly continues to grow at a torrential rate.

Source: Investor Presentation

Intel has three major focuses that it calls ‘big bets’ and is devoting significant resources to developing.

The first is memory. As an existing leader in this market, Intel is likely to benefit from this fast-growing segment of the technology industry.

The second is autonomous vehicles, which the company expects to be mainstream by 2030 thanks to companies like Tesla (TSLA), General Motors (GM), and Ford (F).

The third is 5G, which is expected to connect 50 billion devices once implemented.

Intel generated $72 billion of revenue last year while earnings-per-share improved 6%. We expect earnings to grow at an annual clip of 5% over the next five years.

The stock has a current multiple of 13x earnings, which matches our targeted price-to-earnings ratio of 13. Valuation isn’t projected to play a major role in total returns going forward.

Intel had increased its dividend for 10 consecutive years prior to pausing its dividend growth in 2014, meaning that the company has raised its dividend in 16 out of the past 17 years. Shares yield 2.0% at the moment.

Intel is therefore expected to return 7% annually over the next five years.

No. 6: Chevron Corporation (CVX)

Dividend Yield: 4.7%

Market Capitalization: $208 billion

Forward Price-to-Earnings Ratio: 17.7

Chevron is the third-largest energy company in the world by market capitalization. Despite the downturn in the price of oil and gas in 2014, Chevron continued to increase its dividend. The company has increased its dividend for 33 years, qualifying it as Dividend Aristocrat.

This streak of dividend growth is especially impressive as the company is vulnerable to sudden downturns in the price of oil. Approximately 75% of its total production output is related to the price of oil, making Chevron more leveraged to the price of oil than the other oil majors.

Chevron followed up last year’s larger than normal increase by raising its dividend 8.4% for the 3/10/2020 payment. For context, the average raise over the last five years is less than 4%. This suggests that the company believes the operating environment has begun to improve.

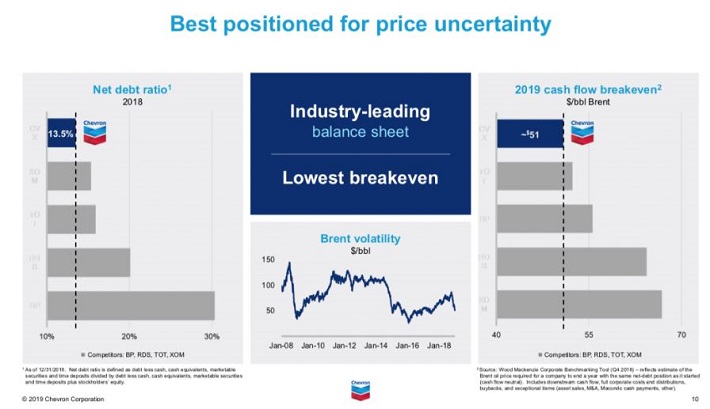

Chevron also enjoys the lowest cash flow break even oil price among its competitors.

Source: Investor Presentation

Chevron has seen the value of its Permian assets double over the last two years due to new discoveries and improvements in technology. This should help propel 3% to 4% annual output over the next five years. Earnings-per-share are projected to increase 8% annually over the next half-decade.

Shares of Chevron have a price-to-earnings ratio of 17.7, higher than our target multiple of 15.8x earnings. Reverting to this target would decrease annual returns by 2.2%.

Add in a 4.7% dividend, Chevron should return 10.5% annually through 2025.

No. 5: Home Depot (HD)

Dividend Yield: 2.2%

Market Capitalization: $269.5 billion

Forward Price-to-Earnings Ratio: 24.6

Home Depot is the largest home improvement retailer in the United States with a market capitalization of almost $225 billion. Similar to its competitor, Lowe’s (LOW), Home Depot tends to grow at a solid rate.

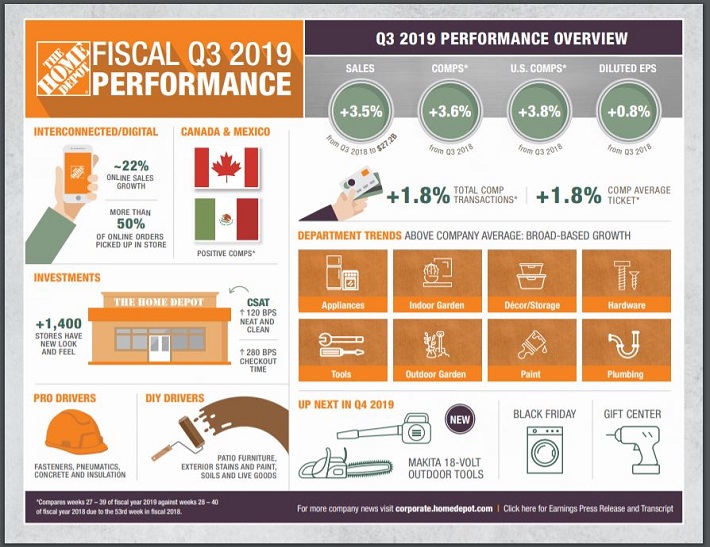

Source: Investor Presentation

Total sales grew 3.5% in the most recent quarter, with same-store sales improving 3.6%. Earnings-per-share improved 0.8%, but full year earnings are expected to grow 3.1%.

We see earnings-per-share growing at a rate of 7% per year over the next five years due to solid same-store sales growth and share repurchases.

The company has long been a leading operator in its industry and passes its financial success onto its shareholders in the form of steadily rising dividend payments. Home Depot hasn’t disclosed its dividend increase for 2020 yet, but last year’s raise was 32% and the average increase over the past five years is 18%. After pausing its dividend in 2009 due to the Great Recession, Home Depot has increased its dividend for the past 10 years.

Shares trade today with a price-to-earnings ratio of 24.6 against our 2025 target price-to-earnings ratio of 19. If the stock were to trade with our valuation target by 2025 then annual returns would be reduced by 5% over the next five years.

In total, shares of Home Depot are expected to return 4.2% per year through 2025.

No. 4: Procter & Gamble (PG)

Dividend Yield: 2.4%

Market Capitalization: $313 billion

Forward Price-to-Earnings Ratio: 26.2

Procter & Gamble is a stalwart among dividend stocks. It has increased its dividend for the past 60 years in a row. This makes the company one of only 30 Dividend Kings,a list of stocks with 50+ years of rising dividends.

It has done this by becoming a global consumer staples behemoth. It sells its products in more than 180 countries around the world with annual sales of more than $65 billion.

The company is organized into five operating segments:

- Fabric and Home Care (32% of sales)

- Baby, Feminine, and Family Care (27% of sales)

- Beauty (19% of sales)

- Health Care (12% of sales)

- Grooming (10% of sales)

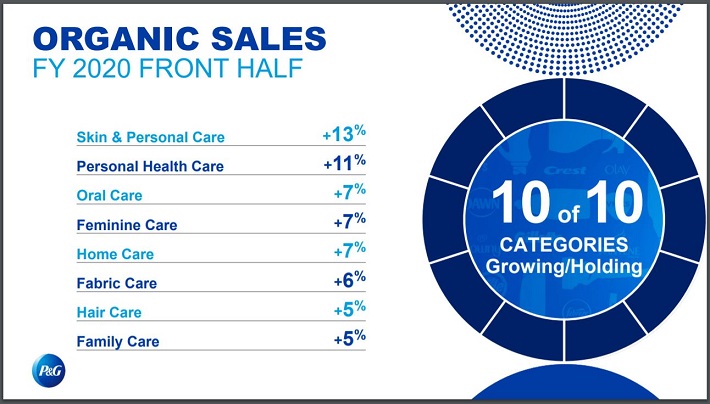

These products are in high demand regardless of the state of the economy, making the company rather recession proof. Many of these product categories have seen solid organic growth rates in the first half of fiscal 2020.

Source: Investor Presentation

Procter & Gamble is seen as delivering 5% earnings growth through 2025 due to the strength of its business

If shares were to revert from the present price-to-earnings ratio to our target of 20, then valuation would be a 5.3% headwind to annual returns over the next five years.

In all, Procter & Gamble is estimated to return 2.1% per year for the next five years.

No. 3: Exxon Mobil (XOM)

Dividend Yield: 5.8%

Market Capitalization: $253 billion

Forward Price-to-Earnings Ratio: 17.1

Exxon Mobil is the largest publicly-traded oil company in the world. It also has an unparalleled dividend track record among its peer group.

The company has paid a dividend for more than 100 years. And, Exxon Mobil is a Dividend Aristocrat, with annual dividend increases for 37 consecutive years.

Exxon Mobil and Chevron are the only two energy-sector stocks on the list of Dividend Aristocrats.

As with Chevron, Exxon Mobil managed to increase its dividend during the 2014 collapse in the price of oil and gas. The average raise over the last five years is just 3.6%. However, the company’s last raise was 6.1% for the 6/10/2019 payments. The energy giant pays a hefty dividend yield of 5.8%, the highest yield among Mr. Wonderful’s top 10 largest holdings.

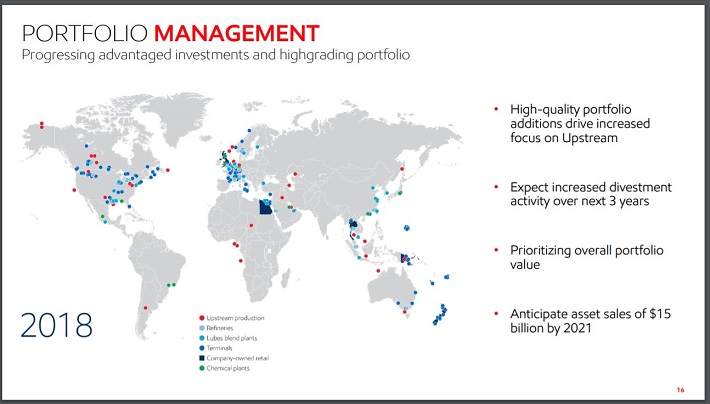

Exxon Mobil generated nearly 90% of earnings for its upstream segment prior to the collapse in oil price in 2014. But the company has diversified somewhat since the last oil bear market.

Source: Investor Presentation

The company now sees increased contributions from its downstream and chemical operations.

The company also expects to grow production from 4.0 to 5.0 million barrels per day by 2025. Due to these factors, earnings are likely to grow by at 12% annually through 2025.

Exxon Mobil has a valuation of 17.1x earnings, which compares unfavorably to our targeted price-to-earnings ratio of 13. Reverting to this level would be a 5.3% headwind to total returns over the next five years.

Added together, Exxon Mobil is seen as offering a return of 12.5% through 2025.

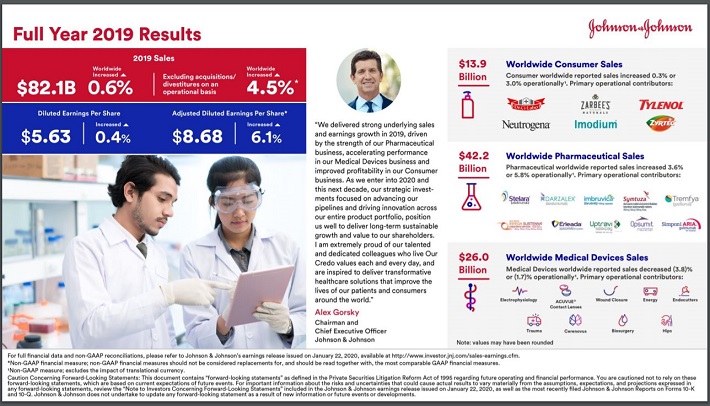

No. 2: Johnson & Johnson (JNJ)

Dividend Yield: 2.5%

Market Capitalization: $390 billion

Forward Price-to-Earnings Ratio: 16.4

Johnson & Johnson is one of the most well-known dividend stocks in the marketplace, so it should come as no surprise that it is a top holding for O’Leary.

After raising its dividend by 5.6% for the payment made last June, Johnson & Johnson has now increased its dividend for 57 consecutive years. This is one of the longest streaks in the market and makes the company one of just a handful of Dividend Kings.

Johnson & Johnson is organized into three business segments:

- Pharmaceutical (40.7% of sales)

- Medical Devices (27% of sales)

- Consumer (13.9% of sales)

Johnson & Johnson’s 2019 was another solid year of growth for the company.

Source: Investor Presentation

Excluding acquisitions and divestitures, revenue was higher by 4.5% while adjusted earnings-per-share increased 6.1% in 2019.

The company’s diversified business model helps insulate revenue and earnings against a decline in any one single area. Due to this, earnings-per-share are expected to grow at a clip of 6% per year for the next five years.

Shares of the healthcare giant trade at 16.4x expected earnings for 2020, which is above our target price-to-earnings ratio of 15.8. Investors buying today can expect multiple reversion to remove 0.7% from annual returns over the next five years.

In total, Johnson & Johnson should return 7.8% per year through 2025.

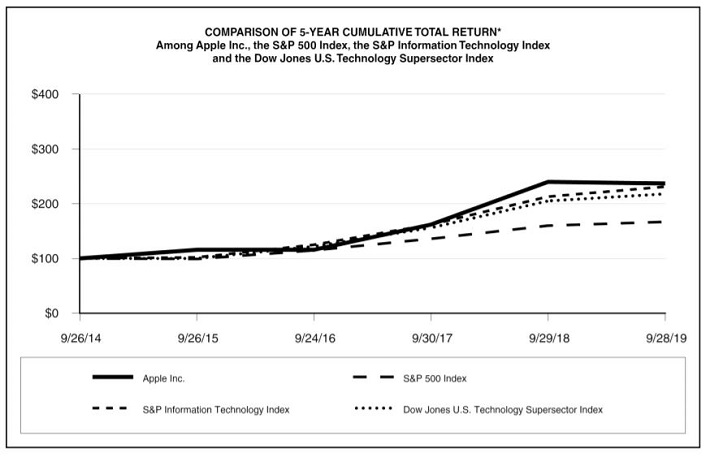

No. 1: Apple (AAPL)

Dividend Yield: 1.0%

Market Capitalization: $1.4 trillion

Forward Price-to-Earnings Ratio: 23.7

Apple, the largest company in the world by market capitalization, was not among the top 10 largest holdings for O’Leary when we first published this article in early May of last year. Now, the stock is the ETF’s largest holding with a 5.7% weight.

Considering that Mr. Wonderful prefers companies that return capital to shareholders, this weighting should be a surprise.

Apple is the youngest dividend paying stock on this list, having only distributed income to shareholders since 2012. Since then, the dividend has grown more than 8x in a very short amount of period. This is in addition to the massive number of shares that have been repurchased over the years.

Apple’s dividend of 1.0%, however, is the lowest yield among the top 10 largest holdings, but investors likely approve of this trade off in income for an 86% return over the last year.

This type of return shouldn’t come as a surprise to shareholders of the company, as Apple has regularly beaten the market.

Source: 2019 Annual Report

Apple’s future continues to be bright. While iPhone sales still contribute a significant portion of revenues, the company’s other business segments have performed quite well in recent years. Services grew almost 17% in the most recent quarter while Wearables were up 40%.

Total revenue increased 9% to a record $91.8 billion while earnings-per-share improved 19.4%, due in large part to a lower share count. Due to product growth and share repurchases, Apple should grow earnings-per-share at a rate of 7% through 2025.

Earnings growth and dividend yield will be offset by a likely 7.6% headwind from valuation reversion as the stock trades with a multiple of 23.7x earnings compared to our target multiple of 16x earnings.

Total returns are expected to be 0.4% through 2025, the lowest projected return on this list.

Final Thoughts

Kevin O’Leary has become a household name due to his appearances on the TV show Shark Tank. But he is also a well-known asset manager, and his investment philosophy aligns very closely with ours. Specifically, Mr. Wonderful typically invests in stocks with large and profitable businesses, with strong balance sheets and consistent dividend growth every year.

Not all of these stocks are currently rated as buys in the Sure Analysis Research Database, which ranks stocks based on expected total return due to a combination of earnings per share growth, dividends, and changes in the price-to-earnings multiple.

However, several of these 10 stocks are valuable holdings for a long-term dividend growth portfolio.