Is Samsara Poised To Reach New All-Time Highs?

Shares of Samsara (NYSE: IOT) have had a stellar year. The stock is up 117% year-to-date, vastly outperforming the overall market. After making a new 52-week high in June, the stock has pulled back near previous resistance and formed a bullish consolidation near its all-time highs. This makes for an exciting opportunity that could offer a skewed risk: reward.

Samsara made its debut on NYSE in December 2021, under the ticker IOT. The company sold 35 million shares priced at $23 and raised $805 million. The stock experienced extreme volatility after its debut, with shares reaching $31.41 in late December 2021 before beginning a lengthy downtrend resulting in the stock making fresh lows in November 2022 near $9.

That downtrend did not last forever, though, as the stock has experienced fantastic gains this year and now presents a unique opportunity.

Samsara is a prominent provider of Industrial Internet of Things (IoT) solutions focused on fleet management, safety, and compliance. They aim to enhance operational efficiency and customer security through innovative IoT technology. They offer GPS tracking, ELD compliance, video telematics, and environmental monitoring services.

The Opportunity In IOT

With the stock confidently trading above its rising 200-day SMA and consolidating near its all-time high (ATH) of $31.41 and 52-week highs, IOT is showing a strong bullish trend. Following its recent highs in June, the stock has spent the past month consolidating and absorbing the price action.

Notably, the bullish wedge pattern has emerged, indicating potential further upside for the stock if it can break above and hold above the $30 resistance. To validate this potential breakout, an increase in volume would be encouraging. In such a scenario, the stock could move toward $32.

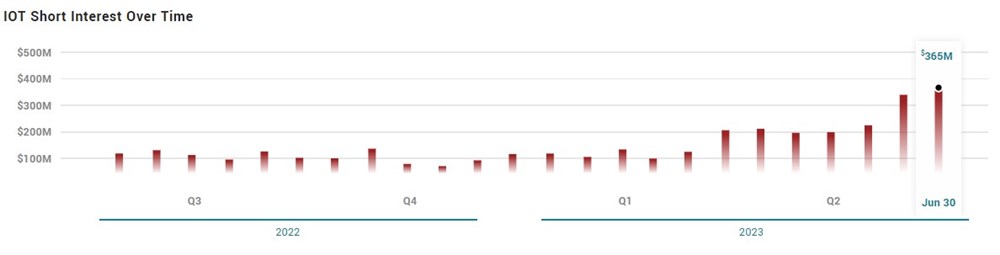

Almost 10% of The Float Is Short

As of June 30, 9.83% of the float is short, or 13.1 million shares. Month over month, the short interest has increased by 13%. The dollar volume sold short currently stands at $365 million.

With a steady increase in the short interest, and the stock consolidating near a potential breakout level, the growing short interest might act as a catalyst for higher prices in the short term.

Consensus Analyst Rating

Based on the nine analyst ratings of IOT, the stock currently has a consensus rating of Hold and a price target of $24.80. Although the consensus price target increased compared to the prior month's price target of $23.30, it predicts an 8.69% downside in the stock. Five of the nine analyst ratings rate IOT as Hold and four as Buy.

Most recently, on June 23, Truist Financial boosted its price target from $20 to $27, and the Royal Bank of Canada increased its target from $27 to $32.

Should You Invest?

As it applies to the above setup and promising technical analysis, deciding to invest or trade in shares of IOT should be conditional on identifying and receiving confirmation. For example, if the stock can hold over $30 with rising volume and continued abnormal short interest, then a move toward $32 is possible.

However, specific conditions must be met for the setup to have confidence and confirmation.

Source MarketBeat