Is Mid-America Apartment's Latest Dividend Hike Sustainable?

Mid-America Apartment Communities’ MAA, also known as MAA, board of directors approved an increase in the company’s quarterly dividend payment. The company will now pay out $1.53 per share, reflecting a hike of 1% from the prior dividend of $1.515.

Based on the increased rate, the annual dividend comes to $6.12 per share, marking an increase of 6 cents from the prior annual dividend. At this new rate, the annualized yield comes at 4.46%, based on the stock’s closing price of $137.09 on Dec. 17. The new dividend will be paid out on Jan. 30 to shareholders of record as of Jan. 15, 2026.

Solid dividend payouts are arguably the biggest enticements for REIT shareholders, and MAA remains committed to the same. The company has a good record of paying out dividends to its shareholders. The recent hike reflects MAA’s ability to generate solid income through its operating platform and high-quality portfolio. It also marks the 16th consecutive year MAA has hiked its dividend and also represents compounded growth of 8.3% over five years. Check Mid-America Apartment’s dividend history here.

Is MAA's Dividend Sustainable?

Mid-America Apartment is well-positioned to gain from its well-diversified Sun Belt-focused portfolio. The favorable in-migration trends of jobs and households in these submarkets, along with the high costs of home ownership, are likely to keep renter demand up. Improving absorption despite supply pressures is expected to help sustain the occupancy level and support revenue growth for MAA. In the third quarter of 2025, the average physical occupancy for the same-store portfolio was 95.6%. The prospects of its redevelopment program and technology measures are expected to drive margin expansion.

MAA enjoys a solid balance sheet, with low leverage and ample availability under its revolving credit facility. As of Sept. 30, 2025, MAA had $814.7 million of combined cash and available capacity under its unsecured revolving credit facility. In October 2025, the company increased its borrowing capacity to $1.5 billion, with an option to expand it to $2 billion through an amendment to its unsecured revolving credit facility. It also has a low net debt/adjusted EBITDAre ratio of 4.2.

In the third quarter of 2025, it generated 95.9% unencumbered NOI, providing the scope for tapping additional secured debt capital if required. Moreover, with long-term credit ratings of A- (Stable outlook) from Fitch Ratings and Standard & Poor’s Ratings Services and A3 (Stable outlook) from Moody’s, the company enjoys access to debt at favorable rates. Hence, the company is well-positioned to bank on growth scopes. Moreover, this REIT’s trailing 12-month return on equity (ROE) highlights its growth potential. The company’s ROE of 9.14% compares favorably with the industry’s 4.45%, reflecting that MAA is more efficient in using shareholders’ funds than its peers.

Backed by healthy operating fundamentals, balance sheet strength and prudent financial management, the company is well-poised to capitalize on growth opportunities and reward shareholders handsomely. Looking at its lower dividend payout (than its industry), its dividend distribution is expected to be sustainable.

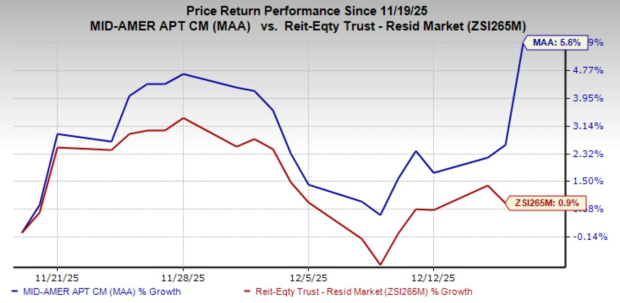

Shares of the Zacks Rank #3 (Hold) company have risen 5.6%, outperforming the industry’s growth of 0.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Recent Dividend Increases

Apart from MAA, two other REITs, W.P. Carey WPC and CubeSmart CUBE, have announced hikes in their dividends recently.

On Dec. 15, W.P. Carey announced a 1.1% hike in its dividend. WPC will now pay a quarterly cash dividend of 92 cents per share, up from 91 cents paid in the prior quarter. The increased amount will be paid out on Jan. 15, 2026 to shareholders on record as of Dec. 31, 2025. Check W.P. Carey’s dividend history here.

On Dec. 15, CubeSmart’s board of trustees declared a quarterly cash dividend on its common shares of 53 cents per share for the period ending Dec. 31, 2025, representing a 1.9% increase from the previous dividend payout. The increased dividend will be paid out on Jan. 16, 2026 to its shareholders of record as of Jan. 2, 2026. Check CubeSmart’s dividend history here.

Currently, W.P. Carey carries a Zacks Rank #2 (Buy), while CubeSmart has a Zacks Rank of 3.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mid-America Apartment Communities, Inc. (MAA): Free Stock Analysis Report

CubeSmart (CUBE): Free Stock Analysis Report

W.P. Carey Inc. (WPC): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com