Insider Watch: 3 CEOs Buying the Dip

Investors closely monitor insider buys, as they can give hints surrounding the long-term picture.

But it’s critical to note that insiders have a longer holding period than most, and many strict rules apply to their transactions.

Recently, CEOs of several companies – Church & Dwight CHD, Eli Lilly LLY, and Viatris VTRS – have made splashes, acquiring shares. Let’s take a closer look at the transactions for those interested in trading like the insiders.

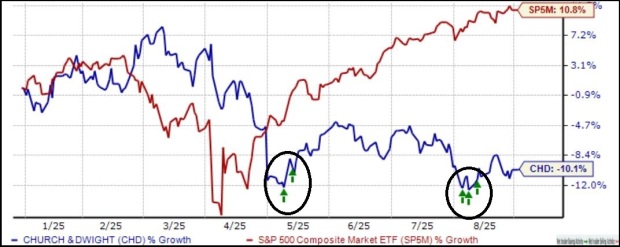

CHD CEO Buys $500K Worth

Church & Dwight develops, manufactures, and markets a broad range of household, personal care, and specialty products. The CEO dove in near mid-August, purchasing roughly 5.5k CHD shares at an overall transaction cost of just over $500k.

As shown below, shares have outperformed big in 2025 so far, losing roughly 10%. Still, insiders have been busy buying the dip, with the green arrows circled in the chart representing net insider buying activity.

Image Source: Zacks Investment Research

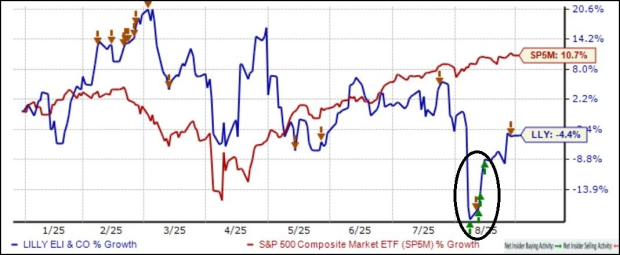

LLY CEO Buys Post-Earnings Weakness

LLY shares have faced pressure in 2025 so far, down 5% overall and widely underperforming relative to the S&P 500. But shares have shown nice life off the post-earnings lows so far, with insiders also buying after selling all throughout the year.

As we can see below, net insider buying activity has finally shown up after a 2025 that was primarily packed with selling.

Image Source: Zacks Investment Research

VTRS Insiders Buy On Momentum

Viatris, a global healthcare company, boasts an extensive product portfolio that comprises more than a thousand approved molecules across a wide range of key therapeutic areas. CEO Scott Smith made a sizable purchase, acquiring 22k VTRS shares at an overall transaction cost of roughly $220k.

Like those above, VTRS shares have lagged the S&P 500 considerably in 2025, down roughly 12%. But as shown again, insiders have been busy scooping up shares at discounted levels.

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, seeking insights into the longer-term picture. The transactions shouldn’t be relied on for near-term performance, as insiders’ holding periods are longer than most, and many strict rules apply.

Rather, investors can see insider buys as an overall net positive concerning the longer-term outlook.

All large-cap stocks above – Church & Dwight CHD, Eli Lilly LLY, and Viatris VTRS – have seen their respective CEOs make purchases over the last month.

Higher. Faster. Sooner. Buy These Stocks Now

A small number of stocks are primed for a breakout, and you have a chance to get in before they take off.

At any given time, there are only 220 Zacks Rank #1 Strong Buys. On average, this list more than doubles the S&P 500. We’ve combed through the latest Strong Buys and selected 7 compelling companies likely to jump sooner and climb higher than any other stock you could buy this month.

You'll learn everything you need to know about these exciting trades in our brand-new Special Report, 7 Best Stocks for the Next 30 Days.

Download the report free now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD): Free Stock Analysis Report

Viatris Inc. (VTRS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com