How Valero's Operational Flexibility Drives Profitability

Valero Energy VLO is a leading refining player with a robust network of 15 refineries located across the United States, Canada and Peru. The company has a combined throughput capacity of 3.2 million barrels per day, which distinguishes it among other independent refiners. Notably, VLO’s refineries have the operational flexibility to process various kinds of feedstock, including heavy sour, medium/light sour and sweet crude.

The operational flexibility of VLO’s refineries and refinery optimization provides a strategic advantage to the company. The flexibility to vary product yields allows the refineries to shift their production between light products and distillates, adjusting their mix of refined products according to market and pricing conditions. This shift in production based on market signals allows them to capture higher margins and support profitability.

Valero’s high-complexity, diversified refinery footprint and ability to process a wide range of crude feedstocks enable it to drive profitability. The refining industry is cyclical and highly volatile. However, the flexibility and operational reliability positions Valero to protect its profits in a volatile market environment.

PSX & PARR Are Two Other Leading Refiners

Phillips 66 PSX and Par Pacific Holdings PARR are two other refining players with a diversified refinery footprint.

Phillips 66 operates 11 refineries across the United States and Europe. The company recorded a 99% crude utilization rate in the third quarter, the highest since 2018. Its refining results benefit from strong refining margins seen this year. Further, its involvement in other segments, including midstream, renewables and chemicals, provides earnings stability.

Par Pacific Holdings is a Houston-based refining player with a combined refining capacity of 219,000 barrels per day, and operations spread across Hawaii and the Pacific Northwest. The company also operates 119 retail locations along with a logistics business segment.

VLO’s Price Performance, Valuation & Estimates

Shares of VLO have gained 46.8% over the past year compared with the 12.3% rise of the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

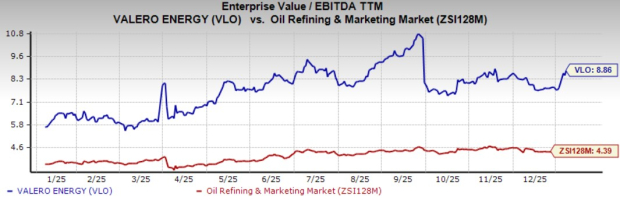

From a valuation standpoint, VLO trades at a trailing 12-month enterprise value to EBITDA (EV/EBITDA) of 8.86X. This is above the broader industry average of 4.39X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for VLO’s 2025 earnings has seen downward revisions over the past 30 days.

Image Source: Zacks Investment Research

VLO and PARR currently carry a Zacks Rank #3 (Hold) while PSX holds a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valero Energy Corporation (VLO): Free Stock Analysis Report

Phillips 66 (PSX): Free Stock Analysis Report

Par Pacific Holdings, Inc. (PARR): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com