How Does Business Diversification Help Boeing Sustain Growth?

The Boeing Company BA benefits from several lines of business — not just commercial airplanes but also defense systems, space technology and global services. This mix helps protect the company from financial ups and downs.

If a particular division, like commercial airplanes, suffers during a downturn in air travel, other segments, such as defense or space, usually provide stability, thanks to their reliance on long-term government contracts. These contracts provide steady income even when the economy is weak.

Boeing gains from operating in related industries by sharing suppliers, infrastructure, and technical resources across its product lines. As production stabilizes, costs come down and efficiency improves. The company’s extensive product line also allows it to serve a wide range of global customers, including airlines, government agencies and defense partners, providing numerous opportunities for expansion as demand in commercial aviation, space and defense grows.

For the nine months ended Sept. 30, 2025, each of Boeing’s segments contributed a different share to the company’s total sales. Nearly 46% came from the Commercial Airplanes division, 30% came from the Defense, Space & Security segment and the remaining 24% came from Global Services. This breakdown shows that Boeing’s revenues are spread across multiple divisions rather than relying on a single line of business.

In general, this diversification helps Boeing maintain its financial stability under various market conditions by distributing the risk.

Balanced Portfolios Drive Stability and Growth

Diversification benefits companies by providing resilience against economic volatility, opening up new revenue streams. A few U.S. defense companies with a diversified portfolio have been discussed below:

General Dynamics GD operates across several areas — building combat vehicles, constructing Navy ships, providing IT and cybersecurity services, and manufacturing Gulfstream business jets. This diversification helps balance its revenues and reduces reliance on any single market.

Northrop Grumman NOC focuses on a diverse set of high-tech defense areas, including advanced aerospace systems, space technologies and nuclear modernization programs. This allows it to benefit from multiple long-term government priorities and maintain steady growth.

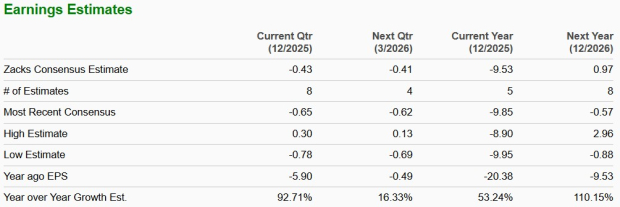

BA Stock’s Earnings Estimates

The Zacks Consensus Estimate for 2025 and 2026 EPS indicates a year over year improvement of 53.24% and 110.15%, respectively.

Image Source: Zacks Investment Research

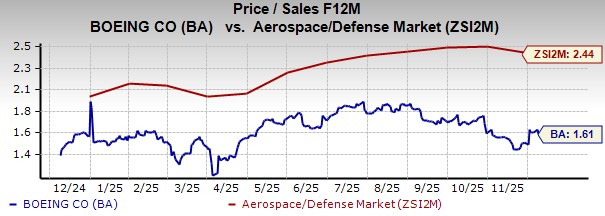

BA Stock Trades at a Discount

In terms of valuation, BA’s forward 12-month price-to-sales (P/S) is 1.61X, a discount to the industry’s average of 2.44X.

Image Source: Zacks Investment Research

BA Stock’s Price Performance

In the past year, the company’s shares have risen 22.1% compared with the industry’s 15.8% growth.

Image Source: Zacks Investment Research

BA’s Zacks Rank

The company currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA): Free Stock Analysis Report

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

General Dynamics Corporation (GD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com