Hims & Hers Scales Technology-Driven Care as Profitability Evolves

The renowned health and wellness platform, Hims & Hers Health, Inc. HIMS exemplifies a public-market growth company where scale, profitability and reinvestment are evolving in parallel rather than sequentially. Recent quarterly results show rapid top-line expansion alongside improving earnings, with third-quarter 2025 revenues nearing $600 million and positive net income, despite HIMS continues to invest heavily in technology, marketing and infrastructure. Profitability remains in transition, shaped by deliberate spending on new specialties, international expansion and vertical integration that temporarily pressure margins but are intended to support durable, recurring growth.

Operationally, Hims & Hers is broadening its platform beyond episodic care toward personalized, longitudinal health management. Recent launches include comprehensive lab testing, expanded weight-loss and hormone health offerings, and new women’s health specialties such as menopause and perimenopause care. Strategic developments — such as the acquisition of YourBio Health to enable pain-free blood sampling, the appointment of an AI-focused chief technology officer and continued investment in proprietary compounding and diagnostics — highlight a clear emphasis on data, personalization and user experience as long-term growth drivers.

Geographic expansion further reinforces this transition phase. Hims & Hers’ official entry into markets such as Canada and the U.K., along with continued expansion across Europe, reflects confidence in the portability of its business model. At the same time, recent capital raises and active balance-sheet deployment highlight management’s willingness to accept near-term margin volatility in pursuit of sustained global growth and deeper platform capabilities.

GDRX & TEM’s Evolving Platforms Balancing Growth and Profitability

GoodRx Holdings, Inc. GDRX exemplifies a public-market growth company navigating profitability transition through mix shift rather than pure volume expansion. GoodRx continues to report stable overall revenue while reallocating growth toward higher-margin pharma manufacturer solutions, which expanded sharply year over year. GDRX has also launched new condition-specific subscriptions, including weight loss and hair loss offerings, reinforcing GoodRx’s consumer-direct strategy. While prescription transaction volumes remain pressured, GoodRx is prioritizing disciplined cost control and margin durability as GDRX evolves its growth model.

Tempus AI, Inc. TEM represents a high-growth precision medicine platform where profitability is emerging alongside heavy reinvestment. Tempus AI delivered strong year-over-year revenue growth in third-quarter 2025 and achieved positive adjusted EBITDA for the first time, marking a key inflection. TEM continues to expand across genomics, data licensing and AI-enabled diagnostics, supported by regulatory clearances and strategic collaborations. With new oncology studies, federal program participation, and expanded AI platforms, Tempus AI remains firmly in an investment-driven growth phase while progressing toward sustainable profitability.

HIMS’ Price Performance, Valuation and Estimates

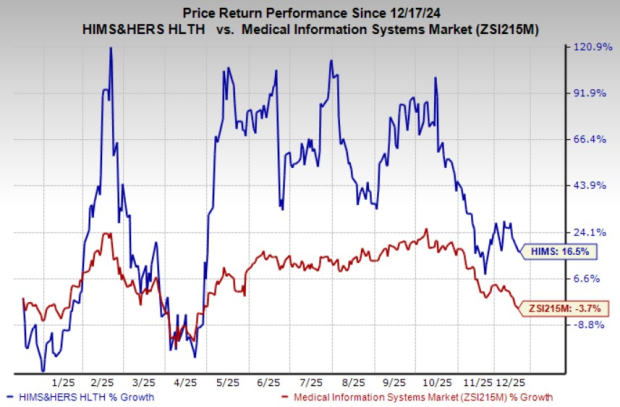

Shares of Hims & Hers have gained 16.5% over the past year, outperforming the industry’s decline of 3.7%.

Image Source: Zacks Investment Research

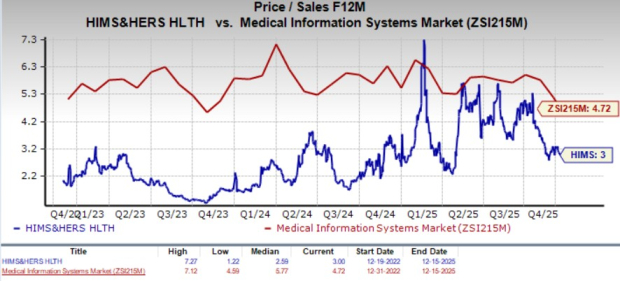

HIMS’ forward 12-month P/S of 3X is lower than the industry’s average of 4.7X, but is higher than its three-year median of 2.6X. It carries a Value Score of D.

Image Source: Zacks Investment Research

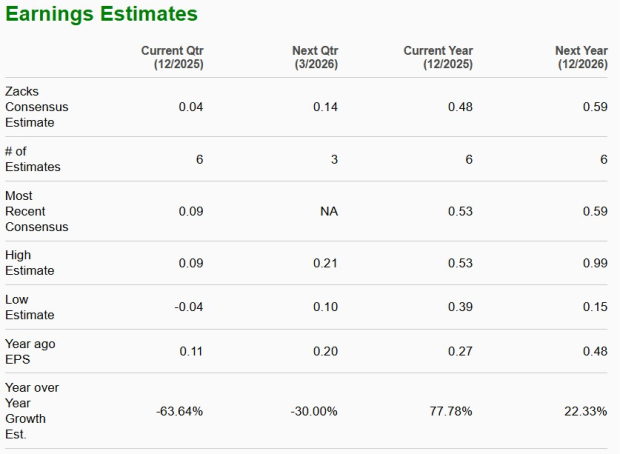

The Zacks Consensus Estimate for HIMS’ 2025 earnings per share suggests a 77.8% improvement from 2024.

Image Source: Zacks Investment Research

Hims & Hers currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GoodRx Holdings, Inc. (GDRX): Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS): Free Stock Analysis Report

Tempus AI, Inc. (TEM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com