Published on March 28, 2022, by Felix Martinez

Unum Group (UNM) is an undervalued high yield dividend growth stock. The company has been paying a rating dividend for thirteen consecutive years. The company now sports a high dividend yield of 3.8%, higher than its five-year dividend yield average. If you as a dividend growth investor, this is a company that you should have on your watchlist.

We also cover a lot of other different high-yield stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Thus, we will review Unum Group (UNM) for the following high-yield stocks in this series, with a current dividend yield of 3.8%.

Business Overview

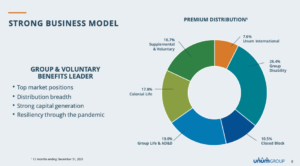

Unum Group is an insurance holding company providing a broad portfolio of financial protection benefits and services. The company operates through its Unum U.S., Unum U.K., Unum Poland, and Colonial Life businesses, providing disability, life, accident, critical illness, dental, and vision benefits to millions of customers.

Unum has about 182,000 businesses in the U.S. and U.K that offer benefits to its employees that are provided by Unum. The company is number 266 on the fortune 500 list, and 1 in 3 companies on the Fortune 500 list orders Unum benefits to their employees.

Source: Investor Presentation

On February 1, 2022, the company reported fourth-quarter and full-year results for Fiscal Year (F.Y.)2021. Revenue for the fourth quarter was down 30.3% compared to the fourth quarter of 2020. This decrease was primarily from net investment gain. In 4Q2020, the net investment gain was $1,304 million compared to a loss of $8.7 million last quarter. However, premium income, the company’s main revenue segment, grew 2.4% year over year.

The reported net income for the fourth quarter was $159.7 million or $0.78 per diluted common share for the fourth quarter of 2021. After-tax adjusted operating income was $182.0 million or $0.89 per diluted common share. This compares more profitable to 4Q2020, where the company made a profit of $135.4 million or $0.66 per diluted common share.

Unum’s U.S. segment reported an adjusted operating income of $81.4 million last quarter, a decrease of 43.3% from $143.5 million in 4Q2020. Premium income for the segment increased 3.0% to $1,529.3 million for the quarter, compared to premium income of $1,485.1 million in the fourth quarter of 2020. Net investment income for the segment increased 5.2% to $182.1 million in the quarter compared to $173.1 million in the same period of 2020.

For the year, revenue was down 8.7% compared to FY2020. Again, this was because of the net investment gain segment, which saw a substantial decrease year-over-year. However, Premium income for the year was up 1.1% compared to the entire year of 2020. Net income for the year was up 3.9%, from $793.0 million in FY2020 to $824.2 million last year.

Adjusted earnings-per-share equaled $4.35 compared to $4.93 in 2020. This was a decrease of 11.8% year-over-year. We expect the company will earn $4.80 per share for FY2022. This will be a gain of 10.3% compared to the entire year of 2021.

Growth Prospects

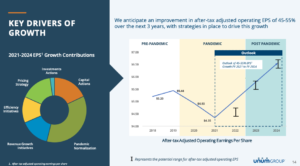

As an insurance holding company, there are a few different ways a company can continue to grow. As you see in the image below, the company has a few plans to drive growth. For example, a pricing strategy will be one way to grow the company. Management plans to have core competence in pricing and renewals. This will allow the company to align sales, underwriting, and actuarial.

The company also has efficiency initiatives plans, which will lower expenses. The company has plans for a digital-first, end-to-end leave experience. There is a significant increase in the adoption of digital channels for enrollment, administration, and claims. They also plan to reduce their real estate footprint.

Source: Investor Presentation

Another growth driver of earnings will be how the company allocates its capital. The company expects to maintain $200 million of buybacks per year over its outlook horizon and expected Fairwind LTC contributions between $550-650 million. Since the stock price is still undervalued, these steps should surely help future earnings growth.

Competitive Advantages & Recession Performance

The company is in the insurance industry with commodity-like products in nature. However, the company’s competitive advantage is its size and history. This allows the company to compete with better pricing. The company works with 1 in 3 companies on the fortune 500 list that orders Unum benefits to their employees. This would be challenging for competitors to step into this space.

The company performed very well during the great recession; however, the company stock price did not. The stock price saw a decrease of over 47% from 2007 to the low in 2009. However, earnings grew in that same period.

UNM’s earnings-per-share throughout the Great Recession:

- 2007 earnings-per-share of $2.04

- 2008 earnings-per-share of $2.51 (23% increase)

- 2009 earnings-per-share of $2.63 (5% increase)

- 2010 earnings-per-share of $2.66 (1% increase)

As you see, the company did very well during the 2008-2009 Great Recession. Both the earnings and dividend grew in those years. Thus, this led us to believe that the company will perform well in another recession, but the stock price will decline with the broader market.

Dividend Analysis

The company has been paying a rising dividend for thirteen straight years. The dividend growth rate has been 11.5% in the past ten years. However, the company’s dividend growth rate has been slowing down in recent years. For example, in the past five years, the dividend growth rate has been 8.7%. For the past three years, it has been 6.1%. The most recent dividend increase was 5.3% on May 27, 2021. Thus, we expect another dividend increase at the end of next month.

We believe that the company will grow earnings at a 2% rate over the next five years. Even though the dividend payout ratio is low, we think that the dividend growth rate will also be near this level. Most likely in the low-to-mid single-digit.

The dividend payout ratio has been meager for the company based on prior years. For example, the highest dividend payout ratio was 23% over the last ten years. This was achieved in 2020 when earnings were down because of the COVID-19 pandemic. As mentioned above, we expect the company to earn $4.80 per share for FY2022. Currently, the company pays a dividend of $1.20. This will give us a dividend payout ratio of 25% based on FY2022 earnings. This makes the dividend extraordinarily safe.

Also, management plans to allocate funds towards buybacks with any extra cash. Since the company is undervalued to its book value, management is raising its share buybacks with $250 million announced through the end of 2022, which is almost 5% of the market cap. This amounts to a notable return of capital for investors.

The company also has an outstanding balance sheet. The company has a 0.3 debt-to-equity ratio, which is excellent. Also, PRU has an S&P Credit Rating of “A.” The “A” credit rating is an investment-grade rating.

Thus, the balance sheet is excellent and should help the company withstand a recession without a dividend cut. Therefore, we think the dividend is very safe.

Final Thoughts

The company is a very safe and boring business. This is the type of business that dividend growth investors love to own. The company continues to generate cash flow. This increase in cash flow is being used for repurchasing sizable amounts of shares, paying out a significant dividend, and strengthening its investment-grade balance sheet.

Overall, this is a solid company with the ability to continue to pay and increase its high dividend yield for years to come.