Published on March 27, 2022, by Felix Martinez

Prudential Financial Inc. (PRU) is a high dividend yield company. The company is a dividend contender, a U.S. stock that has grown its dividends for 10-24 consecutive years. In this case, Prudential has raised its dividend for fourteen straight years.

We also cover a lot of other different high-yield stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Thus, we will review Prudential Financial Inc. (PRU) for the following high-yield stocks in this series, with a dividend yield of 4.0%.

Business Overview

Prudential Financial Inc. has operations in the United States, Asia, Europe, and Latin America. The company provides customers with various products and services, including life insurance, annuities, retirement-related services, mutual funds, and investment management. Prudential Financial has now been in business for over 140 years with $1.7 trillion in assets under management (AUM).

Prudential operates in four divisions: PGIM (formerly Prudential Investment Management), U.S. Businesses, International Businesses, and Corporate & Other. The company trades with a $45.4 billion market capitalization.

Source: Investor Presentation

On February 3, 2022, the company reported fourth-quarter and full-year results for Fiscal Year (FY)2021. The company had strong financial results for the growth quarter and full year. In this period, the company made significant progress in becoming a higher growth, less market sensitive, and more agile company.

For the quarter, Prudential reported a net income of $1.208 billion or $3.13 per share compared to $819 million or $2.03 per share in 4Q2020. This is an increase of 54.2% year-over-year. After-tax operating income equaled $1.227 billion or $3.18 per share compared to $1.13 billion or $2.80 per share in 4Q2020, or an increase of 13.6%. On a book value per common share, the company reported $161.26 versus $167.81 per share for the year ago. AUM grew slightly for the quarter by 1.2% compared to 4Q2020.

The company reported a total operating income of $7.3 billion for the entire year compared to the $4.95 billion the company made in FY2020. This is an increase of 47.5% year over year. The PGIM segment saw growth of 30.2%, while the U.S. businesses segment saw growth of 43.4%.

For the year, Prudential generated a net income of $7.724 billion or $19.51 per share compared to a loss of $374 million

or a loss of $1.00 per share in 2020. However, 2020 included significant investment losses. Adjusted after-tax operating income

equaled $5.772 billion or $14.58 per share compared to $3.913 billion or $9.72 per share for 2020.

The company also entered into agreements to divest lower growth and more market-sensitive businesses throughout last year. The divestments will help the company perform much better for the next recession.

Overall, the company earned $14.58 per share for the entire year, which is an increase of 43% compared to FY2021. We expect the company to earn $12.50 per share for FY2021. This will denote a decrease of 14.3%. This will be mostly driven by the slowdown of the market.

Growth Prospects

Prudential growth prospects will come from programmatic acquisitions and investments in asset management and emerging markets. For example, the company acquired Montana Capital Partners, Green Harvest Asset Management, and ICEA LION Holdings. While these are excellent acquisitions, Prudential is also divesting heavily market-sensitive assets. These divestments will help stabilize the company during the next recession. Thus, making the dividend safer.

Another growth driver for the company would be outside the U.S. As you can see below, AUM from European clients grew 13% CAGR over the last five years. Chian is also a significant opportunity for the company.

Source: Investor Presentation

Competitive Advantages & Recession Performance

Prudential Financial does not necessarily have competitive advantages. Life insurers do not benefit from favorable competitive positions. The industry competition is fierce, and the products are commoditized in many cases. Furthermore, insurers do not know the cost of goods sold for several years, allowing them to underprice policies without knowing it.

During the Great Recession, the company took hard earnings hit in 2008, with an earnings decline of 65%. The company also had to cut the dividend because of the fast decrease in earnings that year. Prudential cut its dividend from $1.15 per share to $0.58 per share for a reduction of 49.6%. However, it rebounded very well in the following years after 2008.

PRU’s earnings-per-share throughout the Great Recession:

- 2007 earnings-per-share of $7.58

- 2008 earnings-per-share of $2.69 (65% decrease)

- 2009 earnings-per-share of $5.58 (107% increase)

- 2010 earnings-per-share of $6.27 (12% increase)

As you see, the company ok during the 2008-2009 Great Recession. Both the earnings and dividend took high reductions in 2008 but came to their previous levels in just about three years.

Dividend Analysis

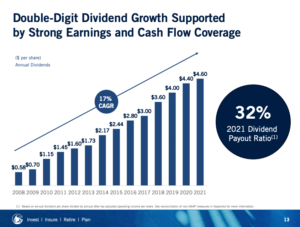

As mentioned above, the company has a dividend growth history of fourteen consecutive years. The only reason why it is not longer than fourteen years is because of the Great Recessions in 2008. Other than that, the company has a ten-year dividend growth rate of 12.2%. Over the past five years, PRU has had a dividend growth rate of 10.4%.

The combination of a high dividend yield with a high dividend growth rate makes Prudential Financial a desirable investment for dividend and income-driven investors. The most recent dividend increase was on February 3, 2022, when Prudential declared a $1.20 quarterly dividend, marking a 4.3% increase.

The company also pays a high dividend which is very safe. In the past ten years, the highest dividend payout ratio was 43% in 2020. Based on our expected earning of $12.50 per share for FY2021, this will give us a dividend payout ratio of 38%. Thus, the dividend is very safe and will continue to grow in the foreseeable future.

Source: Investor Presentation

The company also has an outstanding balance sheet. The company has a 0.3 debt-to-equity ratio, which is excellent. Also, PRU has an S&P Credit Rating of “A.” The “A” credit rating is an investment-grade rating.

Thus, the balance sheet is excellent and should help the company withstand a recession without a dividend cut. Therefore, we think the dividend is very safe.

Final Thoughts

Overall, Prudential Financial has been a solid business over the years with a variety of positive attributes. The dividend is very safe and secure. The high dividend yield and the high dividend growth make PRU an attractive investment for dividend and income-driven investors.