Published on March 23rd, 2022 by Aristofanis Papadatos

High-yield stocks are great candidates for the portfolios of income investors. However, there are usually good reasons for a high dividend yield. Therefore, investors should not purchase high-yield stocks without performing their due diligence.

We have created a spreadsheet of high dividend stocks with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the prospects of Phillips 66 (PSX), one of the highest-quality stocks of the energy sector. Phillips 66 is recovering strongly from the pandemic and is currently offering an above-average 4.6% dividend yield.

Business Overview

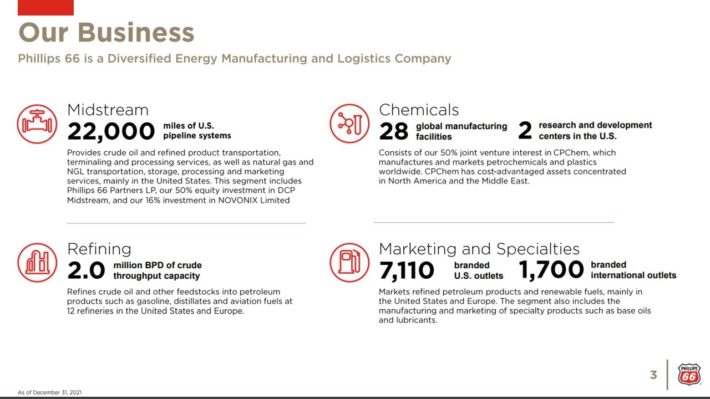

Phillips 66 was spun off from ConocoPhillips in 2012. It operates in four segments: refining, midstream, chemicals, and marketing. The refining segment includes 12 refineries with total capacity of 2.0 million barrels per day (2% of global capacity), while the midstream segment includes approximately 22,000 miles of pipelines in the U.S, which transport crude oil, refined products, natural gas liquids and LPG.

Source: Investor Presentation

Under normal business conditions, the refining segment of Phillips 66 is its most profitable segment. However, Phillips 66 has a key difference from the well-known, almost pure refiners, such as Valero (VLO) and Marathon Petroleum (MPC).

Phillips 66 has a much more diversified business model, generating a significant portion of its earnings from the other divisions. As a result, Phillips 66 is much more resilient than the other refiners to downturns, such as the coronavirus crisis.

On the other hand, Phillips 66 was not immune to the pandemic in 2020. Due to the unprecedented lockdowns imposed and the resultant collapse of global oil consumption, the refining segment of Phillips 66 incurred material losses for the first time in a decade. The midstream and chemical segments of the company performed much better than its refining division but still Phillips 66 posted its first loss in 2020.

Nevertheless, its adjusted loss per share of only -$0.89 was much lower than the excessive losses incurred by its peers. Therefore, Phillips 66 proved its superior resilience during the pandemic.

Even better, Phillips 66 is thriving right now thanks to the strong recovery of global oil consumption from the pandemic. In the fourth quarter of 2021, the refining margins of the company greatly expanded thanks to pent-up demand for refined products.

As a result, the refining segment of Phillips 66 achieved a profit of $404 million, its first material profit since the onset of the pandemic.

In addition, the midstream, chemicals and marketing segments reported solid earnings, up 37%, 301% and 27%, respectively, over the prior year’s quarter. Consequently, Phillips 66 switched from an adjusted loss per share of -$1.16 to a profit per share of $2.94 and exceeded the analysts’ estimates by an impressive $1.01.

Moreover, the business momentum of Phillips 66 has remained strong this year. In fact, the company is likely to benefit from the invasion of Russia in Ukraine, which has sent the prices of crude oil and refined products close to a 13-year high level.

Given also the low global inventories of refined products, especially gasoline, Phillips 66 enjoys multi-year high refining margins right now.

Growth Prospects

Phillips 66 is well-known for the discipline of its management to invest exclusively in high-return growth projects. However, the company has a volatile performance record due to the high cyclicality of the oil industry, which results from the dramatic swings of the price of oil.

Due to this cyclicality and the impact of the pandemic on the energy sector in 2020-2021, Phillips 66 has not grown its earnings per share over the last decade.

On the other hand, this is somewhat misleading due to the exceptionally low earnings in 2020-2021 amid the health crisis. Moreover, the company has several ongoing growth projects in its midstream segment right now.

Furthermore, Phillips 66 is likely to benefit from the new international marine rules, which force vessels to burn low-sulfur diesel instead of heavy fuel oil. The company has not benefited from this standard yet due to the pandemic but it is likely to benefit in the near future, as long as the pandemic continues to subside.

Overall, we expect Phillips 66 to continue thriving for the foreseeable future thanks to the recovery of its business from the pandemic and its high-quality business model.

Competitive Advantages

The most important competitive advantage of Phillips 66 is its exemplary management, which is known for its discipline to invest only in high-return projects. Thanks to its management, Phillips 66 does its best to optimize the factors it can control in its business.

On the other hand, investors should always keep in mind that the energy sector is highly cyclical due to the violent cycles of the prices of oil and refined products.

In the downturn of the oil sector between mid-2014 and 2017, when the price of oil collapsed from $100 to $26, the low oil prices resulted in high refining margins thanks to healthy underlying economic growth. As a result, Phillips 66 thrived in that downturn.

On the contrary, the downturn from the pandemic was much fiercer and it forced Phillips 66 to incur its first annual loss in its 10-year history. Overall, the company’s earnings are very sensitive to the cycles of the energy sector but the company does its best to improve the factors it can control and has one of the highest-quality business models in the energy sector.

Therefore, those who want to gain exposure to this sector should consider purchasing this stock.

Dividend Analysis

Phillips 66 has a solid dividend growth record. Due to the pandemic, the company froze its dividend for 10 consecutive quarters. However, thanks to its ongoing recovery, it raised its dividend by 2% in the fourth quarter of 2021. It has now raised its dividend every year since its formation in 2012, at an 18% average annual rate.

Source: Investor Presentation

It is also remarkable that Phillips 66 has returned $29 billion to its shareholders via dividends and share repurchases over the last decade. As this amount is nearly equal to the market capitalization of the stock, it is a testament to the shareholder-friendly character of the company.

Moreover, the stock is currently offering a 4.6% dividend yield. It also has a healthy payout ratio of 48% and a solid balance sheet, with net debt of $23.3 billion.

As this amount is 70% of the market capitalization of the stock and about 7 times its expected earnings this year, it is undoubtedly manageable. Overall, the dividend of Phillips 66 has a wide margin of safety.

Final Thoughts

Due to the rally of the price of oil to a nearly 13-year high level, the stocks of most oil producers have enjoyed a breathtaking rally and have become somewhat richly valued from a long-term perspective. This is not the case for Phillips 66.

The stock remains attractively valued and has one of the highest-quality business models in its sector. Therefore, investors should add this stock in their portfolios.