Published on April 6th, 2022, by Prakash Kolli

High yield stocks with dividend yields above 5% are appealing to income investors. However, not all high dividend stocks are created equal. Some have secure dividend payouts. However, others are in questionable financial condition, leaving shareholders vulnerable to a dividend cut in a downturn.

With this in mind, we created a full list of high dividend stocks.

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Philip Morris has been a high dividend yield stock for much of the past decade. The company had challenges with declining volumes and investment in the smoke-free business. However, the company is benefitting from focusing on smokeless products. As a result, the dividend yield is now over 5.5%.

Business Overview

Philip Morris International traces its history to 1847. Until the 2008 spin-off, Philip Morris International was the international operating segment of Altria. The company is headquartered in the US, but its operational headquarters is in Switzerland. The company manufactures and sells cigarettes, smokeless tobacco, and other products outside the US, and it has no sales in the US. It operates in more than 175 markets and is often the No. 1 or No. 2 company by market share.

The company’s major brands include Marlboro, Parliament, Bond Street, Chesterfield, L&M, Lark, and Philip Morris. Philip Morris USA, a subsidiary of Altria, owns the cigarette brand rights in the US. In addition, the company owns local brands in the Philippines and Indonesia.

Philip Morris International is expanding into smoke-free tobacco that heats but does not burn tobacco. The company owns iQOS and STEEM. Smoke-free brands include HEETS, Marlboro Dimensions, Marlboro HeatSticks, Parliament HeatSticks, VEEV, Shiro, and licensed brands. The brands are popular in Europe and Japan, and the company operates in 71 markets.

Total revenue was approximately $31,405 million in 2021 and in the past 12 months.

Source: Investor Relations

Growth Prospects

Philp Morris International’s primary business until about 2015 was cigarettes. However, health concerns have led to fewer users each year, and cigarettes are declining business. Cigarette sales volume declined from a peak of 635.6 billion in 1981 to 203.7 billion in 2020. The combination of regulation and health concerns about cancer and other diseases means it is unlikely the long-term decline will reverse.

The company successfully raised prices to increase revenue for many years despite declining volumes. But health concerns combined with growing competition from heat-not-burn, e-vapor, and nicotine pouches meant this trend eventually abated as revenue fell and earnings were flat.

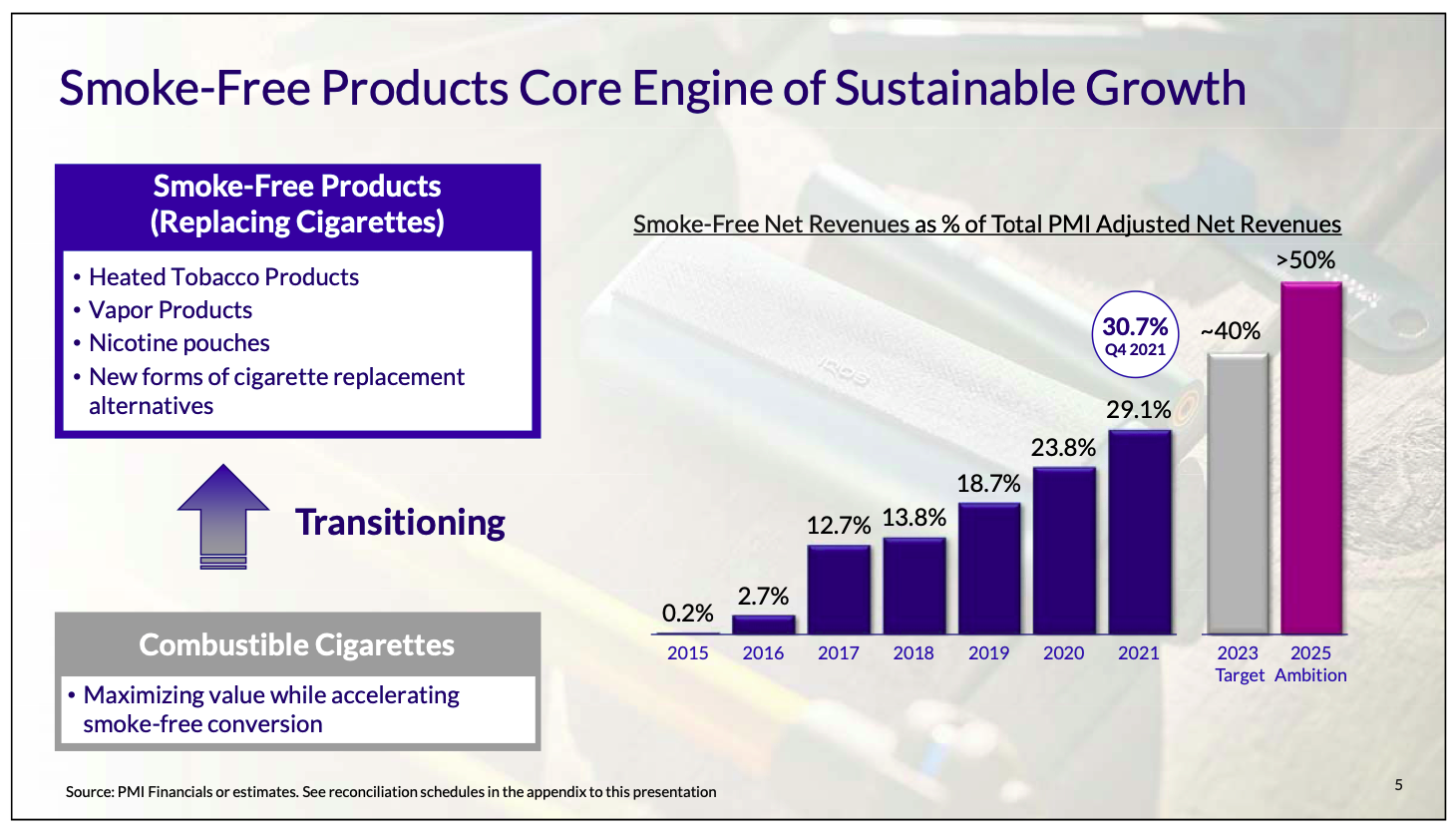

However, since 2015, the company has increasingly focused on these smokeless categories. Philip Morris International is replacing cigarettes with products from smokeless categories. As a result, the company has grown revenue in the smoke-free business from 0.2% in 2015 to almost 30% in 2021. Furthermore, the company has a goal of more than 50% of revenue from smokeless categories by 2025.

Source: Investor Relations

Overall, this strategy is a necessity. The majority of smokers intend to quit at some point. Alternatively, many are switching to smokeless categories. Philip Morris invested in the iQOS and heatsticks technology and platform to meet this growing trend. However, these investments were costly and impacted profits and margins.

However, the investments are proving fruitful. Philip Morris is deriving more revenue from the smoke-free business in some markets. For instance, in Italy, the Czech Republic, Greece, and Japan, more than 50% of revenue is from the smoke-free business. Furthermore, smoke-free products have higher margins and are taxed at lower rates.

This trend of switching to smokeless products will likely continue. Philip Morris has indicated combustion is the primary cause of smoking-related disease due to certain chemicals. The company touts the better health profile of smoke-free products and is actively trying to generate clinical data to demonstrate the benefits of switching.

Competitive Advantages

Philip Morris has several competitive advantages, including valuable brands, market share leadership, scale, and the addictive nature of nicotine.

The company is one of the largest cigarette manufacturers in the world. This fact gives it scale resulting in cost efficiencies and higher margins. Although fixed costs are high, producing additional cigarettes only has an incremental cost. Cigarettes are essentially the same size and shape, making scaling manufacturing relatively simple.

Philip Morris owns some of the leading premium brands in the world. For example, Marlboro is probably the most recognized brand globally and had about 37% of total volume in 2020. Additionally, the company owns five of the top 15 international brands. The company has leveraged brand leadership in cigarettes to brand leadership in the smokeless business.

Lastly, nicotine is addictive, and health concerns have led to increasing government regulation on advertising and sales. This point has prevented new entrants in the market and reduced competition between existing producers. In addition, the high tax rate on cigarettes means they do not compete on price but mostly on branding.

Dividend Analysis

Philip Morris pays an excellent dividend yield of approximately 5.6%. The forward dividend rate is $5.00 per share. The forward dividend yield is greater than the 5-year average of about 5.16%. It is also more than three times the average dividend yield of the S&P 500 Index.

The company has delivered an increasing dividend for 14 years, making the stock a Dividend Contender. Philip Morrs’ dividend growth rate has been about 5.68% in the past decade and approximately 3.53% in the trailing 5-years. However, the most recent increase was 4.2%, near the long-term average but suggesting the growth rate is slowing.

The company’s dividend is safe from the perspective of earnings and free cash flow (FCF), but this safety metric value is concerning. The payout ratio is ~80% based on the forward dividend rate and estimated 2022 earnings per share of $6.00. In addition, Philip Morris generated an FCF of approximately $11,219 million in 2021, and the dividend required only $7,580 million. Therefore, the dividend-to-FCF ratio was reasonable at ~68%.

Philip Morris has a conservative balance sheet. At the end of 2021, the company had $4,496 million in cash. Short-term debt was $225 million, current long-term debt was $2,759 million, and long-term debt was $24,760 million. The leverage ratio is only 1.65X, and interest coverage is more than 17X. Furthermore, the current credit rating is A / A2, an upper-medium investment-grade credit rating by S&P Global and Moody’s.

Final Thoughts

Philip Morris has been an excellent high-yield and income stock for years. The company has seemingly developed an effective strategy to move away from cigarettes to a smoke-free business. This change will provide growth and higher margins.

In addition, the high yield is excellent, but investors should be aware of the high payout ratio. However, sales volumes are rising, and earnings are trending higher, suggesting the payout ratio may come down.

Philip Morris is an acceptable stock for investors seeking a high dividend yield and income.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The 20 Highest Yielding Dividend Aristocrats

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 40 stocks with 50+ years of consecutive dividend increases.

- The 20 Highest Yielding Dividend Kings

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly: