Published on March 21th, 2022, by Felix Martinez

High-yield stocks pay out dividends that are significantly in excess of market average dividends. For example, the S&P 500’s current yield is only 1.4%.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

For the next high-yield stocks in this series, we will review a multinational technology company Lumen Technologies, Inc. (LUMN), which currently has a dividend yield of 9.3%.

Business Overview

Lumen Technologies traces its roots to 1930 when the Oak Ridge Telephone Company was purchased by the Williams family. They would eventually expand exponentially into what has become Lumen, which serves customers in over 60 different countries today. It has an $11.4 billion market capitalization and produced $19.7 billion in revenue in 2021. The name Lumen was brought about in September 2020 to rebrand and reposition the company as a critical partner in leading enterprises through the 4th Industrial Revolution – or the smart technology revolution.

The company integrates network assets, cloud connectivity, security solutions, voice, and collaboration tools into one platform that enables businesses to leverage their data and adopt next-generation technologies. Lumen brings together the talent, experience, infrastructure, and capabilities of CenturyLink, Level 3, and 25+ other technology companies to create Lumen Technologies, Inc. The company is designed specifically to address the dynamic data and application needs of the 4th Industrial Revolution.

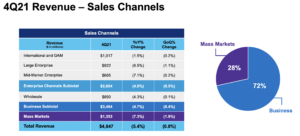

The company reported fourth-quarter and full-year results for Fiscal Year (FY)2021 on February 9th, 2022. The company reported total sales for the quarter of $4,847 million compared to total sales of $5,125 million, which is a decrease of 5.4% year-over-year. Net income was much better than 4Q2021. For the quarter, net income was $508 million, compared to a reported net loss of $2.289 billion for the fourth quarter of 2020. Overall for the quarter, the company had adjusted earnings per share (EPS) of $0.51 was a 21.4% increase over $0.42 earned in the same prior-year period.

Source: Investor Presentation

For the full year, the total revenue was $19,687 million. This was lower than the $20,712 million the company reported in FY2020, a decrease of 4.9%. However, the company did make a profit last year compared to a net loss for 2020. Net income for the year was $2,033 million versus a net loss of $1,232 million in FY2020. For the year, EPS reported $1.91 per share for 2021, compared to $1.51 per share for the full year 2020. This represented an increase of 26.5% year-over-year growth.

Growth Prospects

The biggest growth driver for Lumen would come from acquisitions and mergers. For example, in 2017, the company completed a merger with Level 3 Communications. Because of this merger, the company now derives about 75% of its revenue from enterprise customers, with the remainder from residential consumers. The company also has two divestitures pending, which will help with margins. Thus, these two divestitures will ultimately grow profits.

Another growth driver, for the company, would be the Quantum Filber rollout. If the company can complete the Quantum fiber rollout, it generate about 20% of Lumen’s total revenue, perhaps in five years.

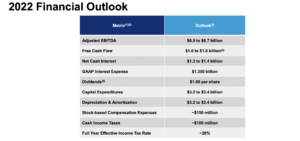

Source: Investor Presentation

Competitive Advantages & Recession Performance

We think its biggest advantage is that, unlike some of its competitors, it can provide businesses with multiple services on a global scale, and its extensive fiber network limits the number of rivals who could attempt to replicate all its services.

The base of Lumen’s business is its extensive long-haul fiber network. With over 450,000 route miles in its terrestrial and subsea transcontinental network, it is one of the worldwide leaders in serving the data transportation needs of enterprises. The company is one of the few Tier 1 networks worldwide, Lumen is a key contributor in making up the backbone of the Internet, which is necessary for the Internet to function. Enterprises companies use Lumen’s services to transport data, both for internal purposes and to reach the public.

As for recession performance, the company did very well during the 2008-2009 Great Recession.

LUMN’s earnings-per-share throughout the Great Recession:

- 2007 earnings-per-share of $3.16

- 2008 earnings-per-share of $3.37 (7% increase)

- 2009 earnings-per-share of $3.60 (7% increase)

- 2010 earnings-per-share of $3.39 (6% decrease)

As you see, the company did very well during the 2008-2009 Great recession. However, during the COVID-19 pandemic, the company increased earnings from $1.32 per share in 2019 to $1.67 per share in 2020, but the company cut its dividend from $2.16 per share for 2019 to $1.00 per share in 2020. This leads us to believe that the company will cut its dividend in another recession.

Dividend Analysis

The company has a very high current dividend yield of 9.3%. However, the dividend looks unsafe. For example, in 2013, the company cut its dividend from $2.90 per share for 2012 to $2.16 per share in 2013. This is a dividend cut of 25.5%. This cut was due to an earnings decrease from 2010 to 2013. Since 2010, earnings have been decreasing putting even more risks to the company dividend.

As mentioned above, earnings grew during the COVID-19 pandemic, but the dividend payout ratio was very high. This caused the company to cut its dividend. Analytics expects earnings to continue to decline in the foreseeable future. This will make the current dividend at risk as earnings decline.

The company pays a $0.25 per share quarterly dividend for a total of $1.00 per share per year. Analytics expects earnings to be $1.35 per share in 2022, $1.01 per share in 2023, and $0.91 per share in 2024. As you can see, this will put heavy pressure on the dividend payout.

Source: Investor Presentation

In addition, the company has a poor balance sheet, with an interest coverage ratio of 2.8, a debt-to-equity ratio of 2.5. This is at concerning levels. Also, the company has an S&P credit rating of BB, which is not an investment grade.

As a result, we view the dividend of Lumen as unsafe for the foreseeable future. Thus, investors should not expect much higher dividend growth and only accept the current high yield.

Final Thoughts

Lumen Technologies’ high dividend yield of 9.3% is unsafe. Earnings are on a downtrend, thus putting more pressure on the dividend payout. This, in addition to the frequent dividend cuts in its recent past, leads us to rate the dividend at a high risk of being cut in a recession or industry downturn. Thus, the company is a buy for aggressive investors, but we caution conservative dividend growth investors that it remains a high-risk, high-reward situation, particularly considering the recent dividend cut and declining revenue.