Published on April 6, 2022, by Felix Martinez

There are a lot of consumer defensive companies in the stock market. However, few of them pay a high dividend yield. This article will cover a high dividend yield consumer defensive company in The Kraft Heinz Company (KHC).

We also cover a lot of other different high-yield stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

This article analyzes the high-yield stock Kraft Heinz Company in detail. While it doesn’t have a 5.0%+ yield currently, its dividend yield of 4.1% is still high compared to the low-interest-rate environment and the broader Market.

Business Overview

Kraft-Heinz is a processed food and beverages company that owns a product portfolio that includes food products such as condiments, sauces, cheese & dairy, frozen & chilled meals, and infant diet & nutrition. The company was created in 2015 in a merger between Kraft Food Group and H. J. Heinz Company, orchestrated by Warren Buffett’s Berkshire Hathaway and 3G Capital. Kraft-Heinz is headquartered in Chicago, IL.

The company leverages its scale and agility to grow across a portfolio of six consumer-driven product platforms. Some of the company’s well-known brands are Heinz ketchup, Mayo, Lunchable, Oscar Mayer, Jell-o, and Kool-Aid. The company has a total net sales of $26 billion for Fiscal Year (FY)2021, with a market capitalization of $48.9 billion.

Source: Company Factsheet

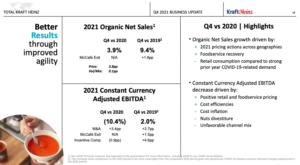

On February 16, 2022, the company reported fourth-quarter and full-year results for FY2021. For the fourth quarter, total sales were down 3.3% compared to the fourth quarter of 2020. Total sales were $6,709 million compared to 4Q2020 of $6,939 million. The United States region saw a significant decrease of 6.8% in sales, whereas the international and Canada region saw sales increases of 6.5% and 5.2%, respectively. However, year-over-year organic net sales growth was 3.9% for the quarter versus the fourth quarter of 2020.

Net income for the quarter was down substantially. The company reported a loss of $257 million compared to a profit of $1,032 million in 4Q2020, largely due to the impairment of the Kraft brand following the closing of the Cheese Transaction. Thus, diluted Earning Per Share (EPS) was negative $0.21 compared to $0.84 per share prior year same quarter. However, Adjusted EPS was slightly down for the quarter by 1.3%, from $0.80 per share in 4Q2020 to a reported $0.79 per share, primarily driven by lower Adjusted EBITDA that more than offset lower taxes on adjusted earnings and lower interest expense.

Source: Investor Presentation

For the fiscal year, total sales were slightly flat compared to FY2020. Total sales were $26,042 million in FY2021 compared to $26,185 million in FY2020, a decrease of 0.5%. The regional segments saw the same kind of results as the fourth quarter. For the year, the United States region saw sales decrease by 3.1%, from $19,204 million in 2020 to $18,604 million last year. However, the International and Canada region saw sales increase by 6.5% and 6.5%, respectively.

Gross profit for the year was down 5.4%, but operating income saw a significant increase of 62.6% year-over-year. Income also saw a significant increase of 184.5% for 2021 compared to 2020. Thus, diluted EPS was $0.82 compared to $0.29 per share prior year same quarter, or a 182.8% increase. Furthermore, Adjusted EPS was slightly up for the year by 1.7%, from $2.88 per share in FY2020 to a reported $293 per share in FY2021.

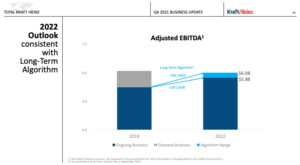

The company expects a low-single-digit percentage increase in 2022 Organic Net Sales versus the prior-year period, reflecting continued stronger consumption versus pre-pandemic levels. They expect adjusted EBITDA to be in the range of $5.8 billion to $6.0 billion.

However, We expect the company to earn $2.62 per share for FY2022. This would represent a decrease of 11% year-over-year compared to FY2021.

Growth Prospects

Growth drivers for the company will come from devasting on low-performing brands and acquiring brands that compliment the company existing brands. Emerging markets are also a source of growth for the company. Organi net sales grew by 17% for the year compared to 2019. Also, focusing on brand expansion like plant-based items and Heinz brand extension should help the company with future growth.

Source: Investor Presentation

As you see in the picture below, the company divested some of its business in 2019. It has been a good move by the management team as the company was able to grow with a 2% Compound Annual Growth Rate (CAGR).

Source: Investor Presentation

Competitive Advantages & Recession Performance

The competitive advantage for the company is its brand awareness. The company has brands that most people, if not all, in America have heard of. Thus, we think maintaining or increasing brand spending will be important in sustaining brand awareness and assuring a competitive advantage. The spending on advertising is essential for the company since most customers are now looking for healthier options.

Since the company was not around during the Great Recession of 2008-2009, we will look at how the company performed during the COVID-19 pandemic.

KHC’s earnings-per-share before and after the COVID-19 pendmic:

- 2018 earnings-per-share of $3.53

- 2019 earnings-per-share of $2.85 (19% decrease)

- 2020 earnings-per-share of $2.88 (1% increase)

- 2021 earnings-per-share of $2.93 (2% increase)

Earnings declined before the COVID-19 pandemic, as the company earnings dropped by 19% in 2019. But the company did recover modestly by 1% in 2020 and 2% in 2021.

Dividend Analysis

In 2019, the company had to cut its dividend by 36%, from $2.50 per share to $1.60 per share a year. The dividend decrease was due to earning pressure and the company focusing on paying down its debt. Since 2019, the company has been paying the same dividend.

To determine the safety of the dividend, we will look at two metrics. We will look at adjusted Earnings Per Share (EPS) and Free Cash Flow (FCF). For FY2021, the company EPS was $2.93 per share. This would give us a dividend payout ratio of 54.6%. This covers the dividend well. In that same year, FCF was $3.61 per share. FCF provided a dividend payout ratio of 44.4%. Thus the dividend is safe based on FY2021 earnings and FCF.

However, since we invest in the future, we will look at the dividend payout ratio based on EPS and FCF for FY2022. We expect the company to earn $2.62. We do not expect a dividend increase, so this will give us a dividend payout ratio of 61.1%. In 2022, we anticipate the company will make $2.62 per share in FCF. This will also cover the dividend by 61.2%. Therefore, the dividend is safe for the foreseeable future.

The company also has a respectable balance sheet. The company has a 0.4 debt-to-equity ratio, which has been improving over the last few years. The company’s interest coverage ratio is 1.8, a fair level. Furthermore, Kraft Heinz has an S&P Credit Rating of “BBB-.” This credit rating is an investment-grade rating from S&P.

Thus, the balance sheet is in good condition, and investors can trust that the company is running well.

Final Thoughts

The Kraft Heinz Company is a company that is trying to change things around. The company owns some of the well-known brands in the USA. . Because of international growth, the company should be able to generate some earnings growth in the long run, but Kraft-Heinz will never turn into a high-growth company. Overall, the company dividend is safe and well suited for investors looking for a safe, high yield company.

This stock is not for dividend growth investors who are looking for years of dividend increases from the companies in their portfolios.