Published on March 21st, 2022 by Aristofanis Papadatos

Foot Locker (FL) has dramatically underperformed the broader market index in the last 12 months. During this period, the stock has plunged 44% whereas the S&P 500 has gained 13%.

As a result, Foot Locker is now offering a 10-year high dividend yield of 5.3% while it is also trading at an exceptionally low forward price-to-earnings ratio of 7.2.

It has thus become a high-yield stock and hence it deserves special attention from income-oriented investors.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Foot Locker expects its earnings to decline this year, but the stock could be priced attractively right now for income investors.

In this article, we will analyze the prospects of Foot Locker.

Business Overview

Foot Locker was established in 1974 as part of the FW Woolworth Company and became independent in 1988. The company has outlived its former parent, which closed in 1997. The athletic apparel retailer, known for its namesake Foot Locker brand, operates nearly 3,000 stores in 27 countries.

Foot Locker reported positive results in the fourth quarter of 2021 but its stock plunged 30% on the day of the earnings release due to the poor guidance issued by management.

In the quarter, Foot Locker grew its revenue 7% over the prior year’s quarter, partly thanks to 0.8% comparable sales growth, with apparel significantly outperforming footwear. The company grew its adjusted earnings per share 8%, from $1.55 to $1.67, and exceeded the analysts’ consensus by a wide margin ($0.21).

In the year, Foot Locker more than doubled its earnings per share, from $2.81 to a new all-time high of $7.77, which was 58% higher than the pre-pandemic record of $4.93, which was achieved in 2019.

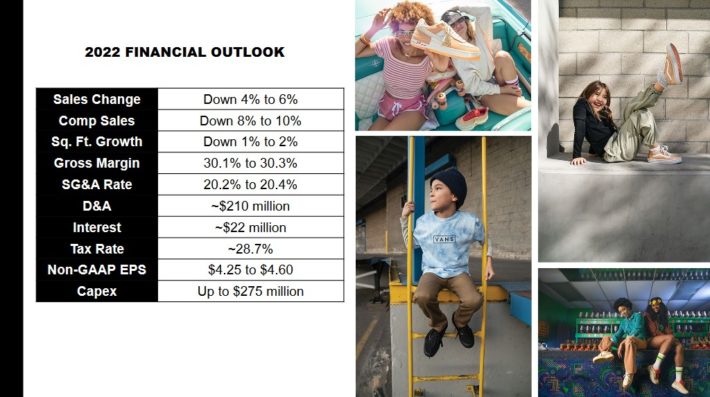

However, management provided daunting guidance for 2022. It expects comparable sales and total sales to decrease 8%-10% and 4%-6%, respectively, this year and its gross margin to shrink from 33% to 30.1%-30.3%.

Source: Investor Presentation

It also expects square footage to slip 1%-2% due to the shutdown of some stores and adjusted earnings per share to plunge 41%-45%, from $7.77 to $4.25-$4.60.

The disappointing guidance resulted from a major shift in the strategy of Nike (NKE), which will accelerate its efforts to sell more products online and fewer products via the network of Foot Locker. The latter stated that no single vendor will comprise more than 55% of its total sales in 2022.

This figure compares with 65% of sales generated by Nike last year. It is thus evident why the stock of Foot Locker plunged after the earnings report. It is also worth noting that the shift of Nike to digital channels probably has ample room to run further and hence this headwind is likely to persist for a few years.

On the bright side, most of the damage has already been priced in the stock of Foot Locker, which is now trading at a forward price-to-earnings ratio of only 7.2. Moreover, the company will take advantage of the exceptionally cheap valuation of its stock and will execute a share repurchase program of $1.2 billion.

At the current stock price, this share repurchase program can reduce the share count by 40%.

Growth Prospects

Foot Locker has exhibited an admirable performance record. The retailer has grown its earnings per share in seven of the last nine years, at a 13.0% average annual rate throughout the nine-year period.

The company has achieved such a great performance thanks to solid revenue growth, expansion of its margins and a 33% decrease in the number of its outstanding shares.

However, due to the aforementioned headwind from the strategic shift of Nike, it is prudent not to expect Foot Locker to keep growing anywhere close to its historical rate. On the bright side, the company will offset some of its sale losses via nearly 50% sales growth from WSS and Atmos.

The former is expected to grow its sales from $650 million in 2022 to $1 billion by 2024. The latter is expected to grow its sales from $220 million in 2022 to $300 million by 2024.

Overall, thanks to these growth drivers and the aggressive share repurchase program of Foot Locker, we expect the retailer to grow its earnings per share by 2% per year on average off this year’s expected earnings per share of ~$4.40.

Competitive Advantages

Foot Locker enjoys material competitive advantages, such as its valuable brand names, its decades of experience in athletic apparel retailing and its enormous scale.

Moreover, Foot Locker has an exceptionally strong balance sheet and thus it pays negligible annual interest expense of only $14 million.

As a result, it has great financial flexibility and hence it can easily endure downturns in its business. In fact, thanks to its solid balance sheet, the company has decided to repurchase its shares aggressively in order to take advantage of its depressed stock price.

On the other hand, the secular shift of consumers from brick-and-mortar shopping to online purchases is a headwind for Foot Locker. The recent shift of Nike towards digital channels is a stern reminder of the sensitivity of Foot Locker to this trend.

Fortunately, Foot Locker is doing its best to adjust to the changing business landscape by enhancing its focus on digital channels but still the company is vulnerable to this transition of the retail industry.

Dividend Analysis

Foot Locker cut is dividend in 2020 due to the impact of the coronavirus pandemic on its business. In addition, during the last decade, the stock has offered a dividend yield between 1.5% and 3.0% most of the time.

Overall, Foot Locker has a lackluster dividend record.

On the other hand, the company recently raised its dividend by 33%. Given also its recent plunge, the stock is currently offering a 10-year high dividend yield of 5.3%. Moreover, it has a solid payout ratio of 36% while it has a healthy balance sheet, with negligible annual interest expense.

Overall, Foot Locker is offering a 5.3% dividend, which is a 10-year high level and has a meaningful margin of safety for the foreseeable future.

Final Thoughts

Foot Locker is offering a 10-year high dividend yield of 5.3% and is trading at a 10-year low forward price-to-earnings ratio of 7.2.

The reason behind these exceptionally attractive metrics of the stock is the ongoing transition of Nike from the network of Foot Locker to digital channels. This is undoubtedly a strong headwind for Foot Locker, which is likely to persist for years.

On the other hand, Foot Locker is doing its best to offset these losses via other brands. As a result, we believe that the plunge of Foot Locker is overdone and hence we view the stock as attractive around its current price.

Nevertheless, as the poor business momentum is likely to persist for a while, only patient investors with a long-term perspective should consider purchasing the stock.