Updated on March 31st, 2021 by Nikolaos Sismanis

Founded by hedge-fund manager Larry Robbins in 2000, Glenview Capital Management is a New-York-based hedge fund with around $13.3B of discretionary assets under management (AUM), counting 9 clients. Mr. Robbins founded the company after his departure from Omega Advisors. Two decades at the helm later, he still remains the CEO, having accumulated a net worth of just under $2 billion. He is also the owner of the Illinois-based hockey team, the Chicago Steel.

Investors following the company’s 13F filings over the last 3 years (from mid-February 2018 through mid-February 2021) would have generated annualized total returns of 15.6%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 12.50% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of Glenview Capital Management’s current 13F equity holdings below:

Keep reading this article to learn more about Glenview Capital Management.

Table Of Contents

- Introduction & 13F Spreadsheet Download

- Glenview Capital Management’s Portfolio, and Top Public Equity Holdings

- Final Thoughts

Glenview Capital Management’s Portfolio, and Top Public Equity Holdings

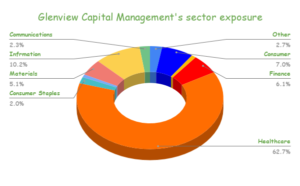

Glenview’s investing style is most commonly referred to as Growth at a Reasonable Price or “GARP,” concentrating on companies in industries that are relatively stable, predictable, often with recurring revenue streams or entrenched market positions. This is evident from the company’s current portfolio of holdings. The fund lacks any significant tech exposure, despite the sector’s attractiveness as of lately, possibly due to its extended valuations. Instead, most of Glenview’s holdings are relatively fairly-priced equities, while still having some potential to grow in the long-term.

The fund’s public-equity investment portfolio consists of 53 individual stocks, with heavy exposure in the healthcare sector. This is most likely due to attractive valuations, and recurring cash flows sourced from insurance businesses, pharmaceuticals, and diagnostics companies.

Source: Company Filings, Author

During the quarter, Melvin made the following notable portfolio adjustments:

New Buys:

- DowDuPont Inc. (Dow Chemical) (DD)

- Union Pacific Corp. (UNP)

- Insperity Inc. (NSP)

- Global Payments Inc. (GPN)

- Aramark (ARMK)

- Dun & Bradstreet Holdings, Inc. (DNB)

- Facebook Inc (FB)

- Amazon.com Inc. (AMZN)

- Anthem Inc (WLP)

New Sells:

- eBay Inc. (EBAY)

- Biohaven Pharmaceutical Holding Co Ltd (BHVN)

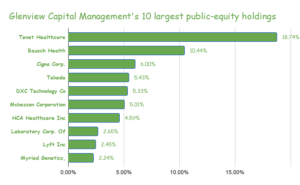

The fund’s holdings are also fairly diversified, despite its relatively thin number of individual equities. No stock exceeds 18.7% of the portfolio’s total weight, while its top 10 holdings account for around 62.8% of the total portfolio.

Glenview’s top 10 holdings are the following:

Source: Company Filings, Author

Tenet Healthcare Corp. (THC)

Tenet Healthcare Corporation is a diversified healthcare services company. It operates through three segments: Hospital Operations and Other, Ambulatory Care, and Conifer, a company that helps enhance the consumers’ and patients’ healthcare experience, as well as help with controlling their costs. Despite the company’s massive revenues relative to its market cap (3.1X over), Tenet has struggled with delivering consistent profits.

In 2020, amid improved cost-management, Tenet reported decade-high net income of just under $400 million, expanding its net income margins to 2.26%. As odd as it sounds, this is the highest net income margin for Tenet since 2002 (excluding adjusted higher profits in 2010,) as the hospital and ambulatory care industry is subject to a razor-thin profit margin.

The recent profits justify the stock’s year-long rally, with the stock currently trading with a forward P/E of around 12.8 attached.

Glenview owns a 13% stake in the $5.6 billion company, having sufficient influence in its operations and strategy (i.e. an activist holding). The fund trimmed its position by 15% during the quarter, likely booking some profits off of the stock’s extended rally.

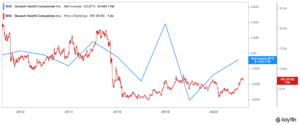

Bausch Health Companies Inc. (BHC)

Canada-based Bausch Health is another company in the healthcare sector that manufactures and markets various pharmaceutical, medical device, and over-the-counter (OTC) products mainly in the therapeutic fields of eye health, gastroenterology, and dermatology. It is Glenview’s second-largest holding, with the fund increasing its exposure by around 9% in the previous quarter.

It’s worth noting that BHC is also struggling with its bottom line, with the majority of its past few quarters posting negative net income. That being said, the company has $605 million in cash which could sustain another year or two of a weaker bottom line. Investors have priced in Bausch’s profitability risks quite accurately. The stock is currently trading at ~7 times its forward net income, which is set to reward those considerably for taking an equally substantial risk with Bausch’s investment case.

Glenview owns around 4.6% of the company, which indicates a high-conviction pick.

Cigna Corporation (CI)

Cigna Corporation is one of the fund’s biggest value plays, and its third-largest holding. While the stock follows the theme of razor-thin margins that Tenet and Bausch share, Cigna has realized cost-efficiencies which have resulted in economies of scale properly kicking in. Consequently, net income has been growing annually quite consistently. Management has chosen stock buybacks as its primary method of returning capital to shareholders, having repurchased and retired 6.8% of its total share count over the past 2 years.

Additionally, management announces that its buyback program is now boosted to $8 billion, compared to last year’s $3 billion, which represents around 10% of Cigna’s current share count. Combined with the stock’s forward P/E of 12, which is below its historical average, current investors may find Cigna’s current price levels quite attractive.

Glenview initially bought into the stock in late 2017 and has since been marginally adding to its position. The position was trimmed by 4% as of the most recent quarter.

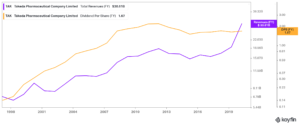

Takeda Pharmaceutical Company Limited (TAK)

Takeda Pharmaceuticals is not just another healthcare company. The Japanese behemoth is the largest pharma company in Asia, and one of the largest in the world, boasting a $60 billion market cap, and around $30 billion in annual revenues. The company pays a relatively stable dividend, currently yielding around 4.4%, though it is only paid once per year. Investors should also be aware of Japan’s high taxation, however, which makes Takeda’s after-tax yield quite compressed.

Glenview has been holdings shares since late 2018, adding to its position occasionally. During the latest quarter, it cut its position by 9%.

DXC Technology Company (DXC)

DXC offers information technology services and solutions globally. The company is quite old in the industry, and more innovative companies have been capturing DCX’s market share over the past few years, causing revenues to stagnate. The dividends have been suspended since the initial COVID-19 outbreak, with no mention from the management of a potential resumption. Considering the not-so-pretty DXC’s investment case, shares are currently trading at just 9 times next year’s income.

The fund has been holding the stock since late 2015, having purchased shares at an average price of around $40.8. Shares are currently trading at around $28.5, as the company has been struggling financially. Glenview sold around 25% of its stake in the previous last quarter (Q3), apparently at a loss. The position was held stead as of the last quarter (Q4).

McKesson Corporation (MCK)

McKesson Corporation offers pharmaceuticals and medical supplies in the U.S. and internationally. It provides pharmaceuticals, prescription technology solutions, medical-surgical solutions, and more. The company is worth around $30 billion, despite generating more than $231 billion in revenues. This is due to its margins being razor-thin, similarly to its industry peers as mentioned above, in which Glenview is quite invested.

Its net income margins average at around 1% (0.39% in FY2020), meaning they are very susceptible to potentially unprofitable quarters. This explains the stock’s compressed valuation which currently stands at around 10.4 times its net income.

Management has never cut the dividend and does increase it whenever the company’s net income levels increase. Still, the stock’s yield remains under 1% as the company maintains a safe payout ratio due to its thin bottom line.

Glenview initially bought the stock in 2016 at an average purchase price of $146, having made respectable gains since. The fund sliced its position by 7% during the quarter.

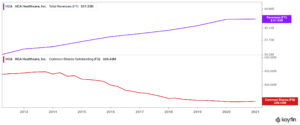

HCA Healthcare, Inc. (HCA)

HCA is Glenview’s 7th largest holding, despite the fund trimming its position by 20% during the last quarter. The company manages general, acute care hospitals that offer medical and surgical services, such as inpatient care, intensive care, cardiac care, diagnostics, and other services. Due to the recurring patient needs, the company’s revenues are very stable and were barely affected by COVID-19.

The company does not pay a dividend. Instead, it prefers to return capital to its shareholders through massive stock buybacks. Over the past decade, management has repurchased nearly 1/3 of the company’s stock, which is outstanding.

Laboratory Corporation of America Holdings (LH)

Laboratory Corporation is a consistent cash cow, operating as an independent clinical laboratory company worldwide. The company produces incredible cash flows, that are mostly recession-proof due to the essential nature of its operations. Due to the mission-critical nature of its operations, LH’s revenues actually grew during the past year despite the ongoing pandemic as demand for use of its laboratories actually increased.

Consequently, gross profit margins also expanded during this period. Management uses the cash generated to buy other labs and expand its reach, or buyback shares instead.

The stock is a relatively new holding for Glenview, initiated in Q2-2020. Laboratory Corporation could be an amazing pick for investors looking to buy into a low volatility company with AAA cash flows.

Lyft Inc. (LYFT)

The ride-sharing company Lyft is Glenview’s 9th largest holding after the company initially buying the stock in Q2 and then increasing its position by 204% during the last quarter. Similar to its competitor Uber, Lyft’s proof of concept, technology and usefulness has been well-documented.

The issue with the business model, however, is the “middleman margins” being even worse than those of the healthcare giants discussed earlier. With gross margins at under 14%, Lyft has been losing billions annually, with no tangible plan when it comes to delivering consistent profits.

The company has $2.25 in cash, which should sustain a couple of money-losing years before Lyft “figures it out”. Still, with investors in the current environment always willing to allocate capital in disruptive companies such as Lyft, the company should not have a hard time constantly raising cheap capital.

Myriad Genetics, Inc. (MYGN)

Myriad Genetics is a molecular diagnostic company, and Glenview 10th largest holding. The company produces predictive, personalized, and prognostic medicine tests for hereditary cancers. Annual revenues have remained stagnant since 2014. While the industry has been growing, so has competition. Amid lower revenues but high R&D expenses to keep up with the competition, profitability has been worsening over the past few years.

The good part is that Myriads’s gross margins are nearly 70%, which could potentially translate into significant profits, and hence more than compensate those buying at the current valuation of 3.6X sales. Still, the industry is brutally competitive, requiring billions in annual spending to keep up with, making Myriad a relatively risky pick at its current money-losing state.

Glenview increased its equity stake by 33% during the last quarter, currently holding a noteworthy 4.9% of Myriad’s total share count.

Final Thoughts

Glenview Capital Management is not the best performing fund in the world, however, its stock picks present investors with some compelling investment ideas, especially in the healthcare sector. The fund’s portfolio is not that well-diversified; however, management expertise in the sector seems to be beating the overall market returns.

Investors should do their own due diligence before allocating capital in Glenview’s holdings. Many of them are not very conventional, and require a deeper understanding compared to the more common stocks we often find in funds, including big tech.

Additional Resources:

Slate Path Capital’s 20 Stock Portfolio: Top 10 Holdings Analyzed

Akre Capital’s 26 Stock Portfolio: Top 10 Holdings Analyzed

Appaloosa Management’s 35 Stock Portfolio: Top 10 Holdings Analyzed

Viking Global’s 75 Stock Portfolio: Top 10 Holdings Analyzed

Lone Pine Capital’s 37 Stock Portfolio: Top 10 Holdings Analyzed