First Financial to Acquire BankFinancial, Expands Chicago Presence

First Financial Corporation Indiana THFF has entered into an agreement to acquire BankFinancial Corporation BFIN, a Chicago-based financial institution, in an all-stock transaction valued at approximately $142 million. The move aligns with First Financial’s strategic focus on strengthening its footprint in the Chicagoland market and enhancing its service offerings.

Financial Details of THFF Deal

Under the terms of the agreement, BankFinancial shareholders will receive 0.48 shares of First Financial for each share they hold. The transaction is unanimously approved by the boards of directors of both companies. It is expected to close in the fourth quarter of 2025, subject to regulatory approvals and shareholder consent.

Upon completion, BankFinancial’s consumer and wealth management services, along with selected commercial credit lines, will be integrated into the existing operations of First Financial. All BankFinancial employees will transition to First Financial, ensuring continuity in client relationships and community engagement.

Rationale Behind BFIN’s Acquisition

The acquisition will expand First Financial’s presence in the Chicagoland area by adding BankFinancial’s 18 financial centers to its network. This added footprint will enhance its market reach and complement its existing branch network across Ohio, Indiana, Kentucky, and Illinois.

The transaction aligns with THFF’s broader Midwest growth strategy, which includes its prior agreement to acquire Westfield Bank in Northeast Ohio. The company is also focusing on its ongoing expansion into Chicago, Cleveland, and Grand Rapids.

Archie Brown, president and CEO of First Financial, stated, “The addition of BankFinancial's retail financial centers enables us to continue our Midwest growth strategy and provides Chicago clients a broader range of banking and specialty solutions to help them meet their financial goals.”

THFF Zacks Rank & Price Performance

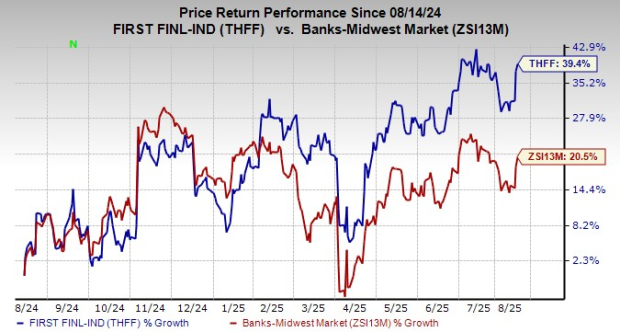

Over the past year, First Financial shares have gained 39.4% compared with the industry’s rise of 20.5%.

Image Source: Zacks Investment Research

Currently, THFF carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Similar Steps by Other Financial Firms

In June 2025, Glacier Bancorp, Inc. GBCI entered a definitive agreement to acquire Guaranty Bancshares, Inc., the bank holding company for Guaranty Bank & Trust, N.A., a leading community bank headquartered in Mount Pleasant, TX. The all-stock transaction is valued at $476.2 million.

Glacier Bancorp’s planned acquisition of Guaranty demonstrates a significant step forward in its long-term growth strategy. Building on its initial entry into the Southwest region through the 2017 acquisition of Foothills Bank in Arizona, GBCI is now poised to amplify its presence by entering the Texas market.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Glacier Bancorp, Inc. (GBCI): Free Stock Analysis Report

First Financial Corporation Indiana (THFF): Free Stock Analysis Report

BankFinancial Corporation (BFIN): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com