E*TRADE Study Reveals the Investing Habits and Challenges of Single Women

E*TRADE Financial Corporation (NASDAQ: ETFC) today announced insights from its most recent wave of StreetWise, the E*TRADE quarterly tracking study of experienced investors. As part of its Diversity in Financial Services Thought Leadership series, E*TRADE examines niche investor populations to create a more inclusive environment around personal finance and break down the barriers of taboo money conversations. In conjunction with Women’s History Month, E*TRADE analyzed trends among single female investors, a segment which is expected to make up almost half of the working female population between the ages of 25–44 in the next 10 years.1 Results show:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200316005404/en/

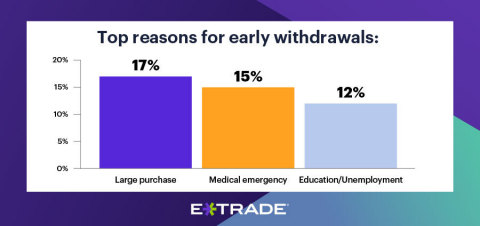

Retirement takes a backseat with nearly half of this population taking early withdrawals (Graphic: Business Wire)

- Single women show outsized interest in less conventional investments. Single females are more interested in marijuana securities (35%) blockchain and crypto-related securities (33%), and Environmental, Social, and Governance (ESG) investments (29%), compared to 26%, 24%, and 18% of the total population respectively. Almost two out of five single women (37%) are more likely to invest abroad than domestically, compared to 29% of the total population.

- Many take early retirement withdrawals. More than two out of five single women (43%) have taken early withdrawals from their retirement accounts, compared to one third of the total population (33%). They’ve dipped into their retirement account for a large purchase (17%), a medical emergency (15%), unemployment (12%), or education costs (12%).

- They show pronounced interest in emerging benefits. Single females are more likely to be interested in financial wellness benefits like student loan refinancing (24%) and education reimbursements (42%), compared to 17% and 34% of the total population, respectively.

“Many single people carry the financial burden of an entire household, which can make it difficult to prioritize and visualize long-term financial goals when you’re trying to stay above water on the day-to-day,” said Kerry McDermott, Senior Director of E*TRADE Advisor Services. “For those who are hesitant to get started, it bears repeating that it’s critical to create a foundation, however small. Over time, the power of compounding can help women build their wealth and put them on the path to financial security.”

E*TRADE aims to enhance the financial independence of traders and investors through a powerful digital offering and professional guidance.

To learn more about E*TRADE trading and investing platforms and tools, visit etrade.com.

For useful trading and investing insights from E*TRADE, follow the company on Twitter, @ETRADE.

About the Survey

This wave of the survey was conducted from January 1 to January 10 of 2020 among an online US sample of 907 self-directed active investors, composed of 121 single female investors, who manage at least $10,000 in an online brokerage account. The survey has a margin of error of ±3.20 percent at the 95 percent confidence level. It was fielded and administered by Dynata. The panel is broken into thirds of active (trade more than once a week), swing (trade less than once a week but more than once a month), and passive (trade less than once a month). The panel is 60% male and 40% female, with an even distribution across online brokerages, geographic regions, and age bands.

Referenced Data:

|

In general, please rate your current interest in each of the following... |

||

|

Total |

Single Females |

|

|

Blockchain and crypto-related securities |

24% |

33% |

|

Marijuana securities |

26% |

35% |

|

ESG investments |

18% |

29% |

|

Real estate |

43% |

53% |

|

Renewable resources |

42% |

52% |

|

Payment stocks |

38% |

46% |

|

I am more likely to invest abroad than domestically this quarter. |

||

|

Total |

Single Females |

|

|

Agree (Top 2 Box) |

29% |

37% |

|

Strong agree |

10% |

16% |

|

Somewhat agree |

19% |

21% |

|

Neither agree nor disagree |

27% |

30% |

|

Somewhat disagree |

29% |

26% |

|

Strongly disagree |

15% |

7% |

|

Disagree (Bottom 2 Box) |

44% |

33% |

|

Have you ever taken out money from an IRA or 401(k) before the age of 59.5 and, if so, for what? |

||

|

Total |

Single Females |

|

|

No |

67% |

57% |

|

Yes |

33% |

43% |

|

Yes, to make a large purchase |

12% |

17% |

|

Yes, because I became unemployed |

11% |

12% |

|

Yes, to pay for education |

8% |

12% |

|

Yes, for a medical emergency |

8% |

15% |

|

Yes, to simply spend on myself or my family |

6% |

11% |

|

Yes, to spend on a vacation |

4% |

6% |

|

Which of the following benefits that a potential employer could provide would be the most important to you? |

||

|

Total |

Single Females |

|

|

Retirement plans |

82% |

79% |

|

Insurance other than health (e.g., life, legal, and auto) |

63% |

62% |

|

Employer stock at a discount or bonus |

48% |

41% |

|

Education reimbursement |

34% |

42% |

|

Commuter benefits |

24% |

28% |

|

Gym discounts |

19% |

17% |

|

Student loan refinancing |

17% |

24% |

|

Product discounts |

12% |

7% |

About E*TRADE Financial and Important Notices

1. Morgan Stanley, “Rise of the SHEconomy,” Morgan Stanley, September 23, 2019. https://www.morganstanley.com/ideas/womens-impact-on-the-economy

Automatic Investment Plans and dollar-cost averaging do not ensure a profit or protect against a loss in declining markets.

E*TRADE Financial and its subsidiaries provide financial services including brokerage and banking products and services to retail customers. Securities products and services are offered by E*TRADE Securities LLC (Member FINRA/SIPC). Commodity futures and options on futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. Bank products and services are offered by E*TRADE Bank, and RIA custody solutions are offered by E*TRADE Savings Bank, both of which are national federal savings banks (Members FDIC). More information is available at www.etrade.com. ETFC-G

E*TRADE Financial, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE Financial Corporation.

© 2020 E*TRADE Financial Corporation. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200316005404/en/