Updated on September 17th, 2020 by Nate Parsh

The “Dogs of the Dow” investing strategy is a very simple way for investors to achieve diversification and income in their portfolios while remaining in the sphere of more conservative blue chip stocks.

The strategy consists of investing in the 10 highest yielding stocks in the Dow Jones Industrial Average, an index of 30 large cap U.S. stocks.

Large-cap stocks represent businesses with market caps above $10 billion. There are hundreds of large-cap stocks to choose from. With this in mind, we have compiled a list of over 400 large-cap stocks in the S&P 500 Index, with market caps of $10 billion or more.

You can download your free copy of the large-cap stocks list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

The “Dogs of the Dow” strategy produces above average income and concentrates on stocks that typically trade at lower valuations relative to the rest of the DJIA. Given that the DJIA represents some of the largest companies in the world, its “dogs” are typically companies with strong track records that have hit temporary problems.

For value investors looking to purchase good businesses that are currently out of favor, this is a great and simple strategy.

To implement this strategy, simply take the amount of money you have to invest and then divide it equally among the 10 highest yielding stocks in the DJIA. Hold these stocks for a whole year and then at the end of 12 months, look at the 30 Dow stocks again and resort them by dividend yield from highest to lowest.

Rebalance and reallocate your capital accordingly and repeat the process. In addition to the simplicity and focus on quality, value, and income that this strategy generates, it also improves discipline by preventing excessive emotion-driven trading.

It also encourages investors to reap the tax benefits from holding positions for at least one year before selling, thereby being taxed at the long-term capital gains tax rate instead of the short-term rate.

The 2020 Dogs of the Dow

The list of the 2020 Dogs of the Dow is below, along with the current dividend yield of the top-ten yielding DJIA stocks. Click on a company’s name to jump directly to analysis on that company.

- The Travelers Company (TRV)

- The Coca-Cola Company (KO)

- 3M Company (MMM)

- Cisco Systems (CSCO)

- JPMorgan Chase (JPM)

- Verizon Communications (VZ)

- Walgreens Boots Alliance (WBA)

- IBM Corp (IBM)

- Dow, Inc (DOW)

- Chevron Corp. (CVX)

- Final Thoughts

Dog of the Dow #10: The Travelers Companies

- Dividend Yield: 3.0%

Travelers was founded in 1864, offering customers life and accident insurance. Over time, the company has expanded into various other types of insurance coverage which now includes auto, home and business insurance. The company generated revenue in excess of $28 billion in 2019 and has a market capitalization of more than $29 billion.

Travelers reported second quarter earnings results on July 23, 2020. The company’s revenue was down by 0.5% to just under $7 billion, missing estimates by $184 million. Core earnings loss per share of -$0.20 was in-line with estimates.

Profits was hurt by higher catastrophe losses of $854 million pre-tax, compared to $367 million pre-tax in the previous year. Lower net investment income and a reserve release in last year’s comparable quarter. Travelers noted that it will likely recognize a $400 million favorable reserve release in the third quarter due to PG&E (PCG) emerging from bankruptcy. This should aid second-half earnings results.

Underlying underwriting margins increased 2% even as net written premiums were lower by 1% to $7.346 billion. Travelers’ combined ratio did increase 530 basis points to 103.7%. On an adjusted basis, the combined ratio actually improved to 91.4% from 94.9% due to excellent underlying underwriting margins.

Book value improved to $106.42 per share from $101.55, but on an adjusted basis, book value declined fractionally to $92.01.

Travelers is blessed with a size and scale that most competitors cannot match. This allows the company to underwrite policies that others cannot. The company has also been able to retain a large number of customers while also passing along increases in premiums.

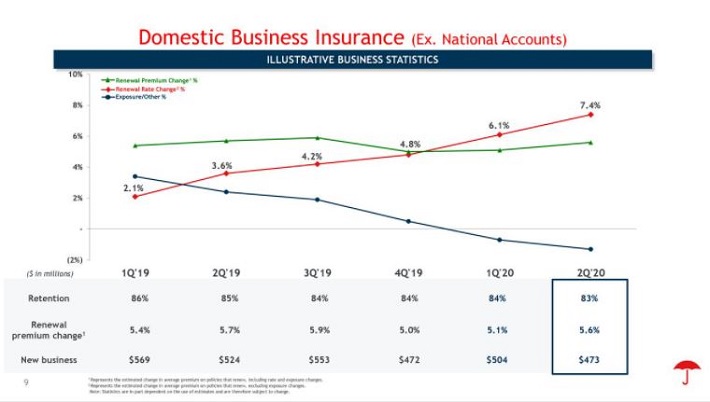

Source: Investor Presentation, slide 9.

The overall retention rate dipped in the second quarter, but has largely remained consistent in recent quarters. Despite headwinds in the quarter, the renewal premium charge was quite high and include a record level in Bond & Specialty Insurance. Business Insurance renewal rate change was 7.4%, almost 4 percentage points higher than the prior year and the highest level since 2013.

Travelers has raised its dividend for the last 16 years, including a 3.7% increase in April. The expected payout ratio of 38% is quite low and should allow for the company to continue to raise its dividend.

Dog of the Dow #9: The Coca-Cola Company

- Dividend Yield: 3.2%

The Coca-Cola Company is one of the largest beverage manufacturers in the world. It owns or licenses more than 500 unique non-alcoholic brands, in more than 200 countries worldwide. It currently has a market capitalization of almost $220 billion and the company generates roughly $37 billion in annual revenue.

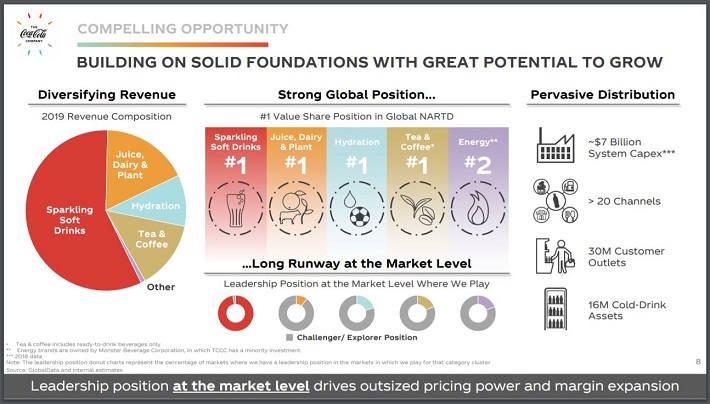

Source: Investor Presentation, slide 8.

Coca-Cola has long struggled against a backdrop of declining soda consumption in the United States. But its investments in new products are finally paying off. The company continues to see the majority of its sales come from sparkling soft drinks, but new products are helping to diversify the revenue stream.

In addition to revamping its product portfolio, Coca-Cola made another strategic move to simplify its operations and increase its profitability. Coca-Cola has sold its bottling businesses in the U.S., Europe, China, and Africa in recent years. This helps Coca-Cola’s bottom line because bottling is a capital-intensive business, with low profit margins.

Like many companies, Coca-Cola struggled during the most recent quarter due to COVID-19. Revenue fell 28.5% to $7.2 billion while adjusted earnings-per-share declined 33% to $0.42.

Prior to this quarter, the company had enjoyed solid organic growth rates as its investments in newer products had begun to pay off and soft drink demand had returned. Organic growth in the most recent quarter declined 26%. Much of this decline was due to concentrate sales dropping 22% due to away-from-home channels, such as restaurants, convenience stores and sports and music venues. Many of these locations experienced forced closures in an effort to slow the spread of COVID-19.

Pricing also was down 4% during the quarter. Coca-Cola’s market share declined overall. North America concentrate volumes were down 18% while Europe/Middle East/Africa was lower by 26%.

On the other hand, home sales were much higher year-over-year. For example, China had a 14% improvement in sales. Case volumes improved as the quarter progressed and lockdown restrictions eased. Case volumes were down 25% in March, but were down 10% in June. This coincides with the reopening of restaurants and other venues selling the company’s products in much of the world.

U.S. volumes started to improve in the first three weeks of July and down just mid-single-digits worldwide. This is evidence that the company’s products remain in demand when consumers were able to return to more normalized day-to-day activities.

Even the loss of volume didn’t register much of a material impact on operating margins. The decline was just 30 basis points to 30%.

We expect Coca-Cola to earn $1.80 per share in 2020, which would be a decline of 15% from the previous year. Nearly all of the decline is related to the impact of COVID-19.

Coca-Cola currently pays a dividend of $1.64 per share, equaling a 3.2% current yield. Coca-Cola has increased its dividend for over 50 years in a row, making it a member of the exclusive Dividend Kings.

Dog of the Dow #8: 3M Company

- Dividend Yield: 3.5%

3M is an industrial manufacturing giant. It has a long track record of growth, and like Coca-Cola, is on the list of Dividend Kings for having raised its dividend for at least 50 consecutive years.

Business conditions have worsened since the start 2019, and the challenges have persisted this year. 3M released weak second-quarter results in which revenue declined 12.2% to $7.2 billion, which was $123 million below expectations. Organic revenue declined 13.1%, considerably higher than the expected 10.4% decrease that analysts had anticipated. Currency was also a headwind, reducing EPS by $0.05.

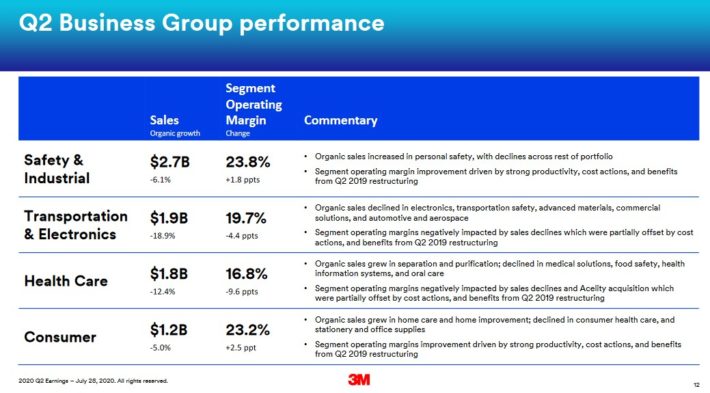

Source: Investor Presentation

Organic revenue growth is now expected in a range of down 1% to up 2%, a big drop from previous

guidance of 1% to 4% growth. Despite the company’s challenging second quarter and lowered full year forecast, the long-term outlook is still positive. 3M has long-term growth catalysts, primarily its healthcare segment.

The demographics of the U.S. health care industry are highly supportive of growth, due to the aging population. 3M is already a major healthcare product manufacturer, with segment sales above $7 billion each year.

Healthcare is expected to lead 3M’s growth in the years ahead, particularly with the recent $6.7 billion acquisition of Acelity.

The costs related to the acquisition reduced EPS by $0.07 in the most recent quarter, but management is high on Acelity’s ability to add to 3M in the future. Acelity manufactures wound dressings and other specialty surgical products. It will expand 3M’s Medical Solutions business with a high-growth category.

Excluding certain one-time transaction and integration expenses, 3M expects the deal to be accretive to earnings by $0.25 per share in the first 12 months after closing. 3M paid approximately 11x estimated annual adjusted EBITDA for Acelity, which is a reasonable multiple for a fast-growing, high-margin business.

3M has a long dividend history. It has paid uninterrupted dividends to shareholders for over 100 years. It has also raised its dividend for the past 62 consecutive years, including a 2.1% increase in February 2020. We continue to view 3M’s dividend as secure.

3M’s dividend growth should continue for the foreseeable future. Even though EPS will be lower this year than the company previously anticipated, 3M remains highly profitable.

At the midpoint of revised guidance, 3M’s dividend payout ratio of 73% still represents solid coverage, with room for future dividend hikes provided the company can successfully rebound from the COVID-19 pandemic.

Dog of the Dow #7: Cisco Systems Inc.

- Dividend Yield: 3.5%

Cisco Systems is the global leader in high performance computer networking systems. The company’s routers and switches allow networks around the globe to connect to each other through the internet. Cisco’s portfolio includes data center, cloud and security products. The company went public in early 1990 and employs more than 72,000 people today. The company has a market capitalization of $171 billion.

Cisco reported fourth quarter and fiscal year 2020 results on August 12, 2020. Revenue declined 9.5% to $12.2 billion, but topped expectations by $60 million. Adjusted earnings-per-share were lower by 3.6% to $0.80, but came in $0.06 ahead of consensus estimates. For fiscal year 2020, revenue decreased 5% to $49.3 billion while adjusted earnings-per-share grew 4% to $3.21.

COVID-19 had the most severe impact on the company’s Infrastructure Platform segment, which had a 16% decline in revenue due to weak demand for switching, routing, data center and wireless products. On the other hand, Cisco’s Catalyst 9K switch, which is twice as fast as competing products, continues to see accelerated demand. This product benefited from the transition to work at home during the quarter. Security sales were also higher during the quarter as customer demand remains robust.

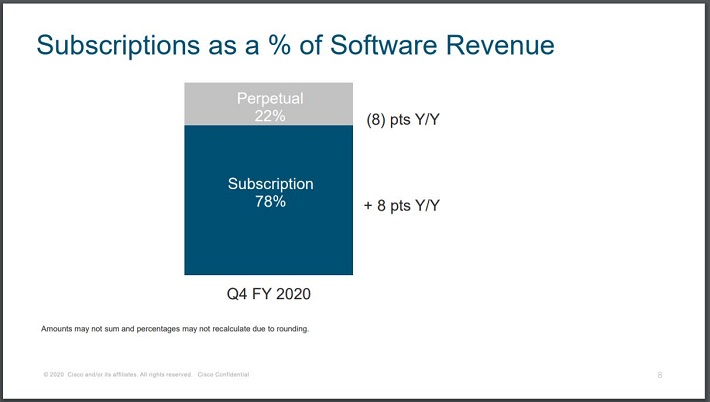

Cisco has transitioned to a software as a subscription model in recent years in an effort to smooth out revenues results.

Source: Investor Presentation, slide 8

Software subscriptions accounted for 78% of total software revenue during the quarter, which was an 8% increase year-over-year.

The company’s cash balance of more than $29 billion places Cisco in a solid position to be able to make acquisitions while also allowing for a growing dividend.

After announcing a 2.9% increase in February, Cisco has now raised its dividend for 10 consecutive years. With a projected payout ratio of 46% for the current fiscal year and cash on the balance sheet, we feel that it is likely that Cisco continues to increase its dividend.

Dog of the Dow #6: JPMorgan Chase

- Dividend Yield: 3.6%

JPMorgan was one of the first commercial banks in the U.S., tracing its roots back to 1799. The company has merged with or acquired more than 1,200 different institutions over the last 220+ years. This has allowed the company to become a global banking leader. JPMorgan has a market capitalization of nearly $304 billion and has annual revenue of almost $116 billion.

JPMorgan released earnings results on July 14, 2020. The company’s revenue was higher by 15% to $33 billion, easily beating estimates by $2.8 billion. This was also JPMorgan’s highest quarterly revenue ever. Earnings-per-share of $1.08 compared unfavorably to earnings-per-share of $2.82 in the second quarter of 2019 and was $0.13 below consensus.

Net interest income fell 4% to $14 billion, but was in-line with estimates. Credit card volumes were down 23%, but nearly every aspect of the company’s business reported strong numbers.

Corporate and Investment Banking was up 66% from the previous year, while Markets & Securities Services grew 77%. Fixed Income revenue doubled due to interest rate products, currencies, emerging markets and credit. High client activity led to 38% growth in Equity Markets. Consumer and Community Banking saw average deposits grow 20%, though average loans were lower by 7%.

Negatively impacting the bottom-line was an addition of $9 billion to credit loss reserves. JPMorgan now has more than $34 billion in credit loss reserves. Lower interest rates also had a negative impact on net interest income, but JPMorgan has one of the best balance sheets in the banking sector.

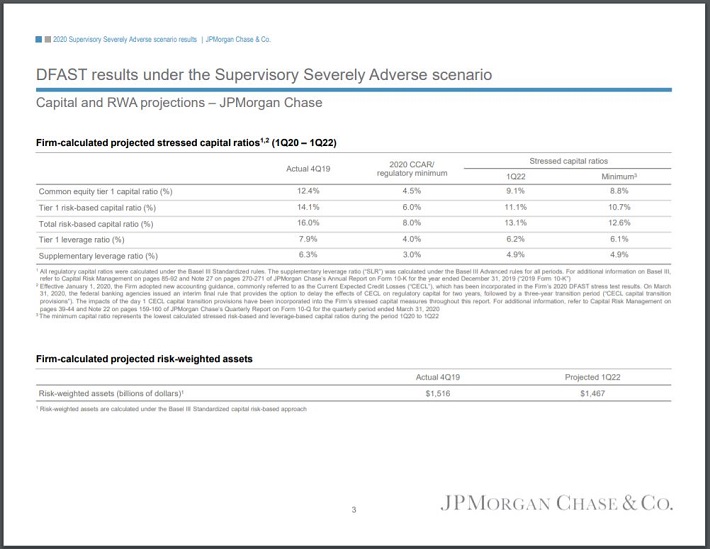

Source: Investor Presentation, slide 3.

As you can see, JPMorgan easily beat the regulatory minimum in all areas of the most recent stress test. This is one of the prime benefits of the company’s size and scale that is almost unmatched by competitors.

JPMorgan did cut its dividend during the last financial crisis, but has increased its dividend for the last nine years. Most of the banks did not raise dividends following the last stress test, but a projected payout ratio of 60% for JPMorgan most likely means that a small raise will be given sometime next year and will preserve the company’s dividend growth streak.

Dog of the Dow #5: Verizon

- Dividend Yield: 4.0%

Verizon operates in the telecommunications sector as one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~298 million people. Verizon has a market capitalization of $249 billion, with annual sales of $132 billion.

Verizon reported financial results for the second quarter on July 24, 2020. The company earned $1.18 per share, topping estimates by $0.03, but declining 4.1% from the previous year. Revenue decreased 5.1% to $30.5 billion, but topped estimates by $455 million.

Revenues for wireless fell 1.7% to $15.9 billion. Verizon did see a total of 352K retail postpaid net additions, including 173K phone net additions. The company’s retail postpaid churn was just 0.78%, with a retail postpiad phone churn of 0.58%.

Verizon’s business segment experienced a revenue decline of 3.7% to $7.5 billion. Media sales were down 24% to $1.4 billion. The company added 10K net Fios connections, but lost a net of 81K Fios video subscribers.

Based on second quarter results, Verizon now expects earnings-per-share to be flat compared to 2019. We only expect 4% annual EPS growth over the next half decade.

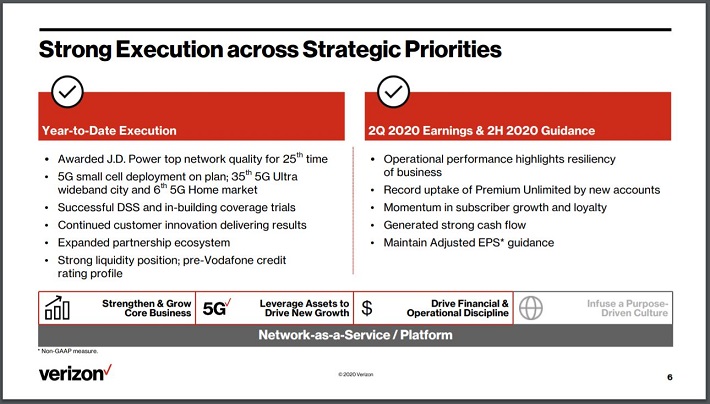

The company’s plans for 5G should allow it to achieve this growth.

Source: Investor Presentation, slide 6.

Verizon has turned on 5G in 35 cities in the U.S., including Washington D.C., Atlanta, Indianapolis and Detroit.

Following an announcement in early September that it would be raising its dividend by 2%, the company has now increased its dividend for the past 16 years and should continue doing so for the foreseeable future.

Verizon’s economic moat resulting from its large scale, network advantage, and brand power in the U.S. should enable it to continue growing with healthy margins, despite growing competition.

This is evident by the company’s wireless net additions and very low churn rate. Management is also taking steps to deleverage Verizon’s balance sheet which should also increase its safety. Verizon’s high dividend yield above 4% is attractive to income investors.

Dog of the Dow #4: Walgreens Boots Alliance

- Dividend Yield: 5.2%

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, Walgreens has a presence in more than 25 countries and employs more than 440,000 people.

In its leading retail pharmacy business Walgreens operates approximately 18,750 stores in 11 countries, and also operates one of the largest global pharmaceutical wholesale and distribution networks, with more than 390 centers that deliver to upwards of 230,000 pharmacies, doctors, health centers and hospitals each year.

In its recent FY20 Q3 results, Walgreens reported net sales growth of 0.12% (1.2% on a constant currency basis) to $34.6 billion compared to the same quarter last year, due to 3.0% growth in the Retail Pharmacy USA division. Adjusted net earnings decreased 12.1% to $1.3 billion and adjusted earnings-per-share fell 44% to $0.83, primarily due to the COVID-19 pandemic.

Walgreens expects adjusted earnings-per-share of $4.65 to $4.75 for its fiscal year 2020 outlook, which includes an adverse impact from COVID-19 of $1.03 to $1.14 per share. The midpoint of this guidance would be a 22% decrease from last year’s EPS results.

Over the long-term the company still believes it can grow the bottom line in the mid-to-high single digits. However, investors should be somewhat skeptical of this forecast, given the unknowns regarding the ongoing pandemic as well as sharp declines in growth and increasing competition in the space.

Therefore, we anticipate earnings per share growth in the mid-single-digits over the next half decade supported primarily by share repurchases and an aging population.

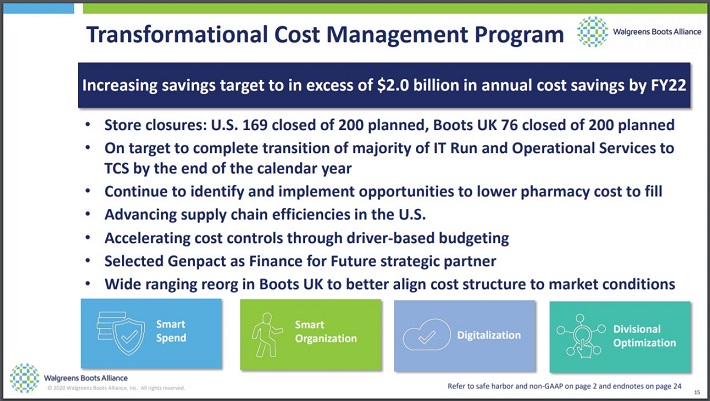

The company is also taking steps to remove costs from its business.

Source: Investor Presentation, slide 15.

Walgreens is targeting a $2 billion reduction in annual costs by fiscal year 2022. The company has already closed 169 or 200 planned stores in the U.S. and 76 of a planned 200 stores in the U.K.

Despite these challenges, Walgreens still enjoys a significant competitive advantage thanks to its vast scale and network in an important and growing industry.

Meanwhile, the payout ratio remains reasonable and supports continued dividend growth. Walgreens is also fairly recession resistant, with its earnings per share dipping only 6.9% in 2009.

The company also holds a very strong balance sheet with more than $1 billion in cash, $18.7 billion in current assets (including $9.3 billion in inventory) and $67.6 billion in total assets against just $25.8 billion in current liabilities and $43.4 billion in total liabilities.

Walgreens has increased its dividend for 45 consecutive years, including a 2.2% increase on July 8th. This makes Walgreens a member of the Dividend Aristocrats, a select group of 65 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases. You can see our list of all 65 Dividend Aristocrats here.

Dog of the Dow #3: IBM

- Dividend Yield: 5.3%

IBM is an information technology company which provides integrated solutions that leverage information technology and knowledge of business processes. The company was founded in 1911, and currently operates five business segments: Cognitive Solutions, Global Business Services, Technology Services & Cloud Platforms, Systems, and Global Financing.

IBM generates annual revenue above $77 billion and trades with a market capitalization of $112 billion. IBM is currently transitioning away from its legacy businesses towards its self-described “strategic imperatives” in data, mobile, security, and analytics. The company had several years of stagnant or declining revenues as the company changed strategies. Year-over-year declines continued in the most recent quarter.

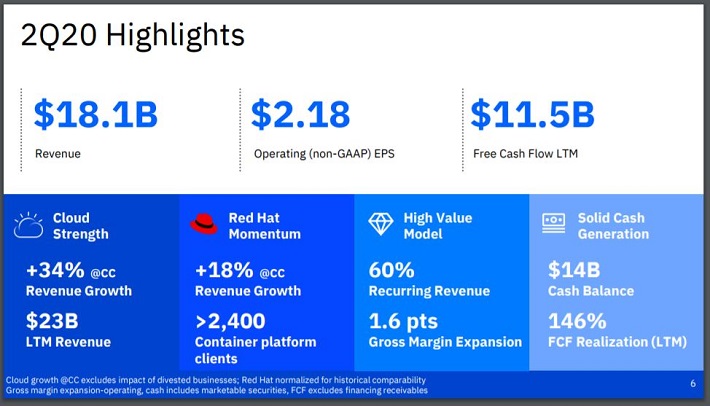

IBM reported 2020 second quarter results on July 20th, 2020. Earnings per share of $2.18 beat estimates by $0.09, but were down 31%. Revenue of $18.1 billion was down 5.4%, but this was $402 million higher than expected. Cloud & Cognitive Software grew revenue 5% while Systems revenue improved 6%.

On the other hand, Global Business Services revenue fell 6% while Global Technology Services saw revenues decrease 5%.

Due to IBM’s global operations, foreign currency exchange headwinds had a meaningful impact causing a 1.5% decline in revenue. IBM is forecasting a 1% to 1.5% headwind due to currency for the fiscal year.

IBM’s future growth will be boosted by its $34 billion acquisition of Red Hat, an open-source cloud solutions provider. Red Hat has a leading position in hybrid cloud, which would in turn make IBM the No. 1 provider of hybrid cloud solutions. Hybrid cloud is a mixed computing environment that uses private cloud and third party cloud. The deal is expected to be accretive to cash flow and accelerate revenue growth.

Red Hat operates in the open-source software market and primarily distributes technology products used in data centers. In addition, the company’s own growth segments, collectively referred to as the strategic imperatives, are growing at a high rate.

Source: Investor Presentation, slide 6.

RedHat had 18% revenue growth during the quarter and has more than 2,400 clients. This growth is expected to continue in the coming years.

Despite IBM’s prolonged difficulties, the company still has a strong balance sheet and a sustainable dividend with an expected dividend payout ratio below 60% for this year. IBM has a price-to-earnings ratio of just 11.2. With a low stock valuation, a high dividend yield, and over 100 years of dividend payments, we consider IBM to be a “blue-chip stock”.

Dog of the Dow #2: Dow, Inc. (DOW)

- Dividend Yield: 5.5%

The second highest-yielding Dow Jones Industrial Average component is Dow, Inc., a newly-formed stock after the separation of its former parent, DowDuPont. That company has broken into three publicly-traded, standalone parts, with the former Materials Science business becoming the new Dow Inc.

Dow produced almost $43 billion in revenue last year and the stock trades with a market capitalization of $37 billion. The company released its second quarter earnings report on July 23, 2020.

Total revenue in the most recent quarter fell 24% year-over-year to $8.4 billion, but this was $454 million higher than expected. Volume declined 9% overall as gains made in food packaging, health and hygiene, home care and pharma applications were more than offset by weakness in durable good end markets.

Industrial Intermediates & Infrastructure declined 28% with an 18% drop in volumes, making this the weakest segment in the quarter. Sales for Performance Materials & Coatings were down 21%, mostly due to lower volumes. Packaging & Specialty Plastics had a 23% decrease in sales, but volumes were flat as growth in non-durable packaging was offset by weakness in durable end markets.

The most recent quarter was difficult, but Dow has plenty of potential growth in its future.

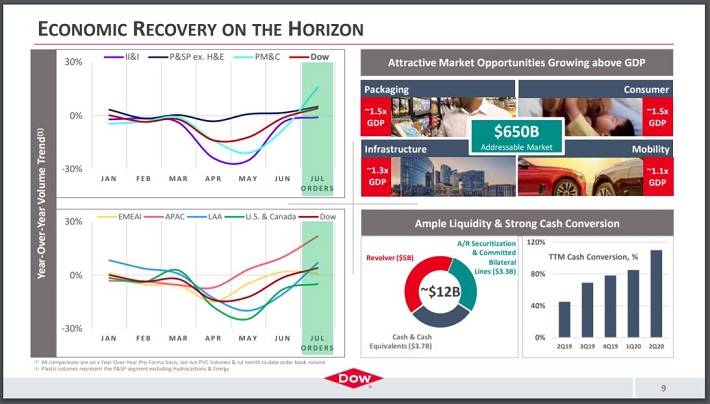

Source: Investor Presentation, slide 9.

Dow saw an improvement in July orders as the economies of the world began to reopen. There is also a massive opportunity in its sector as the company estimates that the total addressable market is $650 billion.

Dow announced that it would reduce its work force by 6%, which would help lead to $300 million in annual costs savings by 2021.

Shareholders currently receive quarterly dividend of $0.70 per share, which remains unchanged since the spinoffs. Management stated it is committed to offering an industry-leading dividend to shareholders.

Dow’s payout ratio is currently at more than 190% of expected earnings for the year. This payout ratio is due to a significant reduction in expectations for EPS for the year due to COVID-19. We believe that the payout ratio will normalize as business prospects improve.

Dog of the Dow #1: Chevron

- Dividend Yield: 6.5%

The highest-yielding Dow Jones Industrial Average component is Chevron. With a market capitalization of $145 billion, Chevron is now the second-largest oil major in the U.S., behind only Exxon Mobil (XOM). The company’s main competitive advantages are its size and industry position, giving it economies of scale, operational expertise, and a vast business network through which to access lucrative deals. The company had $147 billion in revenue last year.

Chevron reported second quarter earnings results on July 31, 2020. Production fell 3% year-over-year due to lower demand as a result of the pandemic. The average realized oil price plunged from $57 to $20 per barrel. As a result, Chevron had an earnings-per-share loss of -$1.59 compared to a profit of $1.77 in the prior year. Revenue declined 65% to $13.5 billion. Both figures were lower than expected.

Chevron has extensively invested in growth projects for years but has failed to grow its output for an entire decade, as oil projects take several years to start bearing fruit. However, Chevron is now in the positive phase of its investing cycle, as its investments are now online and increasing output even as capital expenditures decline. The company expects to grow its output by 3% to 4% by 2024, but the pandemic disrupted these plans.

Chevron’s growth will be fueled by rising demand for its products around the world as well as acquisitions.

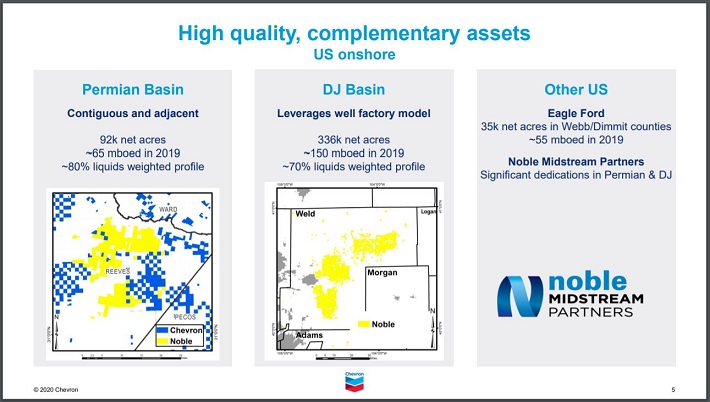

Source: Investor Presentation, slide 5.

Chevron announced on July 20, 2020 that the company had agreed to acquire Noble Energy for $5 billion in an all-stock deal. The deal will provide Chevron with low-cost proved reserves and promising underdeveloped resources. Given that the prudent management of Chevron did not engage in a bidding war with Occidental Petroleum (OXY) for Anadarko, it is safe to assume that the recent deal with Noble will offer attractive returns to Chevron.

Eventually, the pandemic should subside and demand for energy products should increase. We believe that the company can achieve its production targets. We also feel that the combination of current projects, increased demand for energy products and the addition of Noble Energy will lead to earnings-per-share growth of 13%.

Following several years of minimal dividend growth as the price of energy collapsed, Chevron has increased its dividend by 3.7%, 6% and 8.4% over the last three years, respectively.

Chevron has typically had above-average dividend safety, considering its industry. As a commodity producer, the company is vulnerable to any downturn in the price of oil. Due to weakness from the pandemic, we have a projected payout ratio of 118% for the year. This isn’t sustainable long-term, but we expect that earnings growth will resume at a high level and that the payout ratio will fall to a much more manageable 68% by 2025.

Even though Chevron operates in a cyclical industry, we believe the dividend is secure. As a result, we believe they will continue raising their dividend for the foreseeable future, especially considering that it is already a Dividend Aristocrat with 3 consecutive years of dividend growth.

Final Thoughts

Given the descriptions above, the Dogs of the Dow are clearly a very diverse group of blue-chip stocks which each enjoy significant competitive advantages and lengthy histories of paying rising dividends.

As a result, this investing strategy is a great, low-risk way for unsophisticated investors to approach dividend growth investing.

While it may not outperform the broader market every year, it is virtually guaranteed to provide investors with a combination of attractive current yield with steadily rising income over time.