Updated on April 19th, 2019 by Samuel Smith

The “Dogs of the Dow” investing strategy is a very simple way for investors to achieve diversification and income in their portfolios while remaining in the sphere of more conservative blue chip stocks.

It simply consists of investing in the 10 stocks in the Dow Jones Industrial Average (DJIA) – an index of 30 large cap U.S. stocks – with the highest dividend yields.

We have compiled a list of the 30 Dow Jones Industrial Average stocks that you can access below:

As a result, this strategy produces above average income and concentrates on stocks that typically trade at lower valuations relative to the rest of the DJIA. Given that the DJIA represents some of the largest companies in the world, its “dogs” are typically companies with strong track records that have hit temporary problems.

For value investors looking to purchase good businesses that are currently out of favor, this is a great and simple strategy.

To implement this strategy, simply take the amount of money you have to invest and then divide it equally among the 10 highest yielding stocks in the DJIA. Hold these stocks for a whole year and then at the end of twelve months, look at the 30 Dow stocks again and resort them by dividend yield from highest to lowest.

Rebalance and reallocate your capital accordingly and repeat the process. In addition to the simplicity and focus on quality, value, and income that this strategy generates, it also improves discipline by preventing excessive emotions-driven trading.

It also encourages investors to reap the tax benefits from holding positions for at least one year before selling, thereby being taxed at the long-term capital gains tax rate instead of the short-term capital gains tax rate.

The 2019 Dogs of the Dow

The list of the 2019 Dogs of the Dow is below, along with the current dividend yields of the top-ten yielding DJIA stocks:

- IBM Corp (IBM) 4.5%

- Verizon (VZ) 4.2%

- Exxon Mobil (XOM) 4.0%

- Chevron Corp (CVX) 4.0%

- Pfizer (PFE) 3.7%

- Walgreens Boots Alliance (WBA) 3.2%

- Merck (MRK) 3.0%

- JP Morgan Chase (JPM) 2.8%

- Procter & Gamble (PG) 2.8%

- The Home Depot (HD) 2.7%

In the remainder of this article, we will briefly discuss each of the top 10 Dogs of the Dow for 2019.

Dog of the Dow #10: IBM

IBM is an information technology company which provides integrated solutions that leverage information technology and knowledge of business processes. The company was founded in 1911, and currently operates five business segments: Cognitive Solutions, Global Business Services, Technology Services & Cloud Platforms, Systems, and Global Financing.

IBM generates annual revenue above $79 billion. IBM is currently transitioning away from its legacy businesses towards its self-described “strategic imperatives” in data, mobile, security, and analytics After several years of stagnant and/or declining revenues as the company changed strategies, IBM has finally recently returned to revenue growth.

In 2018, total strategic revenue increased 9%, with total cloud revenue leading the way as the largest strategic imperative by growing 12%. In late October 2018, IBM significantly bolstered its cloud business when it acquired Red Hat, Inc. in the largest deal in IBM’s history.

Red Hat operates in the open-source software market and primarily distributes technology products used in data centers. We expect the company to continue growing slowly, with 3% projected annual earnings growth through 2024.

Source: Investor Presentation

Despite IBM’s prolonged difficulties, the company still has a strong balance sheet and a sustainable dividend with a dividend payout ratio below 50%. It has also shown remarkable commitment to growing its dividend as it is about to become a Dividend Aristocrat.

IBM also has a moat due to its strong global brand, extensive and sticky business relationships due to decades of prominence in the tech industry, and an impressive patent portfolio. IBM is also a recession-resistant company, growing its earnings-per-share in 2008 and 2009.

IBM has a price-to-earnings ratio of just 10.0, meaningfully below our fair value estimate of 12.0. This means the stock is significantly undervalued.

With a low stock valuation, a high dividend yield, and over 100 years of dividend payments, we consider IBM a “blue-chip stock”.

You can see a list of four other blue-chip dividend stocks in addition to IBM, in the video below:

Dog of the Dow #9: Verizon

Verizon was created by a merger between Bell Atlantic Corp and GTE Corp in June, 2000 and operates in the telecommunications sector as one of the largest wireless carrier in the country.

Its main business is wireless services and contributes three-quarters of all revenues for the company. Verizon also offers broadband and cable services, which account for nearly all of its remaining sales.

The company’s network is so broad that it covers nearly 98% of the U.S. land area. In 2018, Verizon reported strong earnings growth, with adjusted EPS 26% higher from 2017 as revenue grew 4% during the year to an impressive $131 billion year-over-year.

Looking ahead, however, growth is expected to slow with EPS forecasted to be flat in 2019 and revenue growing in the low single digits due to margin pressures from increased competition. As a result, we only expect 4% annual EPS growth over the next half decade.

Source: Investor Presentation

The company has now increased its dividend for the past 14 years and should continue doing so for the foreseeable future.

Verizon’s economic moat resulting from its large scale, network advantage, and brand power in the U.S. should enable it to continue growing with healthy margins, despite growing competition.

This is evident by the company’s wireless net additions and very low churn rate. Management is also taking steps to deleverage Verizon’s balance sheet which should also increase its safety.

Dog of the Dow #8: Exxon Mobil

Exxon Mobil is an energy giant with $290 billion in annual revenue and net profits in excess of $21 billion. In 2018, the company generated 60% of its earnings from its upstream segment, 26% from its downstream (mostly refining) segment and the remaining 14% from its chemicals segment as it grew revenues by a robust 18.8% increase year-over-year, led by a near doubling in upstream earnings.

While it is a diversified business, Exxon’s results are highly cyclical due to its exposure to the economy and commodity prices. However, given its diversified nature, Exxon is still able to remain profitable through economic and commodity cycles, enabling it to grow its dividend for 36 straight years.

The upstream business tends to thrive when oil prices are high and the downstream and chemical businesses continue to churn out cash flows when oil prices are suppressed.

Source: Earnings Presentation

Looking forward, we anticipate the company’s admirable dividend growth streak to continue on the back of management’s forecast for 140% earnings growth by 2025 thanks to the boom in Permian and Guyana production to meet growth in global energy demand as the developing world continues to increase energy consumption.

To fuel this growth, Exxon is planning to ramp up its capital spending in order to capitalize on its attractive cost of capital and high return on investment opportunities (20% expected returns on capital forecasted in new investments in the upstream business).

Furthermore, if/when oil cycles down again, the company’s flexible balance sheet and the fact that its dividend and spending requirements are fully covered at $40/barrel should enable the company to continue paying and growing its dividend well into the future.

Dog of the Dow #7: Chevron

Chevron is the third-largest oil major in the world, behind only Shell and ExxonMobil. The company’s main competitive advantages are its size and industry position, giving it economies of scale, operational expertise, and a vast business network through which to access lucrative deals.

In 2018, Chevron grew earnings-per-share by 60% with the upstream segment serving as the biggest contributor with 63% earnings growth in that business during the year. As a result, Chevron hiked its dividend by 6%.

Source: Earnings Presentation

The biggest driver of this robust growth despite volatile prices was increased production. Chevron has extensively invested in growth projects for years but has failed to grow its output for an entire decade, as oil projects take several years to start bearing fruit.

However, Chevron is now in the positive phase of its investing cycle, as its investments are now online and increasing output even as capital expenditures decline. The company expects to grow its output by 4%-7% this year and by 2%-3% per year for the next five years.

Given the magnified effect of production growth and the corresponding impact to Chevron’s earnings-per-share, we believe the company is likely to achieve total earnings-per-share growth in the 5%-6% range annually.

Chevron has above-average dividend safety, considering its industry. As a commodity producer, the company is vulnerable to any downturn in the price of oil. Fortunately, thanks to rising production and declining CapEx, Chevron’s dividend is safer than it has been in a while as its payout ratio has fallen to a more reasonable level of 58%.

As a result, we believe they will continue raising their dividend for the foreseeable future, especially considering that it is already a Dividend Aristocrat with 32 consecutive years of dividend growth.

Dog of the Dow #6: Pfizer

Pfizer was founded in 1849 and has grown into one of the largest pharmaceutical companies in the world today. It researches and manufactures drugs for a variety of therapeutic areas and has two core operating segments: Innovative Health (62% of 2018 revenue) and Essential Health (38% of 2018 revenue).

The most common therapeutic areas for Pfizer are internal medicine, oncology, immunology, inflammation, and rare diseases. Pfizer’s global portfolio is based mostly on biopharmaceuticals, but it also includes vaccines.

Source: Investor Presentation

Pfizer’s revenue grew by 2% during 2018 while adjusted earnings-per-share grew 13% as its larger Innovative Health business grew revenue by 6%, while its smaller Essential Health business saw sales decline by 5%.

Innovative Health benefited from the company’s years of significant investments in its R&D pipeline as its flagship products Eliquis (up 31%), Xeljanz (up 37%), and Prevnar (up 13%) drove sales growth.

Going forward, Pfizer sees the potential for approximately 25-30 significant product approvals through 2022, of which up to 15 have the potential to be blockbusters and expects seven of the 15 to receive approval by 2020.

In particular, Pfizer has a very strong oncology development pipeline with 13 oncology products in Phase I of development, another 4 in Phase II, and 6 in Phase III.

In the short run, however, adjusted earnings per share are expected to decline by approximately 4% as the company focuses its cash on its pipeline investments and performance continues to weaken in the Essential Health segment as patent expirations and pricing weakness negatively impact its legacy established products in developed markets.

Given these two conflicting dynamics, we expect earnings-per-share and dividends to grow at an average of 5% per year over the next half decade.

With manageable debt level, strong interest coverage, and a payout ratio of 50%, Pfizer should be able to easily continue raising its dividend each year moving forward. Pfizer also has a strong moat from its robust product pipeline and patent portfolio, securing its earnings power and driving future growth.

Dog of the Dow #5: Walgreens Boots Alliance

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, Walgreens has a presence in more than 25 countries and employs more than 415,000 people.

In its leading retail pharmacy business Walgreens operates approximately 18,500 stores in 11 countries, and also operates one of the largest global pharmaceutical wholesale and distribution networks, with more than 390 centers that deliver to upwards of 230,000 pharmacies, doctors, health centers and hospitals each year.

In its recent FY19 Q2 results, Walgreens reported year-over-year revenue growth of 4.6% but an adjusted earnings-per-share decline of 5.4%. The Retail Pharmacy USA segment saw a 7.3% increase in sales, while the Retail Pharmacy International segment posted a 7.1% decline and the Pharmaceutical Wholesale segment saw sales stay fairly flat with a decline of only 0.3%.

Looking ahead, Walgreens expects adjusted earnings-per-share to be roughly flat year-over-year, a steep downgrade in its previous quarter’s guidance of 7%-12% growth for FY19. This change in guidance comes amid increasing reimbursement pressure, lower generic deflation, and consumer market challenges.

Over the long-term the company still believes it can grow the bottom line in the mid-to-high single digits. However, investors should be somewhat skeptical of this forecast, given the sharp declines in growth and increasing competition in the space.

Therefore, we anticipate earnings per share growth in the mid-single-digits over the next half decade supported primarily by share repurchases and an aging population.

Source: Earnings Presentation

Despite these challenges, Walgreens still enjoys a significant competitive advantage thanks to its vast scale and network in an important and growing industry.

Meanwhile, the payout ratio remains reasonable and supports continued dividend growth. Walgreens is also fairly recession resistant, with its earnings per share dipping only 6.9% in 2009.

The company also holds a very strong balance sheet with $818 million in cash, $19.9 billion in current assets (including $10.2 billion in inventory) and $70.4 billion in total assets against just $25.3 billion in current liabilities and $45.0 billion in total liabilities.

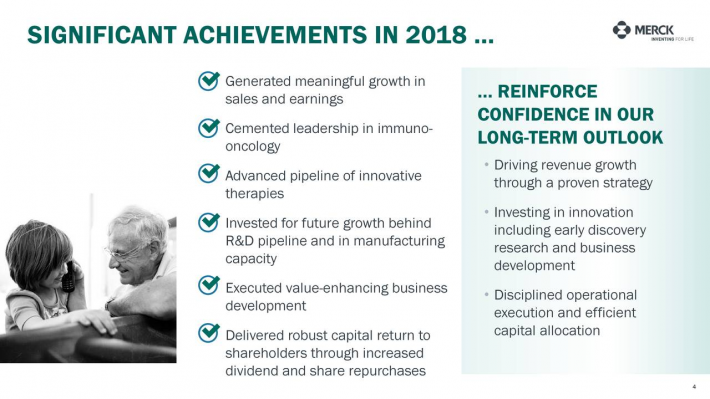

Dog of the Dow #4: Merck

Merck & Company is one of the world’s largest healthcare companies and manufactures prescription medicines, vaccines, biologic therapies, and animal health products while employing 69,000 people at facilities around the world.

The company’s 2018 results showed earnings per share rising 9% and revenues increasing by 5% to $42.3 billion. This growth was fueled in large part by Keytruda, Merck’s top-selling drug which treats cancers such as melanoma that cannot be removed by surgery and non-small cell lung cancer.

It saw 88% growth for the year and received several approvals during the quarter, including approval as a first-line treatment in patients with non-small cell lung cancer.

Despite reaching $7 billion in sales in 2018, management believes it could double this level of annual sales at its peak in the near future. Sales for Gardasil, the company’s HPV vaccine and third best-selling product, increased 37% in 2018.

Meanwhile, revenue for diabetes drug Januvia/Janumet were flat due to increased generic competition. Animal Health revenues grew at a 9% clip thanks to companion animal products, such as Bravecto, which kills fleas and ticks in dogs and cats.

Source: Earnings Presentation

Between share repurchases and dividends, Merck returned $14 billion to shareholders during the year and expects revenue to move higher to a range of between $43.2-$44.7 billion in 2019 alongside EPS growth of 7%.

Thanks to Keytruda’s strength and growth in the company’s Animal Health division, we estimate that Merck can grow earnings-per-share by at least 5% through 2024.

Merck has increased its dividend at an average rate of ~2% per year since the start of 2012 and will likely see continued dividend growth over the next several years.

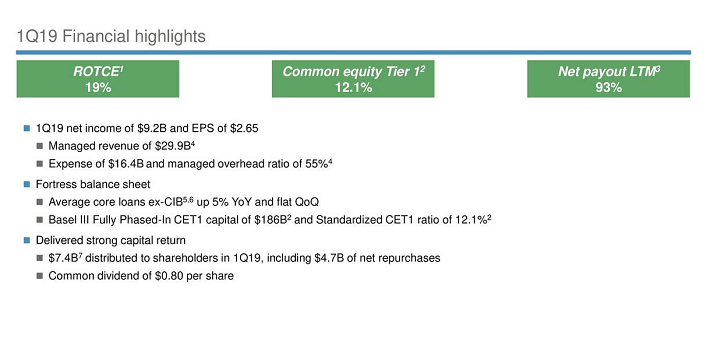

Dog of the Dow #3: JP Morgan Chase

JPMorgan was founded in 1799 as one of the first commercial banks in the US. Since then it has merged or acquired more than 1,200 different institutions, creating a global banking behemoth with $114 billion in annual revenue.

The company competes in every major segment of financial services, including consumer banking, commercial banking, home lending, credit cards, asset management and investment banking.

In its recent Q1 earnings report, JP Morgan set a company record for revenue with strength across all of its major reporting segments, driven by its immense size and diversification competitive advantages. Earnings-per-share came in at over 10% year-over-year and total revenue was up 5% on similar growth in firmwide loans.

Meanwhile, the company’s economies of scale kept noninterest expense at a mere 2% increase in Q1. Credit quality remains outstanding as charge-offs are low, helping to keep earnings moving higher.

In addition, JPMorgan’s balance sheet is robust despite high levels of capital returns. The bank’s common equity tier 1 capital ratio stands at 12.1% and its supplementary leverage ratio is 6.4%. Both of these are well in excess of required minimums.

JP Morgan also continued its very shareholder friendly capital allocation policy, returning $7.4 billion in the first quarter through a combination of the $0.80 quarterly dividend and $4.7 billion of share repurchases.

Source: Earnings Presentation

Looking ahead, a headwind for growth will be the Fed’s new dovish position on interest rates. Still, thanks to the aggressive buyback program and decent growth across the business, we see JPMorgan achieving 5.5% average annual growth over the next half decade.

JPMorgan’s balance sheet and earnings potential are more than sufficient to produce a nice tailwind from repurchases indefinitely, but its leverage to the credit card market – which is seeing loss rates continue to rise from historical lows – as well as the flattening yield curve may keep a lid on profitability going forward.

The dividend should also continue growing at a solid clip, given that JPMorgan’s payout ratio is still very low. We forecast the dividend being around $4.00 per share in five years as the bank continues to expand the payout with earnings growth. This projected payout growth is a strong reason to consider the stock for income investors.

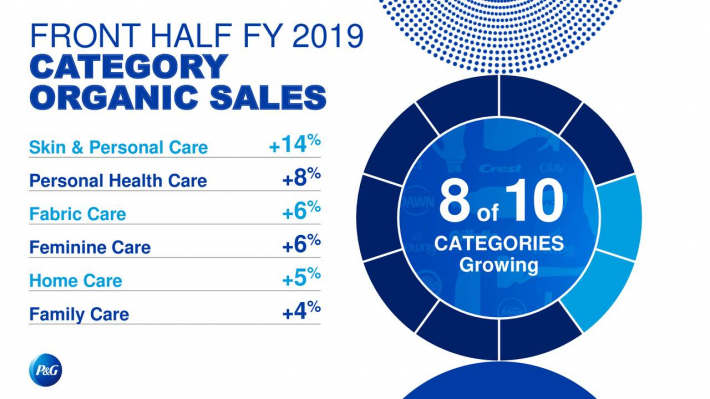

Dog of the Dow #2: Procter & Gamble

Procter & Gamble is a consumer products giant that sells its products in more than 180 countries and generates over $65 billion in annual sales.

Some of its core brands include Gillette, Tide, Charmin, Crest, Pampers, Febreze, Head & Shoulders, Bounty, Oral-B, and many more.

Amazingly, the company has paid increasing dividends for 62 consecutive years, one of the longest active streaks of any company.

Procter & Gamble’s second-quarter results for fiscal 2019 showed revenue staying flat but adjusted earnings-per-share growing 13% excluding currency. Organic sales were also strong, up 4% for the period, driven by beauty products (8% growth), followed by Fabric & Home Care (rising 6%), Health Care (up 5%), and Baby, Feminine, and Family Care (3% increase). However, grooming products saw a 3% sales decline.

Thanks to the company focusing better on its strongest brands, we are forecasting EPS growth to continue at a 5% annual rate moving forward. As a result, we believe Procter & Gamble will be able to keep its dividend growth streak going for the foreseeable future.

Source: Investor Presentation

The company also has a strong balance sheet, enjoys recession resistance due to the necessity of its products, and boasts significant competitive advantages, specifically its strong brands.

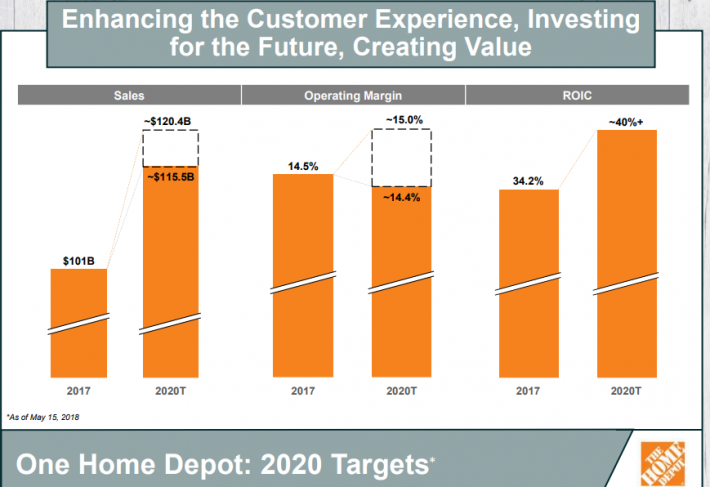

Dog of the Dow #1: The Home Depot

Home Depot was founded in 1978 and since that time has grown into a juggernaut home improvement retailer with almost 2,300 stores in the US, Canada and Mexico that generate around $108 billion in annual revenue.

The company’s 2018 results were strong, showing impressive revenue and comparable store sales growth combining with a lower tax rate and share repurchases to drive 33.5% earnings-per-share growth for the year.

Home Depot plans to keep the momentum going, announcing a new $15 billion share repurchase authorization with plans to buy back 2.5% of the company’s shares in 2019.

The company also boosted the dividend by a staggering 32% to $5.44 annually, while guiding for 5% comparable sales growth, 3.3% total sales growth, and diluted earnings-per-share of $10.03, representing growth of just 3% against 2018.

Source: Investor Presentation

The slower growth rates are in part due to an increased tax rate and a shorter year by a week.

Given the company’s strong business model and aggressive repurchases, we see five-year annual earnings growth of 8%.

In addition, the company’s streak of meaningful dividend growth should continue as we see the payout rising at the rate of earnings, though this could rise at a faster pace if they decide to slow share repurchases in the future.

Final Thoughts

Given the descriptions above, the Dogs of the Dow are clearly a very diverse group of blue chip companies which each enjoy significant competitive advantages and lengthy histories of paying rising dividends.

As a result, this investing strategy is a great, low-risk way for unsophisticated investors to approach dividend growth investing.

While it may not outperform the broader market every year, it is virtually guaranteed to provide investors with a combination of attractive current yield with steadily rising income over time.