Does Pagaya's Asset-Light Strategy Help Reduce Credit Risk?

Pagaya Technologies Ltd. PGY operates a capital-efficient model that largely avoids holding loans on its balance sheet, significantly reducing its exposure to credit risk and market volatility. This is made possible through a robust network of institutional funding partners and a strategic focus on issuing asset-backed securities (ABS).

The capital raised in advance is held in trust and deployed only when a lending partner originates a loan through Pagaya’s artificial intelligence (AI)-driven network. At that point, the loan is immediately acquired by a pre-committed funding source, either through an ABS vehicle or a forward flow agreement. As a result, most loans never reside on Pagaya’s balance sheet or only do so briefly before being transferred.

This off-balance-sheet model has proven particularly effective during periods of elevated interest rates and market stress. A lean balance sheet model helps Pagaya minimize its credit exposure and avoid significant loan write-downs. Fewer loans on balance sheet means less need for big loss provisions if borrowers default. This way, the company manages to preserve its financial flexibility in turbulent environments.

PGY appears to rely heavily on forward flow agreements. These contracts provide a reliable and predictable source of capital, helping Pagaya maintain liquidity even amid tightening credit markets and rising inflation.

Since PGY’s funding strategy is highly capital-efficient, it enables the firm to scale while minimizing equity dilution and limiting balance sheet risk.

Analyzing the Business Model of PGY’s Peers

Like PGY, Upstart Holdings, Inc. UPST is an AI-based lending platform that aspires to become capital-light but often holds loans on its balance sheet temporarily. Its core business model involves finding financing for loans after its network of bank and institutional partners originates them.

Upstart partner banks can finance the loan by keeping it on their balance sheet. The bank can sell the whole loan on Upstart’s platform or use forward flow agreements from institutions that commit to buying a specific volume or type of loan originated on the Upstart platform in the future.

Upstart also uses securitization, wherein pools of loans are bundled together and sold as ABS to institutional investors. However, the firm frequently reverts to a balance-sheet-heavy model, especially in tight liquidity markets, making it more volatile and exposed to macro cycles.

Another close competitor of PGY is LendingTree TREE. But unlike PGY, LendingTree is a marketplace platform, not a lender. It matches consumers with financial product providers like mortgages, personal loans, credit cards and insurance.

LendingTree does not underwrite, originate, or hold loans. Hence, its balance sheet is not credit-heavy. TREE’s balance sheet is detached from revenue generation. The company is primarily structured to support a fee-based digital marketplace, not balance sheet lending.

PGY’s Price Performance, Valuation & Estimate Analysis

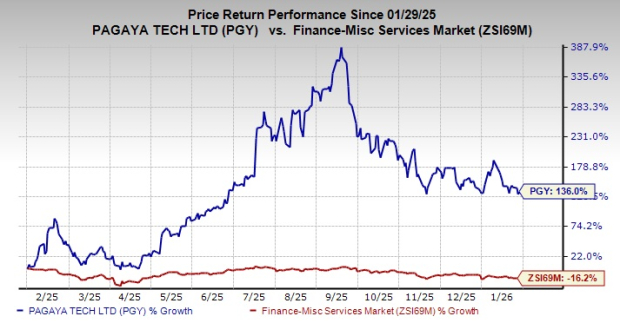

Investors are bullish on the PGY stock, which has skyrocketed 136% in the past year, outperforming the industry’s 16.2% decline.

Image Source: Zacks Investment Research

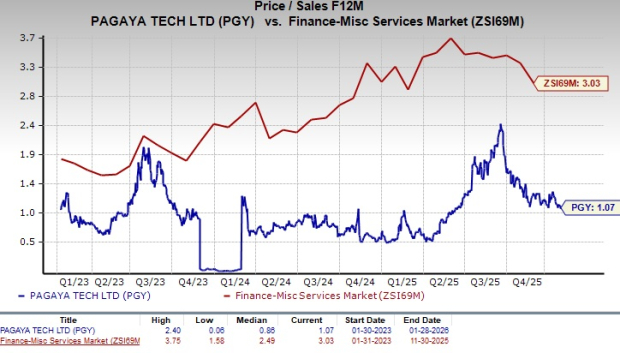

Pagaya’s stock is currently trading at a 12-month forward price-to-sales (P/S) of 1.07X, which is significantly below the industry’s 3.03X.

Image Source: Zacks Investment Research

Over the past 30 days, the Zacks Consensus Estimate for PGY’s earnings for 2025 and 2026 has been unchanged at $3.10 and $3.41, respectively. The consensus estimates indicate 273.5% and 10% year-over-year growth for 2025 and 2026, respectively.

Image Source: Zacks Investment Research

Currently, Pagaya carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

SeeWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LendingTree, Inc. (TREE): Free Stock Analysis Report

Upstart Holdings, Inc. (UPST): Free Stock Analysis Report

Pagaya Technologies Ltd. (PGY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com