Does McDonald's $4B Margin Milestone Signal Model Durability?

McDonald's Corporation MCD crossed a notable threshold in third-quarter 2025, delivering more than $4 billion in total restaurant margin dollars for the first time in its history. In isolation, the figure is impressive. More importantly, the context around it suggests the milestone reflects structural durability rather than a one-off earnings spike.

Management emphasized that the margin expansion came despite a pressured consumer backdrop, elevated food and labor inflation, and heavy reinvestment in value. Global comparable sales rose 3.6% year over year, while system-wide sales grew more than 6% in constant currency, providing the volume leverage needed to offset cost headwinds. This balance, protecting traffic while still expanding margin dollars, highlights the resilience of McDonald’s scale-driven model.

The company’s renewed focus on predictable, everyday value has been central to this outcome. Extra Value Meals and the broader McValue platform accounted for a meaningful share of transactions, helping stabilize guest counts without structurally resetting margins. While corporate marketing spends and short-term franchisee support weighed on near-term profitability, management framed these investments as temporary, designed to reinforce long-term economics rather than chase short-lived gains.

Notably, the $4 billion margin milestone was achieved alongside continued capital returns, including a dividend increase and ongoing reinvestment in digital, beverages, and high-growth menu categories. That combination underscores financial flexibility rarely seen in a challenged consumer cycle.

Taken together, McDonald’s margin achievement appears less about peak profitability and more about proof of endurance, a signal that the brand’s operating model can absorb macro pressure, defend value leadership and still generate expanding cash flow over time.

How Do Key Rivals Compare on Margin Durability?

While McDonald's has demonstrated margin durability by surpassing the $4 billion restaurant margin mark, peers are navigating profitability through different levers. Starbucks Corporation SBUX continues to post strong restaurant-level margins, supported by premium pricing, beverage mix, and a highly engaged loyalty base. However, Starbucks’ heavier exposure to labor costs and discretionary consumer spending makes its margins more sensitive when traffic softens, raising questions about resilience in a prolonged slowdown.

Meanwhile, Yum! Brands YUM benefits from a predominantly franchise-driven, asset-light model that limits direct cost exposure and supports stable operating margins. Taco Bell’s strong U.S. performance and international unit growth underpin profitability, though franchisee economics and emerging-market volatility remain key risks. Compared with SBUX and YUM, McDonald’s margin durability stands out for its balance of scale, value leadership and cash-flow consistency.

MCD’s Price Performance, Valuation and Estimates

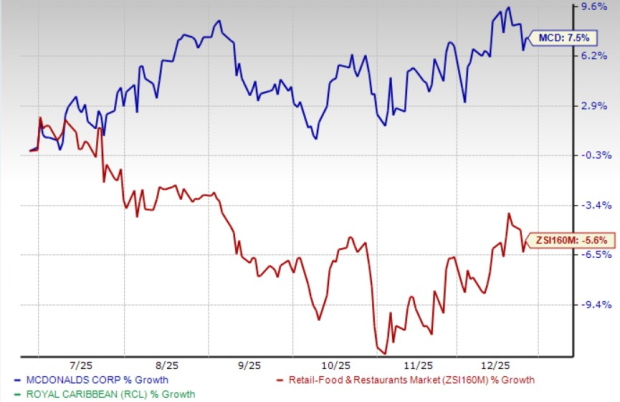

McDonald’s shares have gained 7.5% in the past six months against the industry’s 5.6% decline.

Price Performance

Image Source: Zacks Investment Research

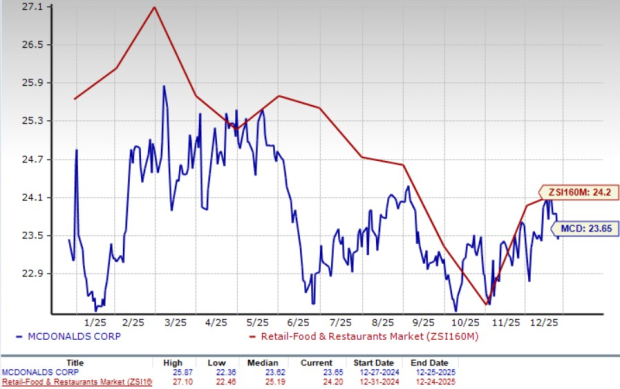

In terms of its forward 12-month price-to-earnings ratio, MCD is trading at 23.65, down from the industry’s 24.2.

P/E (F12M)

Image Source: Zacks Investment Research

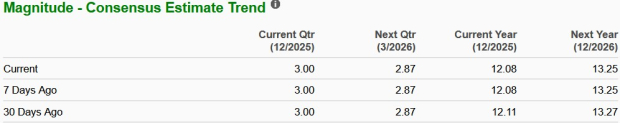

Over the past 30 days, the Zacks Consensus Estimate for MCD’s 2026 earnings per share has decreased, as shown in the chart.

Image Source: Zacks Investment Research

MCD currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Starbucks Corporation (SBUX): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com