Updated on August 20th, 2021 by Bob Ciura

Self-directed investing advocates will tell you investing in individual stocks is the best way to invest. At the same time, aassive investing advocates will tell you passive investing is the best way to invest.

Both have compelling arguments…

Sure Dividend is in a unique situation. We recommend investors buy-and-hold quality dividend growth stocks, such as the Dividend Aristocrats, a group of just 65 stocks in the S&P 500 Index with 25+ consecutive years of dividend growth.

You can download the full Dividend Aristocrats list (along with important metrics that matter like dividend yields and price-to-earnings ratios) by clicking on the link below:

Clearly, we are primarily focused on investing in individual stocks.

But while we prefer investing in individual stocks, that doesn’t mean buying individual securities is the best approach for everyone.

Many people who read Sure Dividend were long-time passive investors who switched over to investing in individual stocks.

This article compares passive investing and active investing. It will help you determine which strategy is right for you.

Table Of Contents

This article is organized into the following sections. While we recommend reading it through in its entirety, feel free to click below to jump to any sections that interest you.

- The Crux of the Tradeoff

- Index Investing’s Biggest Advantage

- Who Is Index Investing Right For?

- Advantages of Individual Stocks

- A Step-By-Step Comparison Of Individual Stocks Versus Funds

The Crux of the Tradeoff

The tradeoff between investing in individual stocks versus funds (or other passive investment products) is the tradeoff between focus and diversification.

Passive investing, by definition, gives investors cheap access to substantial diversification and market exposure. This is often called ‘cheap beta’.

Investors who choose instead to invest in individual stocks eschew diversification in favor of concentrating on their best ideas.

The choice of whether or not to implement a focused investment strategy depends on your investment skill. Investors like Warren Buffett have delivered excellent returns with concentrated investing. Case-in-point: Warren Buffett’s stock portfolio has generated market-beating returns for several decades while being heavily weighted towards his best ideas.

For other people, focused investing will result in poor returns, but this isn’t always the case.

Make no mistake – we’re not saying it’s easy to find attractive investments. But it’s not impossible either– it just takes time. Investors who analyze the most investment opportunities are likely to find a high number of attractive investment opportunities.

Using quantitative screeners and other investing tools can speed up this process considerably. They also take away many of the behavorial biases that impair investment returns.

Indeed, there is compelling evidence that simple algorithms perform better than expert investors.

Using a rule-based system that matches your investment needs and exploits well-document market inefficiencies (like the outperformance of low volatility stocks) is an excellent place for individual investors to start in building their own portfolio of individual stocks.

With that said, passive investing has one big advantage over dividend investing outside of the focus-diversification tradeoff.

Index Investing’s Biggest Advantage

If you are not interested in learning a great deal about the following topics then passive investing through index funds is right for you:

- The stock market

- Financial statement analysis

- Economics

- Consumer behavior & psychology

- Politics

This almost sounds derogatory, but it isn’t meant to. Some people are passionate about businesses and investing. Others aren’t. There is no problem with being disinterested in finance as long as you recognize that you are. In other words, don’t pretend to like investing if you don’t.

For people who meet this description, the biggest advantage to passive investing is its simplicity. It takes very little time to implement an index fund investing strategy, and virtually no research. The two main options for this are mutual funds and ETFs, which we compare in the following video:

Legendary investor Warren Buffett has chimed in on this topic, giving his recommendation for an index fund strategy that suits most people. Better yet, Buffett’s index investing retirement plan is simple:

- 90% in a low-cost S&P 500 index fund. The SPDR S&P 500 Index ETF (SPY) is a good example. It has a rock-bottom 0.09% expense ratio, meaning that for every $100,000 you invest, you’ll pay just $90 in fees.

- 10% in a short-term government bond index fund. The iShares 1-3 Year Treasury Bond ETF (SHY) is a good example. It has a similarly low expense ratio of 0.15%, meaning that investors will pay $150 in fees for every $100,000 invested.

While Buffett doesn’t explicitly state so in his recommendation, I assume the portfolio would be rebalanced occasionally (likely annually, and at most quarterly). An investor could also do ‘contribution rebalancing,’ where new funds are deployed into whichever asset class is below its target portfolio weighting.

Buffett’s recommended portfolio is amazingly cheap. On a weighted basis, it has an annual expense ratio of just 0.10%, implying that a $100,000 portfolio would generate just $100 in fees.

This is much cheaper than mutual funds, which have surprisingly high fees.

This is just one example of a passive, index fund investment strategy. You can put a tremendous amount of time and research into picking the ‘perfect’ passive investing strategy. But you don’t need to.

That’s the biggest advantage of index investing. It is by far the most time efficient investment strategy.

Who Is Index Investing Right For?

If you are looking for ‘average’ returns and a minimum amount of work, index investing is perfect.

I put ‘average’ in quotes because average is not really average. Many investors who buy individual securities significantly underperform the market.

Investing in an all-world fund like Vanguard’s Total World Stock ETF (VT) – which has an expense ratio of just 0.08% per year – may not sound exciting, but it will likely cause you to have much higher returns than your friends (despite what they may tell you about their latest great investment).

Indeed, the returns generated by a broad fund like VT will likely be sufficient – given an appropriate savings rate – to generate a nest egg worthy of retirement.

Another factor to consider when choosing your investing strategy is psychology. You don’t just need to be analytical to make sound investment decisions.

It takes a tremendous amount of patient and determination to invest in individual stocks. People thinking they are going to make a ‘quick buck’ by using their ‘superior intellects’ to crush the market are going to do anything but.

“Success in investing doesn’t correlate with I.Q. once you’re above the level of 125. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.” – Warren Buffett

If you think you are going to pull out 30%, 50%, or 100% per year returns from the market by selecting ‘the best’ stocks, stop now and save yourself a lot of money. Become an index investor. Your investment account will thank me later.

Note: There are people, especially on the Internet, who will sell you anything and play to the false belief that you can double your money quickly with unproven or even fraudulent investment schemes. Avoid these false advertisements and remember that things that seem too good to be true usually are.

To conclude this section, index investing through funds is right for the majority of the investing public. Here’s who should be a passive index investor:

- Those unwilling to learn about businesses in detail.

- Those looking to spend a minimum amount of time on their investments.

- Those looking for a low-cost, low-time, ‘average’ return strategy.

- Those who think they are ‘God’s gift to invest’ and will consistently return 20%+ per year.

If these descriptions don’t suit you, keep reading this article to learn about the benefits of owning individual stocks.

Advantages of Individual Stocks

I invest in individual stocks. This isn’t because I fell on my head one day and decided to ignore funds and other passive strategies…

Instead, this was a deliberate decision.

There is compelling evidence as to why owning individual securities (and particularly owning dividend growth stocks) works.

The first reason is that investors have endless customization possibilities. While passive investors are limited by the number of ETFs and other investment products that are available to them, dividend growth investors can build their ideal portfolio from scratch.

This allows you to select only investments that have a high likelihood of beating the market. Fortunately, these investments aren’t necessarily that hard to find.

Dividend stocks, in particular high-quality dividend growth stocks, have a history of excellent performance. There is no better example of this than the Dividend Aristocrats.

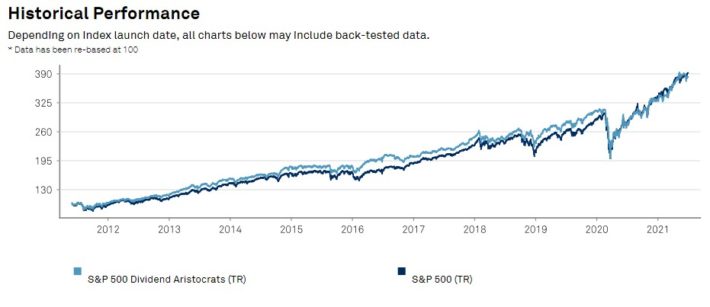

The performance of the Dividend Aristocrats compared with the S&P 500 index over the past ten years is shown below.

Source: S&P

Over the past decade, the Dividend Aristocrats have delivered comparable annualized returns to the broader S&P 500 (15.2% vs 15.4%). And, the Dividend Aristocrats had much lower volatility than the broader index, resulting in better risk-adjusted returns.

You could invest in the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), but there are two main disadvantages: the fund has an expense ratio of 0.35%, and it does not offer any customization – which means buyers of the ETFs will be forced to buy into overvalued stocks. While the Dividend Aristocrats are all great businesses their stocks may not make great investments if they are trading at sky-high valuation multiples.

Indeed, the amount of control that is available to investors who buy individual stocks is hard to overstate.

If you are retired, as an example, you might require high dividend stocks with yields over 5%. You might also prefer low volatility, low price-to-earnings ratios, or stocks with long dividend histories (like the Dividend Kings). A portfolio with these characteristics can only be created by investing in individual stocks.

To sum up, buying individual companies allows investors to tailor their investment accounts to their exact needs and preferences, which is the major advantage over investing in passive investment products.

A Step-By-Step Comparison

This section compares investing in funds to investing in individual stocks on an item-by-item basis. The following items are compared (click to jump directly to them):

Time (Winner: Index Investing)

Index investing is the clear winner when it comes to the amount of time it takes to invest.

Passive investors do not need to spend time keeping up with individual stocks. Conversely, self-directed investors should periodically check in with the businesses in which they’ve invested (we recommend quarterly when earnings releases are presented) to make sure that financial performance is in line with their expectations and the company still has a strong and durable competitive advantage.

Cost (Winner: Individual Stocks)

Cost is not as clear-cut as time when comparing individual stocks versus index funds.

For long-term, buy and hold investors, investing in individual securities is far cheaper than investing in funds (particularly if you have a large investment portfolio). This is due to the lack of expense ratios associated with owning individual stocks.

Investors should also consider the tax implications, as taxes will be a far larger drag on investor returns than commissions or management fees. Buy and hold investors do not pay capital gains tax until they sell, which allows investors to further invest their deferred capital gains to make more money (a strategy known as the Buffett Loan).

Dividends are also taxed, but many funds pay dividends as well. Holding your dividend stocks in a Roth IRA eliminates this disadvantage.

Crunching the numbers can help us determine which investing strategy is actually cheaper. Here is some math behind investing in index funds versus dividend stocks:

- $100,000 in the low-cost Buffett fund (discussed earlier in this article) costs $96 per year

- $100,000 invested in 30 dividend stocks at $7 per transaction costs $210 one time

- After 3 years, the buy and hold self-directed investor will have paid less fees

- A buy and hold investor will pay far less in fees over their investing life.

Clearly, the investor who buys individual stocks pays less in fees as long as they don’t transact very often. That’s why it’s so important to keep portfolio turnover to a minimum.

I give the cost advantage to individual stocks but just by a hair because it depends on how you invest.

Returns (Winner: Individual Stocks)

I’ve cited return data for individual stocks (usually subject to certain constraints) in other places in this article. Investing in individual stocks with:

- Lower than market average price-to-earnings ratios

- Higher than average market dividend yields

- Strong competitive advantages (usually evidenced by long dividend histories)

Will likely result in solid long-term returns.

When I say solid, I mean there’s a good chance total returns will be a few percentage points above the overall market. Investors should not expect 30% annualized returns or anything of that nature.

You might be thinking that passive investors can invest in funds that seek to take advantage of the same market anomalies. You’re right! Unfortunately, the more these funds try to take advantage of specific factors that have historically resulted in greater long-term returns, the more they tend to charge as fees. Reducing fees is likely the single most actionable step you can take to improve your long-term investing outcomes, which means these funds might actually be working against you because of their cost structures.

Again, self-directed investing gets the edge in this category if done well.

Psychology & Risk (Winner: Individual Stocks)

As we’ve seen throughout this article, the decision of whether to invest in funds or individual stocks is partially dependent on the personality of the person doing the investing.

When recessions hit, it’s comforting for many investors to own steady blue-chips like Walmart (WMT) and McDonald’s (MCD). Demand will stay relatively stable for these businesses, no matter what happens to the overall economy.

The psychology of knowing what you own leads to better portfolio management decisions. One of the key mistakes that many investors make is selling a great business when it’s undervalued just because its stock price has dropped. Investors that are familiar with a business and understand that they own a fractional ownership of that business, will find it much easier to hold during recessions.

Dividend investors also typically watch dividend payments instead of the share price (to be fair, they watch both, but pay more attention to dividend payments than other types of investors). Dividend payments are less volatile than share prices.

Share prices among many stocks dropped in the Great Recession of 2007-2009, and again in 2020 during the coronavirus pandemic. But the vast majority of Dividend Aristocrats continued to increase their dividends. If investors looked at the dividend instead of the share price, they would have had much greater peace of mind during these bear markets.

It’s important to remember that declining share prices don’t matter unless you actually sell. When you hold great businesses with strong competitive advantages that are paying rising dividends, it doesn’t make any sense to sell your share of the business when you get a lower offer (when the market falls). Sell rarely, and only if shares become significantly overvalued.

On the other hand, passive investing also has its perks from a psychological perspective. A highly diversified portfolio can be easier for investors to hold, depending on your mentality.

If your thinking is along the lines of ‘the world is not ending, and I own a broad swath of the economy,’ you are not likely to sell. Additionally, index investors will likely be invested in other asset classes: government bonds, gold funds, REITs, or something else. Other asset classes sometimes have low correlation with stocks and could very well be up while the stock market is down.

The permanent portfolio is a good example of this.

Your propensity to sell also depends on your perspective on risk. If you view volatility (i.e. standard deviation) as risk, there is no question that a well-diversified index portfolio will have a lower standard deviation than a dividend stock portfolio, especially if the index portfolio contains multiple asset classes.

The question of what is less risky between these two contrasting styles depends on how you think about risk. Overall, self-directed investing gets the edge here because of the peace of mind that comes from knowing precisely which stocks are in your investment portfolio.

Final Thoughts

Self-directed investing and passive investing through funds are not as different as you might think. Both are valid investing strategies and appeal to different investors for different reasons.

Having an investment plan and sticking with that plan is far more important than agonizing over dividend investing or index investing.

Both strategies can work well. Some people will be more suited to index investing, while others will be more suited to dividend investing.

What you value will determine which is the better choice for you. Investors preferring to minimize time analyzing financial info and volatility risk reduction will do best with index investing.

For all other investors (especially those looking to spend more time learning about businesses and wanting greater customization in their portfolio), we recommend investing in individual stocks (especially dividend stocks).