Published on December 9th, 2021 by Bob Ciura

Target Corporation (TGT) recently increased its dividend by 32%, representing the company’s 50th consecutive annual raise.

As a result, Target has joined the exclusive list of Dividend Kings.

The Dividend Kings have raised their dividend payouts for at least 50 consecutive years.

You can see all 35 Dividend Kings here.

You can download the full list of Dividend Kings, plus important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

In order to raise dividends for 50 years in a row, a company must have durable competitive advantages, and long-term growth potential.

It must also possess a recession-resistant business, and a management team that is committed to increasing the dividend each year.

Target possesses all of these qualities.

This article will discuss Target’s business model, growth catalysts, and expected returns.

Business Overview

Target was founded in 1902. Today, its business consists of about 1,850 big-box stores. These stores offer general merchandise and food, and also serve as distribution points for its e–commerce business. Target should produce about $106 billion in total revenue this year.

Target reported third quarter earnings on November 17th, 2021, and results were ahead of expectations on both revenue and adjusted profits.

Total revenue was $25.65 billion, up 13% year-over-year. Revenue beat expectations by more than $1 billion, representing a very strong performance.

Store comparable sales were up 9.7% year–over–year, while digital comparable sales were up 29%, extending the company’s streak of very strong digital comparable sales.

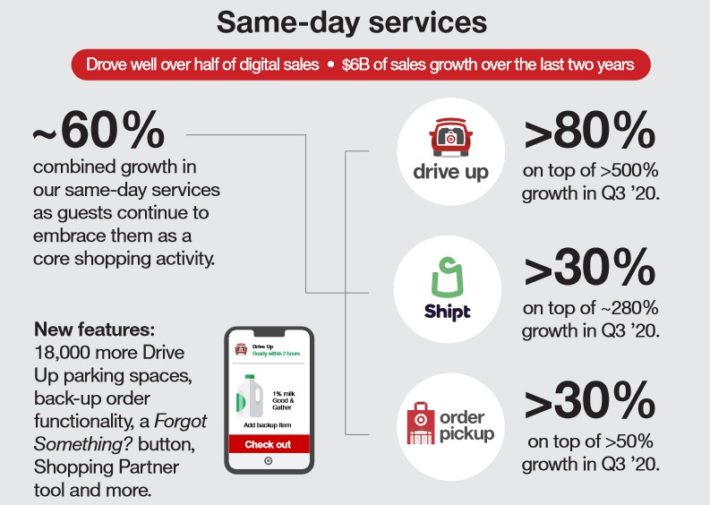

Target saw particularly impressive results from same-day services.

Source: Investor Presentation

The company expects high–single digit to low–double digit growth in comparable sales, which is up from the prior guidance of high–single digit growth.

Target is experiencing some margin pressure as various costs rise. Gross margins came to 28.0% in Q3, which was down from 30.6% in the year–ago period.

The gross margin rate reflected pressure from higher merchandise and freight costs, higher inventory shrink costs, and increased supply chain costs.

Still, Target grew its adjusted earnings-per-share by 8.7% for the quarter.

Growth Prospects

Target’s growth has accelerated in the past few years. Its growth was only slightly impacted by the coronavirus pandemic of 2020, showing the strength of Target’s stores and e-commerce businesses.

For example, Target’s third-quarter GAAP and adjusted EPS have both more than doubled since the third quarter of 2019.

Target has invested heavily in growing new sales channels, which have greatly paid off.

First, Target has invested heavily in e-commerce. The rise in e-commerce initially caught many retail companies flat-footed. Target has really revamped its online offerings and has seen incredible growth rates.

Target’s digital efforts are also working extremely nicely, as we saw again in Q3 results, and the company’s small–format stores are performing very well, opening a new avenue of growth for the company in the coming years.

Share repurchases will be an additional catalyst for earnings-per-share growth. In the 2021 third quarter, the company repurchased $2.2 billion of its shares, retiring 8.8 million shares of common stock.

Target still has $14.6 billion remaining on its share repurchase authorization approved in August 2021. This represents approximately 12.5% of the company’s current market cap, meaning share buybacks will provide a meaningful boost to EPS growth.

Overall, we expect Target to grow earnings-per-share by 4% per year over the next five years.

Competitive Advantages & Recession Performance

Target operates in a difficult industry. Retail is highly competitive. For consumers, retail brands often take a back seat to price and convenience.

This is why Target has invested so heavily in store redevelopment. That has enabled the company to retain its brand strength, even in a fiercely competitive industry.

Most importantly, it has massive distribution and scale capabilities, which allow it to keep prices low.

In addition, Target operates in a defensive niche of the retail business. Discount retail tends to hold up relatively well during economic downturns, when consumers will typically shift from higher-priced retailers.

Target’s earnings-per-share during the Great Recession are as follows:

- 2007 earnings-per-share of $3.33

- 2008 earnings-per-share of $2.86 (14% decline)

- 2009 earnings-per-share of $3.30 (15% increase)

- 2010 earnings-per-share of $3.88 (17% increase)

- 2011 earnings-per-share of $4.28 (10% increase)

Target was remarkably resilient during the Great Recession. It suffered a 14% decline in 2008, but followed this with three consecutive years of double-digit earnings growth.

Target once again performed very well in 2020, a year in which the U.S. economy entered a recession due to the pandemic.

And yet, Target continues to increase its dividend reliably each year, including a 3% hike in 2020 and a massive 32% dividend increase in 2021.

Valuation & Expected Returns

Target shares have had a great run lately. The stock price is up 35% year-to-date, and 37% in the past 12 months. The downside of the stock’s impressive performance, is that it is no longer meaningfully undervalued for new buyers.

We expect Target to generate earnings-per-share of $13.25 this year. As a result, the stock is currently trading at a price-to-earnings ratio of 18. This is exactly in-line with our fair value estimate for the stock.

As a result, valuation is not expected to be a meaningful driver of shareholder returns at this P/E multiple. Therefore, shareholder returns will be derived from future earnings-per-share growth and dividends.

Target shares currently yield 1.5%. And, we expect 4% annual EPS growth over the next five years.

Putting it all together, Target stock is expected to generate annual returns of 5.5% over the next five years.

Final Thoughts

After raising its dividend by 32% in June, Target eclipsed 50 years of annual dividend increases. As a result, Target has joined the exclusive Dividend Kings list.

It has maintained 50 consecutive years of dividend increases due to its leading position in the retail industry. It has also adapted the difficult climate for brick-and-mortar retailers extremely well, thanks to new store formats and huge investment in e-commerce.

The company should benefit from these growth catalysts. This should allow Target to continue raising its dividend for many years to come.

With an elevated valuation compared with its historical averages, Target stock does not appear to be a buy right now. We expect mid-single-digit annual returns for Target stock over the next five years, making the stock a hold.