Published on September 30th, 2020 by Nate Parsh

Investors looking for the best-in-class dividend growth stocks should consider the Dividend Kings. These are stocks that have raised their dividends for at least 50 consecutive years. It is no easy task raising a dividend for over five decades, which explains why there are just 30 Dividend Kings. You can see all 30 Dividend Kings here.

In addition, we created a downloadable list of all 30 Dividend Kings, along with important financial metrics like dividend yields, price-to-earnings ratios, and more. You can download your copy of the Dividend Kings list by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Coca-Cola (KO) is a time-tested Dividend King. It has raised its dividend for 58 consecutive years. This is an extremely impressive history of consistent dividend increases, even in difficult operating environments. Coca-Cola benefits from global competitive advantages and a recession-resistant business model.

Investors can expect the company to continue increasing its dividend for many years. This article will discuss Coca-Cola’s recent earnings, future growth potential, and expected returns.

Business Overview

Coca-Cola was founded in 1892. Today, it is the world’s largest non-alcoholic beverage company. It owns or licenses more than 500 non-alcoholic beverages, including both sparkling and still beverages.

It now sells products in more than 200 countries around the world, and has 20 brands that each generate $1 billion or more annual sales.

The sparkling beverage portfolio includes the flagship Coca-Cola brand, as well as other soda brands like Diet Coke, Sprite, Fanta, and more. The still beverage portfolio includes water, juices, and ready-to-drink teas, such as Dasani, Minute Maid, Vitamin Water, and Honest Tea.

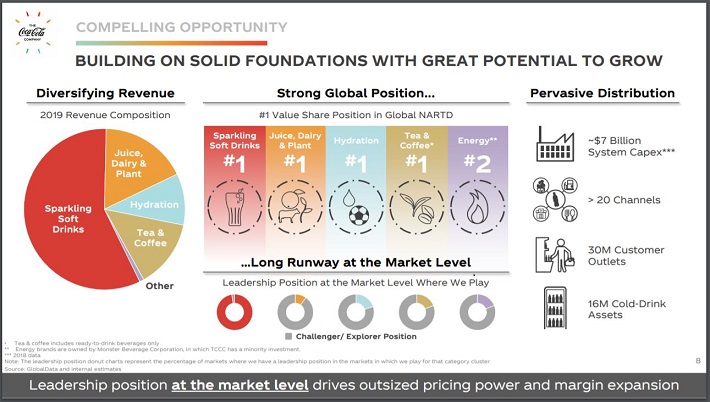

Source: Investor Presentation

Coca-Cola dominates sparkling soft drinks, where it commands over 50% market share. The company is attempting to maintain and even improve this dominant position with product extensions of existing popular brands, including reduced and zero-sugar versions of brands like Sprite and Fanta.

This is a challenging time for Coca-Cola. Sales of soda are slowing down in developed markets like the U.S., where soda consumption has steadily declined for years. For example, a recent report states that soft drink consumption in the United States declined in 2018 for the 13th consecutive year. Further, since peaking at 53 gallons in 2000, soda consumption has declined by 25%.

Declining soda consumption is a significant challenge for the company. While Coca-Cola’s total volumes certainly still rely upon sparkling beverages such as soda, the company has gone to great lengths in recent years to diversify away from its core products, understanding that the long-term growth prospect for sparkling beverages isn’t particularly inspiring. Coca-Cola has acquired multiple still beverage brands in recent years.

In addition, the coronavirus pandemic weighed on recent results. Coca-Cola reported Q4 earnings on 7/21/20, and results were reflected the struggles the company had in face of the ongoing pandemic.

Revenue decreased by 28% year-over-year with weakness across all business segments. Organic revenue was down 26%, mostly due to a 22% decline in concentrate sales. Social distancing restrictions severely impacted the away-from-home channels that Coca-Cola dominates. Operating margins held up quite well as the decline was just 30 basis points to 30%.

Prior to the pandemic, key strategic initiatives continued to advance in management’s pursuit of innovation, revenue growth management, and digitization, driving strong organic growth.

On 2/20/20, Coca-Cola authorized its 58th consecutive dividend increase, raising the payout from $1.56 to $1.60 per year. We expect a 59th consecutive annual dividend hike early next year as well.

Growth Prospects

In an effort to return to growth, Coca-Cola has invested heavily outside of soda, in areas like juices, teas, dairy, and water, to appeal to changing consumer preferences. Despite headwinds from COVID-19, we continue to see Coca-Cola as having a favorable long-term growth outlook.

One reason we like the stock is because it competes in an industry that continues to grow globally in excess of the rate of broad economic growth. This leads to strong levels of overall growth in the industry, which Coca-Cola has certainly been capitalizing on in recent years.

In addition, the ready-to-drink category is sold through highly-diversified channels and continues to have mid-single digit projected growth rates, both for Coca-Cola and the industry. This is particularly true for still beverages like milk, tea and water. Coca-Cola’s years-old strategy to diversify away from sparkling beverages is due to this and it is undoubtedly bearing fruit.

Coca-Cola also continues to acquire brands in order to grow, including its unexpected acquisition of Costa, a coffee brand based in the UK. This is certainly an out-of-the-box buy for a sparkling beverage behemoth, but Coca-Cola is doing what it takes to secure its future.

We continue to like the nearly-complete plan to divest the company’s bottling operations. The major portions of the plan are complete as the company announced it was selling its India bottling assets in early February.

This has resulted in some pretty significant revenue declines over the years, but the end goal is higher margins. That has already begun occurring and with completion of the transformation in 2020, revenue growth will return. Not only will revenue move higher, but margins will continue to do so as well.

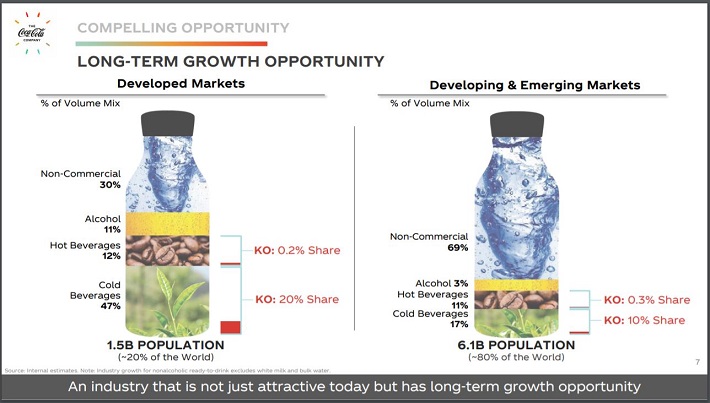

Finally, while Coca-Cola is the largest beverage company in the world, there continues to be ample room for additional growth.

Source: Investor Presentation

The market potential for Coca-Cola’s portfolio of beverages is massive, especially in the developing and emerging markets. This should provide the company with a long runway for growth in the coming years.

Taking all of this into account, in addition to the company’s ample buyback program and productivity improvement efforts, we see total earnings-per-share growth of 7.5% annually in the coming years.

The company’s dividend is now up to $1.64, a 2.5% increase from the previous year. The current yield is 3.3%, which is at the high end of its normal bound over the past decade. On this measure, when taken in combination with its long dividend growth streak, Coca-Cola seems fairly attractive to income investors.

Competitive Advantages & Recession Performance

Coca-Cola enjoys two distinct competitive advantages, which are its strong brand and global scale. According to Forbes, Coca-Cola is the sixth-most valuable brand in the world. The Coca-Cola brand is worth $64.4 billion.

In addition, Coca-Cola has an unparalleled distribution network. It has the largest beverage distribution system in the world. Of the roughly 60 billion beverages consumed around the world every day, about 2 billion come from Coca-Cola.

These advantages allow Coca-Cola to remain highly profitable, even during recessions. The company held up very well during the Great Recession:

- 2007 earnings-per-share of $1.29

- 2008 earnings-per-share of $1.51 (17% increase)

- 2009 earnings-per-share of $1.47 (3% decline)

- 2010 earnings-per-share of $1.75 (19% increase)

Not only did Coca-Cola survive the Great Recession, it thrived. Coca-Cola grew earnings-per-share by 36% from 2007-2010. This shows the durability and strength of Coca-Cola’s business model. The company’s dividend also appears very safe.

Valuation & Expected Returns

Adjusted earnings-per-share for Coca-Cola are expected to be down 15% this year, mostly due to the previously mentioned COVID-19 pandemic. At our current estimate of $1.80 for this year, Coca-Cola trades for a price-to-earnings ratio of 27.4.

This is a premium of approximately 30% from our fair value estimate of 21 times earnings, which takes into account the stock’s historical valuations as well as future growth estimates. Should the stock revert to our fair value estimate of 21 times earnings over the next five years, it would introduce a 4.5% headwind to total annual returns.

Putting all of this together, we expect total annualized returns of ~6%, consisting of the 3.3% dividend yield, 7.5% earnings growth and a 4.5% headwind from the valuation. Because the stock appears to be significantly overvalued, the corresponding contraction of the valuation multiple is expected to meaningfully reduce total returns over the next five years.

Final Thoughts

Coca-Cola has a long and established track record of delivering steady dividends along with annual dividend increases, even during recessions and other challenging periods. We fully expect the company to make it through the coronavirus pandemic and emerge stronger than ever. The company has multiple growth catalysts and a dominant global position in the beverages industry.

The stock appears to be overvalued, which means right now is not the best time to buy shares. But Coca-Cola should easily continue to pay its dividend, currently offering a solid yield above 3%. As a result, while the stock is not a buy based on valuation, it is still an attractive option for income-focused investors.