Updated on October 29th, 2020 by Nate Parsh

Companies that have at least 50 years of dividend growth are considered Dividend Kings. Dividend growth investors won’t be surprised to find large cap names like Johnson & Johnson (JNJ) and 3M (MMM) among the Dividend Kings. These large cap names are some of the most widely owned and followed stocks among income investors. You can see the full list of all 30 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

You might be surprised to find that there are some small cap names that have also raised their dividend for at least the past 50+ years. One such company is SJW Group (SJW), a water utility. The 2020 Dividend Kings In Focus series concludes with SJW.

This article will examine SJW’s business, growth prospects and valuation in order to determine if shares are worth purchasing now.

Business Overview

SJW was founded in 1866 and was initially known as the San Jose Water Company. With a market cap a $1.8 billion, SJW is one of the smallest Dividend Kings. SJW is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses.

Source: Investor Presentation

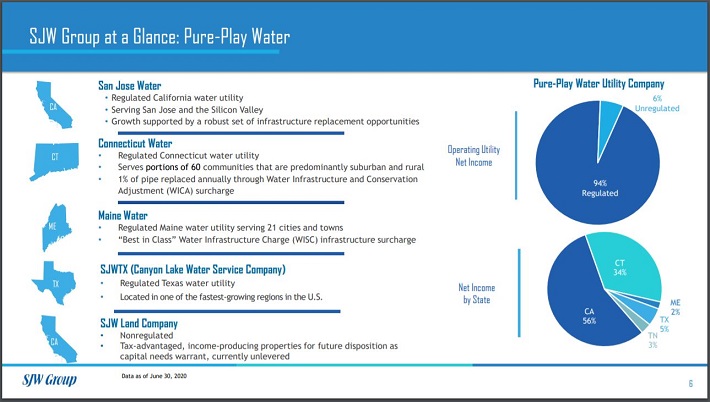

Following the completed merger with Connecticut Water Service (CTWS), SJW currently consists of five subsidiaries:

- San Jose Water

- Connecticut Water

- Maine Water

- SJWTX

- SJW Land Company

San Jose Water Company, a regulated utility, has almost 230,000 connections and provides water to nearly one million people in the well-educated and affluent customer base Silicon Valley area. The purchase of CTWS added 138,000 connections and 450,000 customers between Connecticut and Maine.

SJWTX is a regulated water utility company that supplies water to more than 49,000 people in the area between San Antonio and Austin, Texas. The water utilities supply almost all revenues for SJW, but there is a real estate portion of the company as well. SJW Land owns and develops properties for both residential and warehouse customers in California and Tennessee. SJW uses the rental income for these properties to reinvest in its water utility business.

Growth Prospects

SJW reported first quarter earnings results on 8/6/2020. The company’s earnings-per-share of $0.69 was a 47% increase from the previous year, but $0.02 lower than analysts’ estimates. Revenue surged 43% to $147.2 million, topping estimates by $14.3 million.

While the addition of CTWS was a primary contributor to top and bottom-line growth, SJW’s pro forma sales were up almost 11%. This means that SJW is producing better results all on its own as its footholds in California and Texas continue to see population increases, which means demand for water services have also grown.

Still, the addition of CTWS will help diversify the company’s revenue stream.

Source: Investor Presentation

Prior to the merger, California contributed 92% of SJW’s income. In the most recent quarter, however, this figure was down to 56%. Connecticut is the second-largest source of income at 34% with the remaining states of Texas, Tennessee and Maine making up the rest.

SJW still relies on just two states for the vast majority of its income, but is slightly less top heavy as it was pre-merger. The combination of SJW and CTWS has made the combined company the third-largest water utility company in terms of both enterprise value and rate base. The combined entity has 387,000 service connections and provides services to 1.5 million people.

SJW compounded earnings-per-share at a rate of 8.5% over the last decade. CTWS was no slouch either when it came to earnings growth, as the company’s compounded earnings-per-share by a rate of 6.7% in the decade leading up to the merger. We expect that the combined company will be able to generate earnings growth of 7.6% annually through 2025.

Competitive Advantages & Recession Performance

As a regulated utility, SJW is limited in how much it can raise rates for customers. Fortunately for the company, they operate in areas, i.e. Silicon Valley and Central Texas, that have seen high population growth rates. As these populations grow, they need reliable access to water. To encourage SJW to spend on improving the water infrastructure in these areas, local governments allow the company to raise rates at fairly high levels.

For example, San Jose Water was granted a rate increase of 4.2% for 2018. The company also received approval for rate increase of 9.8%, 3.7% and 5.2% for 2019, 2020 and 2021, respectively. Large rate increases should flow right to the company’s bottom line.

Another advantage for SJW was tax reform legislation that went into effect in 2018. Tax reform actually lowered SJW’s tax rate to 37% from 39% for 2017. The impact from tax reform will be even more profound going forward as SJW’s effective rate decreased to 23% in 2019 and is expected to fall to 18% in 2020.

Between a lower tax rate and the additional income from the merger with CTWS, SJW has an opportunity to offer robust dividend growth going forward. SJW has paid an uninterrupted dividend for the past 76 years. The company has increased its dividend for the past 53 years. The average raise in the decade before the merger was 5.4%.

The last two years have seen slightly higher raises as the company rewarded shareholders with a 7.1% increase in 2019 and a 6.7% raise in 2020. Shares of SJW yield 2% at the moment.

While future growth looks attractive due to the company’s merger with CTWS, it is also important to examine how a company performed during tough economic times. SJW’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share: $1.04 (12.6% decline)

- 2008 earnings-per-share: $1.08 (4% increase)

- 2009 earnings-per-share: $0.81 (25% decline)

- 2010 earnings-per-share: $0.84 (4% increase)

SJW was not immune to the last recession as earnings-per-share declined 22% from 2007 through 2009. While earnings growth did return the next year, it took the company until 2014 to top its pre-recession high.

Water remains a crucial resource for consumers even during a recession, but SJW’s performance during and after the last financial crisis that growth can be elusive. That said, the company’s more diversified business model today makes it likely that the next recession won’t be as severe for SJW.

Valuation & Expected Returns

SJW reaffirmed its guidance for 2020 on the last conference call and expects earnings-per-share of $1.95 to $2.05 for 2020. Using the current share price of $64.54 and the midpoint of expected EPS for the year, the stock has a price-earnings ratio of 31.8.

This compares unfavorably to our target price-to-earnings ratio of 22, which is a premium to the stock’s pre-merger 10-year average multiple. Reverting to our target valuation by 2025 would reduce annual results by 7.1% over this period of time.

Going forward, investors can expect total returns to be the following:

- 7.6% earnings per share growth

- 7.1% multiple reversion

- 2% dividend yield

In total, we expect shares of SJW to offer an annual return of just 2.5% over the next five years.

Final Thoughts

SJW’s merger with CTWS has helped to diversify the company’s business model, making the combined entity less reliant on just California for income. SJW is still top heavy, with just two states contributing 90% of income, but this is an improvement over each individual company prior to the merger.

SJW also has a very long history of dividend growth and is one of just 30 companies with at least five decades of dividend growth. This is an impressive accomplishment.

Despite this track record of dividend growth, SJW’s projected returns earn the stock a sell rating from Sure Dividend as the valuation is too rich in our view. Shares would once again be a buy, if the valuation falls below our fair value estimate.