Updated on September 24th, 2020 by Josh Arnold

Lancaster Colony (LANC) has a dividend track record that few companies can rival. The company has increased its cash dividend for 57 consecutive years, making it one of just 13 companies in the U.S. with such a streak. This puts the company among the elite Dividend Kings, a small group of stocks that have increased their payouts for at least 50 consecutive years. You can see the full list of all 30 Dividend Kings here.

We have created a full list of all Dividend Kings, along with important financial metrics such as price-to-earnings ratios and dividend yields. You can download your copy of the Dividend Kings sheet by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Dividend Kings are the “best of the best” when it comes to rewarding shareholders with cash and higher dividend payouts each year. This article will discuss Lancaster’s dividend and valuation outlook.

Business Overview

LANC began its operations back in 1961 after several small glass and related houseware manufacturing companies combined. The new company almost immediately began rewarding its shareholders with quarterly cash dividends and eventually went public in 1969, the same year it began operations in the foodservice business with the Marzetti brand acquisition.

The company manufactures and distributes a fairly narrow product assortment split into two major categories: frozen and non-frozen. It makes salad dressings and various dips under the Marzetti brand, frozen breads under the Sister Schubert’s and New York brands, as well as caviar, noodles, croutons, flatbreads and other bread products under a variety of smaller brands.

The Marzetti and New York brands are cash cows for Lancaster, offering its core products of dips and dressings as well as croutons and frozen breads, respectively. Lancaster sells what amounts to accessories for meals and does it very well.

Source: Investor presentation, page 4

However, Lancaster also has partnerships with major consumer brands like Olive Garden, Jack Daniel’s, Buffalo Wild Wings and Weight Watchers (WW), licensing the respective trademarks to produce products for grocery store shelves. A portion of the proceeds of these products goes to the license owners but these agreements are a way for Lancaster to diversify away from its own core brands.

Lancaster’s market cap is just under $5 billion after years of strong price appreciation, and the company is expected to produce about $1.4 billion in revenue this fiscal year. Over 95% of Lancaster’s sales are made in the US, so currency risk is not a factor. It sells its products through the Retail and Foodservice divisions, offering its frozen and non-frozen products through those channels.

Two-thirds of Lancaster’s total sales are non-frozen products like dressings, dips, flat breads and croutons. The remaining third is frozen products like garlic bread and yeast rolls. Lancaster has leadership positions in its core brands including New York, Sister Schubert’s, Flat Out (flat breads) and Marzetti, while it is more focused on growth with its smaller brands and acquisitions.

Growth Prospects

Lancaster’s recent quarterly report showed results that beat expectations on both the top and bottom lines. Total sales were off fractionally year-over-year to $321 million, as a surge in Retail sales of 25% offset a 24% decline in Foodservice revenue. Restaurant closures have been and remain a significant headwind for Lancaster, but its Retail business is picking up much of that lost demand.

Gross margins expanded as a favorable sales mix in retail and a shift away from the lower-margin restaurant business drove better price realization. Net income per share was off a dime from the year-ago period on a reported basis, but adjusted, would have risen from $1.06 to $1.11 per share.

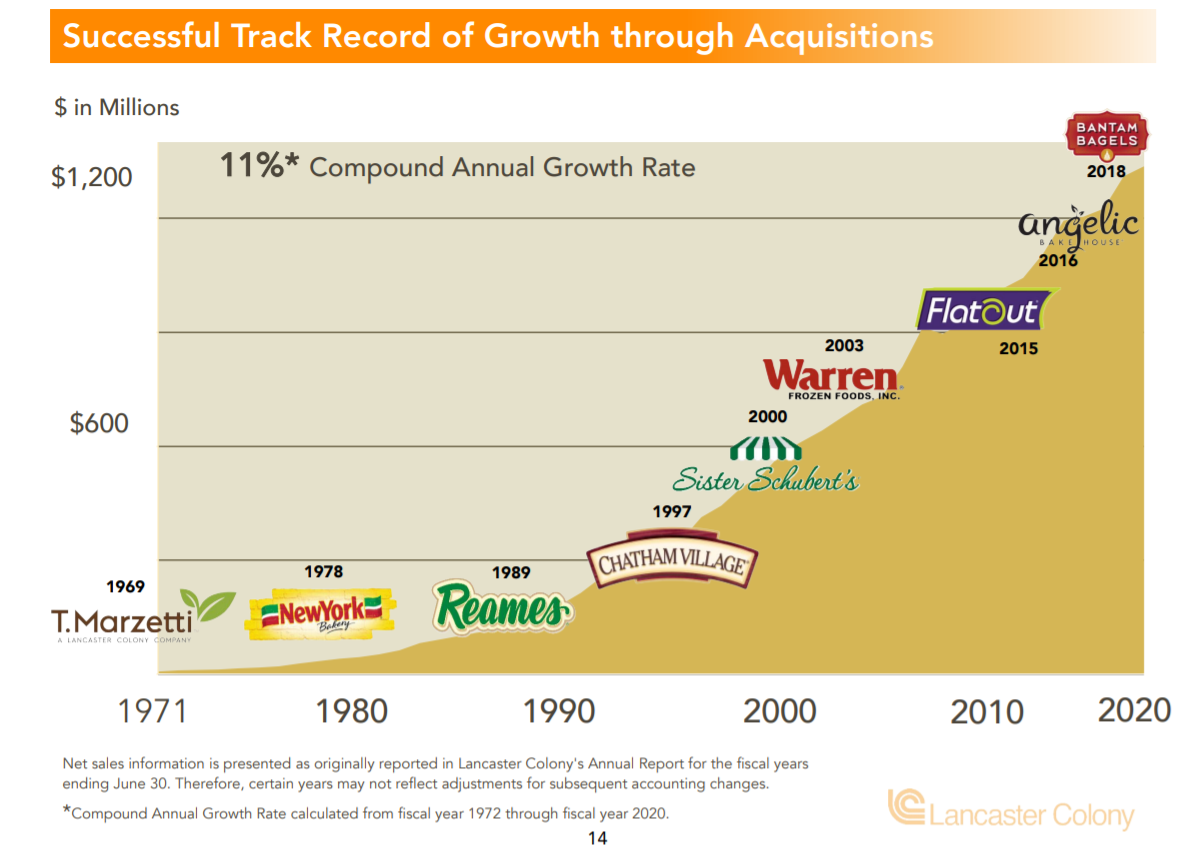

Source: Investor presentation, page 14

Lancaster’s earnings growth has been spotty because it is so beholden to volatile restaurant sales. It has therefore made many acquisitions in the past in order to not only grow the portfolio, but attempt to make its revenue more predictable.

We see 4% average earnings growth annually for the next five years as we see nearly all of that driven by revenue increases. As restaurant traffic returns, we see the Retail business as losing demand, reversing what it has gained in the first half of 2020. We also note that Lancaster will almost certainly not grow linearly, so some years will show declines while others show sizable increases.

Over time, Lancaster has proven it can grow through a variety of environments, including a pandemic, and we don’t see that as changing anytime soon.

Competitive Advantages & Recession Performance

Lancaster’s competitive advantages are mainly in its distributor partnerships with major sellers like Walmart (WMT) and McLane Distributors, as well as its leadership positions in certain categories like croutons, frozen bread products and dressings.

Lancaster has built a niche in these categories over the years and while its heavy reliance upon two distributors for one-third of its revenue is a potential risk, it also means the company’s competitors don’t necessarily have the same access to those large customers. Indeed, we see Lancaster’s exposure to Walmart as a net positive during the pandemic as Walmart experiences surging grocery sales.

Lancaster is in a strong position within its core categories, but that doesn’t make it immune from recessions. Earnings-per-share during and after the Great Recession are below:

- 2007 earnings-per-share of $1.45 (decrease of 42% from 2006)

- 2008 earnings-per-share of $1.28 (decrease of 12%)

- 2009 earnings-per-share of $3.17 (increase of 147%)

- 2010 earnings-per-share of $4.07 (increase of 28%)

Revenue fared pretty well during this period as Lancaster didn’t see any meaningful declines during the period and in fact, revenue was actually higher in 2008 than 2007. However, pricing and cost of goods suffered and as a result, margins declined significantly. This produced the earnings declines Lancaster experienced in 2007 and 2008 but to its credit, the rebound was swift and strong in 2009 and 2010.

Still, Lancaster is far from recession-proof because it sells products to foodservice customers – which suffer mightily during recessions and would thus order less from Lancaster – and consumers that may become cash-strapped during recessions and eschew the food accessories that the company offers. Lancaster, however, has performed extremely well thus far in 2020 despite very challenging conditions. Earnings are expected to surge this year, rather than decline, as would be expected during a typical recession.

Valuation & Expected Returns

We expect Lancaster to produce $6.15 in earnings-per-share this year, a ~24% gain against last fiscal year’s earnings of under $5 per share. Lancaster’s ability to see better price realization in its Retail business is not something we expect to continue after conditions normalize; this was brought about by production shortages at the start of the year, which have since been rectified. We believe the valuation should reflect Lancaster’s normalized conditions. In that light, we see it as overvalued.

Shares trade at 28.6 times this year’s EPS estimate, which is well in excess of our recently-raised target multiple of 24 times earnings. We therefore expect the valuation to fall over the coming years, and produce an annualized headwind of 3% to 4% to total returns.

With the dividend yield at just 1.6%, and expected EPS growth at 4%, total returns are slated to be just over 2% for the next five years. With that underwhelming total return outlook, we rate the stock a sell.

Lancaster’s extremely impressive dividend increase streak is certainly a draw for the stock, but we see the overvaluation as offsetting future growth at this point. We recommend investors wait for a meaningful pullback before buying shares.

Final Thoughts

Lancaster is certainly not a high-yield income stock, due to its low yield, but it does have an impressive track record of dividend increases. Unfortunately the current yield isn’t high enough to warrant a position simply for the dividend, and given the valuation, the risk of weak total returns is too high in the coming years. We note that Lancaster isn’t as expensively valued as it has been at times in the recent past, but is still overpriced in our view.

The company is performing better than expected through this recession thus far, but that is priced into the stock at this point. With all of this in mind, Lancaster doesn’t look like an enticing long position here despite its Dividend King status.