Published on October 20th, 2020 by Josh Arnold

Stocks with very long dividend streaks are sought after because they offer stability of earnings, steady dividends during recessions, and meaningful levels of income. Very few companies can meet all of these criteria, so investors must be careful when selecting which dividend stocks to own for the long-term.

One group of stocks that has stood the test of time is the Dividend Kings, a set of just 30 stocks in the S&P 500 with at least a half century of consecutive dividend increases. You can see all 30 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

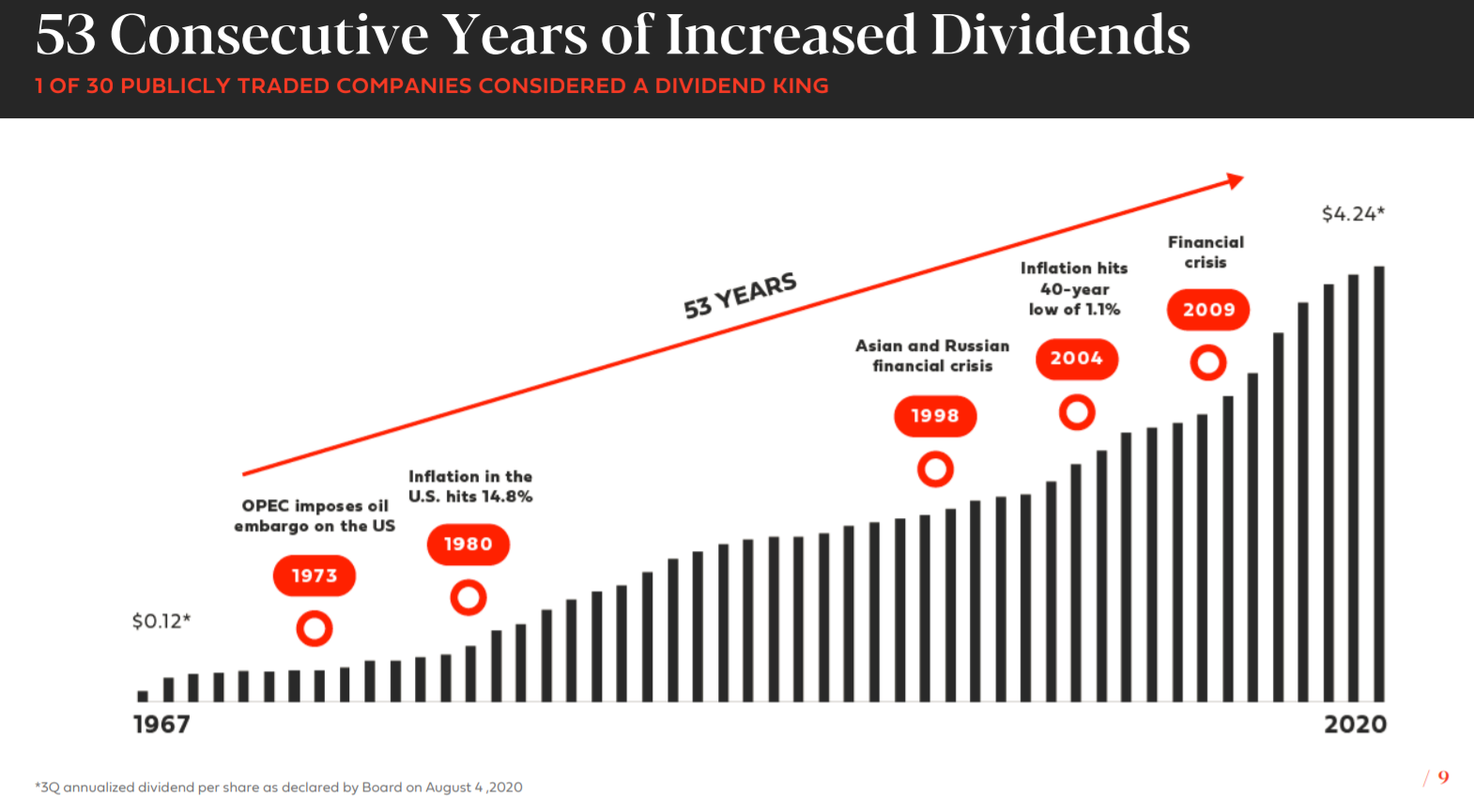

Federal Realty Investment Trust (FRT) is a Dividend King that has 53 consecutive years of dividend increases. This streak would be impressive for any stock, but for a REIT (a sector which is notoriously susceptible to recessions) this streak is extraordinary.

Below, we’ll take a look at Federal Realty’s business and its prospects for continuing its dividend streak.

Business Overview

Federal Realty was founded in 1962 and since that time, it has grown into a powerhouse retail-focused REIT that operates in high income, densely populated coastal markets in the US. The trust sees these markets as having favorable demographics for the long-term in terms of population and income growth.

Source: Investor presentation, page 3

This strategy of owning premium properties in premium markets has served the trust well, and it has grown immensely over the years. Today, the trust produces more than $800 million in annual revenue and has a market capitalization of $5.6 billion.

Growth Prospects

Federal Realty’s growth hasn’t always been huge on a percentage basis, but over time, funds-from-operations continue to move in the right direction. Indeed, 2020 will be the first year in more than a decade where the trust didn’t produce higher year-over-year funds-from-operations per share. For a REIT, that is a staggeringly good track record, and of course, the decline in profitability this year is due to circumstances out of FRT’s control.

Source: Investor presentation, page 4

We see 6.9% annualized FFO-per-share growth in the coming years as the trust comes off of what should be a bottom in 2020. The trust’s focus on raising rents over time, redeveloping properties to make them more upscale to command higher rents, and a constant pipeline of new properties should all contribute.

The trust’s investment thesis can be seen above, with a focus on select markets with the best demographics, in places where space is limited and therefore, new competition. In addition, the trust has a strong balance sheet that affords it the ability to take advantage of investment opportunities as they arise.

These factors create a sort of ecosystem that feeds on itself, and produces higher FFO-per-share over time for Federal Realty. We believe it will bounce back from the bottom in 2020.

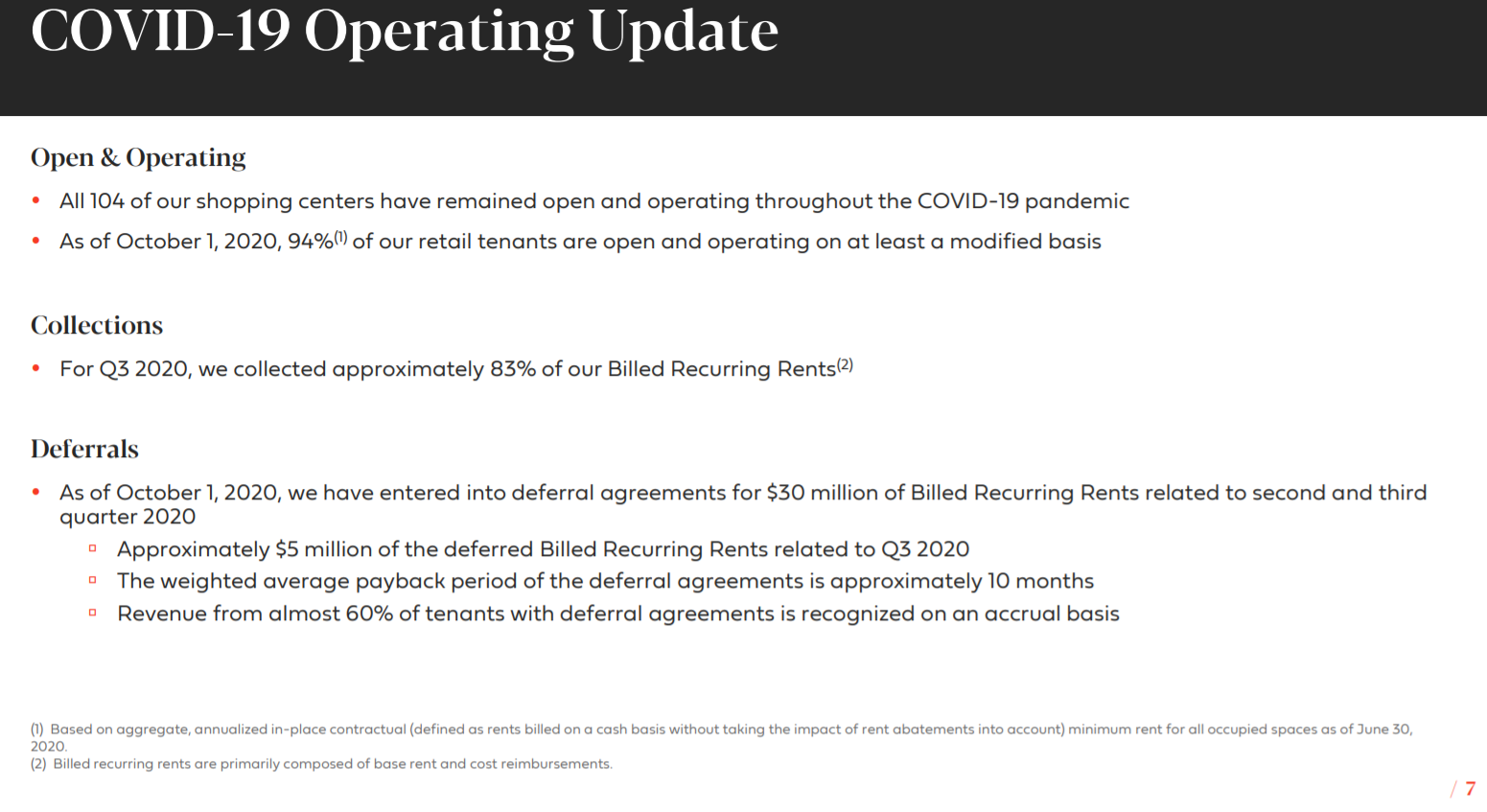

Source: Investor presentation, page 7

The trust’s most recent earnings report showed a huge decline in cash flow. FFO came to $58 million, or $0.77 per share, down from $121 million, or $1.60 per share in the same period last year. The trust saw sizable impacts from COVID-19 given its properties are generally retail-focused and therefore, were open in varying conditions during the quarter.

Many of its tenants are on rent collection modifications, causing revenue and earnings to fall. We see these conditions as temporary, and Federal Realty should be back to a normalized state by the end of 2021.

Competitive Advantages & Recession Performance

Federal Realty’s competitive advantage is in its development pipeline, as well as its focus and relative dominance of very attractive markets. The trust has proven over time it can produce industry-leading average base rents and that is because it has proven extremely adept at selecting and developing the best properties in the US. This has helped it not only grow FFO over time, but continue to raise its dividend during some very harsh recessions.

Below, we have Federal Realty’s FFO-per-share before, during, and after the Great Recession:

- 2007 FFO-per-share: $3.62

- 2008 FFO-per-share: $3.85 (6.4% increase)

- 2009 FFO-per-share: $3.51 (8.8% decrease)

- 2010 FFO-per-share: $3.88 (10.5% increase)

While Federal Realty wasn’t able to grow every year during the recession, it was able to grow over time, albeit slightly. However, this was more than enough to keep its very impressive dividend streak alive. This recession appears to be tougher on retail than the Great Recession given much lower traffic in physical stores, so we see Federal Realty facing a sizable challenge.

Source: Investor presentation, page 9

Consensus estimates are for $4.60 in FFO-per-share this year, while the payout is currently $4.24 per share. While we believe the trust will defend its dividend with every possible measure, if the recession worsens, or shutdown conditions persist into 2021, it is not out of the question that Federal Realty would need to at least consider cutting its dividend.

We can see above some of the crises that the dividend has weathered, so this sort of thing is not unprecedented. However, given the extremely unusual circumstances we’re seeing, this is something dividend investors should certainly keep an eye on as the pandemic continues. Federal Realty is particularly susceptible to the pandemic because of its exposure to the retail industry.

Valuation & Expected Returns

Despite the fact that the stock has been decimated in 2020, Federal Realty is still trading slightly above fair value, which we assess at 15 times earnings. At the current share price of $73, and using $4.60 in FFO-per-share, the stock is trading for 16 times earnings. We therefore see a small headwind to total returns in the coming years from the valuation.

With 6.9% FFO-per-share growth expected, as well as the current yield of 5.8% – which is around double the normal yield for Federal Realty – we still expect 10.4% total annualized returns in the coming years. Should the dividend be able to be maintained through this recession, Federal Realty is offering investors a historic opportunity for a massive yield. That is helping fuel expected returns, as well as what should be strong growth off of this year’s FFO.

Final Thoughts

Federal Realty has its fair share of challenges in this extremely unusual environment. Despite the fact that the stock has fallen as much as it has this year, shares are still only fairly priced, not necessarily as cheap as one might imagine. However, FFO-per-share growth should be reasonably strong off of the bottom as conditions normalize and tenants pay rent again, and the dividend yield is huge.

With expected returns in excess of 10%, we are rating Federal Realty a buy for those seeking high levels of income and a potential reflation of the share price.