Updated on October 9th, 2020 by Nate Parsh

The Dividend Kings are a group of 30 companies in the S&P 500 Index, with 50+ consecutive years of dividend increases. Broadly speaking, they are among the highest-quality dividend growth investments in the entire stock market.

You can see a full downloadable spreadsheet of all 30 Dividend Kings, along with several important financial metrics such as price-to-earnings ratios and dividend yields, by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

This year, there are several new entrants into this exclusive Dividend Kings, including food distributor Sysco Corporation (SYY). Sysco has a long history of steady dividends, and regular dividend increases. It has paid a dividend every quarter since it went public in 1970. Its most recent increase was a 15.4% raise in November 2019.

Sysco stock has had a difficult 2020, mostly due to the impact of the COVID-19 pandemic on restaurants and bars. Shares have declined almost 23% year-to-date. However, there are some signs of a return to life for Sysco’s customers, as the economy (and the restaurant industry in particular) begins to recover.

Sysco has many attractive qualities as a dividend growth stock. It is the largest company in its industry, which provides it with higher profit margins and durable competitive advantages over its smaller rivals. It also has growth potential, and the ability to increase its dividend each year.

Business Overview

Sysco was founded in 1969, and went public the following year. In its first year as a publicly-traded company, it had sales of just $115 million. The company has grown steadily over the nearly five decades since. Last fiscal year, Sysco had sales of $53 billion.

Today, Sysco is the largest food distributor in the U.S. It distributes products including fresh and frozen foods, as well as dairy and beverage products. It also provides non-food products including tableware, cookware, restaurant and kitchen supplies, and cleaning supplies.

The company has a wide range of customers, which include restaurants, healthcare facilities, education and government offices, travel, leisure and retail businesses. It also has a large segment of other customer types such as bakeries, churches, civic and fraternal organizations, vending distributors, and international exports.

In all, Sysco has approximately 600,000 customers. Its position atop the food distribution industry provides Sysco with high profit margins, and future growth potential.

Many of these customers have faced extreme hardship as a result of the ongoing pandemic. Social distancing restrictions in response to COVID-19 severely limited away-from-home dining options for consumers

Source: 2020 Barclays Global Consumer Staple Conference Presentation

Consumer spending on food away-from-home severely declined from the end of February, but appeared to bottom in April. Consumers were forced to eat more meals at home, which resulted in increases in grocery store traffic.

Away-from-home has rebounded since the lows, but still hasn’t regained its pre-COVID-19 levels. Still, this is an improvement from earlier in the year, an excellent sign for Sysco.

Growth Prospects

This isn’t the first time Sysco has faced hardships in its business. The operating climate for Sysco was challenged in 2017, due to the “restaurant recession” that took place in the United States. Restaurant traffic slowed down, driven by several factors including eroding mall traffic, and low grocery prices.

Fortunately, Sysco cut costs in its U.S. business to protect its profit margins. And the company has enjoyed a resurgence in recent years, driven by a strong U.S. economy and high consumer confidence. Unfortunately, all that changed with the onset of the coronavirus pandemic, which has had a negative impact on the company’s results in 2020.

Sysco reported its fourth quarter (fiscal 2020) earnings results on August 11th, 2020. Revenue declined by 43% year-over-year, gross profit decreased 6.9%, and adjusted earnings per share swung from $1.10 in the previous year to a loss of $0.29. These results weren’t exactly unexpected given the circumstances. The company has taken steps to aid its customers.

For example, Sysco assisted customers with creating pop up shops located in front of dining rooms. Almost 16,000 customers created these market places. Sysco even provided connections to help customers with outdoor dining, patio extensions, website design, takeout menu productions and to-go containers.

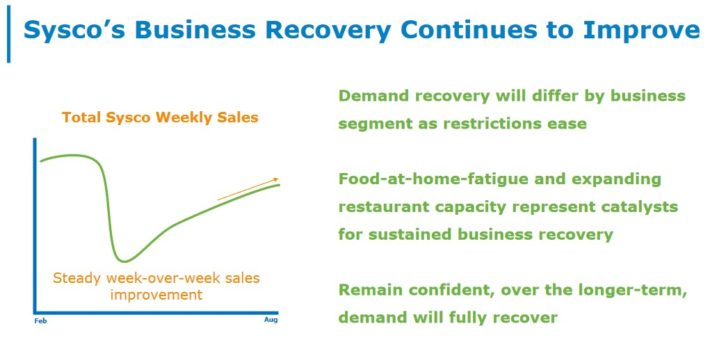

The company reported that customers taking advantage of this assistance performed better than those that did not. Sysco’s actions in assisting customers helps cement relationships while providing a lifeline for restaurants to remain in business. As a result, weekly sales greatly improved over time.

Source: 2020 Barclays Global Consumer Staple Conference Presentation

Sysco has also increasingly utilized acquisitions to drive growth in recent years. In 2016, Sysco acquired U.K.-based Brakes Group for $3.1 billion.

Brakes is one of the largest foodservice companies in Europe. It serves fresh, refrigerated, and frozen foods to over 50,000 customers, and has a leading presence in the U.K., France, Sweden, Ireland, Belgium, Spain, and Luxembourg.

In late January of last year (1/28/19), Sysco announced the acquisition of Waugh Foods, Inc., a food distributor with approximately $40 million of sales. Continued acquisitions such as this help Sysco generate growth in a fairly saturated–and highly competitive–food distribution industry.

The company is also adding delivery to grocery stores in an effort to create new sources of revenue.

The combination of organic sales growth, acquisition-added revenue growth, and share repurchases is expected to result in 5.2% annual earnings-per-share growth, in our view. We believe this is an attainable goal, due to the company’s strong business model and impressive competitive advantages.

Competitive Advantages & Recession Performance

The U.S. foodservice industry is fiercely competitive. There are thousands of competitors to Sysco, which include other food distributors, as well as wholesale or retail outlets, grocery stores, and online retailers. Sysco also faces the risk of its customers negotiating directly with its suppliers.

However, what has kept competitors at bay for so many years, is that Sysco is the largest operator in the industry. It controls about 16% of the $280 billion U.S. foodservice industry. Sysco operates 330 distribution facilities worldwide and serves over 600,000 customer locations. Such a huge presence allows Sysco to keep costs low, and it can pass on the benefit to its customers.

Another benefit of Sysco’s business model is that it is resistant to recessions. Everyone has to eat, which gives Sysco a certain level of demand, regardless of the condition of the U.S. economy.

This is why Sysco’s profits held up well during the Great Recession:

- 2007 earnings-per-share of $1.60

- 2008 earnings-per-share of $1.81 (13% increase)

- 2009 earnings-per-share of $1.77 (2% decline)

- 2010 earnings-per-share of $1.99 (12% increase)

Sysco grew earnings-per-share at a double-digit pace in 2008 and 2010, with only a mild dip in 2009. The company grew earnings from 2007 to 2010, which was a rare achievement.

Sysco’s stable industry and top competitive position, allowed it to raise its dividend each year, even during recessions.

Valuation & Expected Returns

Sysco is expected to produce adjusted earnings-per-share of $2.00 in fiscal 2021. If it weren’t for the COVID-19 disruptions to the business, we believe that the company’s true “earnings power” would be $3.50. Based on the current share price of $66 and our estimate for earnings power, the stock has a price-to-earnings ratio of 18.9. Our fair value estimate is a price-to-earnings ratio of 15.0, which means the stock is currently trading well in excess of fair value. Reverting to this target valuation by 2025 would reduce annual returns by 4.5% over this period of time.

Because Sysco is an overvalued stock, we do not anticipate multiple expansion being a meaningful driver of future shareholder returns. Instead, shareholder returns will be generated by earnings growth and dividends.

Fortunately, Sysco does not need to rely on multiple expansion, as the company has an attractive growth profile and dividend. We expect Sysco to deliver 5.2% annual earnings growth going forward, consisting of organic growth, acquisitions, and share repurchases.

In addition, Sysco has a current dividend yield of 2.7%, which is a higher yield than the average yield of the broader S&P 500 Index. This leads to total expected annualized returns of 3.4% per year over the next five years.

Sysco should have little trouble increasing its dividend going forward. The company had a dividend payout ratio of 90% in fiscal 2021. This indicates the dividend is sufficiently covered, but would likely take a recovery from the pandemic to grow meaningfully. We do anticipate that this will occur and the company’s dividend will continue to move higher.

Final Thoughts

Sysco operates at the top of its industry. Though it is facing headwinds at the moment, we believe that these will mitigate as a recovery from COVID-19 eventually takes place. This should leave Sysco in a solid position once that recovery takes place.

The stock is slightly overvalued, meaning right now is not the best time to buy the stock. We believe future returns will be satisfactory, but not spectacular, for investors buying the stock at the current valuation level.

Still, we believe the stock can generate positive returns even at this valuation, through earnings growth and dividends. As a result, Sysco remains a quality holding within a dividend growth portfolio, but the stock is not a buy at the current price.