Updated on October 7th, 2020 by Josh Arnold

Parker-Hannifin (PH) is in very exclusive company when it comes to its dividend track record. Parker-Hannifin has paid quarterly dividends to shareholders for the past 70 years, and it has raised its dividend for 63 years running. This means Parker-Hannifin has one of the longest dividend increase streaks of any company in the US.

This amazing accomplishment puts it in the elite Dividend Kings, a group of stocks that have increased their payouts for at least 50 consecutive years. You can see the full list of all 30 Dividend Kings here.

Additionally, you can download your free copy of the entire Dividend Kings list (along with metrics that matter like price-to-earnings ratios and dividend yields) by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Dividend Kings are the best of the best when it comes to rewarding shareholders with higher cash returns each year. This article will discuss Parker-Hannifin’s qualities that have put it in such select company.

Business Overview

Parker-Hannifin was founded back in 1917 by Art Parker, who was an entrepreneurial man in every sense of the word. He used his penchant for solving engineering problems to file over 160 patents and created the foundation for what Parker-Hannifin has become today. The company continues to embody Mr. Parker’s approach to solving the world’s engineering problems, and the formula has certainly worked over the past several decades.

Parker-Hannifin sells a wide array of components that help power the world’s factories and machines. Part of the company’s appeal is that it is so diversified in terms of product categories and offerings. This affords it a very long and diverse customer list, meaning it isn’t reliant upon one or two industries for its revenue and profits. Indeed, Parker-Hannifin is one of the most diversified industrials in the market.

Parker-Hannifin’s market capitalization is right at $27B today and the company is expected to produce just under $13B in revenue in fiscal 2021, which ends in June. Parker-Hannifin operates in three major segments called Diversified Industrial North America, Diversified Industrial International, and Aerospace Systems.

The North America business is the largest segment of the three, producing $6.8 billion in revenue in fiscal 2020. This segment provides industrial solutions to engineering problems on a massive scale including valves and fittings, cylinders and actuators, hoses, piping, tubing and a host of other product categories.

The International business is nearly as large as the North America segment and provides the same sort of solutions to its customers outside the US, producing $5 billion in revenue in fiscal 2020. The Aerospace Systems business focuses on an industry where Parker-Hannifin has decades of experience in making the world’s aircraft more efficient and safer to operate. This segment produced $2.5 billion in revenue last fiscal year.

Total revenue is split roughly 48% Industrial North America, 35% Industrial International and 17% Aerospace, so diversification is strong both in terms of customers and geographies.

Growth Prospects

Parker-Hannifin has seen somewhat lumpy earnings growth in recent years, as it is diversification of geographies and products has worked better in some years than others. However, we believe the company has a strong 10% growth rate in front of it.

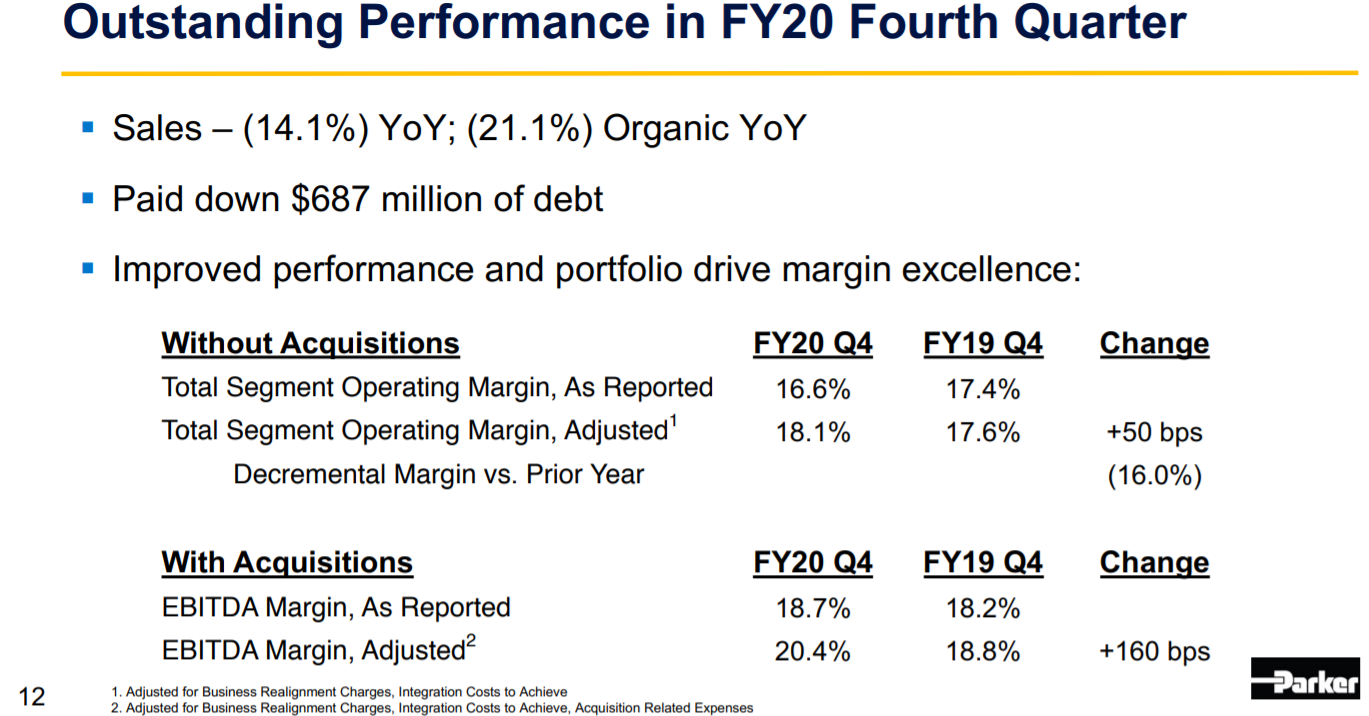

Source: Investor presentation, page 12

Parker-Hannifin reported fourth quarter earnings on August 6th, and results were much better than expected, although year-over-year comparisons were quite unfavorable due to demand disruptions from COVID-19. Organic revenue was off 21% from the prior year, although acquisitions added 7% to the top line, making the total decline in revenue more manageable at -14%.

Impressively, Parker-Hannifin managed to boost its adjusted operating margins by 50bps year-over-year due to its intense focus on operating costs. The company also retired almost $700 million of debt during the quarter, meaningfully reducing is leverage.

Management guided for earnings-per-share of $9.80 to $10.80 for fiscal 2021, but we believe that is too conservative, and therefore expect $11.00 in earnings-per-share for fiscal 2021.

One reason we are bullish on the company’s prospects is its propensity to purchase growth via acquisitions.

Source: Investor presentation, page 8

Parker-Hannifin has made some significant acquisitions in recent years, with CLARCOR, Lord, and Exotic Metals being three examples. Parker-Hannifin is careful about the companies it acquires, ensuring they’ll be accretive to earnings immediately, or at least very quickly after closing on the deal. The revenue the company is acquiring is significant to say the least, with the three companies above representing about 20% of the consolidated company’s expected revenue this year.

As part of its acquisition strategy, Parker-Hannifin has also taken great care to boost its margin profile, with one way being cost saving programs.

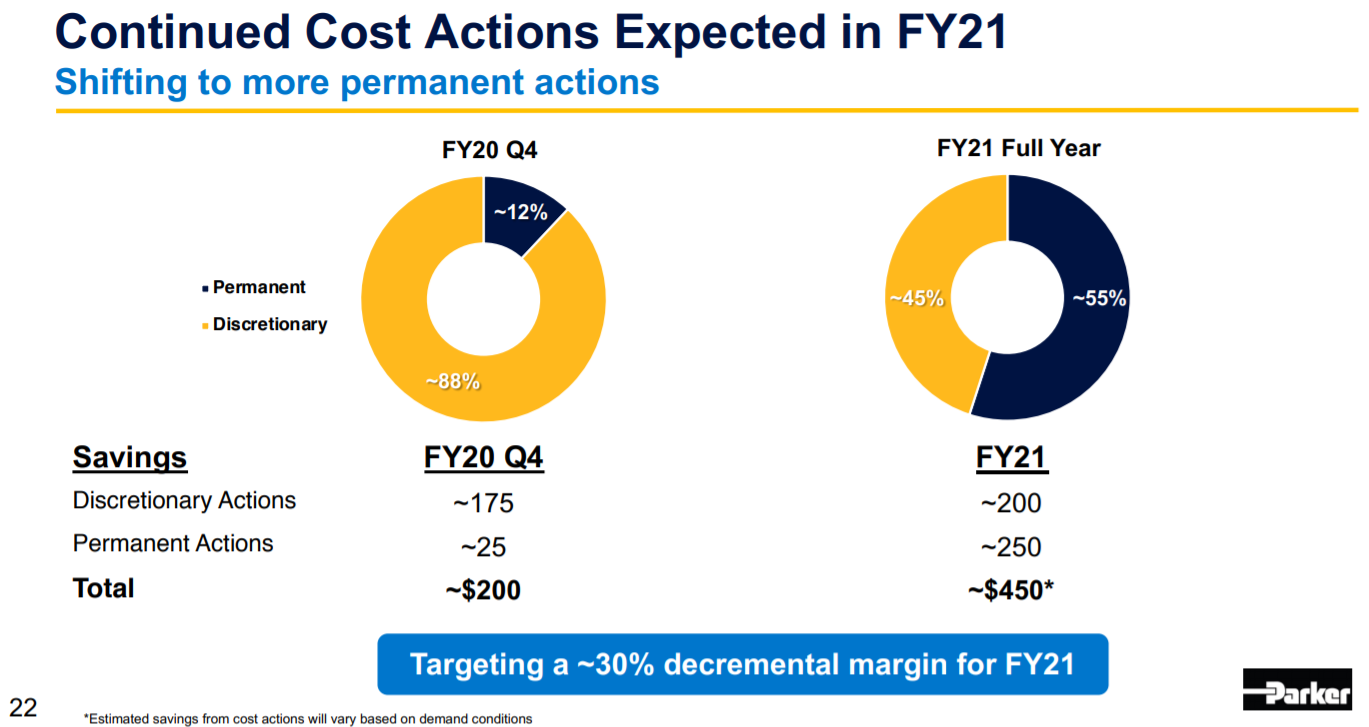

Source: Investor presentation, page 22

The company believes it can save $450 million in fiscal 2021, which would add meaningfully to operating earnings, and make certain cost saving actions that were discretionary last year into permanent cost cuts. Parker-Hannifin has been able to boost its margin profile over time in this way, even when revenue stagnates due to economic weakness.

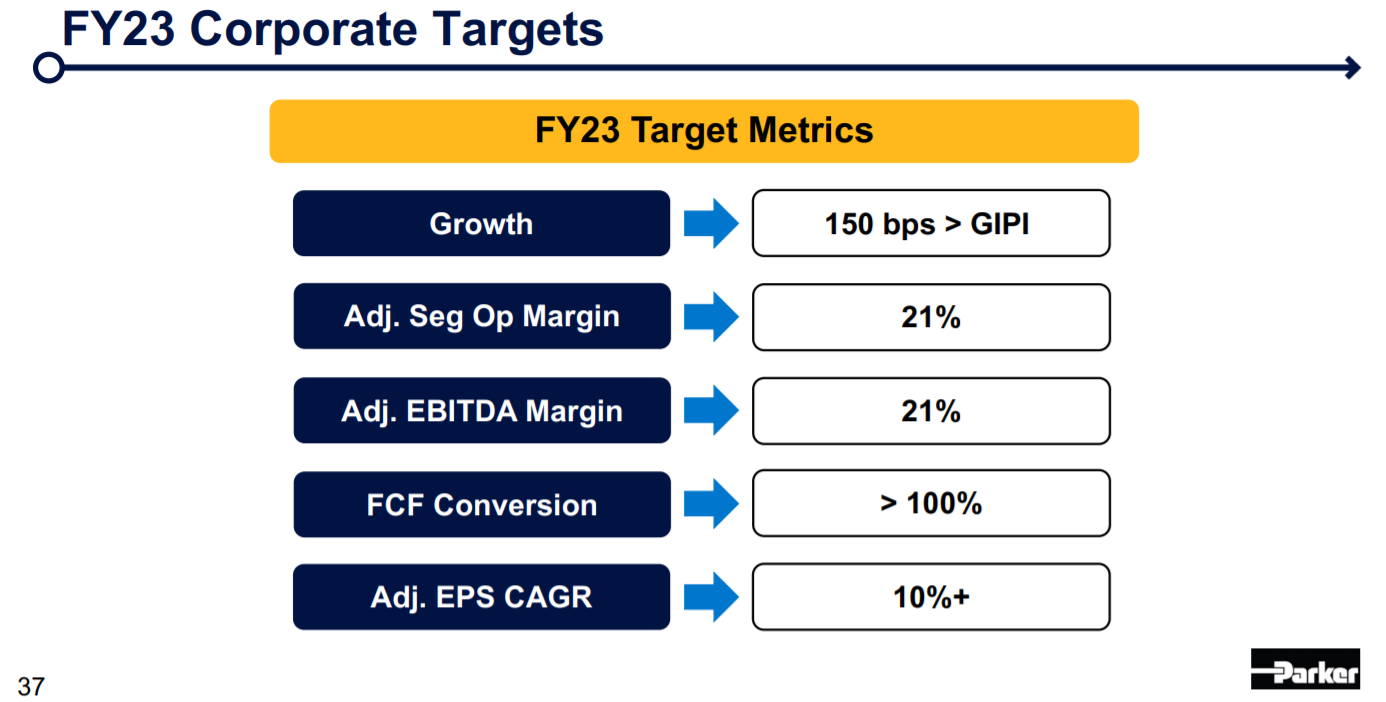

Parker-Hannifin recently provided an update on its strategic priorities, including fairly detailed guidance for fiscal 2023.

Source: Investor presentation, page 37

The company believes it can grow revenue at 1.5% above global economic growth rates, that it can achieve 21% adjusted operating margins, and that it can grow adjusted earnings-per-share at double-digit rates annually. These are lofty goals, but assuming the global economy returns to some sort of normal state by then, we believe Parker-Hannifin can execute on these goals.

The company’s focus on constant improvement in its operating efficiency, as well as the scale that targeted acquisitions provide ensure it is set up for success when it comes to margin growth. The bull case for the stock is predicated upon organic revenue growth in addition to margin expansion, and given the terrific guidance above, it seems the company’s growth story is certainly alive and well.

Competitive Advantages & Recession Performance

Parker-Hannifin’s competitive advantages include its scale, global distribution network, and its 100+ years of experience in solving engineering problems. The company makes some relatively obscure – but very critical – components of heavy machinery, factory equipment, aircraft, etc. and competition in many of these arenas is light. That plays into its hands when it comes to competitive advantage because in many cases, there is very little in terms of actual competition, and pricing power is commensurately high.

This is not to say that Parker-Hannifin is immune from recession, because that is far from the case. After all, its customers need customers of their own in order to justify production, which means that when a recession does strike, Parker-Hannifin suffers as well.

During the Great Recession, revenue fell from about $12B before the downturn to about $9B at the bottom. That’s a very significant decline so again, it isn’t that Parker-Hannifin’s diversification insulates it entirely from recessions. Naturally, this had a corresponding negative impact on earnings-per-share in 2009, as shown below:

- 2007 earnings-per-share of $4.67

- 2008 earnings-per-share of $5.53 (18% increase)

- 2009 earnings-per-share of $3.13 (43% decline)

- 2010 earnings-per-share of $3.40 (8.6% increase)

However, revenue recovered to pre-crisis highs by 2011 so while it was painful to be sure, even something as traumatic as the Great Recessions wasn’t close to a death knell for Parker-Hannifin. This company isn’t beholden to any one particular industry and that diversification of product offerings and customers is what helps it weather economic storms.

This recession has been unkind to Parker-Hannifin, but with factories having been restarted around the world, we see the 2020 recession as a small blip on the radar. We believe its earnings declines will be temporary.

Valuation & Expected Returns

Parker-Hannifin trades today for 19.1 times our earnings estimate of $11 per share for fiscal 2021. This is in excess of our estimate of fair value, which is 15 times earnings. However, we note that Parker-Hannifin has traded with significantly varying price-to-earnings multiples in the past decade, as earnings have moved higher or lower. Still, over the next five years, we expect the current valuation to produce a ~5% annual headwind to total returns.

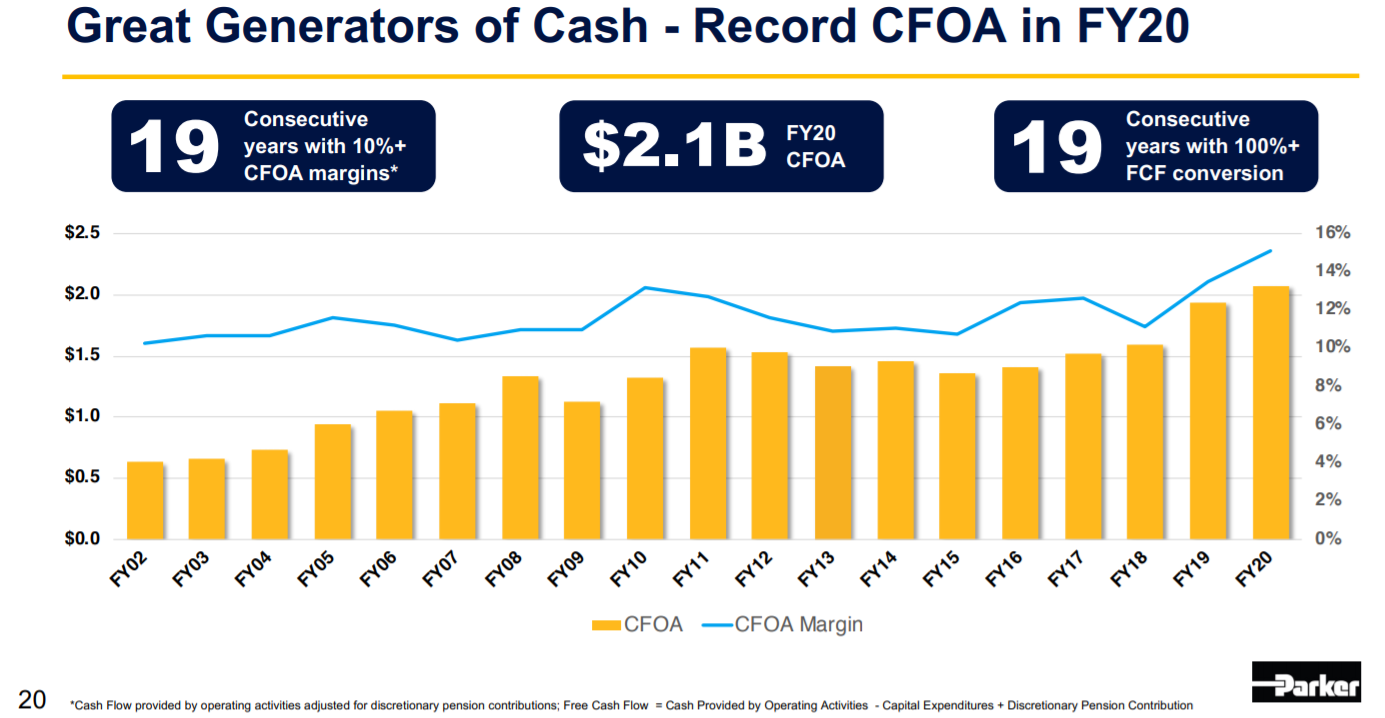

Parker-Hannifin’s dividend history is obviously very impressive, and that has been made possible by the company’s outstanding free cash flow generation over time.

Source: Investor presentation, page 20

At a time when the global economy was extremely challenged, Parker-Hannifin posted record cash flow from operations. In addition, it has 19 consecutive years with 100% free cash flow conversion, meaning that more than 100% of its earnings-per-share is converted into free cash flow. This provides a huge margin of safety for the dividend, and we believe Parker-Hannifin’s payout is ultra-safe as a result.

If we assume long-term earnings growth of 10% and add in the current yield of 1.7%, Parker-Hannifin’s total return outlook is in the 6% to 7% range. Returns would be higher, but the valuation of the stock is a headwind at this point.

We continue to think Parker-Hannifin has a bright future in front of it, but the valuation has moved meaningfully higher in the recent past. Therefore, we recommend investors wait for a better price before buying the stock, due to overvaluation.

Final Thoughts

Parker-Hannifin is not a high-yield income stock, and it almost certainly never will be. The company’s enormous dividend track record is impressive to be sure and appears that it will continue for decades to come, but the company doesn’t set out to be an income stock. It uses its prodigious free cash flow to reward investors via a decent yield that grows over time, but also through growing by acquisitions and investing in its business.

That’s not to say the dividend should be discounted, but a high dividend yield is not the primary focus of this company, despite its Dividend King status. The stock looks a bit expensive today, which has reduced the total return outlook. Given this, we rate Parker-Hannifin a hold, but if it were to trade closer to fair value, we’d upgrade to buy due to the company’s outstanding track record of growth and dividends.