Updated on September 29th, 2022 by Josh Arnold

The Dividend Kings are considered the best-of-the-best when it comes to dividend growth stocks. There is good reason for this, as it is extremely difficult to become a Dividend King. That’s why there are only 45 of them out of the thousands of publicly-traded companies. To be a Dividend King, a company must raise its dividend each year for over 50 years.

You can see the full list of all 45 Dividend Kings here.

We have created a full list of all 45 Dividend Kings, along with important financial metrics such as price-to-earnings ratios and dividend yields. You can access the spreadsheet by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Increasing dividends for five decades is no easy task. A company must possess durable competitive advantages and an ability to outlast recessions. This explains why there are relatively few stocks that qualify as Dividend Kings.

One of them is home improvement retailer Lowe’s Companies (LOW), a Dividend King that has declared a cash dividend every quarter since going public in 1961.

Lowe’s stock has pulled back sharply in 2022 on interest rate and recession fears. Given this, as well as the company’s outstanding earnings and dividend growth history, we see very attractive total returns ahead.

Business Overview

Lowe’s traces its roots back to 1921, when LS Lowe founded a hardware store in North Wilkesboro, North Carolina. The company remained a single store operation until 1949, when a second store was opened in Sparta, North Carolina. Since then, Lowe’s has grown to more than 2,200 stores in the US and Canada.

The company generates about $97 billion in annual revenue, with its 270,000 employees serving ~18 million customers every week.

Lowe’s has made its mark in the US with its 1,800+ stores by focusing on merchandising excellence, supply chain efficiency, operational efficiency, and engagement of customers. Lowe’s fell behind rival Home Depot (HD) in recent years as Home Depot focused on professional customers, building out digital capabilities, and an intense focus on the customer experience.

Lowe’s, for its part, has made necessary investments in recent years to close the gap.

It has also been able to successfully translate this success into Canada, which many retailers have tried to do without success. The company has a handful of banners it sells under in Canada, and has tapped into a $35 billion home improvement market.

The current business environment remains strong for Lowe’s despite the constant headwind of supply chain issues many businesses are dealing with.

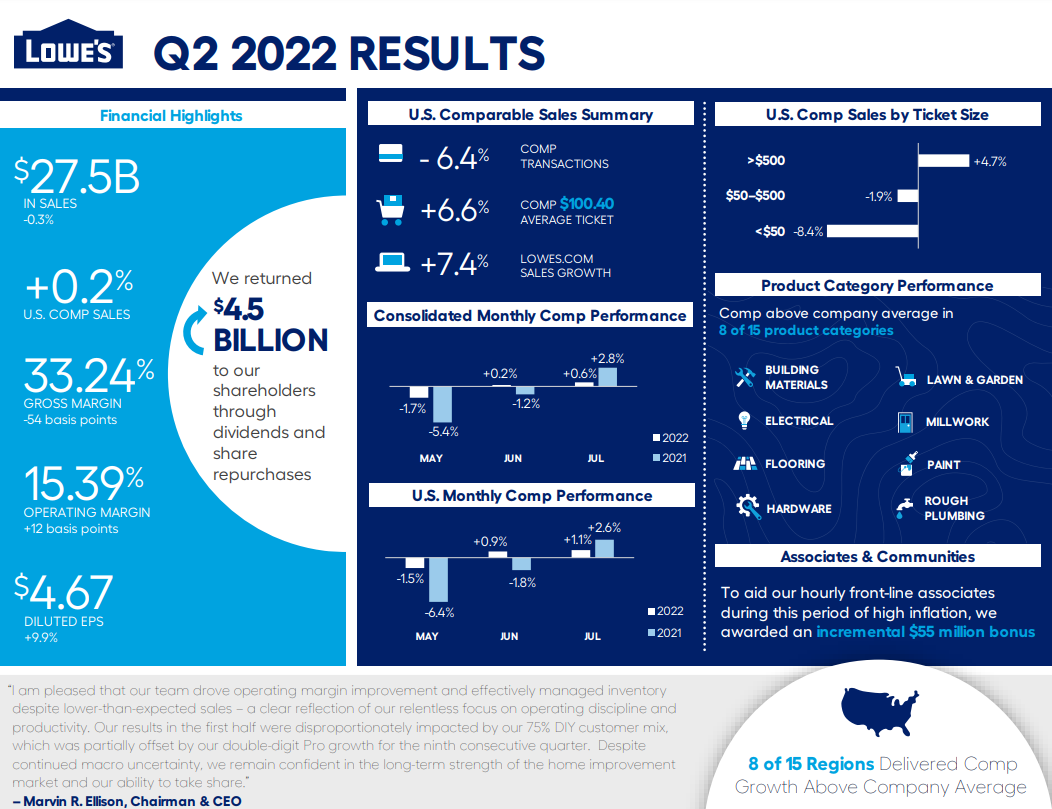

Lowe’s reported second quarter earnings on August 17th, 2022, and results were somewhat weak. Sales were essentially flat year-over-year at $27.5 billion, as comparable sales declined 0.3%. Pro customer sales were the bright spot at +13%. Earnings came to $3 billion, also roughly flat year-over-year. However, earnings-per-share rose 10% to $4.67 due to share repurchases reducing the float significantly. We expect $13.40 in earnings-per-share for this year.

Source: Infographic

We expect Lowe’s to continue generating strong sales and earnings growth for many years, with blips expected during recessionary periods.

Growth Prospects

Lowe’s has kept its store base fairly constant in recent years, as it appears the company is happy with the footprint it possesses at the moment. The number of markets Lowe’s can enter is somewhat limited by the massive size of the stores it operates, as small markets generally cannot support a Lowe’s store. However, despite this lack of footprint growth, Lowe’s has plenty of runway for additional earnings expansion.

One way Lowe’s expands its earnings is through strong comparable sales. The company has managed to produce positive same-store sales growth each year for the past decade.

Lowe’s has been able to grow through a variety of economic situations and changes in consumer spending habits, and we think that will continue. That said, the potential for sales declines exists for short periods during recessions.

The second growth driver for Lowe’s is margin expansion. Gross margins tend not to move much in the home improvement business, and Lowe’s is no exception. However, it has seen SG&A costs leveraged down over time as revenue has risen, and so long as comparable sales are rising, this should continue to be a tailwind.

Third, Lowe’s spends freely on share repurchases, and it expects to spend more than $10 billion on repurchases this year alone. We expect Lowe’s to continue buying back stock in the years ahead, as the company has plenty of cash on hand and earnings strength to do so.

Combined, these factors should see Lowe’s grow earnings-per-share by 6% annually over the next five years.

Competitive Advantages and Recession Performance

Lowe’s main competitive advantage is one it shares with Home Depot; size and scale that affords it superior buying power over smaller rivals. Lowe’s and Home Depot operate a near-duopoly in the US, and thus, Lowe’s is competitively positioned by virtue of its scale.

Apart from that, Lowe’s has focused its energy in recent years on building out a customer base that is more durable and less cyclical. Pro customers are about one-quarter of revenue, and Lowe’s has gone after those customers aggressively to try and take share from Home Depot.

Pro customers tend to spend heavily throughout the year as they complete customer jobs, and are therefore quite lucrative. Lowe’s continues to build digital tools and pro-only shopping experiences to lure this customer away from its main rival.

Lowe’s tends to be somewhat cyclical given recessions generally result in lower discretionary spending and lower rates of construction. This recession is actually proving to be a boon for Lowe’s as consumers are spending more time in their homes than ever and therefore, are spending to improve them.

We see the next recession as having the ability to be harsher to Lowe’s if it is accompanied by a slowdown in housing and commercial construction, since those are huge drivers of revenue for Lowe’s.

Related: Analysis on the 9 best construction stocks.

Valuation and Expected Returns

We see Lowe’s producing $13.40 in earnings-per-share this year, so at the current price, Lowe’s stock trades for just 14 times earnings. That is far below our estimate of fair value, which stands at 19.5 times. We therefore see a nearly 7% tailwind from the valuation alone annually for the next five years.

The dividend yield stands at 2.2%, which is much higher than it has been in recent years. This is attributable to the substantial share price decline suffered in 2022.

The yield, combined with 6% estimated earnings-per-share growth and a tailwind from the valuation, should produce annual returns of nearly 15% over the next five years.

Final Thoughts

Lowe’s has an impressive track record of increasing its dividend each year, regardless of the state of the broader economy. Home improvement retail has continued to benefit from a strong housing market, although with interest rates spiking to decade-highs, that tailwind has cooled of late. Still, we see the company’s growth outlook as robust, powered in no small part by its huge share repurchase program, and the valuation is extremely attractive.

Lowe’s is not the cheapest stock around, but it is not unusual for the best businesses to command a higher valuation multiple. We see Lowe’s as a buy today for its world-class dividend history, low valuation, and 6% earnings growth projection.