Published on January 31st, 2022 by Bob Ciura

We believe long-term investors should focus on the highest-quality dividend growth stocks. These are companies with long histories of raising their dividends, and durable competitive advantages to fuel continued dividend growth.

Therefore, we tend to steer investors toward the Dividend Kings, a group of 38 stocks with 50+ years of dividend increases.

You can also download an Excel spreadsheet with the full list of all 38 Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

We review each of the Dividend Kings every year. The next stock to be reviewed in this year’s edition is AbbVie (ABBV).

AbbVie is coming off a multi-year period of excellent growth, thanks to the massive success of its flagship product Humira.

There are questions regarding the company’s future growth due to increasing competition facing its flagship product Humira. But the company has a plan to continue growing.

This article will discuss AbbVie’s business model, growth potential, and why we rate the stock as a buy for dividend growth investors.

Business Overview

AbbVie is a global pharmaceutical giant. It began trading as an independent company in 2013, after it was spun off from fellow pharmaceutical Dividend King, Abbott Laboratories (ABT).

AbbVie has generated strong growth since the spin-off. According to AbbVie, it grew revenue and adjusted EPS growth by 14.7% and 19% respectively, each year from 2013-2021.

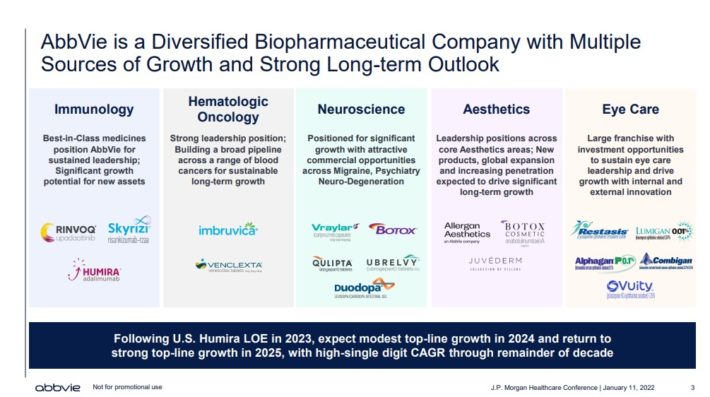

Today, AbbVie focuses on one main business segment—pharmaceuticals. It focuses on a few key treatment areas, including immunology, hematologic oncology, neuroscience, and more.

Source: Investor Presentation

The company has seen excellent growth since it was spun off from Abbott. AbbVie now generates annual revenue above $56 billion.

Since the spin-off from Abbott, AbbVie has produced excellent growth, due in large part to Humira. Humira is a multi-purpose drug, and was once the top-selling drug in the world.

The challenge for AbbVie is that Humira is now facing biosimilar competition in Europe, and will lose patent protection in the U.S. in 2023.

Even so, AbbVie remains a giant in the healthcare sector, with a large and diversified product portfolio.

AbbVie reported its third quarter earnings results on October 29. Revenue increased 11% to $14.3 billion. Earnings-per-share of $3.33 increased 18% year-over-year.

The company hiked its full-year guidance, now expecting 2021 adjusted EPS in a range of $12.63 – $12.67. AbbVie also announced an 8.5% dividend increase in October, lifting the quarterly payout to $1.41 per share.

Growth Prospects

The major risk for global pharmaceutical manufacturers is patent loss. When a particular drug loses patent, the market is typically flooded with competition, especially for the world’s top-selling products.

For AbbVie, its biggest risk is the competition about to hit its flagship drug Humira, a multi-purpose drug that is used to treat a variety of conditions. Some of these include rheumatoid arthritis, plaque psoriasis, Crohn’s disease, ulcerative colitis, and more.

Humira at one point generated over half of AbbVie’s annual sales. Loss of patent exclusivity is a significant overhang–AbbVie expects its total sales will decline in 2023 as a result. At the same time, AbbVie also expects to return to sales growth in 2024.

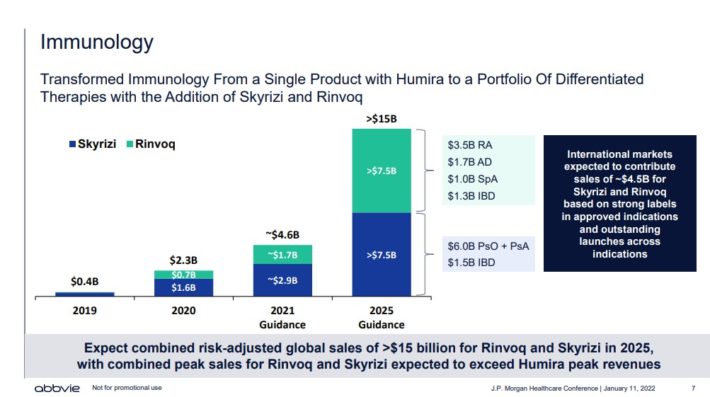

Fortunately, the company prepared for the loss of patent exclusivity on Humira, by investing heavily in new products as well as acquisitions to boost its growth. For example, Rinvoq and Skyrizi are two key products that represent long-term growth catalysts.

Source: Investor Presentation

AbbVie also completed the $63 billion acquisition of Allergan. Allergan’s flagship product is Botox, which diversifies AbbVie’s portfolio with exposure to global aesthetics.

In 2020, AbbVie’s aesthetics portfolio generated revenue of $2.59 billion. The company sees its aesthetics revenue growing at a high-single digit rate on a percentage basis, reaching $9 billion in annual sales in 2029.

Share buybacks will also add to AbbVie’s future earnings growth.

Since the company is highly profitable and generates significant free cash flow, it can afford to invest in growth and also return cash to shareholders.

In all, we expect 3% EPS growth for AbbVie, reflecting the steep patent cliff facing Humira.

Competitive Advantages & Recession Performance

The most important competitive advantage for AbbVie, and any pharmaceutical company, is its patent portfolio. Pharmaceutical giants need to spend heavily to innovate new drugs and therapies, when one of their blockbusters loses patent protection.

Research and development expense exceeds $6 billion per year. AbbVie has multiple growth opportunities to replace Humira, particularly in the therapeutic areas of immunology, hematology, and neuroscience.

The result of its significant investment in R&D is a well-stocked pipeline.

Source: Investor Presentation

AbbVie was not a standalone company during the last financial crisis, so there is no recession track record. However, the fact remains that since sick people require treatment whether the economy is strong or not, it is highly likely that AbbVie would continue to perform well during a recession.

AbbVie’s earnings are likely to decline somewhat in a recession, but the dividend should remain secure. AbbVie has a projected dividend payout ratio of ~45% for 2021.

Valuation & Expected Returns

AbbVie is expected to generate adjusted EPS of $12.65 for 2021, at the midpoint of guidance. At this EPS level, the stock is currently trading for a price-to-earnings ratio of just 10.8.

Our fair value estimate for AbbVie is a price-to-earnings ratio of 10.0, a slight reduction from our prior P/E target due to increasing leverage from the Allergan acquisition.

We view AbbVie as just slightly overvalued. A declining P/E multiple could reduce shareholder returns by approximately 1.5% per year over the next 5 years.

In addition, we expect annual earnings growth of 3% through 2026.

Lastly, the stock has a current dividend yield of 4.1%. In total, we expect annual returns of 5.6% per year over the next five years, making AbbVie stock a hold.

Final Thoughts

AbbVie is a very high-quality business, with a strong pharmaceutical pipeline and growth potential. It is also a shareholder-friendly company that returns excess cash flow to investors through stock buybacks and dividends.

AbbVie faces a significant challenge in replacing lost Humira sales as it faces competition in the U.S. and Europe. This is why we have fairly low assumptions for the company’s future EPS growth and fair value P/E multiple.

Still, the company has built a large portfolio of new products that should keep its growth intact. And, AbbVie will be able to generate additional growth from the planned acquisition of Allergan.

We believe AbbVie is a strong holding for long-term value investors and income investors.