Updated on February 1st, 2022 by Quinn Mohammed

Each year, we individually review each of the Dividend Aristocrats, a group of 66 companies in the S&P 500 Index with at least 25 consecutive years of dividend increases. We believe the Dividend Aristocrats list is a great starting point for investors looking for quality dividend stocks to buy for the long-term.

With that in mind, we created a list of all 66 Dividend Aristocrats, with important financial metrics like dividend yields and price-to-earnings ratios. You can download your free copy by clicking on the link below:

Next in the Dividend Aristocrats In Focus series is People’s United Financial (PBCT). People’s most recent dividend increase was its 28th consecutive annual increase, making it a fairly new Dividend Aristocrat. However, for a bank, that is a very strong accomplishment.

People’s United has a strong history of dividend growth, particularly for the highly cyclical financial sector, which saw many of even its largest constituents cut their dividends during the financial crisis. That wasn’t the case for People’s United. In fact, the company continued to increase its dividend each year during the Great Recession.

People’s United managed to increase the dividend again in 2021, as it achieved record earnings even with the ongoing coronavirus pandemic.

People’s not only has an impressive streak of dividends, but a fairly high current yield as well. At a time when the S&P 500 Index has an average dividend yield of 1.3%, People’s United has a 3.8% dividend yield, making it an attractive stock for dividend income.

Business Overview

People’s was founded in 1842 in Bridgeport, Connecticut. The bank began operations with just $97 in total deposits and had no paid employees for its first 10 years of operations. In the 179 years since that humble beginning, People’s United has grown into a regional bank with nearly 400 retail locations in the Northeast United States.

Today, People’s United has assets and loans of $65 billion and $38 billion, respectively.

People’s United generated strong year-over-year results in 2021, however part of this was due to a reversal in provisions for loan losses as a result of better credit metrics and an improved economic outlook. For the fourth quarter, net interest margin fell once again from 2.64% to 2.51% sequentially, due to depressed interest rates. Net interest income declined by 2% in the fourth quarter, from the previous quarter.

Non-interest income also declined by 1% and net loan charge-offs decreased sharply, from 0.12% to 0.03% of the total loans in the fourth quarter. People’s has enjoyed class-leading asset quality over the years, and that continues today. This outstanding asset quality means that it has the ability to lend out all of its deposits without fear of high levels of losses. Overall, operating earnings-per-share improved 2.9% for the fourth quarter, and 16.5% for the full year.

Source: Investor presentation

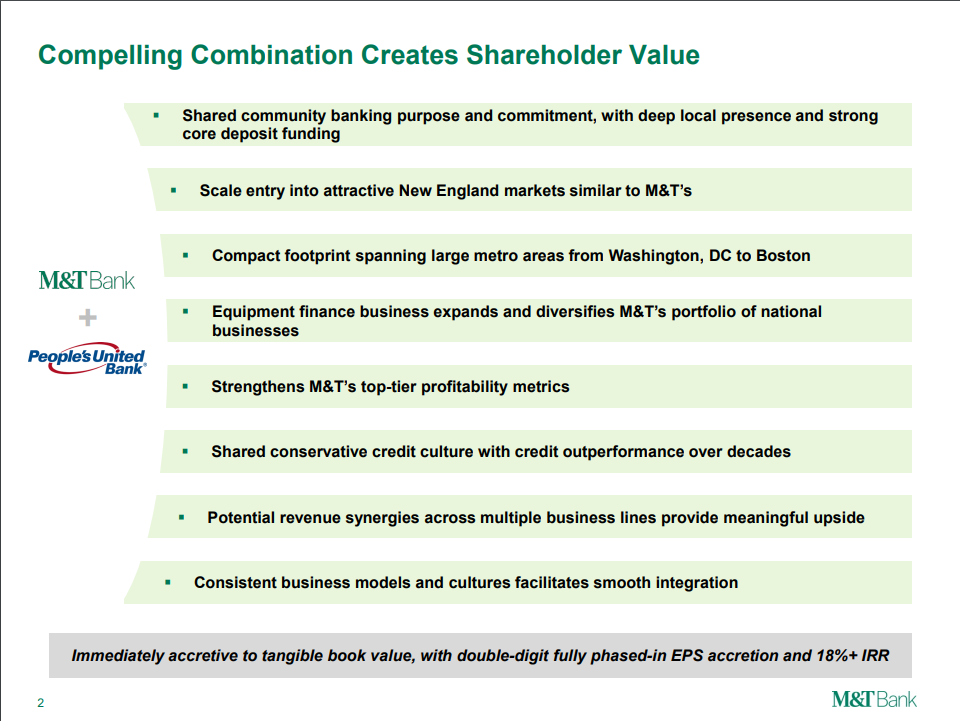

On February 22nd, 2021, People’s agreed to be acquired by M&T Bank (MTB) in an all-stock deal, culminating in PBCT shareholders receiving 0.118 shares of M&T Bank for each share owned. The combined bank will reach more than 20% of the U.S. population. Almost all of the required approvals have closed, with only the Board of Governors of the Federal Reserve remaining.

Growth Prospects

While People’s United produces a small amount of organic growth – as just about any other bank would – its strategy instead focuses on acquiring its growth. It has a diversified portfolio of financial services it can offer to customers, but its bread and butter is still core deposit-taking and lending activities.

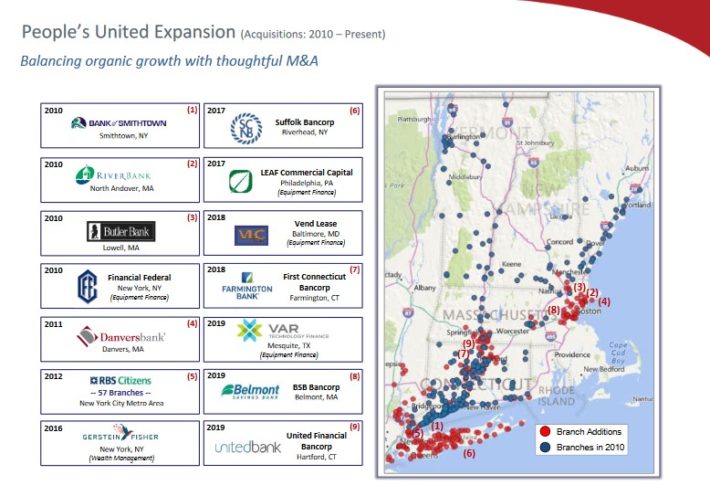

Source: Investor presentation

Above we can see the myriad acquisitions the bank has made in the past decade. This has helped People’s United bolster its organic branch growth, and as mentioned, earnings have grown steadily over time.

We see People’s United producing 4% earnings-per-share growth annually over the next five years, given that its growth-by-acquisition strategy is lumpy and unpredictable. However, much of the company’s future growth will be determined by the combined entity formed once the acquisition closes between PBCT and MTB.

With interest rates near historic lows, organic growth of earnings is tough to come by for all banks, People’s United included. In addition, since it issues stock for acquisitions, its share count rose over time, introducing a significant headwind for earnings-per-share even if earnings grow.

Still, we see the bank as a strong operator, so we think it has some meaningful growth in front of it, particularly once its acquisition closes.

Competitive Advantages & Recession Performance

Competitive advantages are difficult to come by for banks given that they largely offer the same products and services as their competitors. However, one way to offer an advantage is to grow scale in key markets, and that is exactly what People’s is doing with Boston as an example.

Growing scale and name recognition in key markets like that can help drive efficiency and scale. This key strategic pillar is a differentiator, and we think it will serve People’s well in the coming years.

However, that certainly does not insulate People’s from economic downturns. Its performance during the Great Recession was not spectacular, but it did fare much better than many of its larger competitors in the banking industry. People’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $0.52

- 2008 earnings-per-share of $0.42 (19% decline)

- 2009 earnings-per-share of $0.30 (29% decline)

- 2010 earnings-per-share of $0.24 (20% decline)

While People’s remained profitable throughout, the damage was significant. Indeed, it was 2011 before People’s earnings-per-share crested its pre-recession high, hitting $0.57 in that year to top 2007’s level of $0.52. Growth has been robust since that time, however, and we are anticipating the company will generate earnings-per-share of $1.36 this year.

Valuation & Expected Returns

People’s has a current price-to-earnings ratio of 14.3 based on our estimate of $1.36 of earnings-per-share for this year. This is slightly higher than our fair value estimate of 13.5 times earnings, so we see People’s United stock as somewhat overvalued after the run-up in the stock price.

Thus, People’s United stock does not possess a margin of safety at current prices. Should the stock valuation contract to our estimate of fair value, it would provide a -1.5% annual headwind to total returns for shareholders.

In addition, we see earnings-per-share growth at 4% annually. Combined with valuation changes and the current 3.8% yield, total annual returns are expected to reach nearly 6%. This is a fair expected rate of return, which earns a hold recommendation, due to the expected growth and yield, offset by the the lack of a margin of safety. People’s may intrigue income investors interested in the high current yield.

The payout ratio is also just over half of earnings after years of slow payout growth. This was necessary as the company’s payout ratio had previously exceeded earnings, but it is in a much better spot now. Keep in mind that all-stock acquisitions make the dividend costlier even if it isn’t raised on a per-share basis, meaning growth will likely be muted. We are forecasting low-single-digit growth in the payout in the coming years for this reason.

Final Thoughts

People’s United stock has an attractive dividend yield of nearly 4%, and growth potential for the years ahead. The bank is not immune from economic downturns, but the larger combined company with M&T Bank will be better equipped to weather an economic storm. People’s United has proven to be adept at finding and acquiring growth in its key markets, and we have no reason to believe that won’t continue.

People’s United stock is appealing for those interested in the combined company with M&T Bank, its strong competitive position in key markets in the Northeast, and its 3.8% dividend yield, however, shares currently trade above our fair value. For these reasons, we continue to rate People’s a hold for high-yield investors.