Updated on November 22nd, 2019 by Eli Inkrot

There are several things about United Technologies (UTX) that make it a unique dividend stock. For starters, the company has paid a dividend every year dating back to 1936. Even more impressive is the fact the company has increased its dividend for 25 consecutive years, earning the prestigious Dividend Aristocrats and joining an exclusive group of 57 such companies.

In addition to the full downloadable spreadsheet, you can see a preview of the Dividend Aristocrats list in the table below:

| 3M Co. | 165.49 | 3.4 | 94,963 | 19.3 | 66.4 | 1.07 |

| A. O. Smith Corp. | 48.21 | 1.8 | 6,640 | 19.9 | 36.3 | 0.91 |

| Abbott Laboratories | 83.19 | 1.5 | 147,896 | 44.8 | 68.9 | 1.06 |

| AbbVie, Inc. | 86.02 | 4.9 | 127,947 | 39.5 | 196.3 | 0.88 |

| Aflac, Inc. | 53.88 | 2.0 | 39,541 | 13.2 | 26.3 | 0.71 |

| Air Products & Chemicals, Inc. | 237.41 | 1.9 | 52,365 | 29.8 | 57.4 | 0.81 |

| Archer-Daniels-Midland Co. | 42.71 | 3.2 | 23,837 | 20.2 | 65.5 | 0.81 |

| AT&T, Inc. | 37.81 | 5.4 | 274,668 | 16.9 | 91.0 | 0.61 |

| Automatic Data Processing, Inc. | 170.58 | 1.9 | 73,498 | 31.2 | 57.8 | 1.02 |

| Becton, Dickinson & Co. | 249.23 | 1.2 | 67,207 | 62.9 | 77.7 | 0.99 |

| Brown-Forman Corp. | 67.28 | 1.0 | 32,109 | 39.2 | 38.2 | 0.71 |

| Cardinal Health, Inc. | 55.43 | 3.5 | 16,136 | -4.0 | -13.6 | 0.92 |

| Caterpillar, Inc. | 143.41 | 2.5 | 79,229 | 13.5 | 34.0 | 1.38 |

| Chubb Ltd. | 150.57 | 2.0 | 67,966 | 18.9 | 37.2 | 0.63 |

| Chevron Corp. | 119.30 | 3.9 | 224,578 | 17.0 | 66.8 | 0.85 |

| Cincinnati Financial Corp. | 106.39 | 2.1 | 17,332 | 18.9 | 39.3 | 0.72 |

| Cintas Corp. | 256.13 | 1.0 | 26,250 | 29.4 | 29.3 | 1.01 |

| The Clorox Co. | 144.93 | 2.8 | 18,200 | 22.7 | 63.2 | 0.45 |

| The Coca-Cola Co. | 52.92 | 3.0 | 226,906 | 29.3 | 87.9 | 0.43 |

| Colgate-Palmolive Co. | 66.61 | 2.5 | 57,207 | 24.7 | 62.9 | 0.54 |

| Consolidated Edison, Inc. | 86.59 | 3.4 | 28,861 | 20.3 | 69.0 | 0.24 |

| Dover Corp. | 109.39 | 1.8 | 15,848 | 24.4 | 43.1 | 1.07 |

| Ecolab, Inc. | 182.96 | 1.0 | 52,754 | 34.6 | 34.8 | 0.80 |

| Emerson Electric Co. | 73.42 | 2.7 | 44,809 | 19.6 | 52.3 | 1.17 |

| Exxon Mobil Corp. | 69.60 | 4.9 | 294,781 | 20.3 | 98.5 | 0.92 |

| Federal Realty Investment Trust | 130.06 | 3.2 | 9,904 | 38.6 | 122.1 | 0.52 |

| Franklin Resources, Inc. | 27.40 | 3.8 | 13,572 | 11.6 | 44.1 | 1.11 |

| General Dynamics Corp. | 182.95 | 2.2 | 52,928 | 15.7 | 34.2 | 0.91 |

| Genuine Parts Co. | 102.82 | 2.9 | 14,901 | 18.8 | 55.0 | 0.78 |

| Hormel Foods Corp. | 42.76 | 1.9 | 22,811 | 23.2 | 44.3 | 0.48 |

| Illinois Tool Works, Inc. | 172.87 | 2.4 | 55,481 | 22.7 | 53.3 | 1.20 |

| Johnson & Johnson | 137.13 | 2.7 | 359,092 | 25.8 | 69.7 | 0.61 |

| Kimberly-Clark Corp. | 132.84 | 3.1 | 45,716 | 22.6 | 69.7 | 0.46 |

| Leggett & Platt, Inc. | 52.19 | 3.0 | 6,845 | 23.4 | 70.0 | 1.08 |

| Linde Plc | 205.03 | 1.7 | 110,797 | 21.0 | 35.3 | 0.78 |

| Lowe's Cos., Inc. | 117.62 | 1.8 | 89,871 | 31.1 | 54.4 | 1.04 |

| McCormick & Co., Inc. | 166.09 | 1.3 | 22,120 | 31.2 | 41.9 | 0.39 |

| McDonald's Corp. | 192.98 | 2.4 | 144,857 | 25.1 | 60.3 | 0.43 |

| Medtronic Plc | 111.28 | 1.9 | 148,098 | 32.0 | 59.7 | 0.67 |

| Nucor Corp. | 54.71 | 2.9 | 16,446 | 9.3 | 27.3 | 1.15 |

| People's United Financial, Inc. | 16.29 | 4.3 | 7,203 | 12.4 | 53.6 | 0.96 |

| Pentair Plc | 43.36 | 1.6 | 7,288 | 21.1 | 34.7 | 1.20 |

| PepsiCo, Inc. | 134.03 | 2.8 | 186,728 | 15.2 | 42.7 | 0.53 |

| PPG Industries, Inc. | 125.43 | 1.6 | 29,718 | 24.6 | 38.3 | 0.91 |

| Procter & Gamble Co. | 119.98 | 2.4 | 300,105 | 74.5 | 181.8 | 0.53 |

| Roper Technologies, Inc. | 352.90 | 0.5 | 36,838 | 31.7 | 16.6 | 1.04 |

| S&P Global, Inc. | 267.53 | 0.8 | 64,616 | 31.5 | 26.0 | 0.99 |

| The Sherwin-Williams Co. | 570.17 | 0.7 | 52,483 | 37.6 | 28.0 | 0.87 |

| Stanley Black & Decker, Inc. | 155.19 | 1.7 | 23,575 | 33.3 | 57.3 | 1.52 |

| Sysco Corp. | 79.32 | 2.0 | 40,420 | 24.0 | 47.2 | 0.51 |

| T. Rowe Price Group, Inc. | 120.67 | 2.5 | 28,048 | 15.1 | 37.3 | 1.22 |

| Target Corp. | 127.68 | 2.0 | 65,220 | 20.2 | 41.2 | 0.85 |

| United Technologies Corp. | 147.98 | 2.0 | 127,134 | 24.8 | 49.2 | 1.09 |

| VF Corp. | 85.22 | 2.3 | 33,866 | 26.2 | 60.3 | 1.14 |

| W.W. Grainger, Inc. | 316.50 | 1.8 | 16,840 | 18.4 | 32.5 | 1.07 |

| Walmart, Inc. | 119.96 | 1.8 | 340,915 | 23.8 | 41.9 | 0.61 |

| Walgreens Boots Alliance, Inc. | 61.11 | 2.9 | 54,105 | 14.2 | 41.2 | 1.03 |

| Certain securities may be excluded due to data limitations | ||||||

| Name | Price | Dividend Yield | Market Cap ($M) | Forward P/E Ratio | Payout Ratio | Beta |

The structure of these payouts is also interesting. Unlike many of its dividend growing counterparts, United Technologies does not follow the traditional “four quarters and raise” method of extending a yearly dividend growth streak. Instead, the company usually pays the same dividend for 5 quarters before increasing it.

This still leads to year-over-year increases, but it moves the company’s dividend boost throughout the year. There are many ways to become a successful Dividend Aristocrat.

United Technologies is in a period of significant transformation, but investors can be confident that the company should maintain its dividend growth for many years.

Business Overview

United Technologies was founded in 1934 and has since grown into a very successful group of companies. These include Pratt & Whitney, which manufactures and services engines for commercial and military customers; Otis, the world’s largest producer and servicer of elevators and escalators; UTC Climate, which produces HVAC equipment; and UTC Aerospace, which creates aerospace and industrial products.

However, the company is currently going through a significant transformation. In November 2018, United Technologies completed a $30 billion acquisition of Rockwell Collins. At the same time, the company announced that it was spinning off its Otis business and its Climate, Controls and Security (CCS) business into two separate independent companies. Otis will retain its name and CCS will take the name of Carrier.

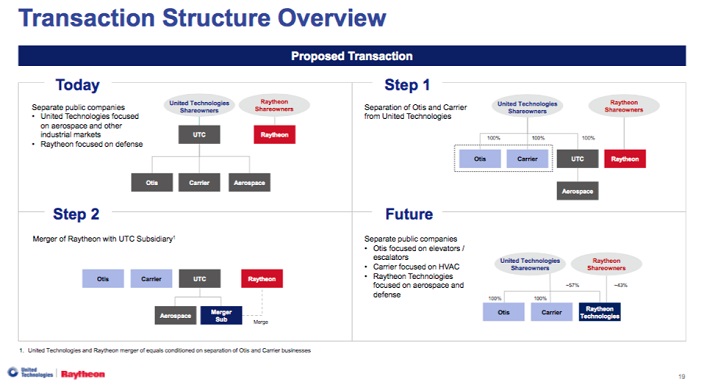

On June 9th, 2019 it was announced that the remaining United Technologies businesses would merge with Raytheon Company (RTN). The deal is expected to close following the spinoffs of Otis and Carrier in the first half of 2020. Raytheon shareholders will receive 2.3348 shares in the combined company for each share of Raytheon they own. The new company will be called Raytheon Technologies. Pro forma 2019 sales are expected to be approximately $74 billion. Shareholders for both companies approved the merger on October 11th, 2019 and it is expected to be completed in the first half of 2020.

Here’s what United Technologies path to a new company will look like:

Source: United Technologies Aerospace Businesses and Raytheon to Combine

Current UTX shareholders currently have one stake in United Technologies, which means they own 100% of the Otis, Carrier and Aerospace businesses. After all of the transactions are complete, today’s UTX shareholders will own three separate businesses: 100% of Otis, 100% of Carrier and roughly ~57% of the new company to be called Raytheon Technologies. With that in mind, it is somewhat difficult to forecast how each of these companies will perform independently in the years to come. However, it is still useful for investors to understand the terms of the deal and the future growth outlook of the respective companies.

Growth Prospects

The aerospace and defense industries have seen a renaissance in recent years. Air travel is expected to double in the next two decades. Only 20% of the world’s population has flown by airplane. It is expected that more people will be able to travel by air as the middle class grows in emerging markets.

In addition, the world’s fleet of airplanes is quite old. Boeing (BA), the world’s largest manufacturer of commercial airplanes, expects that the world will need as many as 43,000 new planes over the next twenty years.

Defense spending has also increased. The U.S. had a defense budget of $700 billion for fiscal year 2019. That spending is expected to increase in future years as well.

This trend is noticeable in the United Technologies’ expectations for this year’s sales growth:

Source: Third Quarter 2019 Earnings

Organic sales are expected to be flat at Carrier and up low to mid-single digits at Otis, while the Collins Aerospace and Pratt & Whitney segments are expected to be up mid-to-high single digits and high single digits respectively.

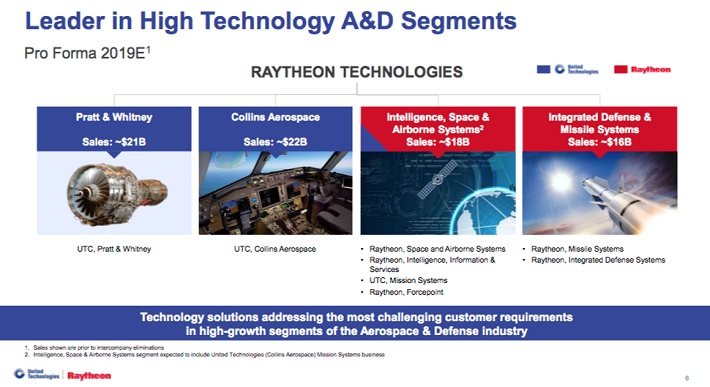

Of course, the businesses will look much different next year. Focusing on Aerospace & Defense, two of United Technologies legacy businesses will make up a little over half of the new, combined corporation.

Source: United Technologies Aerospace Businesses and Raytheon to Combine

As such, coming up with a growth forecast can be challenging. Still, we have a bit of precedent, as both United Technologies and Raytheon have very solid operating histories. Over the last decade United Technologies has grown its earnings-per-share by an average compound rate of roughly 4.5% per annum, while Raytheon has compounded earnings-per-share by 9.9% per year. Granted, both are much larger now, and there is some uncertainty related to the merger. Taken collectively, reasonable expectations would be for 5% growth as an intermediate-term baseline.

Competitive Advantages & Recession Performance

Both United Technologies and Raytheon have exhibited strong competitive advantages in their respective businesses for many years. Each has a strong independent record, with billions in annual profits (that grows over time) and a dividend that increases as well. Raytheon does not quite have the same dividend growth track record, but the payout has been increasing for the last 15 years.

Here’s a look at United Technologies record during the last recession:

- 2007 earnings-per-share of $4.27

- 2008 earnings-per-share of $4.90 (15% increase)

- 2009 earnings-per-share of $4.12 (16% decrease)

- 2010 earnings-per-share of $4.74 (15% increase)

Industrial companies depend on a growing economy in order to perform well, with recessions causing customers to pause large purchases. However, United Technologies actually held up fairly well during the last recession, remaining profitable throughout the entire period and growing at a reasonable pace since that time.

With that said, the company will be less diversified after the completion of the Otis and Carrier spin offs.

Here’s a look at Raytheon’s record during the last recession:

- 2007 earnings-per-share of $3.31

- 2008 earnings-per-share of $3.95 (19% increase)

- 2009 earnings-per-share of $4.89 (24% increase)

- 2010 earnings-per-share of $4.79 (2% decrease)

Raytheon held up even better than United Technologies, with earnings barely declining in 2010. Indeed, the company’s earnings-per-share have increased in 12 of the last 15 years.

While the combined company will be more of a “pure-play” than United Technologies investors may have been used to, it is clear that the merger is between two strong businesses.

Valuation & Expected Returns

For the remainder of 2019, United Technologies anticipates adjusted earnings-per-share of between $8.05 to $8.15. Based on the current share price near $148, shares are presently trading hands at a P/E ratio of 18.2 times this year’s expected earnings, at the mid-point of guidance.

United Technologies’ typical P/E ratio has been in the 13 to 18 range over the past decade, with an average near 16 times earnings. If shares were to revert to this mark after 5 years, this would imply a -2% to -3% annualized valuation headwind.

When you combine the expected growth rate (~5%) and the 2.0% starting dividend with the possibility of a moderate valuation headwind, this means that investors might anticipate mid-single-digit annualized total returns over the intermediate-term.

This thesis could be too conservative if shares were to trade at a higher multiple or if growth accelerates faster than expected, For example, higher-than-expected cost synergies from the merger could boost EPS growth higher than current expectations. However, the valuation is elevated based on a historical prospective and it is yet to be seen whether or not the merger benefits shareholders as anticipated.

Final Thoughts

A year from now, United Technologies will be a significantly different company than it is today. Instead of owning a single stock industrial conglomerate, shareholders will own a stand-alone elevator company, a stand-alone HVAC company and a merged Aerospace & Defense company. Collectively the risk profile would be quite similar, but independently these businesses may perform significantly different than in the past.

Focusing on its aerospace and defense businesses will likely put United Technologies in a position to succeed in future years. In addition, the company recently became a Dividend Aristocrat, which could make the stock an attractive option for dividend growth investors.

That said, we find that shares of United Technologies may only offer mid-single-digit total return potential from this juncture. We are enthused about the company’s enhanced growth prospects moving forward, along with its solid history, but we are not yet compelled by the valuation.