Updated on January 20th, 2020 by Bob Ciura

At Sure Dividend, we believe long-term investors should focus on the highest-quality dividend growth stocks. Broadly speaking, these are companies with long histories of raising their dividends, and the competitive advantages and growth potential to fuel continued dividend growth in the years ahead.

Therefore, we tend to steer investors toward the Dividend Aristocrats, a group of 57 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases. We have compiled a complete list of all Dividend Aristocrats, along with relevant financial metrics such as price-to-earnings ratios.

You can download your free list of all Dividend Aristocrats by clicking on the link below:

We review each of the 57 Dividend Aristocrats every year. The next stock to be reviewed in this year’s edition is AbbVie (ABBV).

AbbVie is coming off a multi-year period of excellent growth, thanks to the massive success of its flagship product Humira. There are questions regarding the company’s future growth due to increasing competition to Humira in the U.S. and Europe, but the company has a plan to continue its impressive growth.

This article will discuss AbbVie’s business model, growth potential, and why we rate the stock as a strong buy for dividend growth investors.

Business Overview

AbbVie is a global pharmaceutical giant. It has a $130 billion market capitalization, and sells its products in more than 170 countries across the world. AbbVie began trading as an independent company in 2013, after it was spun off from fellow pharmaceutical Dividend Aristocrat, Abbott Laboratories (ABT).

Today, AbbVie focuses on one main business segment—pharmaceuticals. It focuses on a few key treatment areas, including immunology, oncology, and women’s health. The company has seen excellent growth since it was spun off from Abbott. AbbVie now generates annual revenue of nearly $33 billion.

Since the spin-off from Abbott, AbbVie produced 12% annual revenue growth and over 20% annual earnings growth through 2018. Humira has been the major reason for AbbVie’s huge growth. Humira is a multi-purpose drug, and is the top-selling drug in the world.

AbbVie reported its third-quarter earnings results on November 1st. Revenue of $8.5 billion increased 3.5% operationally. Revenue was positively impacted by strong growth from Imbruvica, grossing sales of $1.3 billion, up 29% from the previous year’s quarter.

However, Humira’s total global revenue declined by 3.2% year over year. Domestic sales growth of 10% for Humira was more than offset by a 32% decline in the international markets, due to biosimilar competition. That said, on an adjusted basis, AbbVie grew earnings-per-share by 8.9% year-over-year.

Along with its quarterly results, the company raised its full-year guidance. AbbVie now expects 2019 adjusted EPS in a range of $8.90 to $8.92, up from $8.82 to $8.92. The new guidance range represents full-year adjusted EPS growth of 12.6%, at the midpoint. In addition, AbbVie raised its quarterly dividend by 10%.

Growth Prospects

The major risk for global pharmaceutical manufacturers is patent loss. When a particular drug loses patent, the market is typically flooded with competition, especially for the world’s top-selling products.

For AbbVie, its biggest risk is the competition about to hit its flagship drug Humira, a multi-purpose drug that is used to treat a variety of conditions. Some of these include rheumatoid arthritis, plaque psoriasis, Crohn’s disease, ulcerative colitis, and more.

Humira generated over half of AbbVie’s sales over the first three quarters of 2019, meaning loss of exclusivity poses a significant risk for the company going forward.

Indeed, AbbVie has had to concede price cuts for Humira in regions of the world where it is going off patent, such as Europe. As a result, international Humira sales fell 28.5% operationally over the first three quarters of 2019.

In addition, AbbVie will face biosimilar competition to Humira in the U.S. starting in 2023. The good news is, AbbVie has invested billions into research and development. As a result, the company has a large portfolio of new products that should offset any sales declines from the competitive threats to Humira.

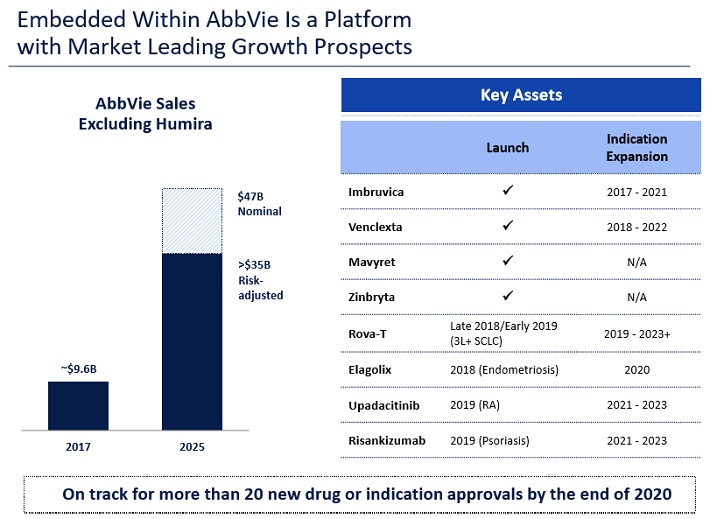

Its two biggest areas of growth going forward will be hematologic oncology, and next-generation immunology. AbbVie management believes the company’s oncology business has the potential to reach $9 billion in sales by 2025.

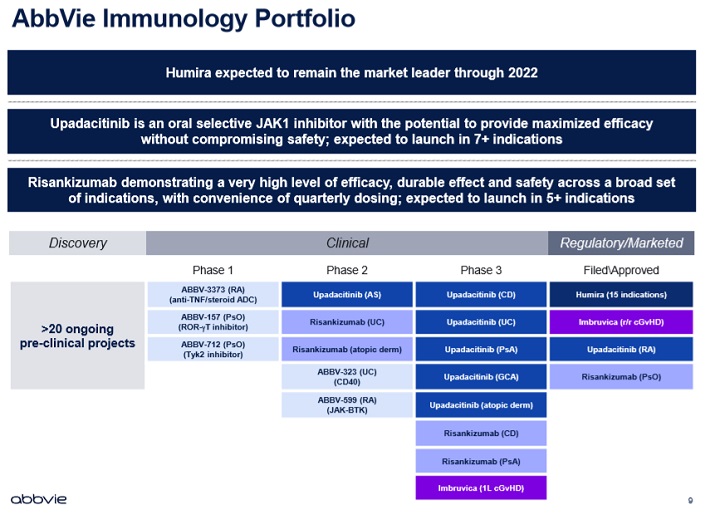

Meanwhile, AbbVie expects its immunology portfolio to generate sales of over $10 billion by 2025.

Source: Investor Presentation

AbbVie has reached six settlements related to Humira competitors. Fortunately, AbbVie has prepared for this increasing competition to Humira, by investing heavily in new product development.

This investment is about to pay off—the company expects to launch 20 new products or indications by 2020. AbbVie expects non-Humira product sales to exceed $16 billion by 2020, and $35 billion by 2025.

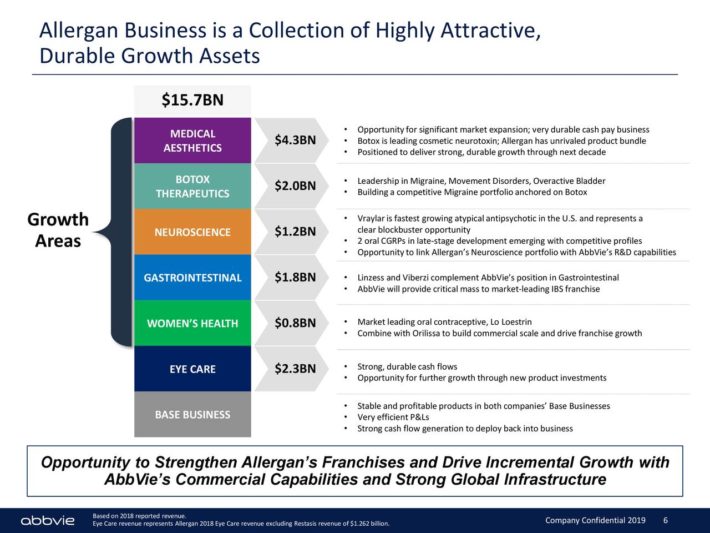

Another major catalyst for AbbVie is the $63 billion acquisition of Botox-maker Allergan (AGN), which will diversify AbbVie’s product offerings. The combined company will have annual revenues of nearly $50 billion. AbbVie expects the transaction to be 10% accretive to adjusted EPS over the first full year following the close of the transaction, with peak accretion of greater than 20%.

Source: Investor Presentation

Share buybacks will also add to AbbVie’s future earnings growth. Since the company is highly profitable and generates significant free cash flow, it can afford to invest in growth and also return cash to shareholders.

Continued buybacks help boost earnings. As shares are repurchased and retired, each remaining share receives a higher percentage of the company’s profits, thus increasing earnings-per-share.

Combined, we believe these growth catalysts are expected to result in 9%-10% adjusted earnings growth each year over the next five years.

Competitive Advantages & Recession Performance

The most important competitive advantage for AbbVie, and any pharmaceutical company, is its patent portfolio. Pharmaceutical giants need to spend heavily to innovate new drugs and therapies, when one of their blockbusters loses patent protection.

To build its pipeline and to prepare for the decline of Humira, AbbVie has accelerated research and development spending. AbbVie spent nearly $5 billion on R&D last year alone.

Fortunately, this spending is starting to show positive results, as AbbVie has a robust pipeline.

Source: Strategic Update

It is unclear how AbbVie itself performed during the Great Recession, as it was still part of Abbott Laboratories. However, it stands to reason the company would hold up fairly well during the next recession.

Prescription drugs and medical supplies are necessities, with stable demand. Consumers often cannot choose to go without healthcare, even when the economy is in a downturn. As a result, investors can reasonably assume AbbVie’s profits would experience a modest decline during a recession.

Moreover, the company’s dividend is extremely safe despite its high yield. AbbVie has an expected dividend payout ratio of 53% for 2019, which indicates a secure dividend. AbbVie will be more leveraged following the transaction, as a portion of the cash component of the offer will be funded with new debt.

Fortunately, the company is committed to a Baa2/BBB or better credit rating. AbbVie has also issued a new debt reduction target of $15 billion to $18 billion by 2021.

Valuation & Expected Returns

AbbVie is expected to generate adjusted EPS of $8.91 for 2019. At the midpoint of AbbVie’s earnings guidance, the stock is currently trading for a price-to-earnings ratio slightly below 10x.

AbbVie is valued considerably below the S&P 500 Index. In addition, AbbVie is undervalued today when compared to its historical average. Our fair value estimate for AbbVie is a price-to-earnings ratio of 11.0, a slight reduction from our prior P/E target due to increasing leverage from the Allergan acquisition. Still, we view AbbVie as significantly undervalued. An expanding P/E multiple could boost shareholder returns by approximately 2.1% per year over the next 5 years.

In addition, we expect annual earnings growth of 9.5% through 2024. Lastly, the stock has a current dividend yield of 5.4%. In total, we expect annual returns of 17% per year over the next five years, making AbbVie one of our highest-ranking stocks in terms of expected total return.

Final Thoughts

AbbVie is a very high-quality business, with a strong pharmaceutical pipeline and growth potential. It is also a shareholder-friendly company that returns excess cash flow to investors through stock buybacks and dividends.

AbbVie faces a significant challenge in replacing lost Humira sales as it faces competition in the U.S. and Europe. Fortunately, the company has prepared for this with heavy R&D investments. From this, it has created a large portfolio of new products that should keep AbbVie’s growth intact. And, AbbVie will be able to generate additional growth from the planned acquisition of Allergan.

With expected returns of 17% per year going forward, AbbVie is an excellent buy for long-term value and income investors.