Updated on January 17th, 2020 by Josh Arnold

The Dividend Aristocrats represent a group of 57 stocks in the S&P 500 Index, each with at least 25 consecutive years of dividend increases.

The Dividend Aristocrats are among the highest-quality dividend growth stocks in the entire stock market. For this reason, we individually review every Dividend Aristocrat each year.

You can download your full list of Dividend Aristocrats by clicking on the link below:

The next installment of the 2020 series takes a closer look at Linde plc (LIN), which qualifies on the list as a result of its acquisition of Praxair, a former Dividend Aristocrat.

The Praxair acquisition should be a meaningful growth catalyst for many years to come, as it has been in the year or so since it was completed. As a result, we view Linde favorably as a dividend growth stock.

Linde is an industry leader with a highly profitable business, but a sustained rally in the stock has the yield down to just 1.6%. The valuation has grown substantially with the recent rally, which is why investors should hold off from buying the stock right now.

Business Overview

Linde plc – which was created through the merger of Linde AG and Praxair – is the world’s largest industrial gas corporation. Linde AG is headquartered in the U.K. following the merger. The company produces, sells, and distributes atmospheric, process, and specialty gases, along with high-performance surface coatings.

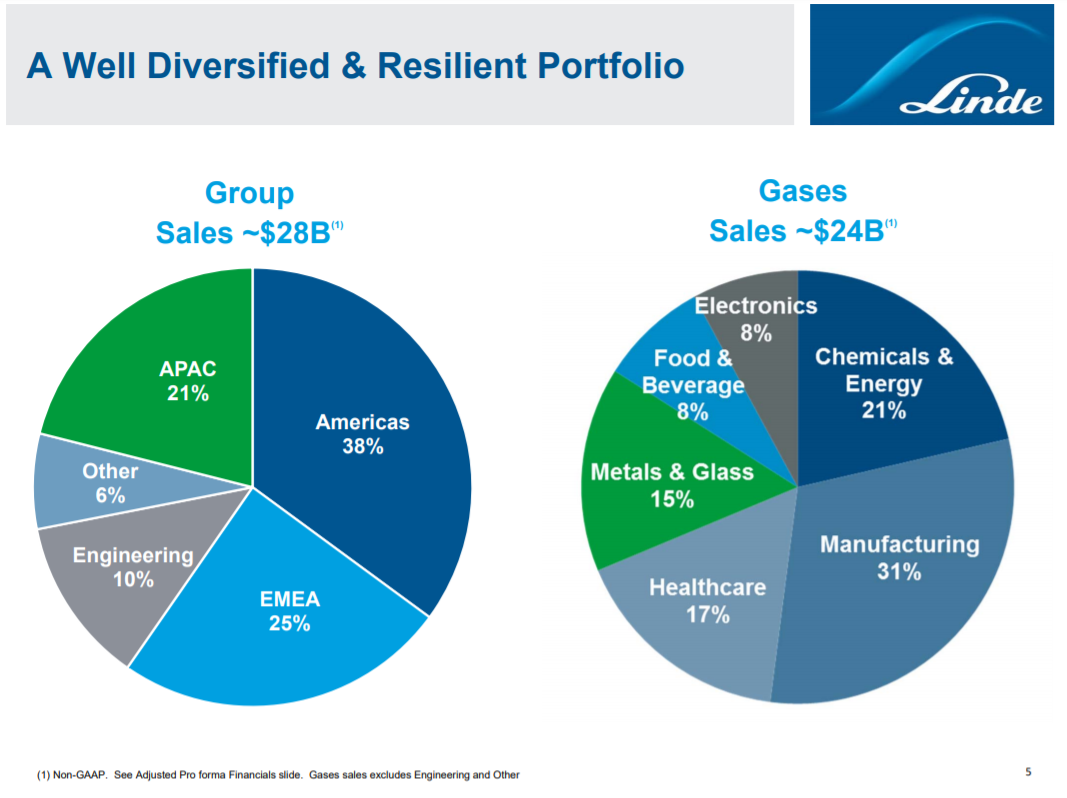

Linde products and services can be found in nearly every industry, in more than 100 countries around the world. The combined company now generates about $30 billion of annual revenue, and trades with a market capitalization of $113 billion. The company operates in five segments: Americas, EMEA, APAC, Engineering, and Global Other.

Linde gases are used in a variety of industries, including energy, steel production, chemical processing, environmental protection, food processing, electronics, and more. The company also has a healthcare business consisting of medical gases and services. In total, Linde derives about half of its revenue from Energy customers.

Source: Investor Presentation, page 5

Linde’s exposure to any particular geographical area has been improved thanks to the merger, as it now has a strong, global customer base throughout a variety of industries. Indeed, Linde now serves customers in more than 100 countries around the world. In addition, it has scale and size unlike any competitor, putting it in an enviable position.

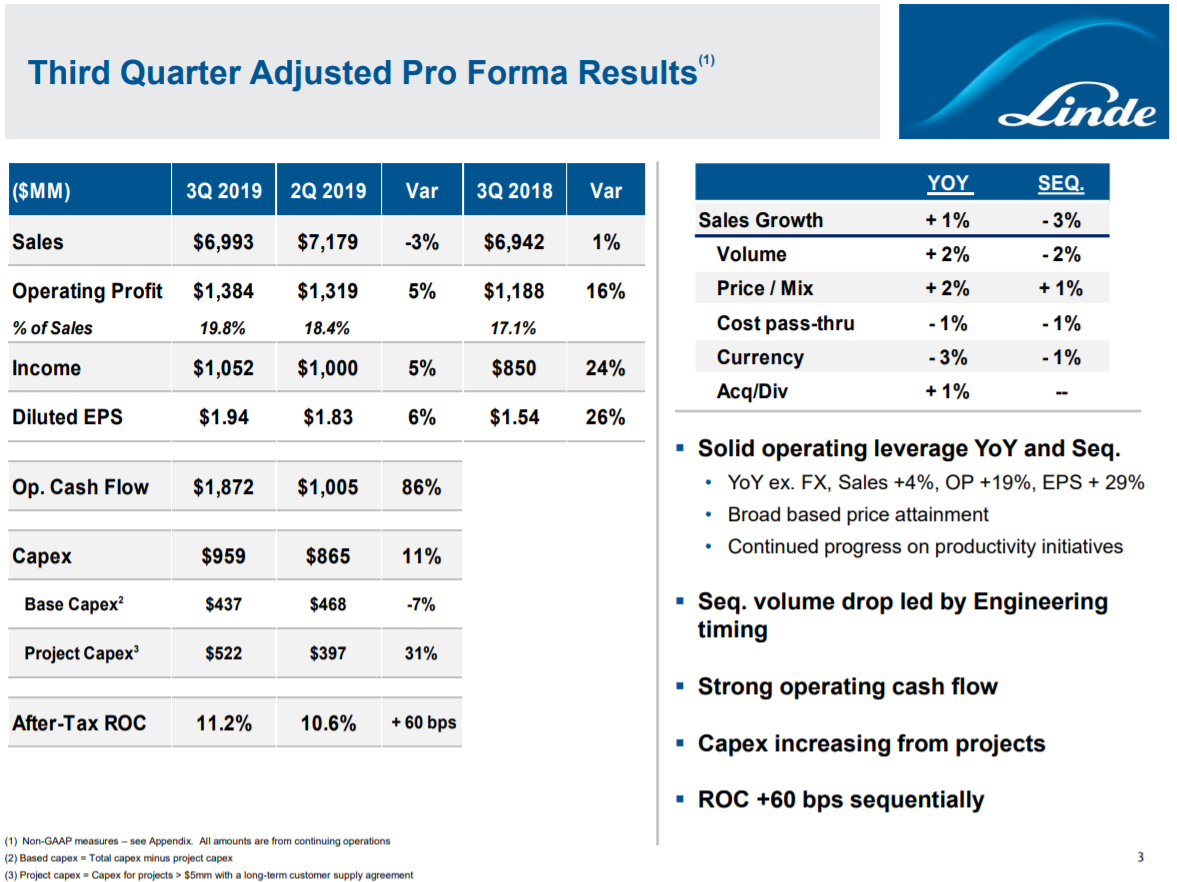

Linde’s recent earnings have shown little growth on the top line, but merger synergies are producing very strong profit growth. Total revenue was up just 1% year-over-year, and down 3% sequentially. On the plus side, excluding forex translation, revenue would have risen 4%.

Source: Investor presentation, page 3

The company did produce year-over-year volume and price/mix growth of 2% each during the quarter, although volume was certainly weak against Q2 of 2019. Management commentary suggests macro weakness globally for Linde’s products, and Q3 results are supportive of this cautious view.

The good news is that operating profits soared as operating income as a percentage of revenue rose from 17.1% to 19.8% year-over-year. This led to a 16% gain in operating income despite a modest revenue increase, given that merger synergies are taking shape. Earnings-per-share rose 26% year-over-year thanks to a lower share count and the gain in operating margins.

Looking forward, management expects full-year results to see earnings-per-share of $7.25 to $7.30 following Q3 results.

Growth Prospects

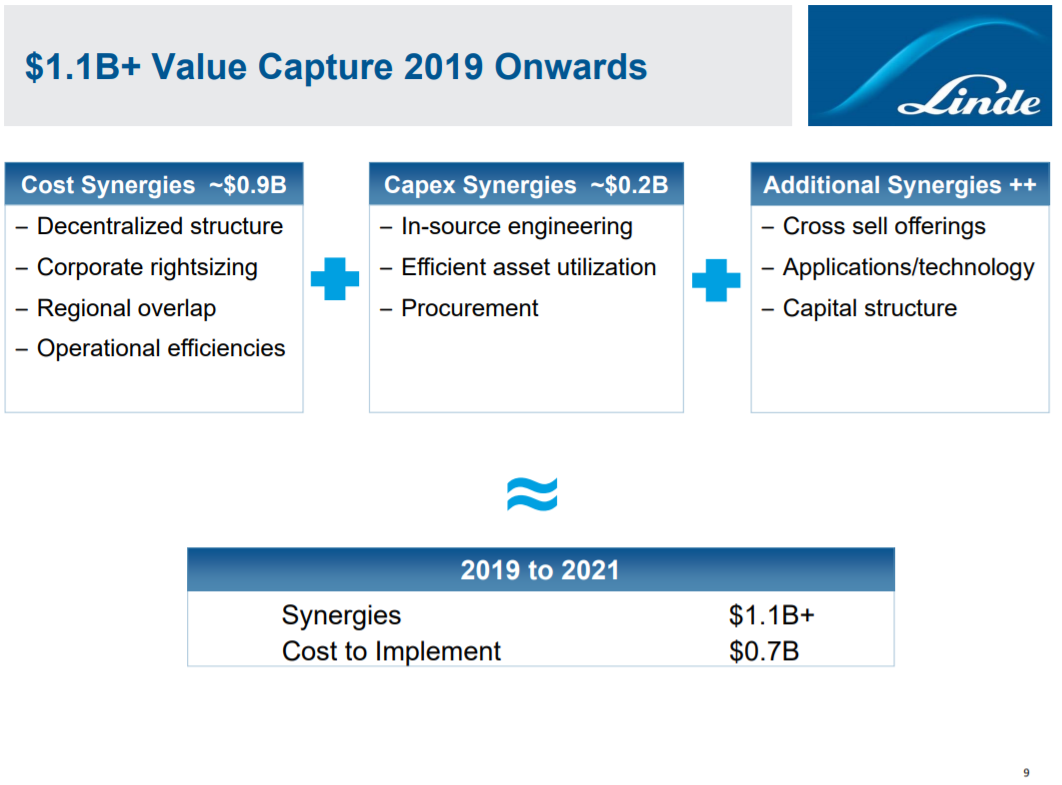

The Praxair merger has been the primary driver of growth since it was consummated, with this year’s results showing merger synergies coming through. Cost savings are resulting in much higher operating margins, growing earnings at a much faster rate than revenue.

Source: Investor presentation, page 9

This slide gives us an overview of the types of savings the company expects to accrue over time, and the methods via which those synergies will be achieved. Results for the first nine months of 2019 showed much higher SG&A costs over the comparable period in 2018, which is expected given the two companies are still being integrated. During merger integrations, surplus employees must be bought out and infrastructure combined, both of which are expensive and take time to complete. The good news is that as these synergies continue to accrue, margins should also continue to improve into 2020 and beyond.

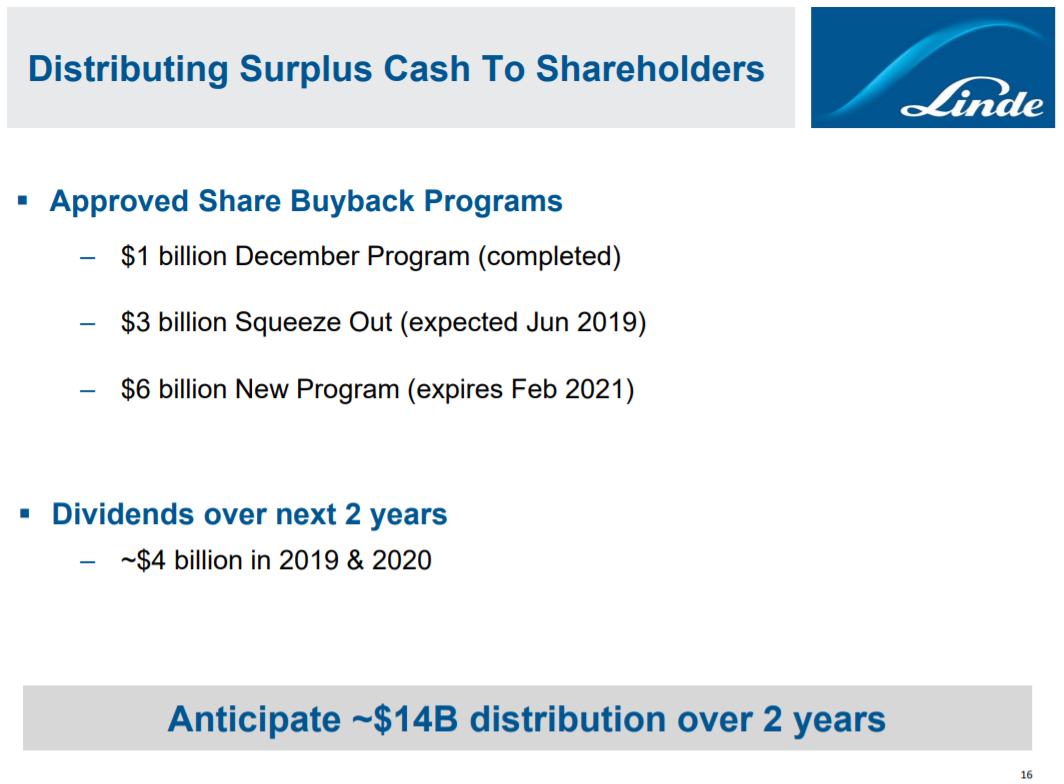

Source: Investor presentation, page 16

Share repurchases will also be a major catalyst for Linde’s future earnings growth. Linde completed a $1 billion share repurchase program in December of 2018, followed by a $3 billion buy out of Linde shares that weren’t tendered in the merger – “Squeeze Out” as listed above. Finally, the company has another $6 billion program that runs through February 2021.

In addition, the dividend was recently raised once again and now runs at about $2 billion annually. Linde is very serious about its capital returns as the business generates more cash than it can profitably invest, leading to these strong buyback and dividend numbers.

We expect Linde to grow its earnings-per-share by 6% per year over the next five years. We see revenue growth as modest, in addition to a small tailwind from margin growth and a lower share count, respectively.

Competitive Advantages & Recession Performance

Linde enjoys multiple competitive advantages. As the leader in industrial gases, the company enjoys economic scale and greater operational efficiency than its smaller competitors.

In addition, Linde’s financial resources allow the company to invest heavily in research and development. Linde spends about $180 million annually to build and maintain its competitive advantages.

Another competitive advantage is Linde’s strong financial position. The company has a healthy balance sheet, with high credit ratings of ‘A2’ from Moody’s and ‘A’ from Standard & Poor’s. Given that total liabilities have fallen from $36 billion to $33 billion in the time since the merger was completed, we expect these credit ratings to be stable. Maintaining investment-grade credit ratings helps the company access capital markets at an attractive cost, which means Linde can spend its cash on things like the dividend and buyback.

On the other hand, Linde is not a recession-resistant business. As a global industrial manufacturer, its business model is sensitive to fluctuations in the global economy. An economic downturn typically sees lower demand from industrial customers.

Linde’s earnings-per-share during the Great Recession are as follows:

• 2008 earnings-per-share of $4.19

• 2009 earnings-per-share of $4.01 (4.3% decline)

• 2010 earnings-per-share of $3.84 (4.2% decline)

• 2011 earnings-per-share of $5.45 (42% increase)

The company did see a modest decline in earnings-per-share during the recession, but fortunately saw its earnings improve alongside the broader global economic recovery. By 2011, Linde’s earnings had surpassed 2008 levels. We expect Linde’s revenue and margins to suffer during the next recession, but note that its current growth outlook is robust.

Valuation & Expected Returns

Linde is expected to generate earnings-per-share of $7.28 for 2019. Based on this, shares currently trade for a price-to-earnings ratio of 29. This is a high valuation for the stock, even though the company is highly profitable and growing earnings at a satisfactory rate. In addition, we see Linde as receiving a premium valuation due to its unmatched competitive position in the industry it serves.

Over the past 10 years, shares of Linde traded for an average price-to-earnings ratio near 21. As a result, our fair value estimate for the stock is a price-to-earnings ratio of 20. This is a reasonable fair value target for a strong company with durable competitive advantages. In addition, investors should keep in mind that earnings-per-share growth – despite all the advantages Linde possesses – should be in the mid-single-digits for the foreseeable future.

As a result, Linde appears to be significantly overvalued. If shares were to experience a falling valuation to reach our fair value estimate, it would reduce annual returns by nearly 7% per year. This represents a strong headwind for investors buying at the current price level.

Future returns will be boosted by earnings growth and dividends. In addition to Linde’s expected earnings growth of 6% per year over the next five years, the stock has a current annualized dividend of $3.50 per share.

Linde can certainly be classified as a dividend growth stock. The most recently quarterly dividend payout was increased 6% from the previous dividend, and we expect another dividend increase in February 2020. On an annualized basis, Linde’s dividend of $3.50 per share represents a dividend yield of 1.6%.

The combination of valuation changes, earnings growth, and dividends results in total expected returns of essentially zero through 2025. Earnings-per-share growth and the dividend yield will be virtually entirely offset by the valuation headwind, and we therefore see the stock as unattractive.

Linde is a very profitable company with a positive earnings and dividend growth outlooks, but the impact of overvaluation is enough to warrant a sell recommendation at the current price.

Final Thoughts

Linde stock has performed well since the merger with Praxair. Expectations are high for the potential of the combined company, but at this time we feel Linde’s stock is significantly overvalued.

Linde will be an industry leader with clear and durable competitive advantages. The company should grow revenue and earnings at a steady rate going forward, assuming the global economy stays out of recession.

However, while Linde is a strong business, the stock is too richly valued to buy today. While Linde should continue to raise its dividend each year, investors should wait for a significant decline in the share price before buying Linde stock.