Updated on January 15th, 2020 by Nathan Parsh

Every year, we individually review all the Dividend Aristocrats . The Dividend Aristocrats are a select group of stocks in the S&P 500, with 25+ years of consecutive dividend increases.

You can see a full downloadable spreadsheet of all 57 Dividend Aristocrats, along with several important financial metrics such as price-to-earnings ratios, by clicking on the link below:

The next Dividend Aristocrat in our 2020 series is A.O. Smith (AOS). On October 10th 2019, A.O. Smith increased its dividend by 9.1%. This marked the 26th consecutive year of dividend growth for the company.

With a current dividend yield of 2.0%, A.O. Smith might not appeal to investors looking for income right now, such as retirees. Those looking for high-growth dividend growth, on the other hand, might find the company attractive. Over the past five years, it has increased its dividend by 20% each year, on average.

And with a dominance of its industry, potential for growth, and a low dividend payout ratio, A.O. Smith could have much greater appeal to dividend growth investors.

Business Overview

A.O. Smith is a global leader applying energy-efficient products and solutions. It manufactures a variety of residential and commercial water heating equipment, as well as water treatment and air purification products.

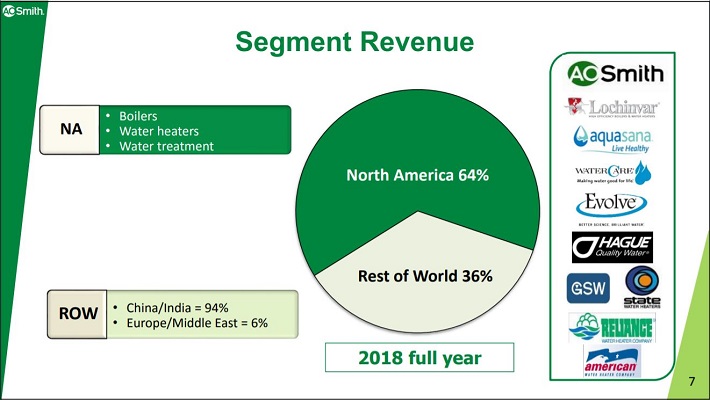

The company is perhaps best-known for its water heaters. It operates in two operating segments, separated by geography:

Source: Investor Presentation

- North America (64% of sales)

- Rest of World (36% of sales)

As you can see, the company has a sizable international presence, particularly in China where it generates 34% of total sales. The company is also in the early stages of operating in India, the second most populous country in the world. This business represents approximately 2% of total sales. Sales in India improved 9% in the most recent quarter.

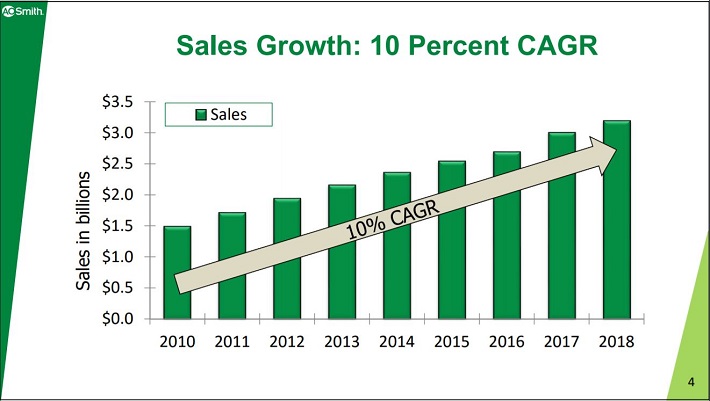

A.O. Smith has performed very well over the past decade, thanks largely to the steady global economic recovery coming out of the Great Recession of 2007-2009. The company’s sales have grown at a double-digit annual rate, on average, in the past 10 years.

Source: Investor Presentation

Combined with margin expansion and share repurchases, A.O. Smith’s impressive sales growth has fueled impressive earnings growth as well. In the same 10-year period, adjusted earnings-per-share increased 25% per year.

A.O. Smith has continued its growth in recent periods. On October 29th, A.O. Smith released third quarter earnings results, which were mixed. The company generated earnings-per-share of $0.53, which meet analysts’ estimates, but represented a decline of 13% from the previous year. Quarterly revenue declined 3.4% to $728.2 million, which missed estimates by $24.4 million.

For the first three quarters of 2019, revenue decreased 5.6% to $2.2 billion, while adjusted earnings-per-share were down 10.7%, to $1.67. A.O. Smith also lowered its earnings-per-share forecast to a range of $2.25 to $2.28 for 2019. This marks three consecutive quarters that the company lowered its earnings forecast for the year.

Much of these declines has been due to A.O. Smith’s international markets. This has been due to the ongoing worsening in global trade conditions, highlighted by the trade war between the U.S. and China. Still, we believe the company does have opportunities for long-term growth.

Growth Prospects

A.O. Smith’s growth catalysts in the U.S. include continued economic growth and increasing housing prices. As a manufacturer of water heating, water treatment, and air purification products, the company is reliant on a financially healthy consumer and housing market.

When home prices are rising and unemployment is low, consumers with disposable income are much more willing to invest in upgrades like new water heaters. This is how A.O. Smith realized record sales for 2018, which broke 2017’s record sales total.

Outside the U.S., the company’s main growth prospects are in China, where it already has a large operation. China is arguably the most attractive economy in the world. Not only does it have a population of more than 1 billion, and a growing middle class, but the country has been growing its economy at a high rate over the past several years.

While sales in China for 2018 grew 4% (2% excluding currency), sales for this very important region declined 20% in the most recent quarter. Weaker consumer demand and higher inventory levels were the primary drivers of this decline. Trade worries could also be impacting sales in China.

Still, China represents a major long-term opportunity for A.O. Smith. In the long run, the potential for growth in China is apparent. China now contributes over $1 billion in annual sales for the company and had been growing at a high rate before this year.

Sales in China rose more 20% each year in the ten year-period through 2017.

Source: Investor Presentation

There are reasons to be optimistic about A.O. Smith’s China business. Besides China’s large population, the air quality in the country is quite poor. This has caused demand for A.O. Smith’s air purifiers to be quite strong.

We expect A.O. Smith to grow earnings-per-share at a rate of 9% per year through 2025, which is half of the company’s growth rate over the last decade. We believe the company should be able to achieve at least this level of growth due to organic revenue growth and share repurchases.

A.O. Smith bought back 4.0 million shares in the first nine months of 2019 and has 4.1 million shares remaining on its repurchase authorization. The remaining share repurchase authorization represents 2.4% of the current $8 billion market cap. As a result, we see the potential for A.O. Smith to produce high-single digit EPS growth over the next several years.

Competitive Advantages & Recession Performance

A.O. Smith’s strong growth is due to its competitive advantages, primarily its top market share. A.O. Smith has the #1 market share in U.S. water heaters. It holds almost 40% domestic share, nearly 10 percentage points above its closest competitor.

In the commercial gas water heater market, A.O. Smith’s U.S. market share is 50%, while the closest competitor has market share below 30%. A.O. Smith is also the exclusive supplier of Lowe’s (LOW) water treatment products.

Possessing the top industry position gives A.O. Smith pricing power, and high margins. In turn, this provides the company the ability to generate lots of cash flow, which enables it to invest in new product innovation.

One potential risk for A.O. Smith is a recession. As a manufacturer, the company is closely tied to the health of the overall economy. It is not a highly recession-resistant business model.

Earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $0.48

- 2008 earnings-per-share of $0.49 (2% increase)

- 2009 earnings-per-share of $0.57 (16% increase)

- 2010 earnings-per-share of $0.43 (25% decline)

- 2011 earnings-per-share of $0.60 (39% increase)

As you can see, the company performed very well during 2008 and 2009, the worst years of the recession. Earnings took a significant hit in 2010, but quickly recovered in 2011. Overall, the company performed exceptionally well, since it was still able to grow earnings over the course of the recession.

Valuation & Expected Returns

Based on the current share price of $46 and the midpoint of the company’s lowered earnings per share guidance for 2019 of $2.27, A.O. Smith shares currently trade for a price-to-earnings ratio of 20.4. The stock has traded with a least a price-to-earnings ratio of at least 20 for much of the past decade. Due to current conditions in the company’s Chinese business, we believe a price-to-earnings multiple target of 18 seems appropriate.

While the stock has spent much of the last ten years above this valuation, shares of A.O. Smith are overvalued at the moment against this figure. If the stock could expand to meet our target valuation by 2025, investors would see annual returns reduced by 2.5% over the next five years.

Shareholder returns will also be boosted by earnings growth and dividends, which together add up to 11% annual returns. All told, total returns are expected to reach 8.5% per year through 2025.

Another item investors should keep in mind is that A.O. Smith has a fairly low dividend payout ratio. The company paid out $0.90 in dividends per share in 2019.

Using the company’s guidance for earnings-per-share, this would equate to a payout ratio of just 40%. This is above the company’s 10-year average payout ratio of 26%, but not in a range where the dividend is at risk for a cut.

This leaves A.O. Smith plenty of room to increase its dividend, even in the event of a prolonged recession.

Final Thoughts

A.O. Smith is an industry-leading company. It has the top brand in its category, with compelling future growth potential.

While currency and trade issues may impact performance in China in the short term, A.O. Smith has such a dominant market share of its industry that the company can likely weather near-term difficulties. Over the long-term, we believe the potential growth opportunities in emerging markets is highly attractive.

While the dividend yield is on the low side, A.O. Smith still beats the average yield of the S&P 500 Index. And, the company’s dividend growth is impressive.

Shares usually have to offer at least 10% annual returns in order to earn a buy recommendation from Sure Dividend. Due to projected returns falling short of this threshold, A.O Smith receives a hold recommendation at the moment.

However, on a pullback, investors looking for a high quality Dividend Aristocrat could find A.O. Smith stock to be a buying opportunity.