Updated on November 21st, 2019 by Eli Inkrot

Insurance can be a great business. Not only do insurers collect revenue from policy premiums, they also make money by investing the accumulated premiums not paid out in claims, known as the float.

Even legendary investor Warren Buffet sees the value of insurance stocks –his investment conglomerate Berkshire Hathaway (BRK.A) (BRK.B) owns GEICO, General Re and more.

High profitability allows many insurance companies to pay dividends to shareholders, and raise their dividends over time. For example, Aflac (AFL), has increased its dividend for 37 years in a row.

This means the company qualifies as a Dividend Aristocrat – a group of 57 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases.

This article will take an inside look at Aflac’s business model, and what drives its impressive dividend growth.

Business Overview

Aflac was formed in 1955, when three brothers — John, Paul, and Bill Amos — came up with the idea to sell insurance products that paid cash if a policyholder got sick or injured. In the mid-twentieth century, workplace injuries were common, with no insurance product at the time to cover this risk.

Today, Aflac has a wide range of product offerings, some of which include accident, short-term disability, critical illness, hospital indemnity, dental, vision, and life insurance.

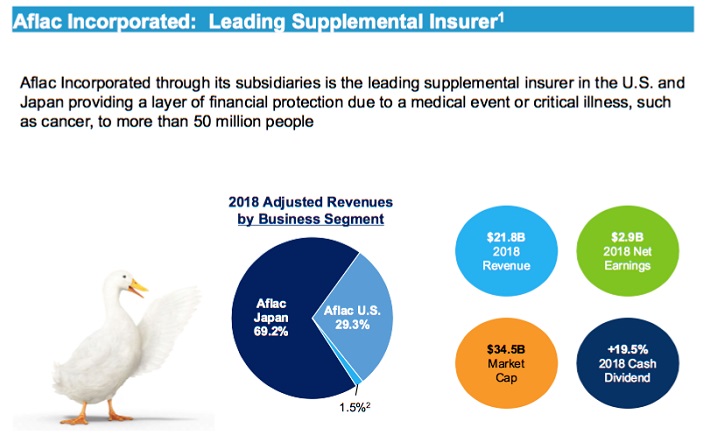

Source: Aflac Debt Investors Update

The company specializes in supplemental insurance, which pays out to policy holders if they are sick or injured, and cannot work. Aflac operates in the U.S. and Japan, with Japan accounting for approximately 70% of the company’s premium income. Because of this, investors are exposed to currency risk.

Aflac’s earnings will fluctuate, in part based on exchange rates between the Japanese yen and the U.S. dollar. When the yen rises against the dollar, it helps Aflac because each yen earned becomes more valuable when it is reported in U.S. dollars.

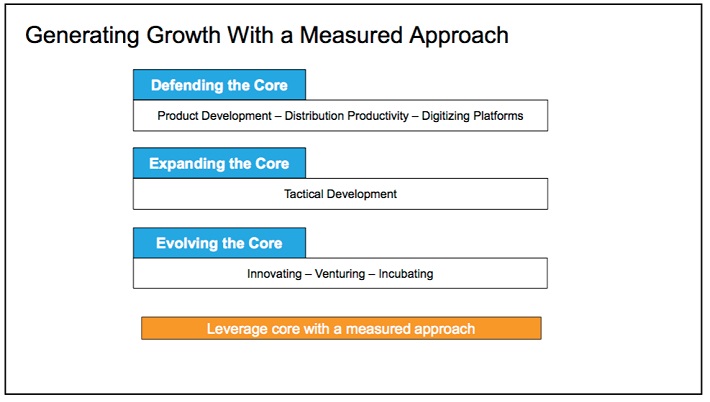

Aflac’s strategy is to increase premium growth through new customers, as well as increase sales to existing customers. It is also investing to expand its distribution channels, including its digital footprint, in the U.S. and Japan.

Aflac continues to perform well overall. Last quarter, Aflac generated $5.54 billion in revenue and $1.16 in adjusted earnings-per-share, representing a 12.6% year-over-year improvement. For the first three quarters of 2019 the company has generated $16.7 billion in revenue, a 0.4% increase, and $2.6 billion in earnings ($3.41 per share) compared to $2.4 billion ($3.15 per share) in the first three quarters of 2018.

In addition, Aflac has guided investors to anticipate $4.35 to $4.45 in adjusted earnings-per-share for 2019, compared to the $4.17 posted in 2018. At the midpoint, the company is likely to grow adjusted EPS by 5.5% from 2018.

Growth Prospects

From 2007 through 2018 Aflac was able to grow its earnings-per-share by an average compound rate of 8.8% per annum. This type of growth may be difficult to sustain over the longer-term, but Aflac has laid out clear growth avenues in its respective markets.

Source: Aflac 2019 Financial Analysis Briefing

In Japan, Aflac wants to defend its strong core position, while further expanding and evolving to customer needs. To this point, Aflac Japan is expanding its offerings of “third-sector” products. These include non-traditional products such as cancer insurance, as well as medical and income support.

Aflac has enjoyed strong demand in Japan for third-sector products, due to the country’s aging population, and declining birthrate.

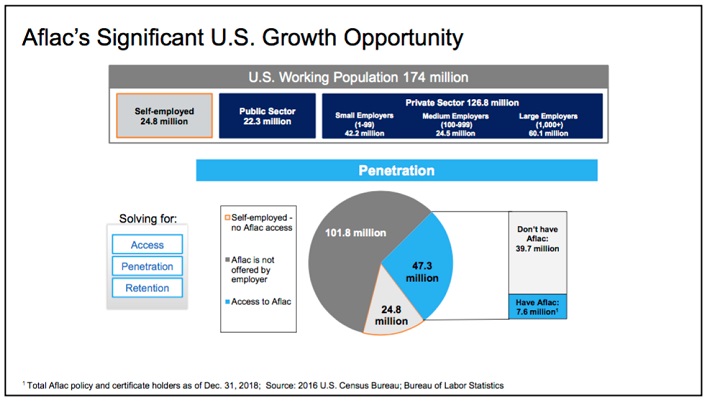

Source: Aflac 2019 Financial Analysis Briefing

Meanwhile, in the U.S., Aflac believes it has a long way to go to penetrate the market. While the brand name is well-known, only a small fraction of the U.S. working population has access to Aflac and an even smaller fraction actually purchases Aflac – under 5% of the working population.

In general terms, Aflac has two sources of income: income from premiums and income from investments. On the premium side, this tends to be a sticky business with renewals making up the bulk of income. That said, Aflac operates in two very developed countries, so outsized growth in policies does not seem likely.

The other source of income – investments – depends a great deal on interest rates, as Aflac holds the majority of its portfolio in bonds. Should interest rates rise in the future this could be an opportunity for growing investment income, but that is far from certain in today’s low-rate environment.

Taking the items collectively, in addition to an active share repurchase program, reasonable expectations would be for 6% annual earnings-per-share growth over the intermediate-term, in-line with the company’s guidance for 4.3% to 6.7% growth for 2019.

Competitive Advantages & Recession Performance

Aflac has many competitive advantages. First, it dominates its niche. It operates in supplemental insurance products, and is the leading company in that category. The company also has a strong brand, its business model has low capital expenditure requirements, and it sells a product that enjoys steady demand.

Aflac’s strong brand is a key competitive advantage. Competition is intense in the insurance industry, considering the commodity-like nature of the products. To retain customers and attract new customers, Aflac invests heavily in advertising.

Aflac is also a recession-resistant company. It remained profitable even during the Great Recession:

- 2007 earnings-per-share of $1.64

- 2008 earnings-per-share of $1.31 (-20% decline)

- 2009 earnings-per-share of $1.96 (49.6% increase)

- 2010 earnings-per-share of $2.57 (31.1% increase)

Notably, Aflac had a tough year in 2008, which is understandable given the deep recession at the time. However, its earnings-per-share came roaring back in 2009 and 2010.

Valuation & Expected Returns

During the last decade shares of Aflac traded at an average P/E ratio of about 10 times earnings. Based on 2019 expected earnings-per-share of $4.40, at the midpoint of guidance, shares are presently trading hands at 12.3 times earnings. As such, this could imply a moderate valuation headwind (~4%) over the next five years, should shares revert to their historical average.

On the other hand, the 6% expected growth rate and 2.0% current dividend yield (which ought to grow over the years) should aid in shareholder returns. Still, combined this would only imply ~4% annual returns over the next five years. Granted this could be too pessimistic should shares trade at a higher valuation or if Aflac grows at a faster pace, but in our view these figures represent realistic expectations.

Importantly, regardless of anticipated returns, Aflac’s dividend is very safe. With an expected dividend payout ratio of 25% for 2019, Aflac’s dividend appears to be highly secure, with room for future increases even if EPS growth slows.

Final Thoughts

Aflac is a high-quality company, with a profitable business and a strong brand. The company has increased its dividend for 37 years in a row, and should continue to do so, thanks to a low payout ratio and future earnings growth. While Aflac does not have the highest yield around at 2%, it offers steady dividend increases and a highly sustainable payout.

With that said, shares are presently trading above the company’s historical average valuation. As a result, this limits the future return potential in our view. However, should shares revert to a more typical valuation, this could transform a strong business and dividend story into a much better investment thesis. Aflac is a strong company, but we would wait for a slightly lower valuation multiple before buying the stock.