Updated on January 13th, 2020 by Nathan Parsh

The Dividend Aristocrats are a select group of 57 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases.

Retail heavyweight Walmart Inc. (WMT) is one of the better-known Dividend Aristocrats. It is widely recognized, not just for its strong brand and industry dominance, but also for its long dividend history.

You can see a full downloadable spreadsheet of all 57 Dividend Aristocrats, along with several important financial metrics such as price-to-earnings ratios, by clicking on the link below:

Walmart’s first dividend was $0.05 per share, paid in 1974. It has increased its dividend each year since, and now pays a quarterly dividend of $0.53 per share.

Walmart has increased its dividend by a rate of almost 7% over the past decade, though the most recent raise was for just 1.9%. The company has increased its dividend for 46 consecutive years.

Recent years have been difficult for many retailers. The threat of Internet retail competition, led by Amazon (AMZN), has blown a huge hole in retailers with a large brick-and-mortar store count.

However, Walmart has fared very well in recent years. The stock is up nearly 26% over the last year. Walmart, as opposed to many other retailers, has proven it is one of the best-equipped retails to compete with Amazon.

Business Overview

The first Walmart store opened in 1962 in Rogers, Arkansas. It was founded by Sam Walton, who started the business with a simple vision: to offer the lowest prices. This philosophy led to Walmart’s huge growth over the years. Walmart went public in 1972. At that time, it had 51 stores, and annual sales of $78 million.

Today, Walmart generates annual sales of $514 billion. It operates more than 11,400 stores, located in 28 countries around the world. The company serves more than 275 million customers and members worldwide each week.

Walmart has also expanded into a variety of different services, making it a true conglomerate.

Source: 2019 Annual Report

The Walmart U.S. segment includes retail stores in all 50 U.S. states, Washington D.C., and Puerto Rico. It also includes Wal-Mart’s digital business. Walmart International consists of operations in 27 countries outside of the U.S.

Lastly, Sam’s Club consists of membership-only warehouse clubs and operates in 48 states in the U.S. and in Puerto Rico.

Walmart has performed well over the past year. Earnings-per-share increased 7.4% in the third quarter of fiscal 2020, due to higher than expected same-store sales. The company’s investments in e-commerce are really paying off. Given the company’s results and guidance for fiscal 2020, Walmart should see continued growth for years to come.

Growth Prospects

We have a positive long-term outlook for Walmart, as sales should continue to grow modestly for many years. Walmart’s total sales increased 2.5% in the third quarter, to $127 billion. Sales for fiscal 2020 through the end of the third quarter improved 1.8% to $379 billion. Excluding currency, sales were higher by 3.3% for the quarter, and 2.9% over the first three quarters.

Comparable sales increased 3.2% during the quarter, above estimates of a 3.1% increase. Store traffic improved 1.3% while the average ticket was higher by 1.9%. E-commerce sales were impressive. Highlights include a 41% increase in the U.S., 99% growth in China and 65% improvement in Mexico.

For the first nine months of fiscal 2020, U.S. same-store sales increased 1.8%. Walmart now offers grocery pickup at more than 3,000 stores while providing delivery services at more than 1,400 locations in the United States. Rollout of new services such as this will help the company continue to fight off e-commerce competition.

These services were credited with a portion of same-store sales gains. The company also launched InHome Delivery in Kansas City, Pittsburgh and Vero Beach. This service allows for fresh groceries and everyday items to be delivered directly to customers’ homes.

Walmart’s resurgence is due mostly to its e-commerce investments. E-commerce sales reached $23 billion last fiscal year, and have continued to grow at a high rate each quarter.

It has also made a number of acquisitions to accelerate its e-commerce growth, including the $3.3 billion purchase of Jet.com. It also has an investment stake in Chinese e-commerce site JD.com.

In August 2019, Walmart announced that it had completed its $16 billion investment in Flipkart, a leading online shopping company in India. With this investment, Walmart has taken a 77% stake in one of the most popular e-commerce companies in the second most populace country on earth.

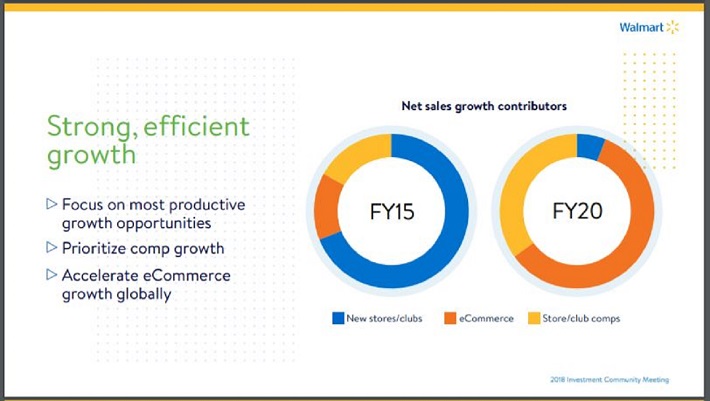

Overall, Walmart’s multiple investments in e-commerce are the reasons why this emerging category will contribute most of the company’s growth going forward.

Source: Investor Presentation

Another growth catalyst for Walmart is international growth, especially in China. The company expects to add more than 500 new stores in China over the next five to seven years. This will more than double the company’s store count in the country. By contrast, Walmart closed more than 20 Supercenter stores in the U.S. in 2019.

Comparable sales in China grew 3.7% in the third quarter. Long term, management feels that China will be a sizable source of growth for the company. Walmart plans to invest more than $1 billion to open and remodel stores in the country.

Aside from China, new international store openings will be focused on Mexico, which is a major growth

opportunity for Walmart as this country, like China, has a large consumer class. Last quarter Walmex grew comparable sales by 3.1%.

Following third quarter results, the company expects earnings-per-share for fiscal 2020 to increase by a low single digit percentage from fiscal 2019, up from an expected slight decrease previously.

Walmart reinvested more than $10 billion in store remodels, customer initiatives, e-commerce and other areas to improve the customer experience last year and expects to invest a similar amount in fiscal 2020.

Net sales are expected to grow 3% in constant currency. Walmart expects U.S. same-store-sales to range from 2.0% to 2.5% growth with e-commerce sales increasing almost 40%. Walmart international sales should be higher at 3% to 3.5% in constant currency.

While the company hasn’t given specific guidance for earnings-per-share, we believe the company will earn $5.00 per share in fiscal 2020. We expect that Walmart can grow earnings-per-share at an annual rate of 5.5% through 2025, due to a combination of same-store-sales and e-commerce growth.

Competitive Advantages & Recession Performance

Walmart’s main competitive advantage is its massive scale. A Walmart store is located within 10 miles of approximately 90% of the U.S. population. Its distribution efficiencies allow Walmart to keep transportation costs low. It can pass on these savings to customers through everyday low prices.

Walmart retains its brand strength through advertising. Because of its immense financial resources, Wal-Mart can afford to spend heavily on advertising:

- 2015 advertising expense of $2.4 billion

- 2016 advertising expense of $2.5 billion

- 2017 advertising expense of $2.9 billion

- 2018 advertising expense of $3.1 billion

- 2019 advertising expense of $3.5 billion

Walmart’s competitive advantage provides the company with steady profitability. This is true, even during recessions. The company performed phenomenally well during the Great Recession.

It steadily grew earnings-per-share each year in that time.

- 2007 earnings-per-share of $3.16

- 2008 earnings-per-share of $3.42 (8.2% increase)

- 2009 earnings-per-share of $3.66 (7% increase)

- 2010 earnings-per-share of $4.07 (11% increase)

This was a very impressive performance, in one of the worst recessions in decades. Walmart’s growth indicates the company might actually benefit from recessions. As the low-cost leader in retail, Walmart conceivably sees higher traffic during economic downturns, when consumers scale down from higher-priced retailers.

Valuation & Expected Returns

Walmart shares currently trade at a price of ~$116. Using our earnings-per-share estimate of $5.00 for the current fiscal year, the stock has a price-to-earnings ratio of 23.2. This is well above the stock’s ten-year average price-to-earnings ratio of 15.3.

As you can see, Walmart’s current valuation stands well above its historical levels. We currently view a P/E ratio of 16 as fair value for Walmart. This is above its 10-year average, and investors should also note that retailers have typically not held P/E multiples above 20. If shares were to revert to our fair value estimate by fiscal 2025, annual returns would be reduced by 7.1% over this period of time.

Walmart shares have performed very well for an extended period. While this has rewarded shareholders with strong returns, it makes the stock fairly unattractive today. We view Walmart as a significantly overvalued stock right now.

The stock has not held an average price-to-earnings ratio above 20, since the middle of the 2000s. A prolonged period of multiple contraction soon followed, with Walmart’s price-to-earnings ratio spending most of the past 10 years in the mid-teens.

Aside from its valuation multiple, Walmart should generate returns from earnings growth and dividends. A projection of expected returns is below:

- 5.5% earnings-per-share growth

- 1.8% dividend yield

- -7.1% multiple reversion

In this scenario, Walmart is actually projected to generate a total return of just 0.2% per year over the next five years. Shares of Walmart are significantly overvalued compared to its history, and we believe this will weigh down the stock’s future returns.

Final Thoughts

While many retailers have struggled with adapting to the change in commerce shopping habits, Walmart has made the proper strategic investments in our view. The company’s e-commerce growth is reflective of this view.

The company has performed well and the stock has outpaced the S&P 500 over the past year. We find the company’s dividend track record to be impressive, even if the most recent raise was on the small side.

However, sometimes a great company can be a poor investment, if too high a valuation is placed on a stock. We feel this is the case with Walmart today. Despite its strong business model and growth potential, the stock appears to be significantly overvalued.

The extended rise in share price has absorbed much of the stock’s potential total return, implying that the next five years will result in weak returns to shareholders. We recommend investors looking to purchase shares of Walmart do so after a meaningful pullback.