Updated on January 9th, 2020 by Samuel Smith

Investors looking for high-quality dividend growth stocks should take a closer look at the Dividend Aristocrats. The Dividend Aristocrats are a group of 57 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases.

You can see a full downloadable spreadsheet of all 57 Dividend Aristocrats, along with several important financial metrics such as price-to-earnings ratios, by clicking on the link below:

We review all 57 Dividend Aristocrats each year. The next stock in the series is aerospace and defense company General Dynamics (GD). General Dynamics is one of the newer members of the Dividend Aristocrats, having joined the list in 2017.

Defense stocks took flight from 2014-2018, but General Dynamics’ once-outstanding share price growth has stalled out over the past two years. General Dynamics’ stock price has declined by over 21% since reaching its peak in March 2018, which has brought its valuation back in line with expectations.

General Dynamics is an attractive holding for dividend growth investors, and is close to being attractive on a valuation basis as well.

Business Overview

General Dynamics was incorporated in 1952, through the combination of the Electric Boat Company, Canadair, and several others.

The company has evolved over the years, to enter new businesses of the future. The biggest transformation came in the 1990’s, when General Dynamics started buying technology-oriented companies. General Dynamics currently generates annual sales nearing $40 billion.

The company’s revenue stream has been diversified in recent years, and it now no longer relies as much upon the Aerospace segment as it used to.

A breakdown of its segments and their contribution to revenue is below:

- Aerospace (23% of revenue)

- Combat Systems (17% of revenue)

- Information Technology (23% of revenue)

- Mission Systems (13% of revenue)

- Marine Systems (23% of revenue)

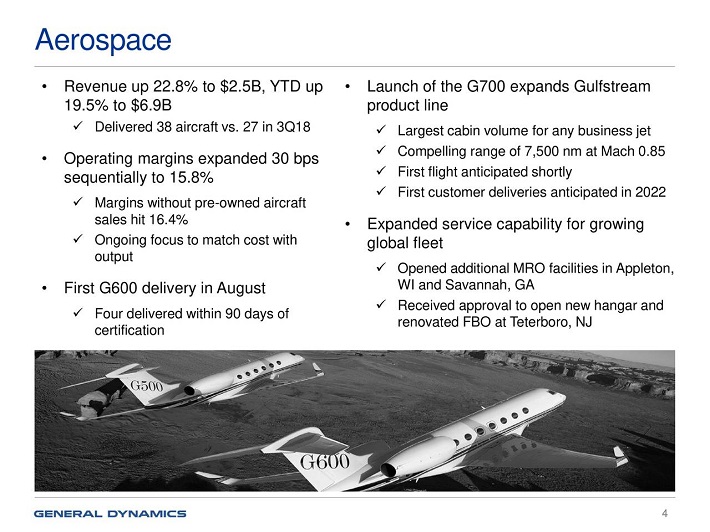

These segments all have varying growth outlooks and margin profiles but together, they create a diversified and very profitable revenue stream for General Dynamics. The company’s Aerospace segment produces aircraft and services them for its customers. It was recently expanded with the acquisition of Hawker Pacific.

Aerospace is General Dynamics’ largest segment.

Source: Investor Presentation

The Combat Systems business manufactures combat vehicles, and related weapons systems and munitions. The Information Systems and Technology business sells technologies, to the military, and for civilian, state, and commercial purposes. Mission Systems provides services to the armed forces such as product line management for training.

Lastly, the Marine Systems group builds nuclear-powered submarines and surface combatants for the U.S. Navy, and also Jones Act vessels.

Growth Prospects

General Dynamics has produced strong earnings growth in recent years, and the trend should continue moving forward, especially strong spending growth on the military and a confrontational foreign policy with Iran, North Korea, and China. The company has recently reported substantial contract wins as well, including a $22.2 billion contract from the U.S. Navy for construction of nine Virginia-class submarines.

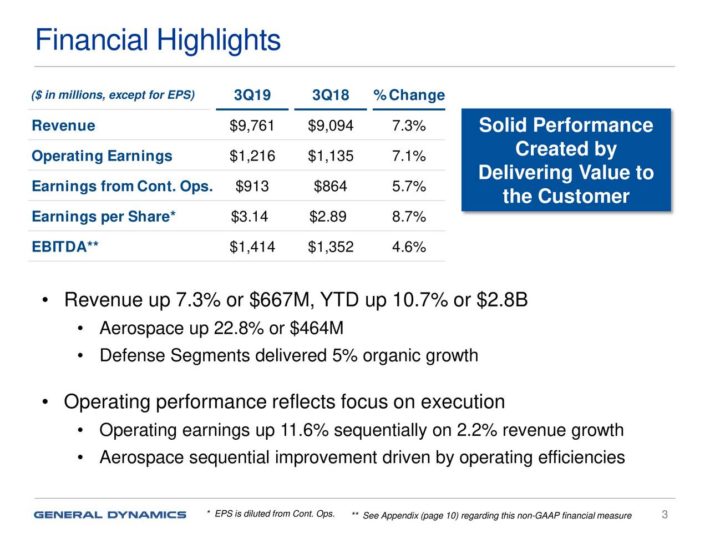

General Dynamics reported third-quarter earnings in late October (10/23/19), and growth was solid. Company-wide revenue increased 7.3% to $9.8 billion from $9.1 billion and diluted GAAP earnings-per-share increased 10.2% to $3.14 from $2.85 on a year-over-year basis.

Three of the company’s five operating segments reported growth: Aerospace revenue increased 22.8% to $2.5 billion from $2 billion in the prior year on the strength of more aircraft deliveries, offset by declining margins to 15.8% versus 18.5% in the prior year.

Combat Systems increased revenue 14.2% to $1.7 billion from $1.5 billion driven by growth in munitions and armaments, including sizable orders from Canada and Thailand. Revenue for Marine Systems increased 11.6% to $2.2 billion from $2 billion.

Among General Dynamics’ other operating segments, Information Technology revenue decreased by 10.2% to $2 billion from $2.3 billion due to divestures and program timing. Revenue for Mission Systems declined by 0.8% to $1.22 billion from $1.23 billion.

Source: Earnings Presentation

Moving forward, General Dynamics will continue to benefit from growth in defense spending, both in the U.S. and the international markets. First, President Trump has advocated for higher levels of defense spending in the U.S., which has been and will continue to be a tailwind for General Dynamics.

In addition, international markets are likely to continue raising defense spending as well. Geopolitical risk remains elevated across many parts of the world. General Dynamics and its competitors will be the beneficiaries of this risk.

In the first nine months of 2019, General Dynamics generated $3.9 billion in EBITDA (up 6% year-over-year). Free cash flow generation in the third quarter came in at a highly impressive 93% conversion rate and it grew free cash flow by 36.2% year-over-year, enabling it to return $295 million to shareholders via dividends during the quarter and $858 million via dividends during the first nine months of the fiscal year.

The company has also spent $231 million during the first three quarters of 2019 on share buybacks to reduce the shares outstanding and further boost value for shareholders. General Dynamics also pays a dividend to return even more cash to shareholders. And, it raises the dividend each year.

General Dynamics increased its quarterly dividend by 9.7% in March of 2019, marking its 28th consecutive annual dividend increase. The company believes it will see $11.90 in earnings-per-share this year, representing 6.1% growth over 2018.

General Dynamics has had years of slow or even negative growth in the recent past, which is not unusual given that it operates in a cyclical industry. Management sees revenue growth as the key driver of earnings in 2019, offset partially by lower margins.

In particular, Aerospace margins are set to move materially lower this year, while Marine Systems margins should moderate slightly.

Competitive Advantages & Recession Performance

General Dynamics has several competitive advantages. First, it operates in defense, which has very high barriers to entry. Defense companies rely on contracts from the U.S. and foreign governments. A small competitor would have difficulty entering the defense industry and trying to take share.

In addition, General Dynamics has industry-leading brands, such as Gulfstream and Stryker. It has built these brands with significant research and development spending, that totals in the hundreds of millions of dollars annually. Indeed, this is part of the significant barriers to entry for potential competitors.

General Dynamics is built to last. The company performed very well during the last recession:

- 2007 earnings-per-share of $5.10

- 2008 earnings-per-share of $6.13 (20% increase)

- 2009 earnings-per-share of $6.20 (1.1% increase)

- 2010 earnings-per-share of $6.82 (10% increase)

As you can see, the company grew earnings in each year of the recession, including two years of double-digit growth. It would not be easy to find many companies that grew earnings-per-share by 20% in 2008, but General Dynamics did it.

One major reason for the company’s excellent recession performance, is because it sees steady demand for its products and services each year. The world has many dangerous places. Global conflicts are not likely to cease any time soon, regardless of the economic climate. This will drive ever-increasing levels of defense spending, the US included.

And, General Dynamics’ revenue is secured by long-term contracts with its customers, and switching costs are very high, sometimes impossibly so. This also keeps earnings intact during recessions.

Valuation & Expected Returns

General Dynamics stock has a price-to-earnings ratio of 15.3 today, which is well off of its former highs in 2017 in excess of 20. It is also much more in line with the company’s historical multiple, which has tended to be around 14-15 times earnings.

Thus, at its current valuation, General Dynamics is trading only slightly in excess of fair value, making the stock much more attractive than it has been in recent times. Given the stock’s historical multiples as well as the company’s forecast slowdown in growth, we see 14 times earnings as fair value.

Using a fair price-to-earnings ratio of 14, and the company’s expected 2019 adjusted earnings of $11.90, yields a fair value estimate of $167. With the share price at $181, it is trading slightly in excess of fair value. If the valuation multiple declines from 15.3 to our fair value of 14, it would reduce annual returns by approximately 1.8% per year over the next five years.

Given all of these factors, we see total annual returns of about 6% in the coming years, consisting of the current 2.3% yield, 6% expected annualized earnings-per-share growth, and a small 1.8% annual headwind from a contracting valuation multiple. General Dynamics is nowhere near as expensive as it once was, and we therefore rate the stock a hold.

Final Thoughts

General Dynamics is a high-quality business, with a long history of growth. Geopolitical risk remains a constant, which gives the company a long runway of growth going forward.

General Dynamics is a shareholder-friendly company, and should continue returning significant cash to shareholders through buybacks and dividends.

While the valuation has certainly improved, the stock is still trading slightly above fair value. This is expected to limit the stock’s annual returns over the next five years.

Combined with the expected growth slowdown in 2019, we view General Dynamics as a strong holding for dividend growth but believe investors should wait for a better opportunity before initiating a position.