Updated on December 31st, 2019 by Bob Ciura

The best dividend growth stocks have the ability to maintain long records of steady annual increases in their dividend payouts. This is why we focus on the Dividend Aristocrats, a group of 57 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases.

You can see a full downloadable spreadsheet of all 57 Dividend Aristocrats, along with several important financial metrics such as price-to-earnings ratios, by clicking on the link below:

Once per year, we review each of the 57 Dividend Aristocrats. The next stock in the series is industrial manufacturer 3M Company (MMM). 3M has a very impressive track record. It has paid dividends for over 100 years, and it has raised its dividend for 61 years in a row.

This makes 3M a Dividend King, an even smaller group of companies with 50+ consecutive years of dividend increases. There are fewer than 30 Dividend Kings, including 3M.

3M ends 2019 facing a number of uncertainties. While the U.S. economy continues to expand at a modest pace, the lingering trade war with China poses a significant challenge for 3M, given the company’s relative exposure to the emerging markets.

3M stock generated a negative total return of -4.6% in 2019, while the S&P 500 Index returned over 30% including dividends. But 3M’s under-performance in 2019 could set the stage for strong returns in the years ahead.

Business Overview

3M’s history goes all the way back to 1902, when it was a small mining venture. 3M was originally known as Minnesota Mining and Manufacturing.

Its founders started out with a very simple goal: to harvest corundum from a mine called Crystal Bay. There wasn’t much corundum to be mined, but over the next 114 years, 3M grew into one of the biggest industrial conglomerates in the world.

Today, 3M is a diversified global industrial. It manufactures 60,000 products, which are sold in 200 countries around the world. 3M came to dominate the industrial manufacturing industry through a sharp focus on the most attractive market segments.

It has invested heavily across its core areas of focus to build a product portfolio that leads the pack.

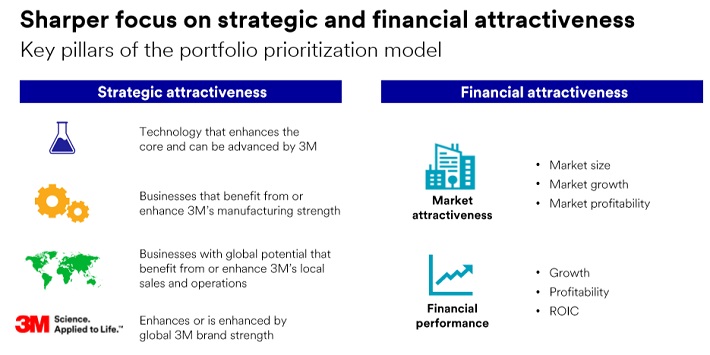

Source: Investor Day Presentation

As of the second quarter of 2019, 3M is now composed of four separate divisions. The Safety & Industrial division produces tapes, abrasives, adhesives and supply chain management software, as well as personal protective gear and security products. The Healthcare segment supplies medical and surgical products, as well as drug delivery systems. Transportation & Electronics division produces fibers and circuits with a goal of using renewable energy sources while reducing costs. The Consumer division sells office supplies, home improvement products, protective materials and stationary supplies.

3M trades with a market capitalization of $102 billion, and generates $33 billion in annual sales. The company reported earnings results for the third quarter on 10/24/2019. Adjusted earnings-per-share for the quarter came to $2.58, which topped estimates by $0.08 and matched results from the same quarter last year. Revenues declined 2.0% to $8 billion, $210 million below estimates. Currency translation reduced results by 1.3%.

U.S. sales were higher by just 0.8% while Asia-Pacific dropped 5% and Europe/Middle East/Africa was lower by 4.1%, reflecting the challenges 3M is facing in the international markets.

Organic sales for the Safety & Industrial segment were down 3.3% as gains made in roofing granules were more than offset by weaker results for multiple product categories, including personal safety, abrasives and automotive. Transportation & Electronics were down 3.4%. Advanced materials, transportation safety and commercial solutions improved during the quarter while automotive & aerospace and electronics were lower.

On the other hand, Health Care and Consumer segments both showed growth during the quarter. Organic sales increased 2% in Health Care due to several product categories, including health information systems, food safety and medical solutions, while consumer sales rose 2.6%.

Growth Prospects

3M has generated steady earnings growth in recent periods. In 2018, organic revenue increased 3.2% for the year and earnings-per-share increased 14%, thanks to gains in adjusted operating income margin growth, organic growth in all divisions of the company, a lower tax rate and share repurchases.

However, 2019 proved difficult for the company, due primarily to the trade war between the U.S. and China. In addition, economic slowdowns across the emerging markets negatively impacted the company’s international business.

After 3M provided third-quarter financial results, it also cut its adjusted earnings-per-share guidance for the year and now expects to earn $8.99 to $9.09 per share in 2019, down from $9.25 to $9.75 per share previously. Local currency organic growth is now expected to be down 1% to 1.5% compared to previous guidance of down 1% to up 2%.

Still, 3M maintains a promising long-term outlook. We believe the company is capable of growing adjusted earnings-per-share by 5% per year over the next five years. While the international markets are in decline at the moment, this is likely to be a short-term challenge. The long-term prospects for the emerging markets remain highly attractive, due to the relatively high economic growth rates in the under-developed regions of the world.

3M is still generating meaningful growth in health care and consumer products, two of its core business segments. Acquisitions are likely to add to its growth, especially in health care, such as the nearly $7 billion acquisition of Acelity.

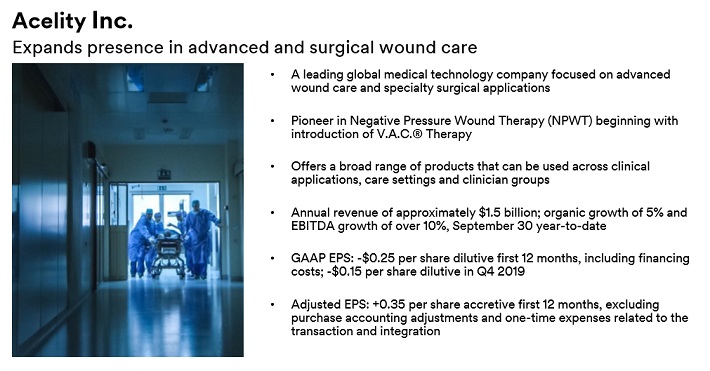

Source: Investor Presentation

Acelity is a leading global medical technology company that manufactures wound care and specialty surgical products under the KCI brand. Acelity generates annual revenue of $1.5 billion, with organic growth of 5%. 3M expects the acquisition to add roughly $0.35 per share to its adjusted EPS in the first 12 months after closing.

Health care is a growth industry, and the acquisition only further bolsters 3M’s already-strong presence in health care.

Competitive Advantages & Recession Performance

To raise dividends for over 50 years, requires multiple durable competitive advantages. For 3M, technology and intellectual property are its biggest competitive advantages.

3M has over 40 technology platforms and a team of scientists dedicated to fueling innovation. Innovation has provided 3M with over 100,000 patents obtained throughout its history, which helps fend off competitive threats.

3M continues to invest heavily in research and development. The company aims to spend ~6% of annual sales on R&D. The company’s recent R&D investments are:

- 2014 research-and-development expense of $1.77 billion

- 2015 research-and-development expense of $1.76 billion

- 2016 research-and-development expense of $1.73 billion

- 2017 research-and-development expense of $1.9 billion

- 2018 research-and-development expense of $1.8 billion

3M R&D is so successful in creating new products that approximately 30% of annual sales came from products that didn’t exist five years ago. 3M has established itself as an industry leader, across its product segments. Their competitive advantages also help 3M remain profitable, even during recessions.

3M’s earnings-per-share during the Great Recession are below:

- 2007 Earnings-per-share of $5.60

- 2008 Earnings-per-share of $4.89 (13% decline)

- 2009 Earnings-per-share of $4.52 (7.5% decline)

- 2010 Earnings-per-share of $5.75 (27% increase)

The company is not immune from recessions, and its earnings-per-share fell in 2008 and 2009. However, it bounced back in 2010. And, it remained steadily profitable throughout the recession, which allowed it to continue raising its dividend.

Indeed, 3M has a highly secure dividend payout. The following video further discusses 3M’s dividend sustainability in further detail:

Valuation & Expected Returns

Based on expected adjusted earnings-per-share of $9.04 for 2019, 3M stock has a price-to-earnings ratio of 19.5. This is higher than its average valuation. 3M has held an average price-to-earnings ratio of 17.2 over the past 10 years.

3M is trading at a premium to its historical average. It is also trading above our estimate of fair value. Due to 3M’s weak earnings reports over the course of 2019, we have lowered our estimate of fair value to a price-to-earnings ratio of 16.5.

This doesn’t make the stock extremely overvalued, but this does make the stock less attractive for investment. Shareholders would see total annual returns reduced by 3.3% per year if the stock reverted to its average valuation by 2025.

Owners of 3M stock can also see returns from earnings growth and dividends. 3M has experienced earnings-per-share growth of 6.4% over the last decade. We estimate the company will generate ~5% annual EPS growth over the next five years.

A breakdown of potential returns through 2024 is as follows:

- 5.0% EPS growth

- 3.3% multiple reversion

- 3.3% dividend yield

Contracting of the P/E multiple will essentially offset the current dividend yield in our view, resulting in total expected returns of 5% through 2025. This is a modest expected rate of return, resulting in a hold recommendation at this time.

Final Thoughts

3M remains a high-quality business, and is likely to continue raising its dividend each year. There are very few companies that can match the company’s history of dividend growth. 3M has raised its dividend for 60 consecutive years, and will likely continue to increase the dividend each year for many years to come.

However, the current valuation, though not extreme, reduces total expected returns over the next five years. 3M remains a strong holding for its above-average dividend yield and annual dividend growth. That said, investors looking to add 3M to their portfolio are encouraged to wait for a pullback in the share price, resulting in a lower stock valuation and even higher dividend yield.