Updated on November 20th, 2019 by Josh Arnold

PPG Industries (PPG) is one of the largest paint companies in the world. It is also one of the most reliable dividend stocks in the market–PPG has paid dividends every quarter since 1899.

Moreover, the company has increased its dividend each year for the last 47 years, which qualifies it to be a member of the exclusive Dividend Aristocrats list.

PPG’s remarkable dividend consistency gives it broad appeal to the more conservative members of the dividend growth investing community. Indeed, the company has a very safe dividend payment with room for steady dividend increases each year, thanks to its strong business model.

The only question as to whether the stock is a buy today, is PPG’s elevated valuation. This article will analyze PPG’s investment prospects in detail and determine whether the company merits a buy recommendation at current prices.

Business Overview

PPG Industries was originally founded in 1883 as a manufacturer and distributor of glass. PPG stands for Pittsburgh Plate Glass, which is a reference to the company’s original operations. Over time, PPG has made remarkable strides in becoming an industry leader in the paints and coatings industry.

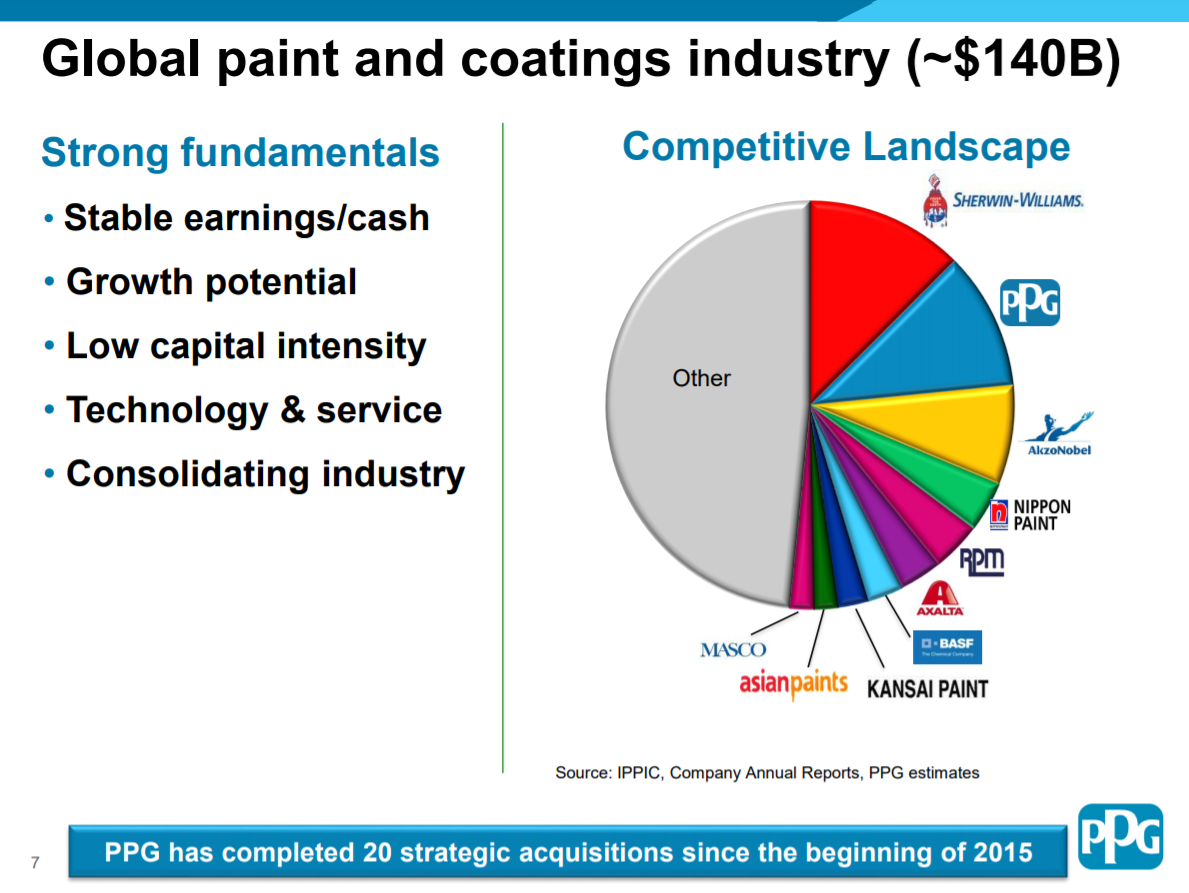

With a market capitalization of $30 billion and annual revenues in excess of $15 billion, PPG’s only competitors of similar size are fellow Dividend Aristocrat Sherwin-Williams (SHW), as well as Dutch paint company Akzo Nobel (AKZOY).

PPGs’ strong market share can be seen in the following image.

Source: Investor Presentation

PPG Industries has grown to such an impressive size thanks to its worldwide operating presence and focus on technology and innovation. The company has approximately 47,000 employees located in more than 70 countries at 150 unique locations.

Its research and development focus is a key differentiator between PPG and other paint & coatings companies. Because of its heavy R&D investments, PPG has grown to be a market leader today. In addition, PPG has a long history of accretive acquisitions that have helped it grow over time.

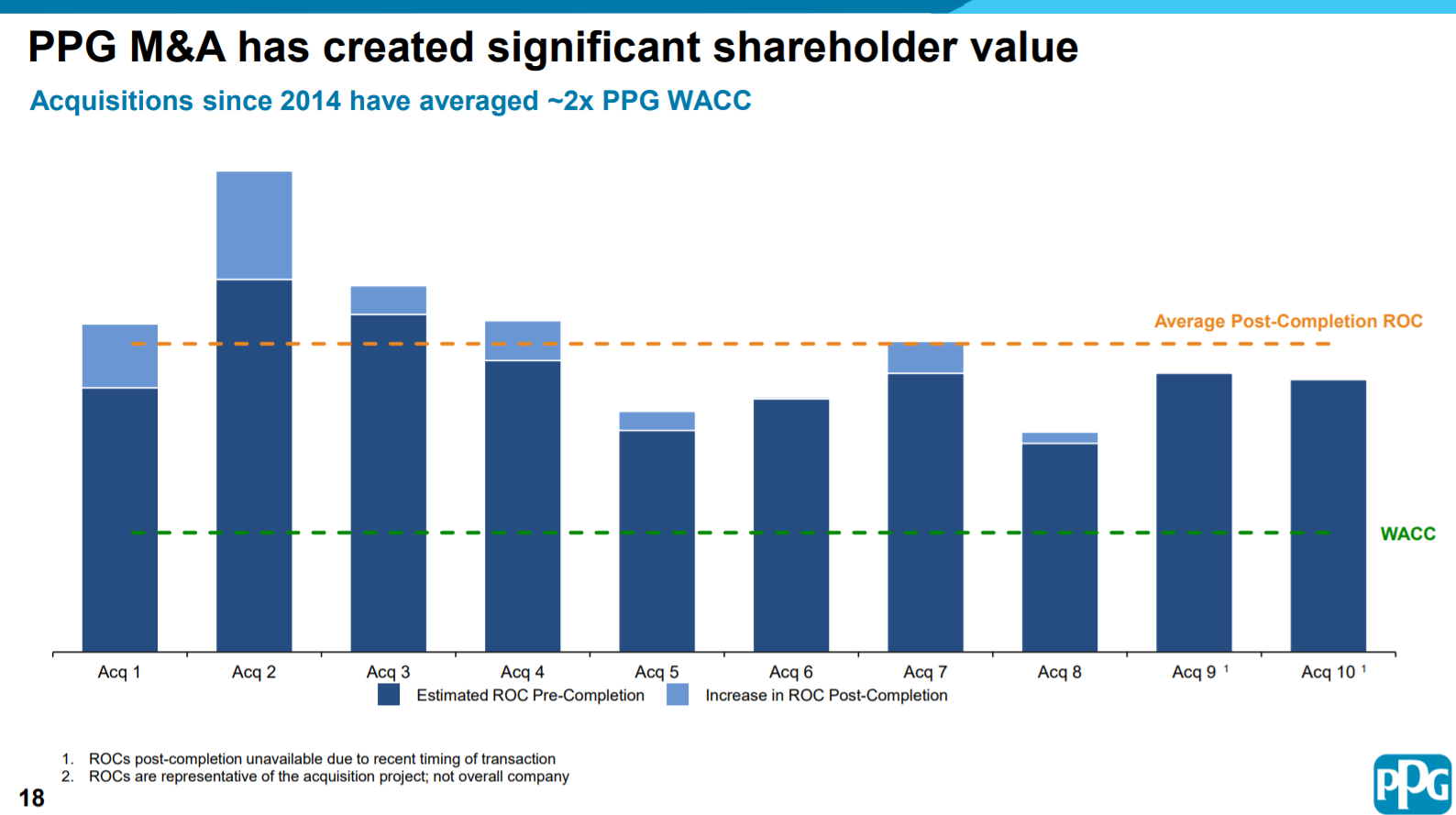

Source: Investor Presentation

As we can see above, all of PPG’s ten most recent acquisitions have exceeded its weighted average cost of capital, and the average has been roughly double the company’s WACC. In essence, this means that PPG’s acquisitions have been accretive in terms of creating economic value as the company’s cost of capital is exceeded by the benefits of the acquisition. This is highly attractive in terms of contributing to long-term growth.

Growth Prospects

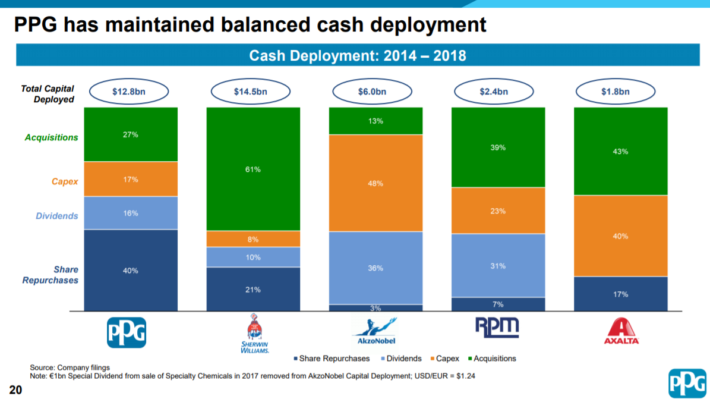

By and large, a company’s ability to increase revenues and profits is a function of its capital allocation. In the four-year period from fiscal 2014 to 2018, PPG spent $12.8 billion in cash. Approximately 25% of that went to acquisitions, while ~17% went to both capex and dividends, respectively, with the balance being allocated to share repurchases.

PPG has spent much more of its deployed cash on share repurchases than its competitors, which has been one source of earnings-per-share growth over time. However, we see PPG’s balanced cash allocation as a favorable mix that supports long-term growth for shareholders.

With this in mind, it is likely that mergers and acquisitions will be a focus for PPG moving forward as the company moves back towards its core competency of portfolio optimization. Acquisitions have been a key growth driver for PPG for many years.

Source: Investor Presentation

PPG is now virtually exclusively a coatings business. The transformation in recent years away from legacy businesses like glass and chemicals has left the company with an impressive portfolio of coatings products that collectively generate more than $15 billion in annual revenue. PPG recognized years ago that its future growth would be in coatings, and has positioned itself as such.

PPG’s track record suggests that its underlying business is likely to continue growing at a satisfactory rate for the foreseeable future. In the past decade, the company has grown its earnings-per-share at an average rate of nearly 20%. We note that the starting point for the past decade’s earnings-per-share was 2009, when earnings had plummeted for PPG, making for a favorable comparison period. As a result, in our opinion ~20% annual growth isn’t repeatable for the long-term.

Even so, that sort of track record is tremendously difficult to find, as PPG has been an elite growth stock for a long time. This growth has not been linear, as there have been ups and downs from year to year, but over time, PPG has delivered impressive growth.

Given its very strong fundamentals and its focus on coatings, we believe investors can reasonably expect 7% adjusted earnings-per-share growth from PPG Industries through full economic cycles. As mentioned, this growth likely won’t accrue evenly, but over time, we see PPG as highly attractive from a growth standpoint.

However, PPG’s performance is likely to suffer during periods of economic recession. The good news is that we would almost certainly see such an event as a buying opportunity of this high-quality business.

Competitive Advantages & Recession Performance

PPG operates in the paints & coatings industry, which is economically attractive for a number of reasons. First, these products have high profit margins for manufacturers. They also have low capital investment, which results in significant cash flow. PPG has put this significant cash flow to use over time, as discussed above.

Given all this, it makes sense that there are just two coatings companies (Sherwin-Williams and PPG Industries) in the Dividend Aristocrats list.

With that said, the paint and coatings industry is not very recession-resistant because it depends on healthy housing and construction markets. This impact can be seen in PPG’s performance during the 2007-2009 financial crisis:

- 2007 adjusted earnings-per-share: $2.52

- 2008 adjusted earnings-per-share: $1.63 (35% decline)

- 2009 adjusted earnings-per-share: $1.02 (37% decline)

- 2010 adjusted earnings-per-share: $2.32 (127% increase)

PPG’s adjusted earnings-per-share fell by more than 50% during the last major recession, and took two years to recover. While the long-term prospects of this Dividend Aristocrat remain bright, investors should be willing to accept volatility in a recession. If anything, a recession and corresponding decline in PPG’s share price would allow investors to purchase more shares of this stock at a much more attractive price.

Valuation & Expected Total Returns

We are forecasting earnings-per-share of $6.22 for this fiscal year, putting the price-to-earnings ratio at 17.3. That compares relatively favorably to our fair value estimate of 17 times earnings, meaning PPG is essentially fairly valued today. As such, we expect virtually no impact from a changing valuation in the coming years.

Shares have traded sideways for years now as PPG’s earnings have moved around somewhat erratically. However, during this time, the company has continued its portfolio transformation, reduced the float via buybacks, and grown earnings. While growth has been uneven, PPG looks attractive today given the lower valuation. Shares have performed very well in 2019 but the valuation is still reasonable given these factors.

We see PPG producing ~8.3% total returns in the years to come, consisting of the current 1.9% dividend yield, 7% expected annual earnings growth and essentially no impact from changes in the stock valuation. After a strong rally in 2019, we rate PPG a hold.

Final Thoughts

PPG Industries has many of the characteristics of a very high-quality business. It has a proven business model, and has generated strong growth over the past several years. It has a significant international presence, and multiple catalysts for future growth. Lastly, it has increased its dividend for nearly 50 years.

However, the company’s weakness during recessions means that even though its valuation looks appealing on paper, better buying opportunities are likely to occur if a recession occurs. PPG is attractive for its growth outlook and fair valuation, but note that investors could see lower prices in a market downturn.