Updated on December 10th, 2019 by Eli Inkrot

When it comes to dividend growth stocks, not many stocks can surpass the Dividend Aristocrats. The Dividend Aristocrats are a group of 57 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases. These companies have managed to increase their dividends every year without exception, even during recessions.

You can download an Excel spreadsheet with the full list of Dividend Aristocrats by using the link below:

But even Dividend Aristocrats can encounter challenges from time to time. One of the Dividend Aristocrats battling through a tough climate is healthcare distributor Cardinal Health (CAH).

Cardinal Health is currently challenged by falling drug prices, fallout from the opioid crisis, and the threat of new competition in pharmaceutical distribution. As a result, shares are trading ~27% lower than their high in 2018 and nearly 40% lower than the high mark established in 2016.

At the same time, the company has increased its dividend for 34 years in a row, with a 1% increase in May 2019. This track record speaks to the resilience of Cardinal Health’s business model.

The company can continue to raise its dividend, because it still generates more than enough cash flow to support annual increases. While it has encountered tougher competition recently, the company is still highly profitable, and is making progress in its turnaround initiatives.

Cardinal Health is an attractive dividend growth stock, due to its comparatively low valuation, growth potential, and 3.5% starting dividend yield.

Business Overview

Cardinal Health, founded in 1971, is one of the “Big 3” drug distribution companies along with McKesson (MKC) and AmerisourceBergen (ABC). Cardinal Health serves over 24,000 United States pharmacies and nearly 90% of the country’s hospitals. The company has operations in 46 countries with approximately 50,000 employees, generating roughly $150 billion in annual revenue.

The company has two operating segments: Pharmaceutical and Medical. The Pharmaceutical segment is by far the company’s largest, as it represents nearly 90% of total revenue. The pharmaceutical segment distributes branded and generic drugs and consumer products. It distributes these products to hospitals and other healthcare providers.

Meanwhile, the medical segment distributes medical, surgical, and laboratory products to hospitals, surgery centers, clinical laboratories, and other service centers.

The business climate for Cardinal Health is difficult right now, as it has been for the past few years. One of the biggest challenges for Cardinal is drug price deflation, which negatively impact margins in the company’s core pharmaceutical segment. Moreover, this could continue to be a challenge if political and competitive pressure on drug prices remain.

Adding to this concern is the potential for new entrants to the space, such as Amazon (AMZN) which acquired PillPack for nearly $1 billion. Previously. the razor-thin margins protected the “Big 3” drug distributors from outside competitors. But Amazon’s potential entry into the space is a significant threat to the established players. Still, Cardinal Health remains profitable and the dividend continues to be well-covered.

Growth Prospects

Since 2010 Cardinal Health has grown both earnings and dividends by a double-digit rate. However, this growth has stalled meaningfully in the last few years.

On November 7th, 2019 Cardinal Health released first-quarter fiscal year 2020 results. For the quarter, Cardinal Health reported revenue of $37.3 billion, representing a 6% increase compared to the $35.2 billion posted in Q1 fiscal year 2019. Operating income equaled negative $5.3 billion compared to positive $816 million previously, as a result of a $5.6 billion accrual related to the opioid litigation. Adjusted net income equaled $378 million, a 4% decline compared to the prior year quarter, while earnings-per-share came in at $1.27 compared with $1.29 previously.

As detailed above, Cardinal Health operates in two segments: pharmaceutical and medical. The pharmaceutical segment makes up the lion’s share of revenues (~90%), but the medical segment remains important due to its higher margins and growth potential.

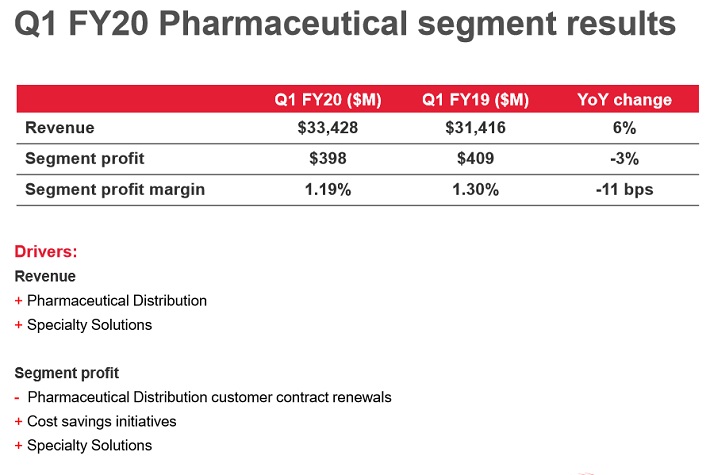

The pharmaceutical segment reported $33.4 billion in revenue and $398 million in profit for the quarter.

Source: 1Q FY2020 Earnings Presentation

Meanwhile the medical segment generated $3.9 million in sales and $170 million in profit for the quarter. Both product segments reported revenue growth for the quarter, although Cardinal Health’s segment profit declined last quarter.

On the other hand, Cardinal Health’s medical segment registered a strong increase in segment profit last quarter.

In addition, Cardinal Health also reiterated its fiscal year 2020 outlook, expecting adjusted EPS between $4.85 and $5.10.

At the midpoint of earnings-per-share guidance – approximately $4.98 for fiscal 2020 – this means that Cardinal Health expects a -5.7% decline in the bottom line.

Furthermore, there are multiple catalysts for the company to return to earnings growth going forward; including acquisitions, moderating price deflation, growth in specialty products and cost cuts. Taking these items collectively, we are forecasting 4% annual EPS growth over the next five years.

Competitive Advantages & Recession Performance

The biggest competitive advantage for Cardinal Health is its distribution capability, which makes it very difficult for competitors to successfully enter the market.

Cardinal Health distributes its products to nearly 90% of U.S. hospitals. It serves more than 29,000 pharmacies, as well as over 10,000 specialty physician offices and clinics. It also serves over 6,500 laboratories with more than 51,000 laboratory products. The company’s home healthcare business serves nearly 3 million patients, with more than 46,000 products.

In addition, Cardinal Health operates in a stable industry with high demand. The company should remain steadily profitable, as there will always be a need for pharmaceutical products to be distributed.

Here’s a look at Cardinal Health’s earnings-per-share during the Great Recession:

- 2007 earnings-per-share of $3.41

- 2008 earnings-per-share of $3.80 (11.4% increase)

- 2009 earnings-per-share of $2.26 (40.5% decline)

- 2010 earnings-per-share of $2.22 (1.8% decline)

While part of this is recession related, keep in mind that Cardinal Health’s financial results were materially impacted by its spinoff of CareFusion Corporation, which was completed in 2009. Despite this spinoff, the company’s segment revenues, segment earnings and dividend continued to grow during this time.

Moreover, earnings returned to growth in 2011 and had a strong run through 2017. Since people will always need their medications and healthcare products, regardless of the economic climate, Cardinal Health could be considered more recession-resistant than the average company.

Valuation & Expected Returns

Based on anticipated adjusted earnings-per-share of $4.98 (at the midpoint) for fiscal 2020, and a share price near $54, Cardinal Health is currently trading at a P/E ratio of 10.9x.

Cardinal Health has traded hands with an average P/E ratio of about 14-15 times earnings dating back to 2010. However, this was during a time when growth was much more robust. We have used a multiple of 10x earnings as a starting place for fair value in recognition of our lower anticipated growth rate and risks in the industry. Given the current valuation near 11 times earnings, this implies a small 1.7% annual deduction from shareholder returns.

That said, if the company can return to positive earnings growth, it could justify a higher valuation. For example, Cardinal Health stock could see its valuation improve due to reduced litigation risk. The major pharmaceutical distributors recently came to a settlement with multiple counties in Ohio. This gives some hope that the company will be able to come to agreeable settlements and finally move past the various legal risks which have had a negative impact on the stock valuation. Still, we prefer to be cautious when it comes to the fair value estimate.

In addition to changes in the valuation multiple, future returns will be generated from earnings growth and dividends. We expect Cardinal Health to grow earnings-per-share by 4% per year, primarily from revenue growth and share repurchases, with a modest decline in margins. Buybacks are a continued boost for EPS growth, as the company has reduced its share count by 2% per year on average from 2013 through 2019.

Finally, the stock has a current dividend yield of 3.5% due partly to an expanding payout ratio, but mostly as a result of a lower share price in the last few years. While the pace of dividend growth has slowed, the starting yield is solid. As a Dividend Aristocrat, Cardinal Health is likely to continue raising its dividend each year. Moreover, the dividend appears secure, with a projected dividend payout ratio of approximately 39% for fiscal 2020.

Putting all the pieces together – average growth and an above dividend yield offset by a small valuation headwind – our expected total return for Cardinal Health is nearly 6% per year over the next five years. This qualifies Cardinal Health stock as a hold right now.

Cardinal Health’s expected return is not spectacular, but our expected return calculation could be understated, if shares were to trade at a higher valuation or if earnings growth accelerates faster than we currently expect.

Final Thoughts

The economics of the healthcare distribution industry have deteriorated in recent years. This has impacted all the major players, including Cardinal Health.

Fortunately, Cardinal Health continues to grow revenue. And while margin erosion has led to declining earnings from the recent annual peak, the company has put in place a number of initiatives that should return it to positive earnings growth going forward.

High-quality companies like Cardinal Health have withstood difficult periods before, and will do so again. The history of the company, its dividend history, and its high current yield of 3.5% make the stock attractive for dividend growth investors. Total expected returns are below our requirement for a buy rating, making the stock a hold.