Updated November 20th, 2019 by Josh Arnold

Every year, we individually review each of the 57 Dividend Aristocrats. The second installment of the 2019 series is Cincinnati Financial (CINF).

Cincinnati Financial has increased its dividend for an amazing 59 years in a row, giving it one of the longest dividend increase streaks anywhere in the stock market. It is a Dividend Aristocrat, a group of stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases.

Not only that, but Cincinnati Financial is also a member of the Dividend Kings, an even more exclusive group than the Dividend Aristocrats. Dividend Kings have increased their dividends for 50+ consecutive years. There are just 27 Dividend Kings.

Cincinnati Financial’s dividend track record is legendary. And yet, the stock does not appear to be an attractive buy right now. The reason is because its valuation has expanded considerably in the past few years, which has simultaneously reduced its dividend yield. As a result, value and income investors should wait for a meaningful pullback before buying shares.

Business Overview

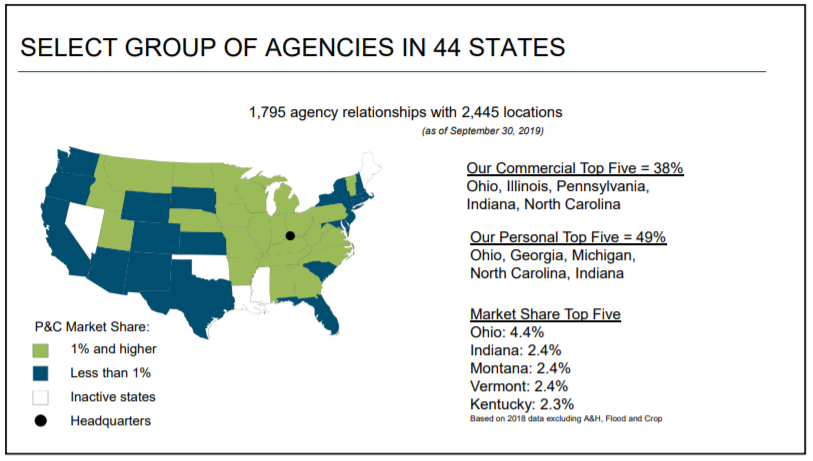

Cincinnati Financial is an insurance company, founded in 1950. It offers business, home, and auto insurance, as well as financial products including life insurance, annuities, and property and casualty insurance. Revenue is derived from five sources, with agencies across 44 states.

The company has nearly 1,800 agency relationships with a staggering 2,445 locations as of the end of Q3 2019. Many of them have meaningful market share as well as Cincinnati Financial has grown over the years.

Source: Investor Handout, page 11

The company has a profitable business model. Instead of focusing solely on high-margin products, Cincinnati Financial is willing to write lower-margin policies. It earns a high level of profit by issuing high volumes and taking market share.

In addition, as an insurance company, Cincinnati Financial makes money in two ways. It earns income from premiums on policies written, and also by investing its float, the large sum of premium income not paid out in claims. Indeed, the company’s cash float is 37% invested in common stocks as a way to grow book value over time, with no single stock making up more than 5% of the investment portfolio. To that end, Cincinnati Financial’s book value is more beholden to stock market performance than some of its peers.

This favorable combination of premiums and investment gains has led to steady growth over many years, and there should be room for continued growth up ahead.

Growth Prospects

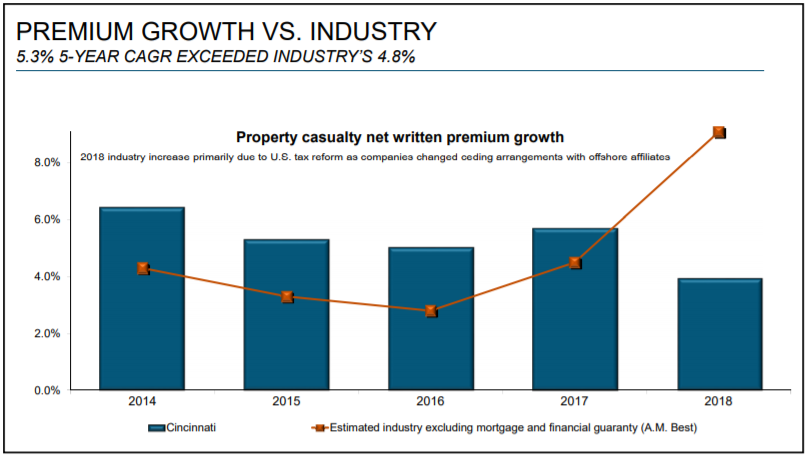

Cincinnati Financial has a positive growth outlook moving forward as growth should continue to come from new policies written. The company has a successful history of growing profits through new policies written, outperforming the industry benchmark, as seen below.

Source: Investor Handout, page 26

Price increases helped the company grow revenue from premiums in recent periods. Interest rates have been a headwind of late given the inversion of the yield curve, and the sharp move down in long-term rates. Like other insurers that rely upon investment income, Cincinnati Financial would prefer higher rates, all else equal. However, as mentioned, the company has a relatively high concentration of common stocks in its investment portfolio, which have performed well while rates have moved down.

Cincinnati Financial’s strong performance has continued in 2019. The company’s third quarter results showed continued growth in earnings and book value over 2018. Total revenue was up 23% in the first nine months of the year to $5.8 billion thanks to robust gains in earned premiums and smaller gains in investment income, net of expenses. Operating income increased 26% in the first three quarters of the year to $491 million, and adjusted earnings-per-share followed suit with a 26% gain to $2.98. Book value also gained 12% to $57.37 over the same period. In short, Cincinnati Financial continues to perform very well and shareholders are being rewarded.

Cincinnati Financial’s earnings-per-share will grow considerably once again for 2019 on an adjusted basis, thanks to the factors discussed above. Over the long-term, the company’s growth prospects are more modest, due to the mature nature of the industry and the fact that Cincinnati Financial is already large in size and scope. We also believe low long-term rates will be a headwind for Cincinnati Financial and its competitors for the foreseeable future, as falling rates will reduce the company’s investment income. Even so, we believe a 5% annual earnings growth rate is reasonable for the next five years.

Competitive Advantages & Recession Performance

There aren’t many identifiable competitive advantages in the insurance industry, other than brand recognition. There are also low barriers to entry in insurance, which leads to fierce competition, much of which is done on price, as differentiation is very difficult. The good news for Cincinnati Financial is that it thrives on competing on price.

Fortunately, Cincinnati Financial has decades of experience, and has built a close relationship with its customers. That said, insurance companies are not immune from economic downturns. Cincinnati Financial does not have a highly recession-resistant business model. Earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $3.54

- 2008 earnings-per-share of $2.10 (41% decline)

- 2009 earnings-per-share of $1.32 (37% decline)

- 2010 earnings-per-share of $1.68 (27% increase)

As you can see, earnings declined significantly from 2008-2010. Insurers like Cincinnati Financial typically sell fewer policies during recessions, along with poor performance of their investment portfolios when markets decline. Given Cincinnati Financial’s relatively high concentration of common stocks, its book value may suffer materially due to broader market declines.

That said, the company did remain profitable during the recession, which allowed it to continue increasing dividends each year. And, the company enjoyed a strong recovery in 2010 and thereafter, once the recession ended.

Valuation & Expected Returns

Cincinnati Financial stock has outperformed the broader S&P 500 Index over the past 30 years, and the share price has continued to rise in recent years. The combination of weak growth and a rising share price means the stock now trades for a relatively high valuation.

Based on 2019 earnings-per-share forecasts, Cincinnati Financial stock trades for a price-to-earnings ratio of approximately 28.8. We see fair value at 19.2 times earnings, so shares are quite overvalued at this point. If the shares revert to their fair value price-to-earnings ratio, future returns would be reduced by about 8% per year. We see fair value at $72 per share today, which compares very unfavorably to the current share price of $108.

Earnings growth and dividends will help offset the decline. However, the company has fairly modest growth expectations. We forecast 5% annual earnings growth for Cincinnati Financial. In addition, the stock has a current dividend yield of 2.1%. The dividend yield is near a multi-year low.

Cincinnati Financial’s dividend is highly secure, and a projected payout ratio of 60% leaves room for future dividend increases. Still, the stock is expected to produce negative total returns of -0.6% per year over the next five years as the dividend yield and earnings growth are offset by a declining valuation multiple.

Final Thoughts

Cincinnati Financial is a steady company with a consistent dividend payout, and the ability to raise the dividend modestly each year. The dividend payout is highly secure and its dividend increase streak is outstanding.

While the company has a strong business model and is solidly profitable, it does not seem to be a particularly attractive stock from a valuation standpoint. Overall, investors interested in buying this stock should wait for a lower valuation and higher dividend yield as the stock is highly overvalued today.